NerdWallet Bundle

How Did NerdWallet Revolutionize Personal Finance?

Ever wondered how a company could transform the way we manage our money? NerdWallet, a prominent force in the fintech world, did just that. Founded in 2009, NerdWallet emerged to simplify complex financial decisions, offering unbiased advice and tools to empower individuals. This brief history of NerdWallet explores its remarkable journey from a simple idea to a leading financial resource.

From its origins in a co-founder's apartment, the NerdWallet SWOT Analysis reveals a company dedicated to financial literacy. The NerdWallet mission, born from the 2008 financial crisis, has always been to provide accessible and trustworthy guidance. Today, NerdWallet continues to evolve, offering a wide array of financial services and remaining a key player in the personal finance landscape, impacting millions with its insightful approach to personal finance.

What is the NerdWallet Founding Story?

The story of the NerdWallet company began in 2009. It was founded by Tim Chen and Jacob Gibson. The idea for the company sparked from a personal need for clear financial information.

Chen, a former hedge fund analyst, saw a gap in the market. His sister needed help choosing a credit card with good foreign transaction rates. This experience highlighted the lack of accessible financial guidance. This led to the creation of a platform designed to simplify financial decisions for consumers.

The initial focus of NerdWallet was on credit card comparisons. The platform provided detailed reviews and tools. This helped users choose the best cards for their needs. Chen initially bootstrapped the company, using his own savings. This allowed the founders to control the company's direction.

NerdWallet started with a simple mission: to provide clear, unbiased financial information. The name 'NerdWallet' reflected this dedication to data-driven analysis.

- The company aimed to help users manage their money smartly.

- The founders' expertise in finance and technology formed a strong foundation.

- The economic climate of 2009, post-recession, increased the need for prudent financial decisions.

- NerdWallet's mission aligned perfectly with the needs of consumers at the time.

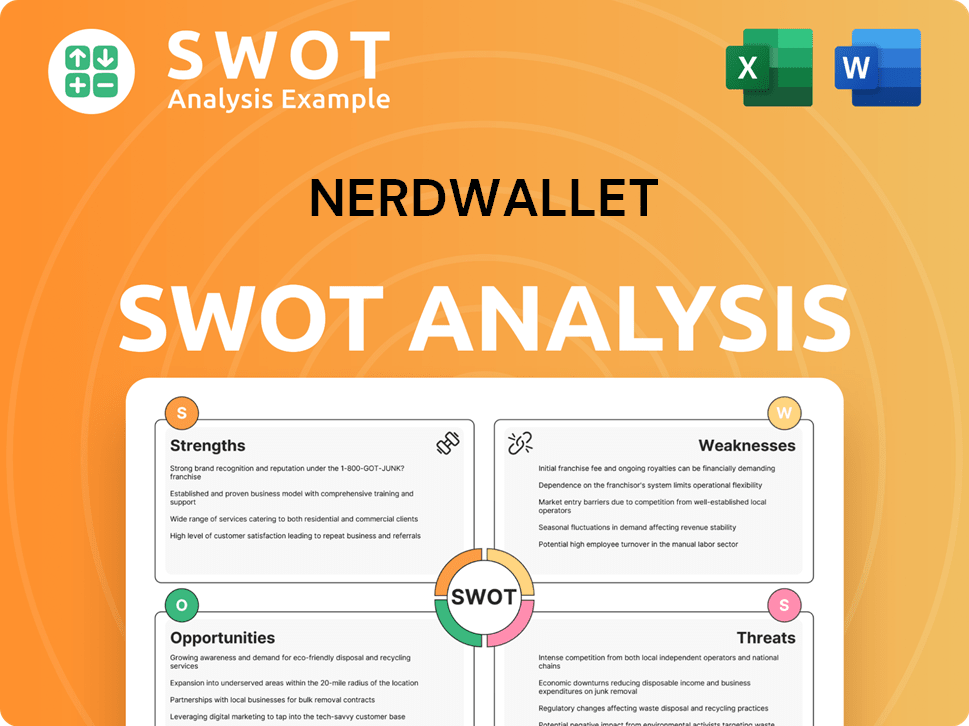

NerdWallet SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of NerdWallet?

The early growth of the company, now known as NerdWallet, was marked by strategic expansion beyond its initial focus on credit cards. After establishing itself as a reliable source for credit card comparisons, the company broadened its offerings. This expansion was driven by the need to provide consumers with comprehensive guidance across their entire financial journey. The company's early years were crucial for establishing its brand and laying the groundwork for future growth.

A key element of the company's early growth was its content-driven approach. The company invested heavily in creating high-quality, unbiased financial content, including articles, guides, and tools. This strategy helped establish the company as an authoritative voice in personal finance, attracting a significant organic audience. The focus on valuable content helped build trust and credibility with users.

In its early years, the company largely eschewed traditional venture capital funding, choosing to remain bootstrapped for a significant period. This allowed it to prioritize user experience and product development without external pressures. As the company scaled, it expanded its team, bringing in experts in finance, technology, and content. This approach allowed the company to maintain control and focus on its core mission.

The company refined its revenue model, primarily through affiliate partnerships with financial institutions, earning commissions when users applied for products through its platform. This model ensured that the company's advice remained unbiased. The company's growth necessitated a move from its initial home-based operations to larger facilities in San Francisco. This relocation reflected the company's expanding operations and increasing headcount.

While specific early financial figures are not widely publicized, the company's growth trajectory is evident from its expansion into various financial sectors. By 2024, the company's revenue was estimated to be in the hundreds of millions of dollars, demonstrating significant growth from its early days. The company's early focus on organic growth and user experience laid the foundation for its financial success.

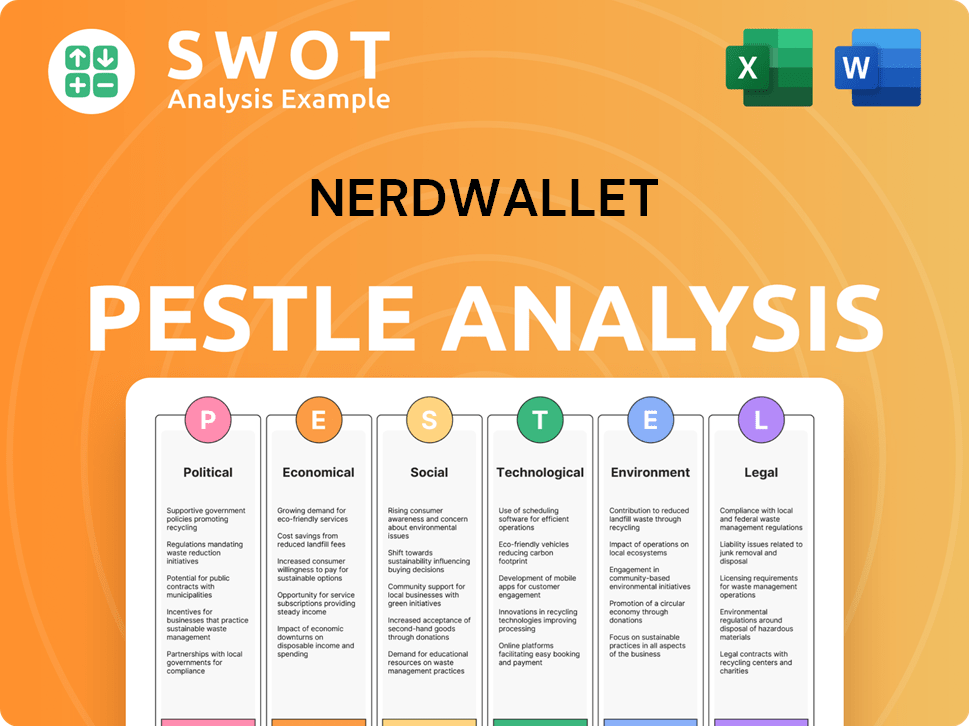

NerdWallet PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in NerdWallet history?

The NerdWallet company has achieved several significant milestones since its inception. These accomplishments reflect its growth and impact in the personal finance sector, showcasing its evolution from a startup to a publicly traded company. The company's journey is a testament to its ability to adapt and innovate within a competitive market.

| Year | Milestone |

|---|---|

| 2009 | NerdWallet was founded by Tim Chen and Jacob Gibson, marking the beginning of its mission to provide clear financial guidance. |

| 2014 | Secured a Series A funding round of $64 million, which significantly boosted its ability to scale operations and expand its product offerings. |

| 2021 | NerdWallet went public with an initial public offering (IPO) in November, trading under the ticker symbol NRDS, transitioning from a private to a public company. |

Key innovations have been central to the success of the NerdWallet company. The company's commitment to providing unbiased financial advice has set it apart from many commission-driven services. This approach, along with the development of proprietary tools, has enhanced user experience and trust.

NerdWallet distinguished itself by offering unbiased financial advice, a critical differentiator in the industry. This approach built trust with users seeking reliable information.

The credit card comparison engine provided users with a transparent and data-driven way to evaluate options. This tool helped users make informed decisions about their financial products.

Mortgage rate tables offered users real-time data and insights into mortgage rates. This feature empowered users to find the best deals for their needs.

Expanding beyond product comparisons, NerdWallet evolved into a comprehensive platform for financial education. This included advice on budgeting, saving, and investing.

The company prioritized user-centric design to ensure an intuitive and accessible experience. This focus helped to increase user engagement and satisfaction.

NerdWallet developed strengths in data analysis and content creation to provide accurate and relevant financial information. This approach enhanced its reputation as a trusted resource.

The NerdWallet company has faced various challenges throughout its history. Maintaining product-market fit in a rapidly changing financial landscape has been an ongoing effort. The company continuously adapts to regulatory changes and evolving user needs.

Maintaining product-market fit in the dynamic financial landscape has been a constant challenge. This involves adapting to changing user needs and market trends.

Fending off new competitors and maintaining a strong market position requires continuous innovation. The company must differentiate itself in a crowded market.

Adapting to regulatory changes in the financial sector is an ongoing effort. This requires staying informed and adjusting strategies to comply with new rules.

Refining content strategy to ensure accuracy and relevance in a dynamic financial environment is crucial. This involves updating information and providing timely advice.

Navigating market fluctuations and competitive pressures requires resilience and adaptability. The company must adjust to changing economic conditions.

Maintaining user trust through accurate and unbiased information is essential for long-term success. This builds credibility and fosters user loyalty.

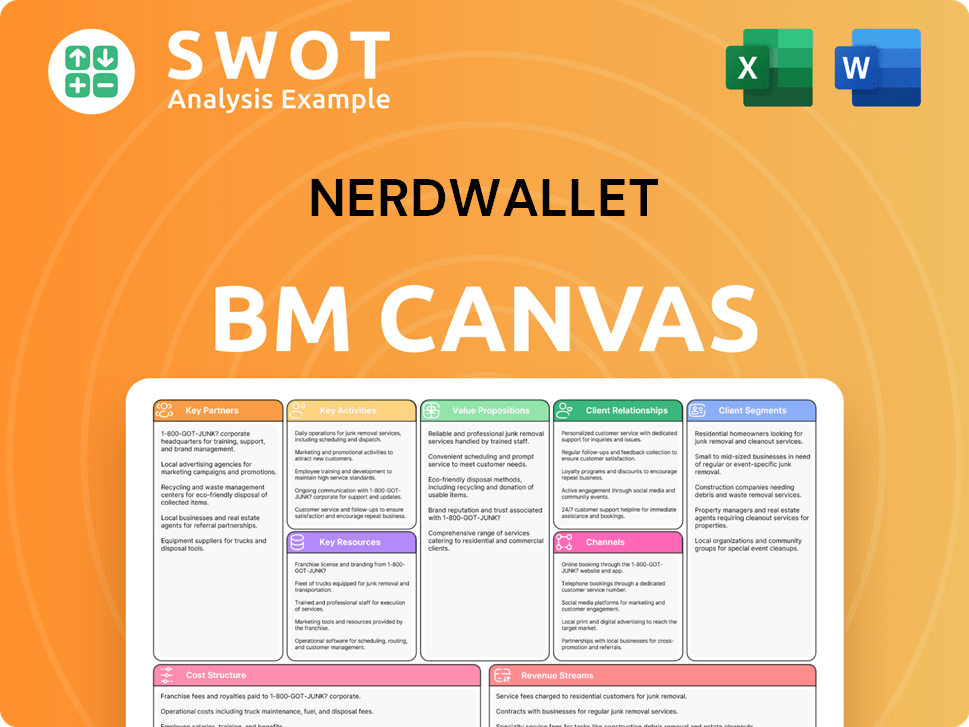

NerdWallet Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for NerdWallet?

The NerdWallet history is marked by significant milestones that have shaped its evolution from a credit card comparison site to a comprehensive financial services platform. Founded in 2009 by Tim Chen and Jacob Gibson, the company quickly expanded its content and offerings, securing substantial funding and achieving a successful IPO in 2021. Strategic acquisitions, international expansions, and a focus on adapting to changing consumer needs have been key drivers of its growth.

| Year | Key Event |

|---|---|

| 2009 | Founded by Tim Chen and Jacob Gibson, initially focusing on credit card comparisons. |

| 2010 | Expanded content beyond credit cards, beginning to cover other financial products. |

| 2014 | Secured a $64 million Series A funding round, enabling significant growth and expansion. |

| 2015 | Acquired its first company, AboutUs.org, to enhance its content and technology capabilities. |

| 2017 | Launched its first national advertising campaign, increasing brand awareness. |

| 2018 | Expanded into international markets, including the UK and Canada. |

| 2020 | Navigated the economic uncertainties of the COVID-19 pandemic, adapting its content to address new consumer financial concerns. |

| 2021 | Successfully completed its Initial Public Offering (IPO) on the Nasdaq stock exchange under the ticker symbol NRDS. |

| 2023 | Continued to expand its product offerings, including tools for investing and retirement planning. |

| 2024 | Focused on leveraging AI and machine learning to personalize financial advice and product recommendations. |

The company is heavily investing in AI and machine learning to offer more tailored financial advice. This includes personalized product recommendations and insights, enhancing user engagement. This focus aims to improve user experience and drive higher conversion rates, as reported in early 2024.

The company plans to broaden its range of financial products and services. This could involve more sophisticated investment tools and comprehensive financial planning services. The expansion strategy is designed to capture a larger share of the personal finance market.

NerdWallet is looking to broaden its reach by exploring opportunities in new geographic regions. The expansion into new markets is a key part of its growth strategy. This will help the company reach more consumers and increase its revenue streams.

The company benefits from strong brand recognition and a reputation for providing clear financial advice. This helps in attracting and retaining users. Analyst predictions remain positive, driven by the consistent demand for reliable financial guidance.

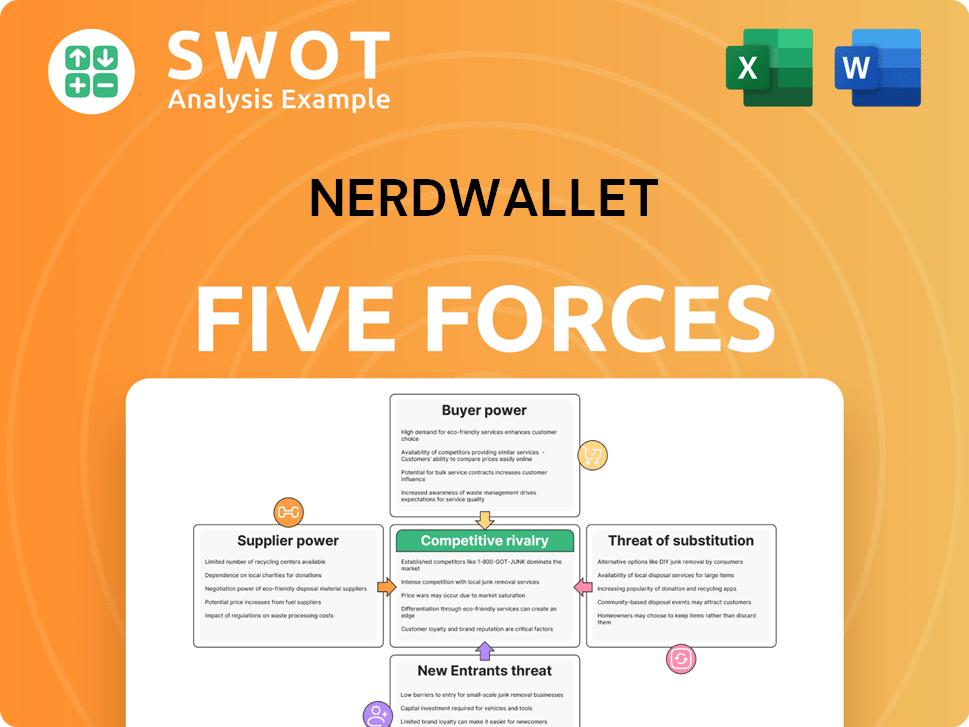

NerdWallet Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of NerdWallet Company?

- What is Growth Strategy and Future Prospects of NerdWallet Company?

- How Does NerdWallet Company Work?

- What is Sales and Marketing Strategy of NerdWallet Company?

- What is Brief History of NerdWallet Company?

- Who Owns NerdWallet Company?

- What is Customer Demographics and Target Market of NerdWallet Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.