Meituan Bundle

How Did Meituan Conquer China's Digital Landscape?

Imagine a company that started as a simple group-buying platform and transformed into a tech behemoth dominating China's online-to-offline (O2O) services. This is the fascinating Meituan SWOT Analysis story, a tale of strategic pivots and relentless innovation. From its humble beginnings in 2010, Meituan, founded by Wang Xing, has redefined how millions experience local services.

Delving into the Meituan history reveals a company that consistently adapted to market demands, expanding its Meituan services beyond just food delivery. Understanding Meituan's founding story is crucial to appreciate its current dominance, with a significant market share and a massive user base. This exploration will cover Meituan's key milestones, Meituan's IPO details, and its ongoing evolution in the dynamic Chinese market.

What is the Meituan Founding Story?

The brief history of Meituan begins in March 2010. It was founded in Beijing, China, by Wang Xing. Wang Xing, a prominent Chinese entrepreneur, had previously been involved in adapting Western social media platforms for the Chinese market.

The initial goal of Meituan was to connect consumers with local businesses. This was achieved by offering discounted deals through collective purchasing. This business model was inspired by Groupon. This 'group-buying' concept allowed users to combine their purchasing power to get better prices on various products and services. These included dining, entertainment, and travel.

Meituan's first product was its group-buying website, Meituan.com. It provided a platform for users to browse and purchase these discounted offers. The company rapidly gained popularity due to its user-friendly interface and mobile app. Early funding included investments from Sequoia China and Alibaba. The rapid emergence of similar platforms led to the 'Thousand Groupons War' in China in 2011. This was a period of intense competition where many group-buying websites emerged. Despite the competition, Meituan expanded by targeting tier-two and tier-three cities. By October 2011, it became the leading group-buying website in China.

Meituan's early success was marked by rapid growth and strategic expansion.

- March 2010: Meituan was founded by Wang Xing in Beijing.

- 2011: The 'Thousand Groupons War' saw intense competition in the group-buying market.

- October 2011: Meituan became the leading group-buying website in China.

- Early Funding: Sequoia China and Alibaba were among the early investors.

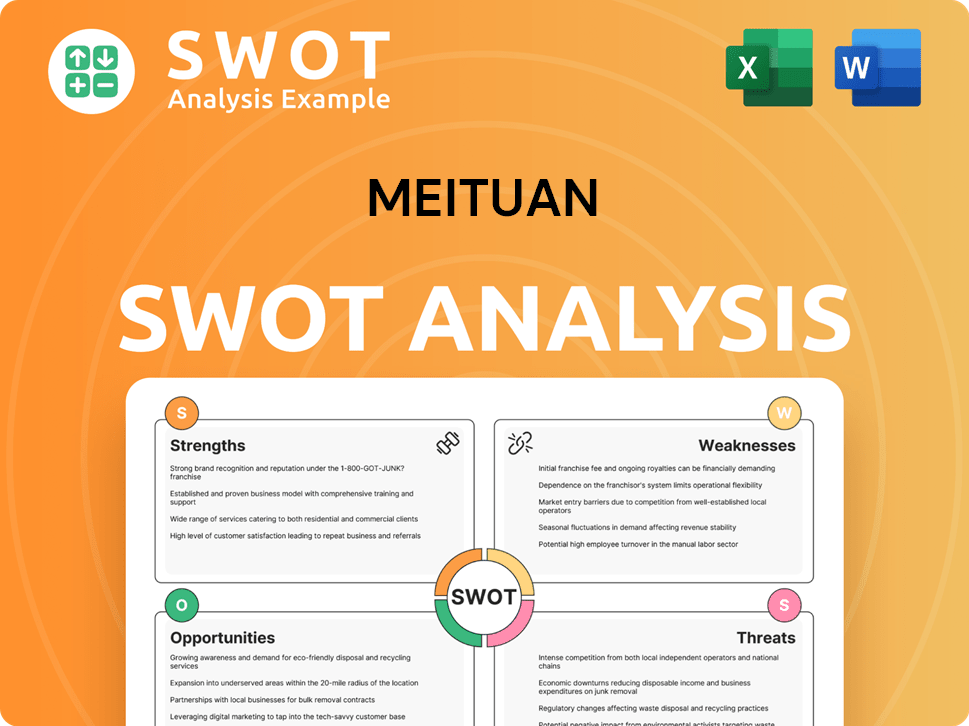

Meituan SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Meituan?

The early growth of the Meituan company was marked by rapid expansion and diversification. Initially focused on group-buying, the company quickly broadened its service offerings. This strategic move allowed Meituan to transform into a comprehensive platform, establishing a strong foothold in the local services market.

In 2011, Meituan integrated restaurant reviews and ratings, enhancing its platform. By 2012, it entered the movie ticketing business, followed by food delivery and hotel booking services in 2013. The launch of its mobile app in 2013 significantly boosted user engagement and transactions, marking a pivotal development in the company's history.

A crucial strategic move was the 2015 merger with Dianping, creating Meituan-Dianping, a dominant force in online-to-offline (O2O) services. Acquisitions included the bike-sharing company Mobike in 2018 and the payment service provider Qiandai in 2016, enabling digital payment services. Meituan also briefly entered the ride-hailing market in 2017.

Meituan's growth was fueled by significant capital raises, including a Series C round of approximately $4 billion in 2015. The company's customer-centric approach and adaptability, like the 'Pin Hao Fan' service, boosted its market reception. This strategic approach helped Meituan secure a 69% market share in the Chinese food delivery industry as of 2024, as highlighted in a recent report on the Target Market of Meituan.

Meituan's early development involved continuous innovation and expansion. Key milestones include the launch of various services like hotel bookings and food delivery. The company's focus on technology and adapting to consumption trends, especially in the competitive landscape, has been crucial to its success. Meituan's history is a testament to its ability to evolve and dominate the market.

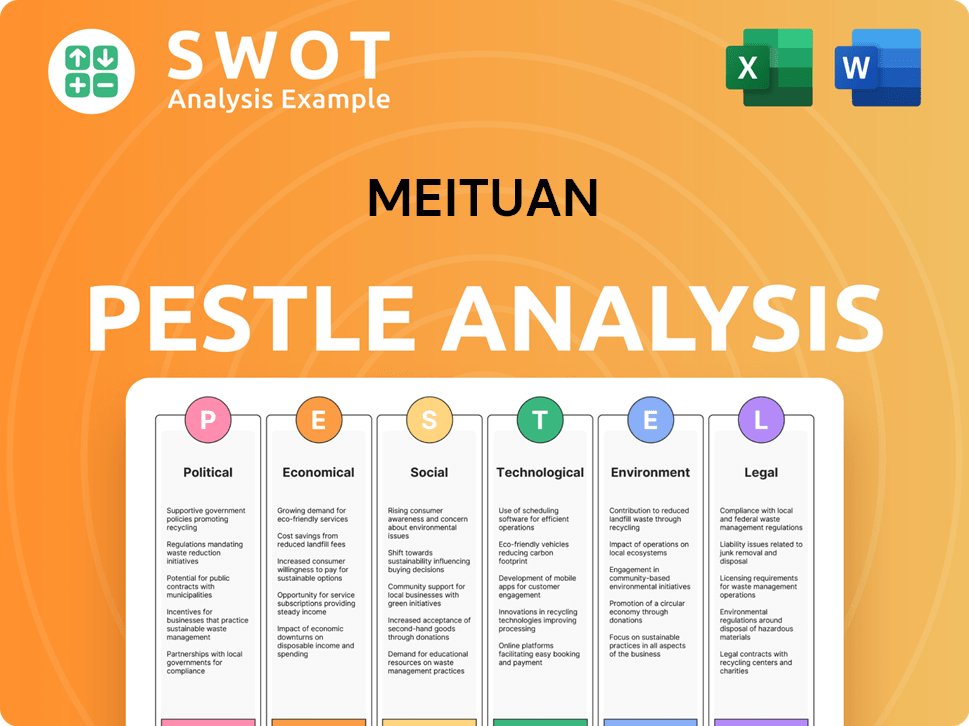

Meituan PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Meituan history?

The brief history of Meituan, a prominent player in China's tech landscape, is marked by significant milestones and strategic expansions. The Meituan company has rapidly evolved from its early days to become a leading force in the online-to-offline (O2O) services sector, significantly impacting the food delivery and local services industries.

| Year | Milestone |

|---|---|

| 2010 | Meituan was founded, marking the beginning of its journey in the group-buying market. |

| 2015 | Meituan merged with Dianping, consolidating its position and expanding its service offerings. |

| 2018 | Meituan went public with its Meituan IPO, raising significant capital for further expansion. |

| 2024 | Meituan Instashopping processed over 10 million orders a day by Q4, demonstrating its strong on-demand retail presence. |

Meituan has consistently demonstrated a commitment to innovation, broadening its service portfolio and integrating advanced technologies. The company's evolution showcases its ability to adapt to changing market demands and consumer preferences, solidifying its position in the competitive landscape.

Meituan expanded from group buying to include food delivery, in-store services, hotel and travel bookings, and various 'new initiatives'. This diversification has been a key driver of its growth, allowing it to capture a larger share of the O2O market.

Meituan has invested heavily in AI capabilities, particularly vision AI, to enhance operations and personalize services. This has improved efficiency and helped maintain a competitive advantage in the market.

The development of Meituan Instashopping as an on-demand retail platform has been a significant innovation. By Q4 2024, it processed over 10 million orders a day, demonstrating its success in this area.

Meituan is actively expanding its international presence, with its Keeta brand in Hong Kong and Saudi Arabia and plans to enter Brazil. This strategy aims to diversify revenue streams and mitigate domestic competitive pressures.

Continuous investment in technology, including AI and data analytics, has enabled Meituan to optimize its delivery logistics and improve user experiences. These advancements are crucial for maintaining a competitive edge.

Meituan is investing RMB 100 billion over three years to support merchants, improve supply quality, and enhance rider social benefits in its food delivery ecosystem. This shows a commitment to the ecosystem's long-term health.

Despite its successes, Meituan has faced several challenges, including intense competition and regulatory scrutiny. These challenges have required strategic adjustments and innovative solutions to maintain its market position and drive sustainable growth.

The food delivery segment faces fierce competition, particularly from rivals like Alibaba's Ele.me and JD.com. This has led to increased subsidies and marketing campaigns, impacting operating margins.

Increased competition and subsidy wars have affected Meituan's profitability. For instance, in Q2 2025, the company anticipates a decline in adjusted net profit by 10.1% due to increased delivery business subsidies.

Meituan, like other major tech companies, faces regulatory scrutiny regarding its business practices and market dominance. Compliance with regulations is an ongoing challenge.

Meituan is focused on improving operational efficiency across all business segments. Narrowing operating losses in its new initiatives segment in Q1 2025 is a key area of focus.

Adapting to dynamic market conditions, including changing consumer behavior and economic fluctuations, is crucial for Meituan's long-term success. The company must constantly innovate to stay ahead.

Expanding internationally presents challenges, including navigating different regulatory environments and adapting to local market preferences. Successful international expansion is key for future growth.

For a deeper dive into Meituan's growth strategies and financial performance, consider reading Growth Strategy of Meituan.

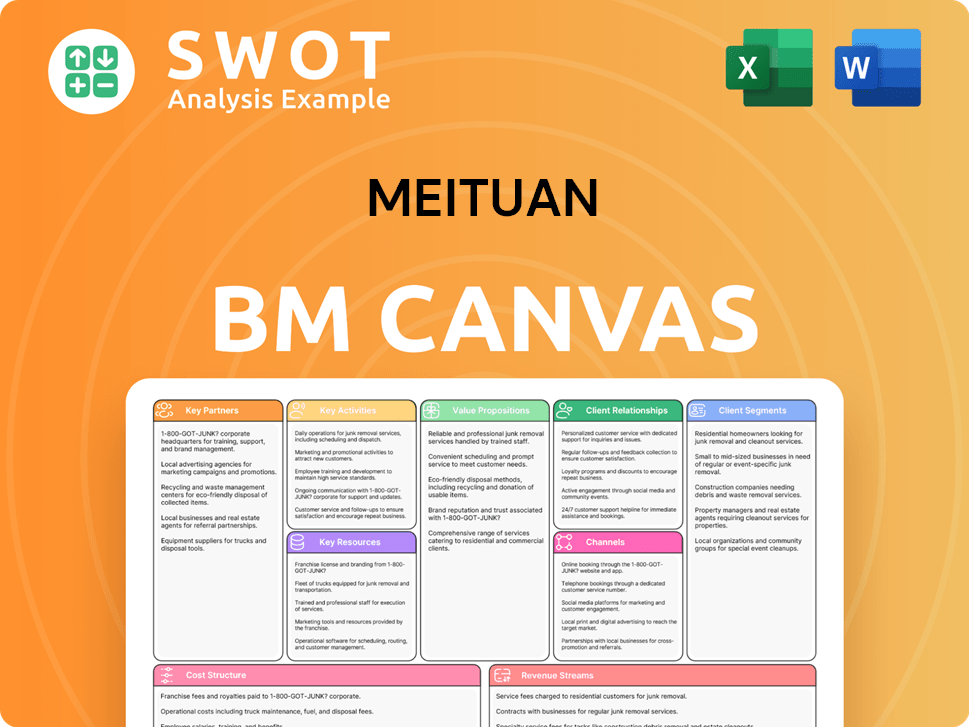

Meituan Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Meituan?

The Meituan company, founded by Wang Xing, has evolved significantly since its inception. Initially a group-buying platform, it expanded into various services, including food delivery and hotel bookings, becoming a major player in China's O2O (online-to-offline) market. The company's journey from its early days to its current status as a publicly traded entity reflects its strategic growth and adaptation to market trends.

| Year | Key Event |

|---|---|

| 2010 | Meituan is founded by Wang Xing in Beijing as a group-buying platform. |

| 2011 | Meituan expands to include restaurant reviews and ratings. |

| 2013 | The Meituan mobile app is launched; the company enters the food delivery and hotel booking businesses. |

| 2015 | Meituan merges with Dianping, forming Meituan-Dianping, a major player in O2O services. |

| 2018 | Meituan-Dianping goes public on the Hong Kong Stock Exchange (HKEX: 3690); acquires bike-sharing company Mobike. |

| September 2020 | Meituan-Dianping officially rebrands to simply Meituan. |

In Q3 2024, Meituan's revenue reached RMB 93.58 billion (US$12.92 billion), marking a 22.4% increase year-on-year. For the full year of 2024, revenue increased by 22.0% to RMB 337.6 billion, with profit increasing by a substantial 158.4% to RMB 35.8 billion. Annual transacting users exceeded 770 million, showcasing strong growth and user engagement.

Total revenue for Q1 2025 reached RMB 86.6 billion, up 18.1% year-on-year. Adjusted net profit for the same period was RMB 10.9 billion, reflecting a 46.2% increase year-on-year. These figures highlight Meituan's continued growth and profitability in the competitive market.

Meituan plans to invest $1 billion over five years to enter Brazil's food delivery market with its Keeta app, which is also the leading player in Hong Kong and performing well in the Middle East. The company aims to capture up to 80% of the Saudi Arabian food delivery market by 2025. Food delivery revenue is forecasted to grow at a CAGR of 10% between FY2024 and FY2027.

Analyst predictions suggest Meituan will generate revenue growth of 12-18% and EBITDA expansion of 8-12% over the next 12-24 months. The company is focused on its 'retail + technology' strategy and investing RMB 100 billion over the next three years in supply-side innovation for the food delivery industry. Despite potential earnings pressure, Meituan expects to maintain its leading position.

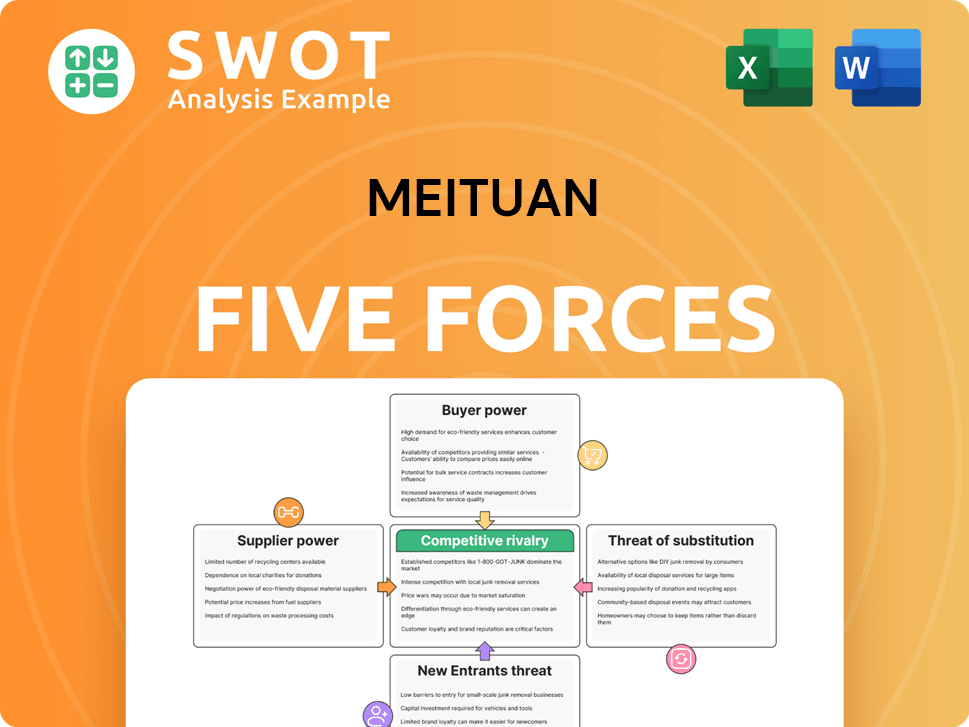

Meituan Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Meituan Company?

- What is Growth Strategy and Future Prospects of Meituan Company?

- How Does Meituan Company Work?

- What is Sales and Marketing Strategy of Meituan Company?

- What is Brief History of Meituan Company?

- Who Owns Meituan Company?

- What is Customer Demographics and Target Market of Meituan Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.