NerdWallet Bundle

Can NerdWallet Conquer the Future of Finance?

Navigating the complexities of personal finance can be daunting, but NerdWallet has emerged as a leading voice, guiding consumers through crucial financial decisions. Founded in 2009, this NerdWallet SWOT Analysis reveals the core strategies driving its evolution from a startup to a publicly traded fintech company. With a market cap of $844.23 million as of January 2025, understanding NerdWallet's growth strategy and future prospects is vital for investors and industry watchers alike.

NerdWallet's journey offers valuable insights into the financial services industry's evolution. This analysis delves into the company's business model, exploring its revenue streams and market share. We'll examine its expansion plans, competitive landscape, and the impact of its strategic partnerships. Furthermore, this report provides a deep dive into NerdWallet's valuation and financial performance, offering a comprehensive look at this personal finance platform's long-term vision and the challenges and opportunities that lie ahead.

How Is NerdWallet Expanding Its Reach?

The expansion initiatives of a personal finance platform like the one discussed here are centered around several key strategies. These strategies aim to broaden its reach and deepen its impact within the financial services industry. The core focus is on accessing new customer segments and diversifying revenue streams.

The company's growth strategy is built on a multi-faceted approach. This includes 'Land & Expand,' 'Vertical Integration,' and 'Registrations & Data-Driven Engagement,' alongside continued global expansion. These initiatives are designed to access new customer segments, diversify revenue streams, and maintain a competitive edge. This strategic direction is essential for sustaining long-term growth and solidifying its position in the fintech company landscape.

The company's expansion strategy is designed to capitalize on opportunities in the financial services industry. By focusing on these key areas, the company aims to enhance its market position and deliver value to both users and stakeholders. Understanding these initiatives provides insight into the company's long-term vision.

The company has been actively scaling its presence internationally. A key aspect of the company's expansion plans involves entering new geographical markets. This strategy is crucial for increasing its user base and revenue streams.

Product diversification is evident in their strategic investments in emerging verticals, such as banking and insurance, which have shown strong growth. This involves expanding into new financial product categories beyond its core offerings. This strategy helps to diversify revenue streams and cater to a broader audience.

A significant aspect of their vertical integration strategy is the expansion into mortgages and SMB tools. This includes the acquisition of Next Door Lending, which contributed to a 23% year-over-year increase in mortgage revenue for Q1 2025. This strategy aims to provide a more comprehensive suite of financial tools and services.

The company is emphasizing data-driven engagement by boosting registered users and leveraging CRM channels for personalized offers. This approach focuses on using data analytics to improve user experience and engagement. This helps to increase customer loyalty and drive revenue growth.

The company's expansion strategy is multi-faceted, focusing on both geographical and product-based growth. The company is actively scaling its presence internationally, notably entering Australia in 2024, where monthly unique users (MUUs) grew 31% year-over-year, and continuing to scale in the U.K. and Canada. The company is also expanding into mortgages and SMB tools.

- International Expansion: Entering new markets like Australia, the U.K., and Canada.

- Product Diversification: Strategic investments in emerging verticals such as banking and insurance. For instance, insurance revenue for the full year 2024 totaled $192 million, growing 326% year-over-year, and in Q1 2025, it increased 246% year-over-year to $74.0 million.

- Vertical Integration: Expanding into mortgages and SMB tools. The acquisition of Next Door Lending contributed to a 23% year-over-year increase in mortgage revenue for Q1 2025 and about 1 percentage point to overall company revenue growth in Q1 2025.

- Data-Driven Engagement: Boosting registered users and leveraging CRM channels for personalized offers.

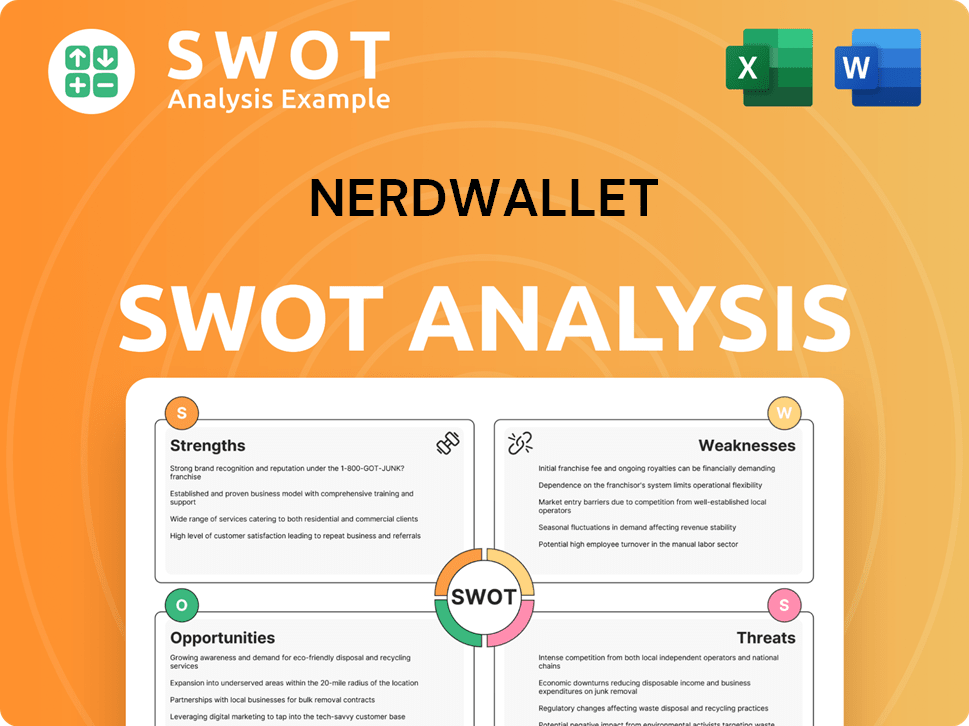

NerdWallet SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does NerdWallet Invest in Innovation?

The company's growth strategy heavily relies on technological innovation to enhance its personal finance platform. This includes leveraging data-driven insights and machine learning to offer personalized financial guidance, which is crucial in the competitive financial services industry. The focus on digital transformation and cutting-edge technologies is central to its long-term vision.

The company's approach involves continuously improving product experiences and user engagement through technological advancements. This is evident in the enhancements made to services like insurance shopping, which have significantly boosted revenue. The strategic pillars of data-driven engagement and vertical integration highlight the importance of technological infrastructure in delivering comprehensive and tailored financial solutions.

The strategic direction aligns with the broader fintech landscape, where AI and automation are increasingly used to improve efficiency and customer experiences. Building a 'Trusted Financial Ecosystem' suggests a platform that seamlessly integrates various financial products and services, likely supported by a robust technological foundation. For more insights, consider reading about the Brief History of NerdWallet.

The core of the company's innovation strategy involves using data and machine learning to provide personalized financial advice. This approach allows the platform to offer tailored recommendations and insights to users, enhancing their experience and engagement. This personalization is key for attracting and retaining users in the competitive personal finance platform market.

The company invests in a robust technological infrastructure to support its various financial products and services. This includes the development and maintenance of a scalable platform capable of handling large volumes of data and user interactions. The infrastructure is designed to ensure seamless integration and efficient operation across all its offerings.

The company is likely incorporating AI and automation to enhance efficiency and improve customer experiences. This includes automating tasks, streamlining processes, and using AI-powered chatbots to provide instant customer support. These technologies are crucial for scaling operations and meeting the growing demands of its user base.

Continuous product development is a key aspect of the company's innovation strategy. This involves regularly updating and improving existing products, as well as introducing new features and services to meet evolving user needs. The product development roadmap is likely driven by user feedback and market trends.

Vertical integration is a strategic pillar, suggesting the company aims to control various aspects of its service delivery. This approach can lead to greater efficiency, better control over user experience, and the ability to offer more comprehensive financial solutions. It involves integrating different financial products and services within a unified platform.

Enhancing user engagement is a primary focus, with the company constantly working to improve user interaction and satisfaction. This involves creating intuitive interfaces, providing valuable content, and offering personalized recommendations. Increased user engagement contributes to higher retention rates and overall platform growth.

The company's technological advancements are directly tied to its strategic pillars, particularly data-driven engagement and vertical integration. These pillars are supported by continuous investment in technology to improve product experiences and user engagement. The financial technology landscape in 2024 and 2025 is seeing increased adoption of AI and automation to enhance efficiency and customer experiences, and the company's strategic direction aligns with these trends.

- Data-Driven Engagement: Utilizing data analytics and machine learning to understand user behavior and preferences, providing personalized recommendations and insights.

- Vertical Integration: Integrating various financial products and services within a unified platform to offer a comprehensive financial ecosystem.

- AI and Automation: Implementing AI-powered tools to automate tasks, improve customer support, and enhance overall operational efficiency.

- Product Development: Continuously updating and improving existing products, and introducing new features and services based on user feedback and market trends.

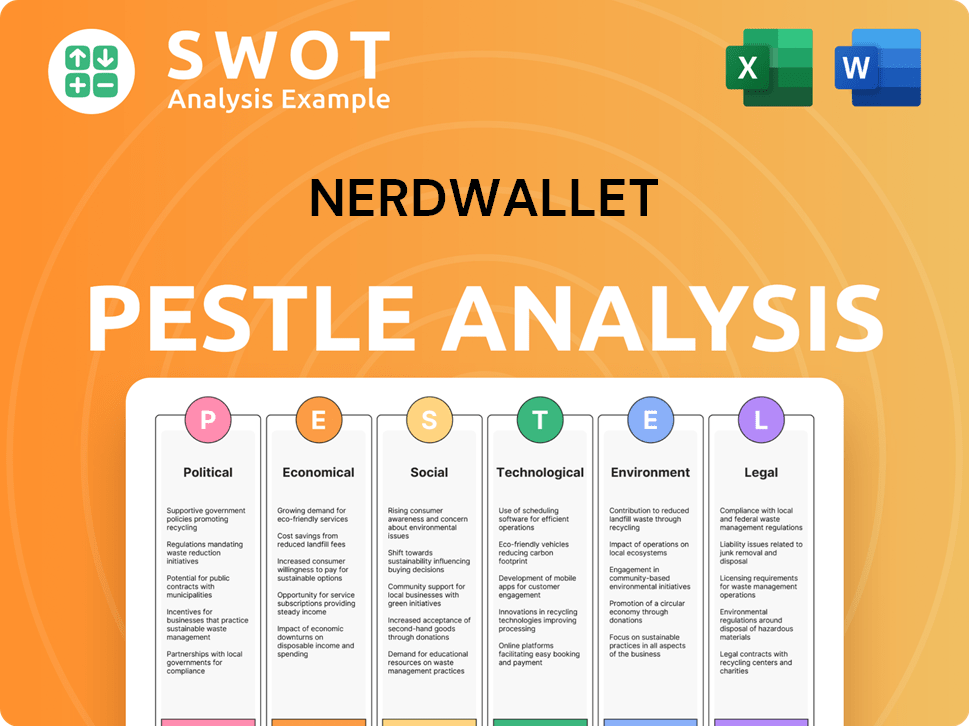

NerdWallet PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is NerdWallet’s Growth Forecast?

Analyzing the financial outlook of the personal finance platform, it's clear that the company is focused on sustained revenue growth and improved profitability. The company's NerdWallet growth strategy is centered on expanding its core business segments while navigating challenges in others.

For the full year 2024, the company reported revenue of $688 million, reflecting a 15% year-over-year increase. This sets a solid foundation for the NerdWallet future prospects. The company's ability to adapt and grow within the dynamic financial services industry is a key indicator of its long-term potential.

In Q1 2025, the company demonstrated strong performance, exceeding its initial revenue guidance. This positive momentum indicates a successful NerdWallet company analysis and strategic execution.

In Q1 2025, revenue reached $209 million, a 29% year-over-year increase. This growth was driven by strong performance in the insurance and banking sectors. The personal finance platform shows robust expansion.

Insurance revenue experienced a remarkable 246% year-over-year increase in Q1 2025, reaching $74.0 million. This significant growth highlights the success of the company's insurance segment. This demonstrates the Fintech company's ability to capitalize on market opportunities.

Banking also showed positive results, with personal loans returning to growth in Q1 2025 after a decline in Q4 2024. This recovery indicates effective strategies in the banking sector. The company is effectively managing its diverse revenue streams.

For full-year 2025, the company has increased its non-GAAP operating income guidance to approximately $55 million to $66 million. The company anticipates at least $80 million in non-GAAP operating income by 2026. This demonstrates a commitment to long-term financial health.

While the credit card and SMB products segments faced challenges, the overall financial trajectory remains positive. The company's focus on balancing profitability and brand investments, coupled with its strong financial health, positions it well for future growth. For a deeper dive into how the company generates revenue, check out Revenue Streams & Business Model of NerdWallet.

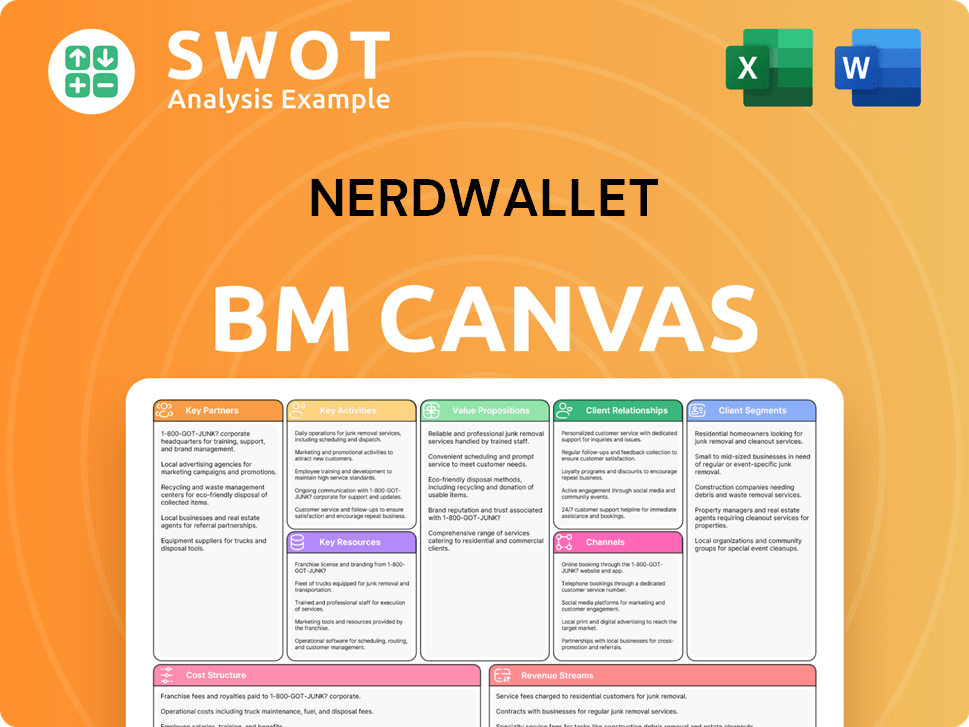

NerdWallet Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow NerdWallet’s Growth?

The path to growth for the company is not without its challenges. Several strategic and operational risks could affect its ambitions, primarily due to market competition, regulatory changes, and technological advancements. Understanding these potential obstacles is crucial for a comprehensive NerdWallet company analysis.

One of the most significant challenges is the volatility in organic search traffic, especially for content that is designed for learning and not directly monetized. This volatility continues to put pressure on the growth of monthly unique users (MUU). Macroeconomic factors and the rise of AI also present considerable hurdles.

In Q4 2024, monthly unique users (MUUs) decreased by 20% year-over-year, reaching 19 million, the lowest since the company's IPO in 2021. The company anticipates a return to user growth by early 2026. The credit card vertical experienced a decline in Q1 2025 revenue, down 24% year-over-year, due to ongoing issues in organic search traffic.

The competitive landscape within the financial services industry is intense. Numerous platforms and services compete for user attention and market share. This competition can impact the company's ability to attract and retain users, influencing its overall growth trajectory.

The financial services industry is heavily regulated, and changes in these regulations can present significant challenges. Compliance with new rules and requirements can be costly and time-consuming, potentially affecting the company's operations and financial performance. The company must stay informed and adapt to these evolving regulations.

Technological advancements, particularly the rise of AI, pose a potential threat. AI could change how users seek financial information, possibly reducing direct traffic to comparison sites. Adapting to these technological shifts is crucial for the company's long-term success. The company must innovate to stay ahead.

Macroeconomic factors, such as high interest rates and tight lending conditions, can affect the company's performance. These conditions can reduce demand for financial products like loans and mortgages, impacting revenue. The company’s ability to navigate these economic cycles is essential.

Given that the company handles sensitive financial information, cybersecurity threats are a major concern. Data breaches and cyberattacks can damage the company's reputation and lead to financial losses. Robust security measures are essential to protect user data and maintain trust.

A significant portion of the company's traffic comes from organic search. Fluctuations in search engine algorithms can, therefore, significantly impact traffic and, consequently, revenue. Diversifying traffic sources is important to mitigate this risk and ensure sustainable growth. The company must constantly adapt its SEO strategies.

To mitigate these risks, the company is focusing on a multi-faceted approach. This includes diversifying its top-of-funnel traffic sources with new organic channels and investing in vertical integration to improve both unit economics and user experience. Moreover, the company is building direct and engaged relationships with consumers and SMBs to drive long-term growth. Balancing profitability with brand investments is also a key focus.

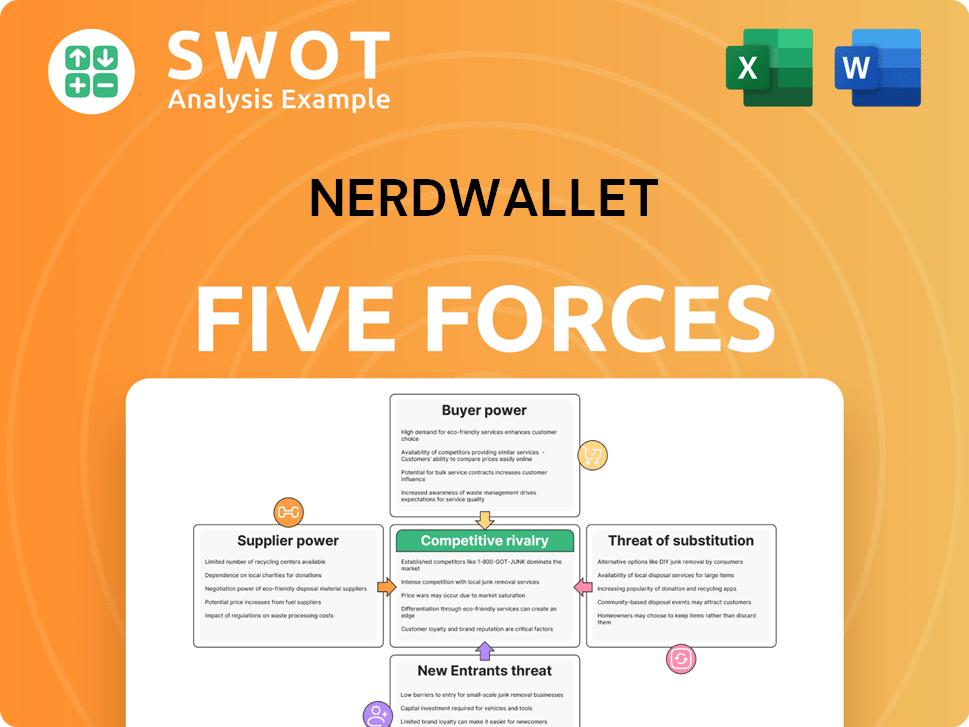

NerdWallet Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of NerdWallet Company?

- What is Competitive Landscape of NerdWallet Company?

- How Does NerdWallet Company Work?

- What is Sales and Marketing Strategy of NerdWallet Company?

- What is Brief History of NerdWallet Company?

- Who Owns NerdWallet Company?

- What is Customer Demographics and Target Market of NerdWallet Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.