NerdWallet Bundle

Who Does NerdWallet Serve?

Understanding the NerdWallet SWOT Analysis is key to grasping its customer base. Knowing the NerdWallet audience and their financial needs is vital for any financial services company. This is especially true for a personal finance platform like NerdWallet, which aims to provide clarity in a complex financial world. Analyzing the customer demographics of NerdWallet target market is essential for strategic growth.

By examining NerdWallet users' profiles, from NerdWallet customer age range to NerdWallet user income levels, we can uncover valuable insights. This exploration will help us understand who uses NerdWallet for financial advice, their financial goals, and how the company adapts to meet their needs. This analysis will also touch upon NerdWallet's ideal customer profile and NerdWallet's marketing strategy for demographics, providing a comprehensive view of its market positioning.

Who Are NerdWallet’s Main Customers?

Understanding the customer demographics and target market of a financial platform is crucial for strategic planning. The primary focus is on consumers seeking assistance with their financial decisions. The platform also extends its services to small and mid-sized businesses (SMBs), broadening its reach within the financial services sector.

The core NerdWallet target market includes millennials and Gen Z individuals. These users are generally tech-savvy, value-conscious, and actively seek financial guidance online. This demographic is typically aged between 25 and 45, making them comfortable using digital platforms for financial management. The platform's ability to cater to this audience is key to its success.

The platform has demonstrated adaptability within the market. For instance, the insurance business saw impressive growth, with revenue increasing by 246% year-over-year in Q1 2025. Banking products also showed robust growth, driven by consumer demand for lower-risk cash options. However, the credit card business faced headwinds, resulting in a 24% year-over-year decrease in revenue in Q1 2025. The platform's ability to adapt to market trends is evident.

The primary NerdWallet audience consists of millennials and Gen Z, aged 25-45. This group is tech-literate and actively seeks financial advice online. They are value-conscious and rely on digital platforms for financial guidance.

Insurance and banking products have shown significant growth. Revenue in the insurance segment surged by 246% year-over-year in Q1 2025. Banking products also experienced strong growth due to consumer demand for low-risk options.

The credit card business faced challenges, with a 24% year-over-year revenue decrease in Q1 2025. The platform has adapted to market changes by focusing on high-growth areas like insurance and banking. Monthly unique users (MUUs) were down 29% year-over-year in Q1 2025, although they were up 7% compared to Q4 2024.

The platform also serves SMBs, though revenue in this segment decreased by 5% year-over-year in Q1 2025. This decline was mainly due to a decrease in business loan originations. The platform is continuously adjusting its offerings to meet market demands.

The platform's success is closely tied to its ability to understand and serve its core demographic. The platform's strategy involves adapting to market dynamics. Focusing on high-growth areas like insurance and banking is crucial for sustained success.

- The primary customer demographics are millennials and Gen Z, aged 25-45.

- Insurance and banking products are key growth drivers.

- The credit card business faced headwinds, highlighting the need for adaptation.

- The SMB segment presents both opportunities and challenges.

- For more insights, explore the Competitors Landscape of NerdWallet.

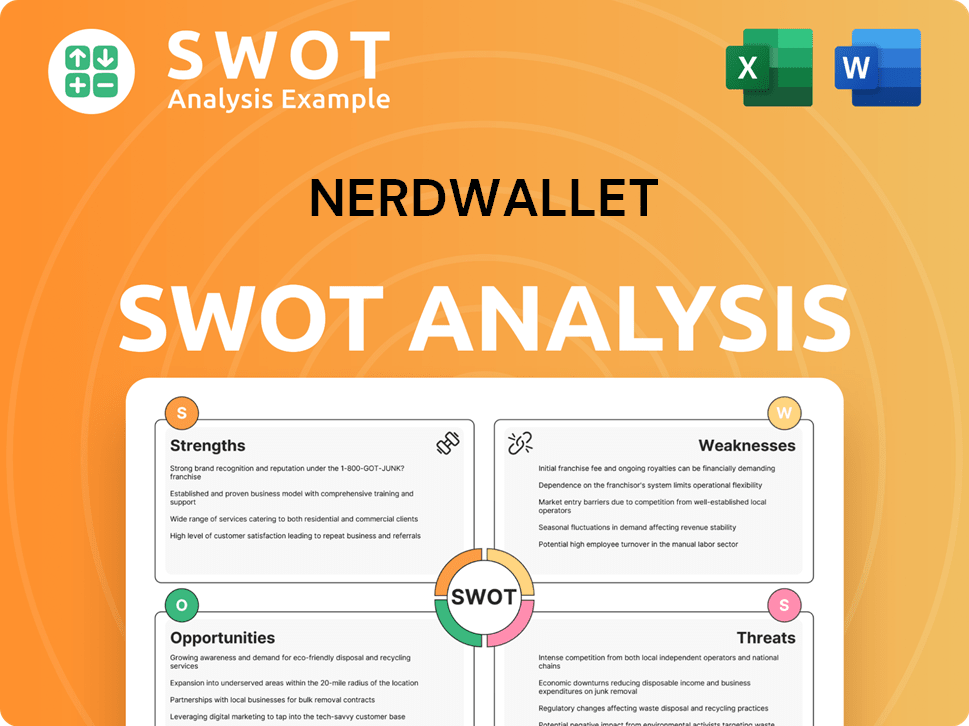

NerdWallet SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do NerdWallet’s Customers Want?

Understanding the needs and preferences of the NerdWallet audience is crucial for its success. The platform caters to individuals seeking clarity in complex financial decisions, unbiased guidance, and tools to save time and money. This focus helps NerdWallet attract and retain users across various financial products and services.

NerdWallet's customers are actively seeking ways to make informed choices about their finances. They are interested in credit cards, mortgages, insurance, banking, and investments. The desire for personalized recommendations and comprehensive financial education heavily influences their purchasing behaviors. This approach helps NerdWallet tailor its offerings to meet the diverse needs of its user base.

The platform addresses common pain points such as navigating fragmented financial services and the increasing complexity of financial products. NerdWallet aims to democratize access to trustworthy financial guidance. The company responds to evolving consumer demand by strengthening its offerings, such as insurance and banking. This responsiveness is a key factor in maintaining its relevance and appeal to its target market.

NerdWallet provides clear, understandable information to help users make informed financial choices. This includes simplifying complex topics like credit scores and investment strategies.

The platform offers unbiased reviews and comparisons of financial products. This helps users make decisions without the influence of hidden agendas or biased recommendations.

NerdWallet helps users save time and money by providing tools and resources to find the best deals on financial products. This includes features like credit card comparison tools and budgeting templates.

The platform offers personalized recommendations based on individual financial goals and preferences. This ensures users receive tailored advice relevant to their specific needs.

NerdWallet provides extensive educational resources to help users understand financial concepts. This includes articles, guides, and calculators to empower users with knowledge.

The platform's user-friendly interface makes it easy for users to navigate and access information. This ensures a seamless experience for all users, regardless of their financial literacy level.

The company tailors its marketing and product features through personalized recommendations and customized experiences, leveraging data analytics and machine learning algorithms. This approach provides tailored financial advice and product suggestions based on individual preferences and goals. For more insights into the company's origins and development, you can read a Brief History of NerdWallet.

NerdWallet offers a range of features and benefits designed to meet the diverse needs of its users. These include:

- Credit Card Comparisons: Tools to compare and find the best credit cards based on individual needs.

- Mortgage Rates: Information and resources to find competitive mortgage rates and understand the mortgage process.

- Insurance Comparisons: Tools to compare insurance policies and find the best coverage at affordable prices.

- Investment Advice: Educational resources and tools to help users make informed investment decisions.

- Banking Product Reviews: Reviews and comparisons of banking products to help users choose the right accounts.

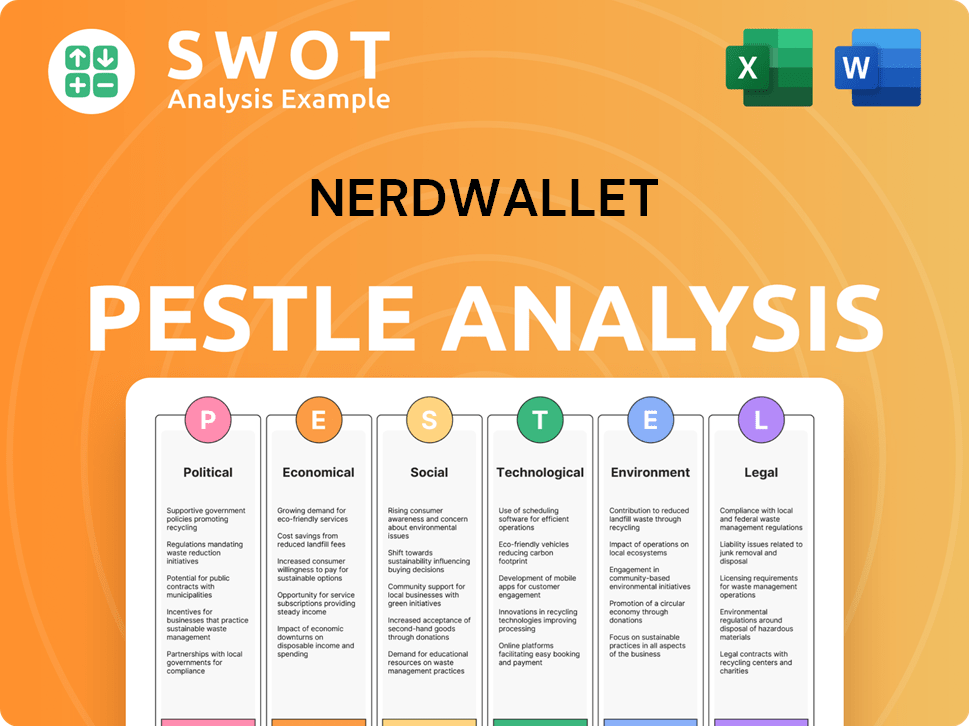

NerdWallet PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does NerdWallet operate?

The primary geographical market for financial services users of NerdWallet is the United States, where it has established a strong presence and brand recognition. The platform's focus on the U.S. market is evident in its content, product offerings, and marketing strategies, which are tailored to meet the needs of American consumers.

However, NerdWallet has expanded its reach beyond the U.S. to include international markets. The company has strategically targeted countries with significant financial services markets to broaden its user base and diversify its revenue streams. This expansion demonstrates NerdWallet's commitment to global growth and its ability to adapt to diverse regulatory environments and consumer preferences.

NerdWallet's international expansion includes the United Kingdom, Canada, and Australia. In August 2020, the company acquired Know Your Money, a UK-based startup, to enter the UK market. More recently, in 2024, NerdWallet expanded into the Australian market, experiencing a significant year-over-year growth of 31% in monthly unique users.

The U.S. remains NerdWallet's core market, with a focus on providing comprehensive financial advice and tools to American consumers. The company's marketing efforts and content are heavily geared towards this demographic. The platform's success in the U.S. market is a testament to its understanding of the local financial landscape and consumer needs.

NerdWallet entered the UK market through the acquisition of Know Your Money in August 2020. This move allowed the company to tap into the UK's financial services sector and provide localized content and product comparisons. The UK expansion is a key part of NerdWallet's international growth strategy.

NerdWallet also serves the Canadian market, offering financial tools and resources tailored to Canadian consumers. The company adapts its content to reflect Canadian financial products and regulations. This demonstrates the platform's commitment to providing relevant information to its users.

In 2024, NerdWallet expanded into the Australian market, experiencing substantial growth in monthly unique users. The company localizes its offerings to meet the specific needs of Australian consumers. This expansion highlights NerdWallet's global growth strategy and its ability to adapt to different markets.

NerdWallet's success in these diverse markets is partly due to its localization strategy. The company adapts its content and product comparisons to reflect regional financial products and regulations. This approach ensures that the information provided is relevant and useful to users in each market.

NerdWallet's strategic expansion into international markets is part of its overall growth strategy. The goal is to scale operations globally and diversify its user base. This approach helps the company reduce its reliance on a single market and increase its overall revenue potential. For more insights, check out the Marketing Strategy of NerdWallet.

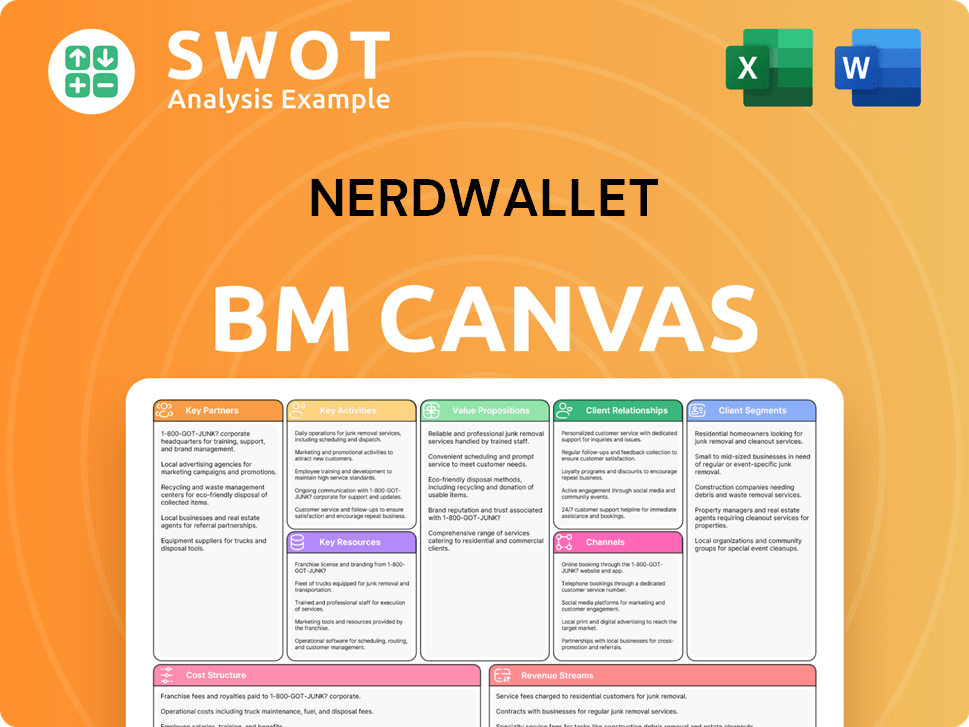

NerdWallet Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does NerdWallet Win & Keep Customers?

The customer acquisition and retention strategies employed by the company are multifaceted, focusing on digital marketing, content creation, and personalized user experiences. A key aspect of their strategy involves expanding their reach through new organic channels, such as the TravelNerd newsletter and the Smart Travel podcast. The company also prioritizes building a robust registered user base, which, as of the end of Q1 2025, exceeded 26 million cumulative users, and leveraging CRM for personalized offers.

Content marketing serves as a cornerstone of the company's strategy, establishing it as a reliable source of financial information and advice. This involves developing informative content, including articles, guides, infographics, and videos, to meet the financial needs of its audience. The company also utilizes social media and SEO tactics to broaden its reach and engage with its target demographics. This approach helps to attract and retain users by providing valuable resources and fostering trust.

For retention, the company emphasizes vertical integration by expanding into services like mortgages through acquisitions such as Next Door Lending. Direct consumer engagement through its app and personalized guidance tools is crucial for building recurring relationships. Moreover, the company focuses on cost control and operational optimization to improve margins. The company's strategy for 2025 and beyond emphasizes 'relentless improvement' through these core growth pillars, aiming to build a 'Trusted Financial Ecosystem.'

The company expands its reach by leveraging new organic channels. This includes the TravelNerd newsletter and the Smart Travel podcast. This approach helps in attracting a wider audience and diversifying the sources of user acquisition. The company aims to capture a broader segment of financial services users through these channels.

The company actively grows its registered user base, which reached over 26 million cumulative users by the end of Q1 2025. This strategy enables personalized engagement and targeted offers. This focus on registrations supports data-driven engagement strategies.

Content marketing is a core element, establishing the company as a trusted source. This involves creating valuable content like articles, guides, and videos. The company uses SEO and social media to expand reach and engage its target audience. This strategy is designed to attract and inform NerdWallet users.

The company emphasizes vertical integration by expanding into services such as mortgages. Direct engagement through its app and personalized tools builds recurring relationships. The goal is to improve user experience and unit economics. These strategies are designed to retain customers and enhance their experience on the personal finance platform.

The company’s strategy for 2025 and beyond focuses on 'relentless improvement'. This includes building a 'Trusted Financial Ecosystem'. The company aims to build a strong foundation for future growth. This approach focuses on building a trusted financial ecosystem.

- Focus on new organic channels

- Growing registered user base

- Content marketing

- Vertical integration

The company's approach involves a blend of strategies designed to attract, engage, and retain customers. The focus on content, user experience, and strategic partnerships reflects a comprehensive effort to build a strong and sustainable business model. For more details on the company's financial strategies, you can refer to Revenue Streams & Business Model of NerdWallet.

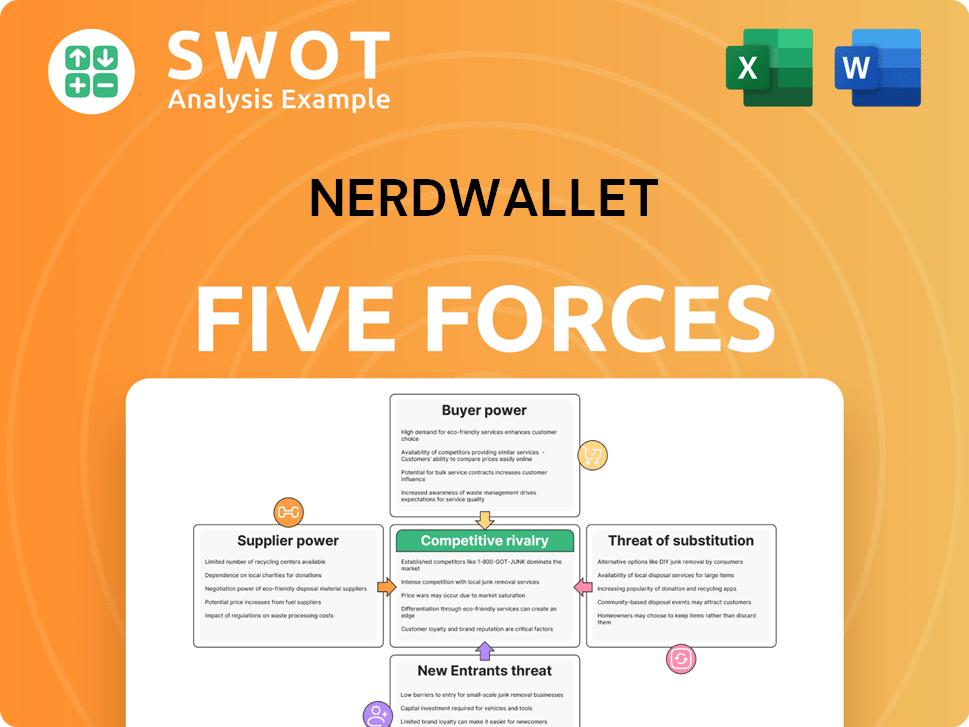

NerdWallet Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of NerdWallet Company?

- What is Competitive Landscape of NerdWallet Company?

- What is Growth Strategy and Future Prospects of NerdWallet Company?

- How Does NerdWallet Company Work?

- What is Sales and Marketing Strategy of NerdWallet Company?

- What is Brief History of NerdWallet Company?

- Who Owns NerdWallet Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.