NerdWallet Bundle

Can NerdWallet Maintain Its Dominance in the Fintech Arena?

The personal finance industry is a battlefield, with digital platforms constantly vying for consumer attention and market share. NerdWallet, a pioneer in this space, has built a strong reputation for providing accessible financial guidance. But how does it stack up against its rivals, and what strategies does it employ to stay ahead? This article dives deep into the NerdWallet SWOT Analysis to explore its position in this dynamic market.

Understanding the NerdWallet competitive landscape is crucial for anyone navigating the personal finance industry. We'll dissect the company's business model, examining its strengths and weaknesses in comparison to its NerdWallet competitors. This NerdWallet analysis will provide insights into its market position, growth strategies, and the broader trends shaping the future of financial comparison websites and Fintech companies.

Where Does NerdWallet’ Stand in the Current Market?

NerdWallet holds a significant market position within the online personal finance industry, known for its strong brand recognition and extensive user base. The company's core operations revolve around providing consumers with financial guidance, primarily through its website and mobile app. It offers tools and advice for a wide range of financial decisions, from credit card comparisons to investment strategies.

The value proposition of NerdWallet lies in its ability to simplify complex financial information, making it accessible to a broad audience. It serves as a comprehensive resource for individuals seeking to make informed financial choices. The company's primary product lines include comparison tools and expert advice for credit cards, loans, banking products, insurance, and investing, all aimed at empowering consumers.

Geographically, NerdWallet's primary presence is in the United States, where it has cultivated a substantial audience. Over time, the company has broadened its offerings beyond simple product comparisons to include more in-depth educational content and personalized financial tools, reflecting a shift towards becoming a holistic financial resource. This strategic diversification has allowed NerdWallet to capture a wider segment of the market, moving beyond a purely transactional model to one that fosters long-term user engagement.

While precise market share figures are fluid due to the fragmented nature of the personal finance industry, NerdWallet consistently ranks among the top independent financial advice websites. It maintains a leading position in credit card and banking product comparison segments.

NerdWallet reported total revenue of $527 million for the full year 2023, an increase of 14% compared to 2022. This financial health underscores its robust scale compared to many industry averages.

The company’s strong brand equity and user trust are particularly evident in the credit card and banking product comparison segments, where it maintains a leading position. NerdWallet's growth strategy involves expanding its content offerings and personalized financial tools to increase user engagement.

NerdWallet primarily targets individual consumers seeking guidance on a wide array of financial decisions. Its user base includes a diverse group of people looking for assistance with credit cards, loans, banking products, insurance, and investing.

NerdWallet's competitive advantages include its strong brand recognition, extensive user base, and comprehensive financial resources. The company's ability to provide clear, accessible financial information and tools sets it apart in the personal finance industry.

- Strong brand reputation and user trust.

- Comprehensive comparison tools and expert advice.

- Strategic diversification into educational content and personalized tools.

- Consistent revenue growth and financial performance.

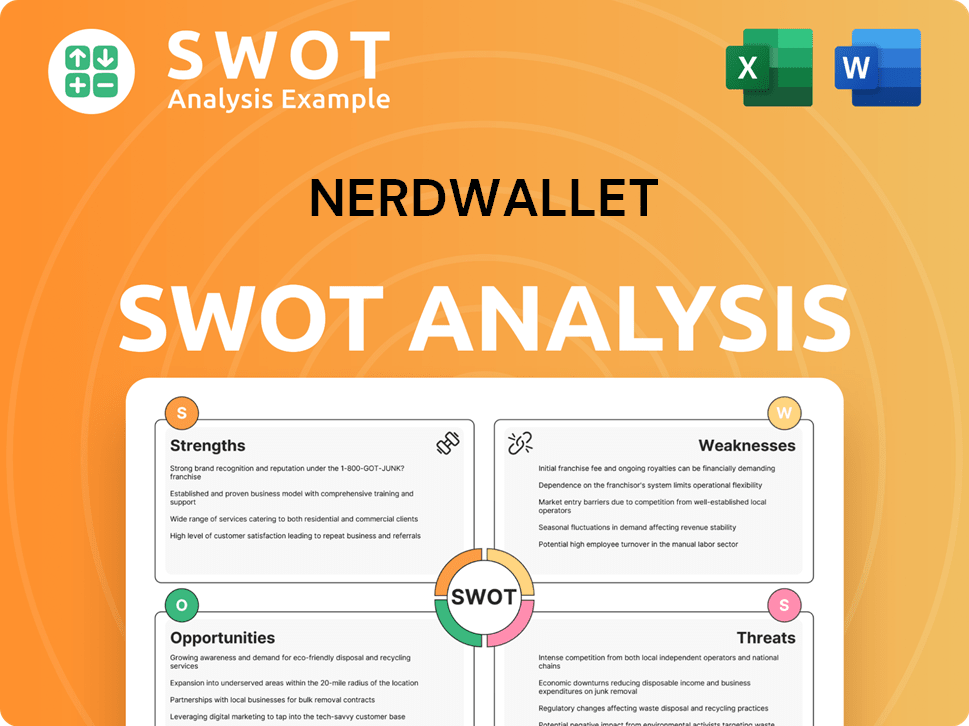

NerdWallet SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging NerdWallet?

The NerdWallet competitive landscape is characterized by a diverse array of players vying for market share in the personal finance industry. This landscape includes both direct and indirect competitors, each employing different strategies to attract and retain users. Understanding these competitors is crucial for analyzing NerdWallet's position and potential for growth.

The personal finance industry is dynamic, with constant shifts due to mergers, acquisitions, and the emergence of new technologies. Analyzing the competitive landscape helps in understanding the challenges and opportunities facing NerdWallet, as well as its potential for innovation and expansion. A detailed NerdWallet analysis reveals the strategies and market positions of key players.

NerdWallet faces competition from various financial comparison websites and fintech companies. These competitors offer similar services, such as financial product comparisons, advice, and tools. Several factors, including marketing, product offerings, and brand recognition, influence the competitive dynamics.

Direct competitors include entities that offer similar services, such as financial product comparisons and advice. These competitors often have established brand recognition and significant marketing budgets.

Bankrate, owned by Red Ventures, is a significant direct competitor. It provides financial product comparisons and advice, with a strong presence in mortgage and savings rates. Bankrate leverages its extensive content network to attract users.

Credit Karma, acquired by Intuit in 2020 for approximately $7.1 billion, is another key competitor. It focuses on credit score monitoring and personalized financial product recommendations. Credit Karma uses its vast user data to offer tailored solutions.

LendingTree specializes in connecting consumers with lenders for various loans. It operates as a marketplace, facilitating direct interactions between consumers and financial institutions. LendingTree's focus is on loan origination.

Indirect competitors include a broader range of entities that offer financial advice or services. These competitors may not directly compete on all fronts but still attract segments of NerdWallet's target audience.

Traditional financial institutions, such as Chase and Bank of America, offer online advice portals. These institutions leverage their existing customer base and brand recognition to provide financial guidance.

The personal finance industry is subject to constant change, driven by mergers, acquisitions, and technological advancements. These trends impact the competitive landscape and influence the strategies of all players. Understanding these dynamics is crucial for NerdWallet's long-term success.

- Mergers and Acquisitions: The acquisition of Credit Karma by Intuit is a prime example of how market power consolidates and service offerings expand.

- AI and Machine Learning: New entrants using AI and machine learning for hyper-personalized financial advice could disrupt the traditional landscape.

- Fintech Innovation: Fintech startups focusing on niche financial services, like budgeting apps (e.g., Mint, YNAB) or specialized investment platforms, attract specific segments of NerdWallet's target audience.

- Market Share: NerdWallet's market share analysis reveals its position relative to competitors, highlighting strengths and weaknesses.

- User Reviews and Ratings: User reviews and ratings provide insights into customer satisfaction and areas for improvement.

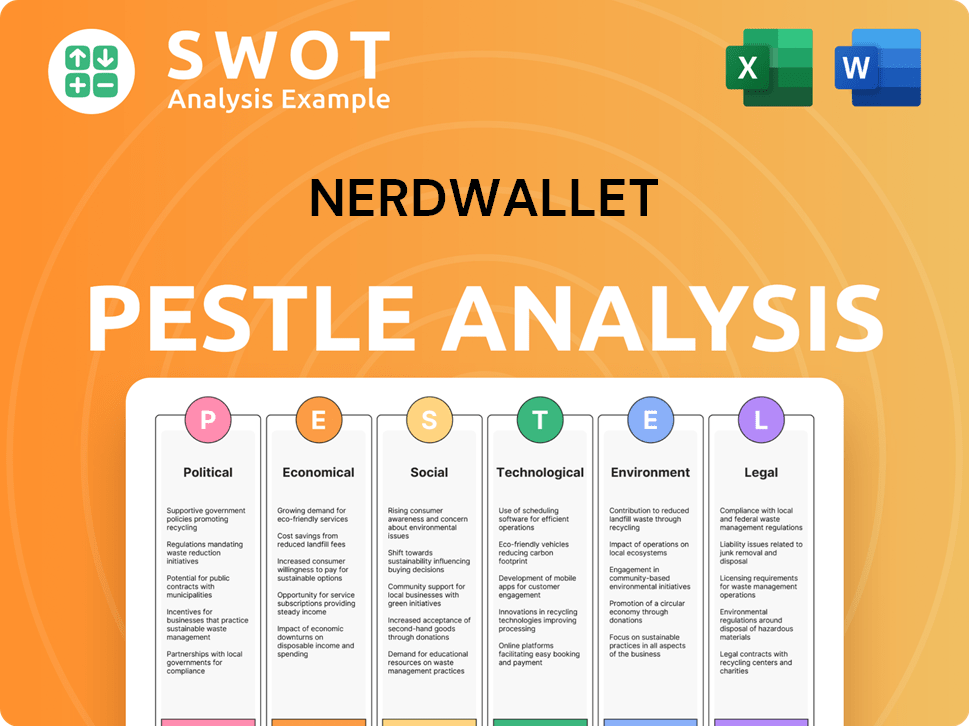

NerdWallet PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives NerdWallet a Competitive Edge Over Its Rivals?

Understanding the competitive advantages of companies like NerdWallet is crucial for anyone involved in the personal finance industry. The Owners & Shareholders of NerdWallet benefit from a deep dive into its strengths and weaknesses. Analyzing the NerdWallet competitive landscape reveals key factors that set it apart in a crowded market. This analysis helps to understand how the company maintains its position and what strategies it uses to grow.

NerdWallet's success stems from a combination of factors. Its ability to provide unbiased advice and build trust with consumers is paramount. The company's focus on education and transparency has cultivated a loyal user base. This strategy is essential in the personal finance industry, where trust is a critical asset. Examining the NerdWallet competitors helps to highlight these differentiators.

The company's technological infrastructure and data analytics capabilities are also significant. By leveraging these tools, NerdWallet can personalize user experiences and offer tailored financial product recommendations. This approach enhances user engagement and provides a competitive edge over generic comparison sites. The evolution of NerdWallet, from its initial focus on credit cards to a broader range of financial products, showcases its adaptability and strategic vision.

NerdWallet has built a strong brand reputation for providing unbiased and expert-driven financial advice. This positions it as a consumer advocate, which fosters trust and loyalty. The company's commitment to transparency and educational content further reinforces its authority in the market. This is a key factor in NerdWallet's competitive advantages.

NerdWallet uses sophisticated data analytics and technology to match consumers with suitable financial products. Proprietary algorithms enhance user experience and offer personalized services. This technology-driven approach is a key differentiator compared to other financial comparison websites.

The affiliate partnership model allows NerdWallet to offer a wide array of product options from various financial institutions. This provides consumers with a comprehensive selection without directly endorsing any specific provider. This model is a significant element of how NerdWallet makes money.

NerdWallet's extensive library of well-researched articles, guides, and tools provides valuable information to users. These resources are consistently updated to reflect market changes, reinforcing the company's trustworthiness. This commitment to quality content supports its NerdWallet's growth strategy.

NerdWallet's strengths include a strong brand, advanced technology, and a comprehensive content library. These factors contribute to its solid market position within the fintech companies landscape. Analyzing NerdWallet analysis reveals its ability to adapt and innovate within the industry.

- Unbiased financial advice builds trust.

- Data-driven personalization enhances user experience.

- Extensive content offerings support user education.

- Affiliate partnerships provide a wide range of product choices.

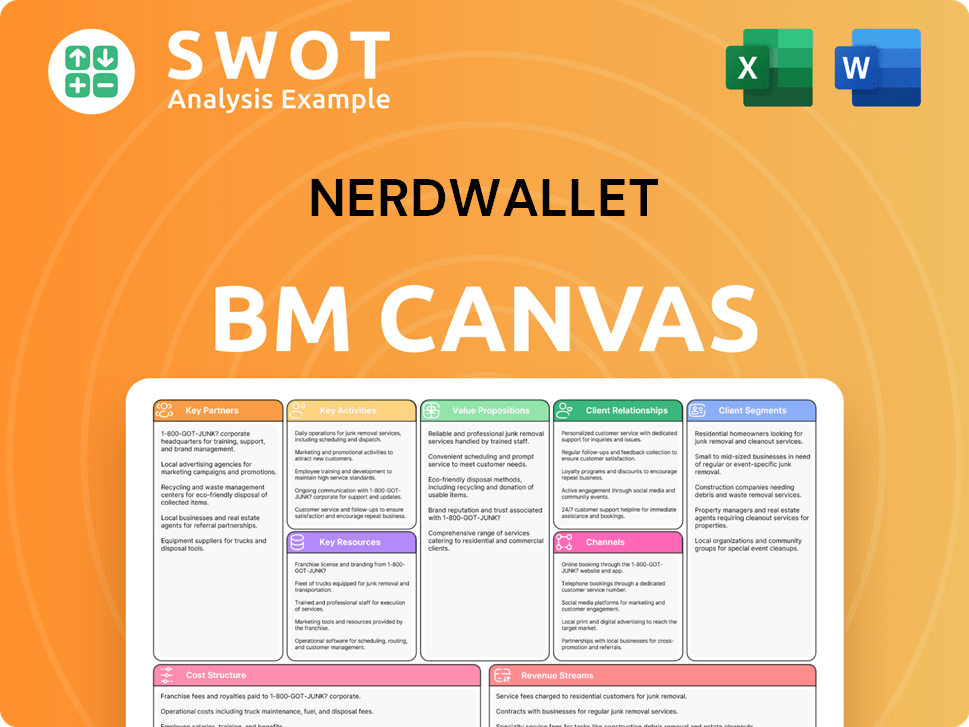

NerdWallet Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping NerdWallet’s Competitive Landscape?

The personal finance industry is undergoing significant transformation, driven by technological advancements, evolving consumer preferences, and increased regulatory scrutiny. This dynamic environment presents both challenges and opportunities for companies like NerdWallet. Understanding the current NerdWallet competitive landscape, its associated risks, and future prospects is crucial for strategic decision-making and sustained growth.

The rise of fintech and the increasing demand for digital financial tools are reshaping the personal finance industry. Companies are competing to offer comprehensive solutions, from budgeting and investing to credit monitoring and insurance comparison. The market is becoming increasingly competitive, requiring constant innovation and adaptation to maintain a strong industry position. The analysis of NerdWallet competitors is vital to understanding the company's position.

Technological advancements, particularly in AI and machine learning, are personalizing financial advice. Regulatory changes, such as increased data privacy, are impacting operations. Consumer preferences are shifting toward mobile-first experiences and integrated financial management tools.

Maintaining a competitive edge against agile fintech startups is a key challenge. Increasing customer acquisition costs and economic uncertainties pose threats. Fluctuating interest rates can impact revenue streams.

Expanding into new international markets, especially those with emerging digital economies, offers growth potential. Developing AI-powered financial planning tools can deepen user engagement. Strategic partnerships with financial institutions can enhance offerings.

Focus on continuous innovation and strategic diversification to strengthen the competitive position. Prioritize user experience and data security. Explore partnerships and international expansion opportunities to ensure long-term resilience.

NerdWallet's competitive advantages include a strong brand reputation and user trust. The company's vast content library and affiliate marketing model are key revenue drivers. However, challenges include the increasing competition from other financial comparison websites and fintech companies.

- Strengths: Strong brand recognition, comprehensive content, and established user base.

- Weaknesses: Reliance on affiliate marketing, vulnerability to economic downturns, and increasing competition.

- Opportunities: Expansion into new markets, development of AI-driven tools, and strategic partnerships.

- Threats: Intense competition, changing consumer behavior, and regulatory changes.

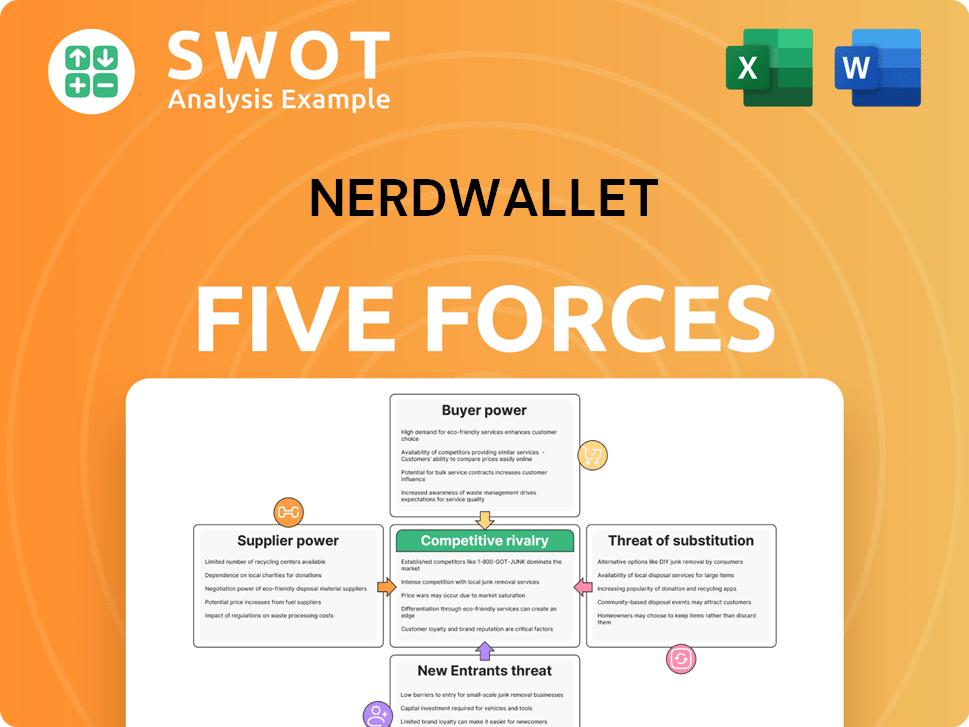

NerdWallet Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of NerdWallet Company?

- What is Growth Strategy and Future Prospects of NerdWallet Company?

- How Does NerdWallet Company Work?

- What is Sales and Marketing Strategy of NerdWallet Company?

- What is Brief History of NerdWallet Company?

- Who Owns NerdWallet Company?

- What is Customer Demographics and Target Market of NerdWallet Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.