NerdWallet Bundle

How Does NerdWallet Thrive in the FinTech Arena?

NerdWallet has become a go-to resource for millions seeking clarity in personal finance. Witnessing an impressive 37% year-over-year revenue surge in Q4 2024, followed by a 29% growth in Q1 2025, the company's success is undeniable. But how does NerdWallet, a platform offering NerdWallet SWOT Analysis, actually work and generate such remarkable returns in a competitive market?

This deep dive into NerdWallet's operations will dissect its core strategies, from providing unbiased financial advice and online financial tools to its diverse revenue streams. We'll explore the NerdWallet business model, analyzing its competitive advantages and its ability to navigate the ever-changing landscape of personal finance. Whether you're curious about NerdWallet review, its investment platform, or just how this company makes money, this is your comprehensive guide.

What Are the Key Operations Driving NerdWallet’s Success?

The core operations of NerdWallet revolve around its digital platform, which offers expert content, comparison shopping marketplaces, and a data-driven app. This platform serves as a comprehensive resource for consumers and small and mid-sized businesses (SMBs) seeking to make informed financial decisions. The company covers a wide array of financial verticals, including credit cards, mortgages, insurance, and personal loans, providing a holistic approach to personal finance.

NerdWallet's operational processes are driven by technology development, data analysis, and content creation. The company uses advanced algorithms and machine learning to analyze user data, providing personalized recommendations for financial products. This approach enhances user satisfaction and retention by helping users find the most suitable products for their specific needs. The content, including articles, guides, and tools, aims to improve financial literacy and simplify complex financial concepts.

The value proposition of NerdWallet is rooted in its independence and unbiased approach. It strives to be a trusted source of information, offering transparent reviews and ratings of financial products. This commitment to consumer advocacy sets it apart from competitors. Furthermore, partnerships with financial institutions expand its reach and credibility, connecting consumers with a wide array of financial products. The company's operations are designed to create a 'win-win-win' scenario for consumers, financial institutions, and NerdWallet itself.

NerdWallet focuses on technology development, data analysis, and content creation to deliver its services. Advanced algorithms and machine learning are used to personalize recommendations. This approach helps users find the best financial products for their individual needs, enhancing user satisfaction.

The company provides independent and unbiased information, offering transparent reviews and ratings. The goal is to be a trusted source, distinguishing itself from competitors. Partnerships with financial institutions expand reach and credibility, connecting consumers with a broad range of products.

NerdWallet offers services across various financial sectors. These include credit cards, mortgages, insurance, SMB products, personal loans, banking, investing, and student loans. This comprehensive coverage ensures users have access to a wide range of financial solutions.

Users benefit from personalized recommendations and educational content. The platform aims to improve financial literacy and simplify complex concepts. The goal is to empower users to make smarter financial decisions.

NerdWallet operates by providing free access to financial tools and resources. The company generates revenue through affiliate marketing, advertising, and partnerships with financial institutions. This model allows NerdWallet to offer valuable services to users while maintaining its business operations.

- The platform offers comparison tools for credit cards, loans, and insurance.

- NerdWallet provides educational content, including articles and guides, to help users understand financial concepts.

- The company's revenue model is based on commissions from financial products and advertising.

- NerdWallet aims to provide a user-friendly experience, making it easy for consumers to make informed decisions.

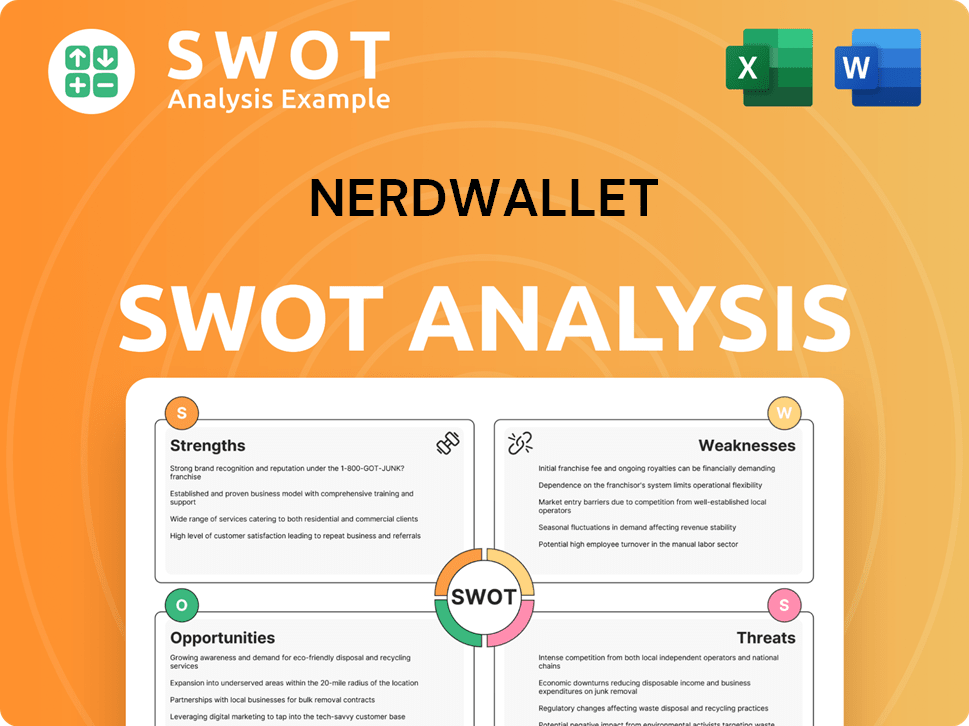

NerdWallet SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does NerdWallet Make Money?

The primary revenue streams for the company are affiliate partnerships and advertising. This approach is central to how the company operates, as it connects consumers with financial products and services. The company's business model is diversified across various financial product categories.

In Q4 2024, the company's total revenue reached $183.8 million, marking a 37% year-over-year increase. Continuing this trend, Q1 2025 saw revenue climb to $209 million, a 29% year-over-year rise, highlighting its sustained growth trajectory. The company uses a variety of online financial tools to generate revenue.

A key driver of this financial performance is the insurance segment. The company provides financial advice to its users.

The insurance segment experienced remarkable growth. In Q4 2024, insurance revenue was $72.0 million, an impressive 821% increase year-over-year. This growth continued into Q1 2025, reaching $74.0 million, a 246% increase year-over-year. This surge was driven by strong growth in auto insurance products.

The credit card category showed a decline. Credit cards revenue was $35.0 million in Q4 2024, down 19% year-over-year, and $38.0 million in Q1 2025, down 24% year-over-year. This was primarily due to challenges in organic search traffic.

SMB products also saw a decrease. Revenue from SMB products was $25.5 million in Q4 2024, down 7% year-over-year, and $28.9 million in Q1 2025, down 5% year-over-year. This was mainly due to a decrease in business loan originations.

Loans revenue showed mixed results. In Q4 2024, loans revenue was $17.6 million, down 26% year-over-year. However, in Q1 2025, it increased to $24.0 million, up 12% year-over-year. The increase in Q1 2025 was driven by mortgage loans, partly due to the acquisition of Next Door Lending, and personal loans.

Emerging verticals showed positive growth. Revenue from emerging verticals was $33.7 million in Q4 2024, up 7% year-over-year, and $44.3 million in Q1 2025, up 15% year-over-year. This growth was primarily driven by banking products.

The company offers a subscription-based financial planning service, NerdWallet Advisors, to diversify its revenue streams. This service provides personalized financial planning at a fixed monthly or annual fee, such as $49/month or $499/year as of March 2024. This service is a part of the company's financial planning tools.

The company's financial performance is also reflected in its profitability. The gross profit margin stood at 90.49% in Q4 2024. If you're curious about how the company operates, a detailed NerdWallet review can provide further insights into its business model and offerings.

- The company generates revenue through affiliate partnerships.

- Advertising is another key revenue stream.

- The company's business model is diversified.

- Subscription-based financial planning service.

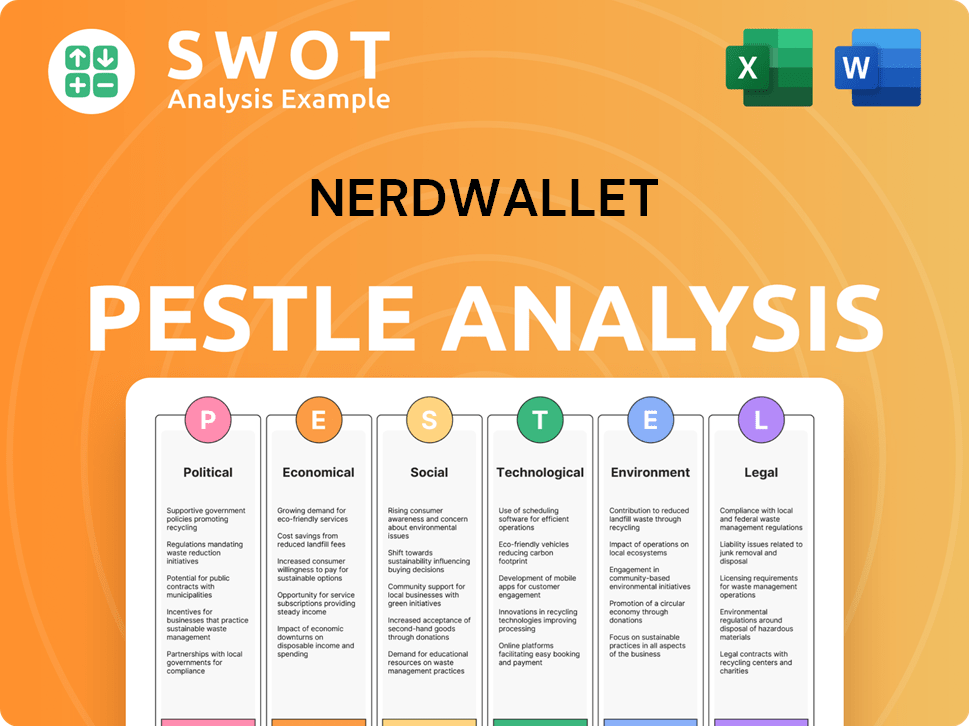

NerdWallet PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped NerdWallet’s Business Model?

NerdWallet has significantly expanded its presence and services, achieving key milestones that have solidified its position in the personal finance sector. Strategic moves, such as acquisitions and international expansions, have been instrumental in its growth. The company's evolution reflects its commitment to providing comprehensive financial information and tools to a broad audience.

A major strategic move for NerdWallet has been its expansion into new geographic markets, including Australia. The acquisition of Next Door Lending has also been a key milestone, bolstering its mortgage business. Furthermore, the launch of NerdWallet Plus, a paid membership program, demonstrates its efforts to offer personalized financial advice and rewards, enhancing user engagement and revenue streams.

The company has faced operational and market challenges, including headwinds in organic search traffic that have impacted revenue in segments like credit cards. Rising interest rates have also created challenges in its lending business. Despite these hurdles, NerdWallet has shown resilience, with its insurance business showing explosive growth.

NerdWallet's acquisition of Next Door Lending significantly boosted its mortgage business. Expansion into new geographies like Australia broadened its market reach. The introduction of NerdWallet Plus expanded its service offerings.

Expansion into new international markets is a key strategic move. The launch of a paid membership program, NerdWallet Plus, offers personalized financial advice. Strategic partnerships and acquisitions have strengthened its market position.

NerdWallet's comprehensive financial information and user-friendly interface set it apart. The company prioritizes trustworthy and unbiased reviews to build consumer trust. Economies of scale and a strong brand presence contribute to its competitive edge.

Headwinds in organic search traffic have impacted certain revenue segments. Rising interest rates pose challenges in the lending business. Despite these issues, the insurance business has shown strong growth, demonstrating resilience.

NerdWallet's competitive advantages are multifaceted, stemming from its comprehensive financial information across various products, personalized recommendations driven by advanced algorithms, and a user-friendly interface. The company emphasizes providing trustworthy and unbiased reviews and ratings, building a strong brand reputation and consumer trust. This 'trusted financial ecosystem' aims to foster deeper, loyalty-based relationships with consumers. NerdWallet also benefits from economies of scale and a strong brand presence, with aided brand awareness increasing to 62% in 2023. The company continues to adapt to new trends by focusing on vertical integration to offer more hands-on guidance in areas like SMB and mortgages, and by leveraging data-driven engagement to grow its registered user base, which was over 26 million as of May 2025. To understand how it stacks up against its rivals, consider exploring the Competitors Landscape of NerdWallet.

As of May 2025, NerdWallet had over 26 million registered users, showcasing its broad reach. Aided brand awareness reached 62% in 2023, indicating strong brand recognition. The company continues to leverage data-driven engagement strategies to enhance user experience and drive growth.

- Expansion into international markets, including Australia.

- Launch of NerdWallet Plus, a paid membership program.

- Acquisition of Next Door Lending to boost mortgage business.

- Focus on vertical integration for SMB and mortgage guidance.

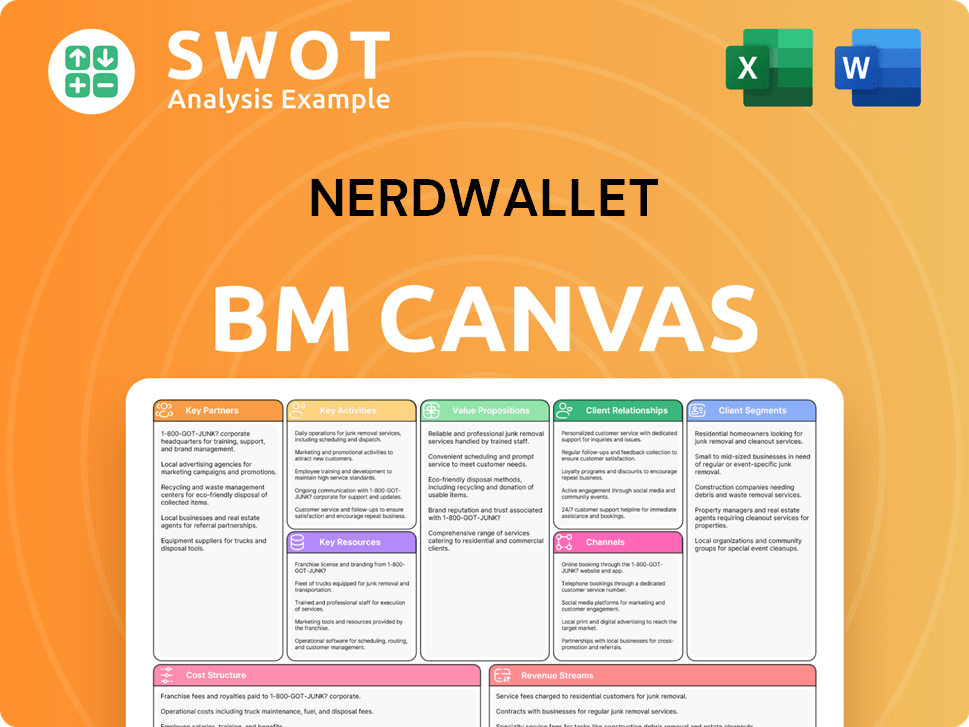

NerdWallet Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is NerdWallet Positioning Itself for Continued Success?

The company holds a strong position in the personal finance industry, recognized as a trusted source for financial guidance. It serves consumers in the U.S., UK, Canada, and Australia. Key competitors include Credit Karma, Bankrate, and Mint. If you want to know more about the company's strategy, you can read about the Growth Strategy of NerdWallet.

Despite its strong position, several key risks exist. A significant challenge is the decline in monthly unique users (MUUs), which plummeted 20% year-over-year to 19 million in Q4 2024, the lowest level since its 2021 IPO. This decline is attributed to 'traffic headwinds worsened in non-monetizing 'learn' topics.' Other risks include continued pressure on credit card and personal loans revenue due to organic search traffic issues and a challenging lending environment with rising interest rates. Regulatory changes and evolving consumer preferences also pose potential impacts.

NerdWallet is a well-established player in the personal finance space, offering financial advice and online financial tools. It competes with companies like Credit Karma and Bankrate. The platform's reach extends across the U.S., UK, Canada, and Australia, providing a wide range of services.

A key risk is the decrease in monthly unique users, down to 19 million in Q4 2024. This decline impacts revenue, especially in non-monetizing areas. Other risks include challenges in credit card and personal loan revenue due to search traffic issues and rising interest rates. Regulatory changes and consumer preferences also pose risks.

The company focuses on 'relentless improvement' through 'Land & Expand,' 'Vertical Integration,' and 'Registrations & Data-driven Engagement.' Revenue for Q1 2025 is projected between $187 million and $193 million, with Q2 2025 revenue expected between $192 million and $200 million. Management is optimistic about future profitability.

Analysts project profitability in 2025, with a full-year 2025 non-GAAP operating income projected to reach $50–60 million. The long-term revenue growth target is in the range of 15% to 20%. These projections indicate continued growth and financial stability for the company.

The company's growth strategy includes diversifying its top-of-funnel with new organic channels, pairing its brand with 'concierge-level' shopping experiences, and growing its registered user base. This approach aims to enhance user engagement and drive revenue. The focus is on long-term revenue growth, targeting between 15% and 20%.

- 'Land & Expand' strategy to reach more users.

- 'Vertical Integration' to improve user experience.

- Leveraging data for personalized offers.

- Focus on profitability in 2025.

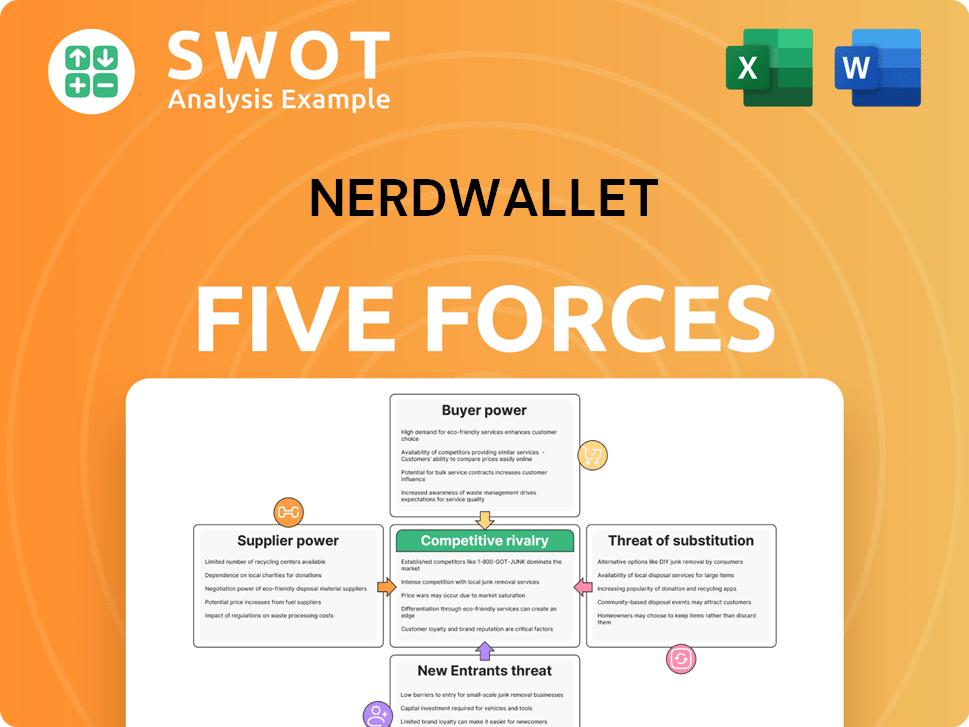

NerdWallet Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of NerdWallet Company?

- What is Competitive Landscape of NerdWallet Company?

- What is Growth Strategy and Future Prospects of NerdWallet Company?

- What is Sales and Marketing Strategy of NerdWallet Company?

- What is Brief History of NerdWallet Company?

- Who Owns NerdWallet Company?

- What is Customer Demographics and Target Market of NerdWallet Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.