Newell Brands Bundle

How Did a Curtain Rod Company Become a Global Consumer Giant?

In 1903, a small company began manufacturing metal curtain rods in Ogdensburg, New York. This humble beginning marked the inception of what would become Newell Brands, a global powerhouse in the consumer goods industry. From its initial focus on a niche product, Newell Brands has undergone a remarkable transformation, expanding its portfolio through strategic acquisitions and innovative product development.

This Newell Brands SWOT Analysis will delve into the Newell Company History, exploring its Newell Brands Timeline from its founding to its present-day status. We'll examine the Newell Brands acquisitions, key milestones, and the evolution of its diverse range of Newell Brands products. Understanding the Newell Brands brands and their impact provides valuable insights into the company's strategic growth and market position.

What is the Newell Brands Founding Story?

The story of Newell Brands, a company with a vast portfolio of consumer products, began in the early 20th century. It started with a simple product and a strategic vision that would evolve over decades. This foundation set the stage for the company's growth through acquisitions and diversification.

The company's origins are rooted in the acquisition of a struggling brass curtain rod manufacturer. This initial move laid the groundwork for what would become a global consumer goods powerhouse. The early focus on a single product line highlights the initial strategy.

The company's journey began in 1903. Edgar Newell took control of the bankrupt W.F. Linton Company, a brass curtain rod manufacturer located in Ogdensburg, New York. He renamed it Newell Manufacturing Company, Inc. While Edgar Newell was skilled in sales, he needed manufacturing expertise. This led to a period of adjustments with different general managers between 1903 and 1907. His son, Allan, eventually took over the management of Newell Manufacturing. Edgar also established Newell Manufacturing Company Ltd. in Prescott, Canada, to benefit from the more favorable Canadian distribution channels.

Newell Manufacturing's early business centered on brass curtain rods.

- The manufacturing process initially used a waterwheel for tube-making.

- F.W. Woolworth became the first national distributor in 1916.

- The company's funding came from Edgar Newell's acquisition of the Linton Company.

- The early 20th-century economic climate supported the demand for household goods.

The initial business model of Newell focused on producing brass curtain rods. The manufacturing process used a waterwheel for the tube-making. A notable event from this period was when F.W. Woolworth became the first national distributor for Newell's bronze-plated curtain rods in 1916. This marked the beginning of Newell's mass merchandising strategy. The company's primary funding source was Edgar Newell's acquisition of the struggling Linton Company. The cultural and economic context of the early 20th century, with growing demand for household goods and the rise of mass retail, provided a good environment for Newell's foundational product to gain traction.

The company's early focus on brass curtain rods proved to be a successful start. The partnership with F.W. Woolworth was a key step in establishing a wide distribution network. This early success set the stage for future expansion and growth. To understand more about how the company has evolved its strategies over time, you can read about the Marketing Strategy of Newell Brands.

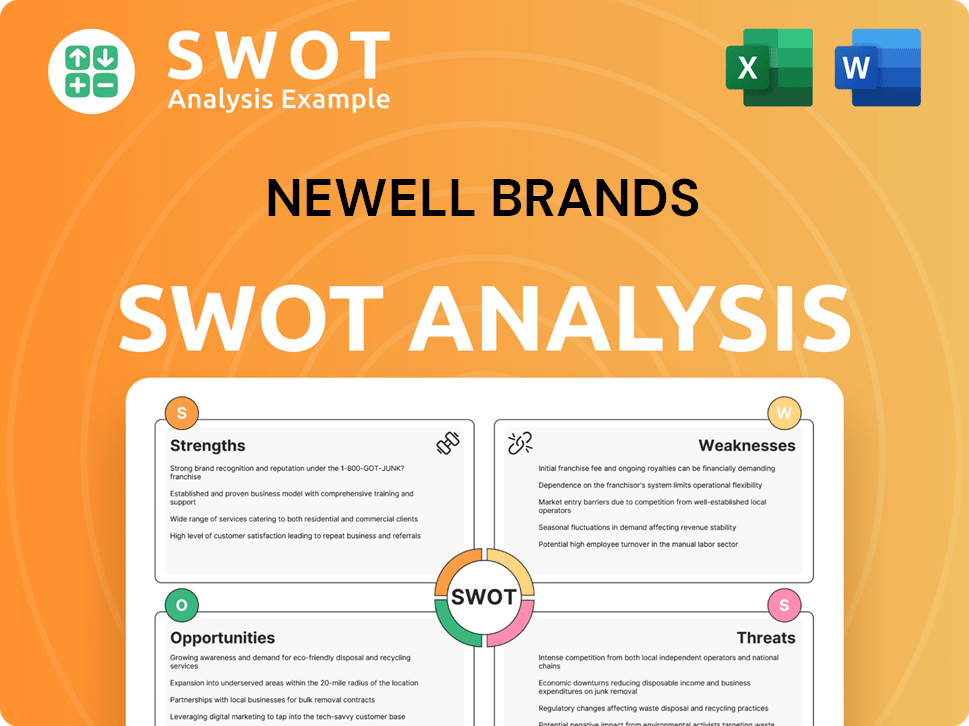

Newell Brands SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Newell Brands?

The early growth of Newell Brands, initially known as Newell Manufacturing Company, was marked by strategic operational improvements and market expansion. This period saw the company invest in more efficient manufacturing processes and broaden its product offerings. Key moves included securing major retail partnerships and a shift towards a growth-by-acquisition strategy.

Around 1908, Newell boosted profits by investing in machines that produced curtain rods more efficiently. In 1910, Newell established an affiliated company in Prescott, Canada. By 1912, a new factory was under construction in Ogdensburg, New York, completed a year later. Securing F.W. Woolworth as a customer in 1916 was a pivotal moment, initiating a mass merchandising strategy.

In 1921, Western Newell Manufacturing Company was formed in Freeport, Illinois, and quickly became profitable. By 1928, Western Newell's sales reached $485,000. The company expanded its product lines to include various drapery hardware, such as extension curtain rods and ornamental drapery rods, broadening its market presence.

Daniel C. Ferguson became president in 1965, driving a growth-by-acquisition strategy. In 1966, all Newell companies were consolidated into Newell Manufacturing Company, based in Freeport. The company went public in 1972, listing on NASDAQ at $28 per share. Key acquisitions followed, including EZ Paintr Corporation in 1974.

In 1983, Mirro Corporation, a cookware manufacturer, was acquired. By 1985, the company officially changed its name to Newell Co. The company's growth efforts during this period were shaped by a focus on cost-effective operations and supply chain management, alongside strategic acquisitions to diversify its product portfolio and expand market reach.

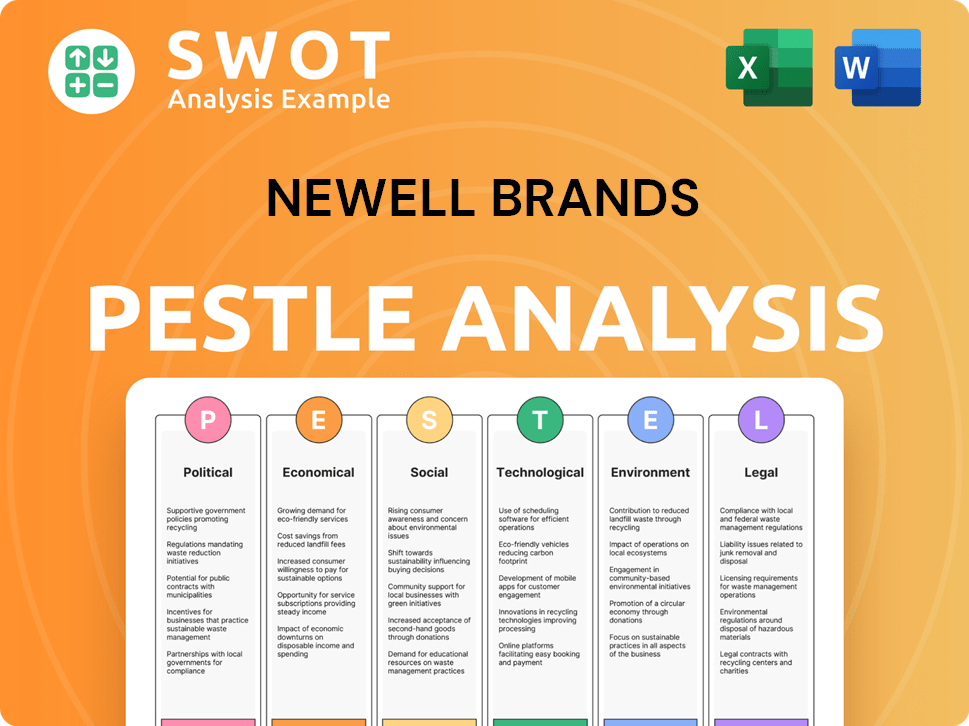

Newell Brands PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Newell Brands history?

The Newell Company History is marked by significant growth through acquisitions and strategic shifts. From its early days, the company has evolved from a hardware manufacturer to a diversified consumer goods giant, navigating market changes and economic challenges to maintain its position in the industry.

| Year | Milestone |

|---|---|

| 1903 | The company was founded as the Newell Manufacturing Company. |

| 1908 | The company adopted roll-forming machines, significantly improving manufacturing capabilities. |

| 1966 | All Newell companies were consolidated. |

| 1972 | The company went public. |

| 1999 | The acquisition of Rubbermaid Incorporated led to the company being renamed Newell Rubbermaid. |

| 2016 | Notable acquisitions included Coleman, Yankee Candle, and Mr. Coffee. |

| 2019 | The company divested non-core businesses like Jostens and Pure Fishing. |

| 2024 | An organizational realignment was implemented to strengthen commercial capabilities. |

Early on, a major innovation was the adoption of roll-forming machines in 1908, which allowed for a greater variety of curtain rod shapes and a faster, more adaptable manufacturing process. The company's approach to innovation also included the 'Newellization' strategy, focusing on optimizing acquired companies' operations.

In 1908, the adoption of roll-forming machines allowed for a greater variety of curtain rod shapes and a faster manufacturing process. This was a key early innovation that improved production efficiency and product diversity.

The 'Newellization' strategy focused on optimizing costs and operations of acquired companies. It involved inventory optimization, integrated systems, and lean operations to increase profitability and shelf space with major retailers.

The company has faced challenges such as market downturns and competitive pressures. In 2019, a sharp decline in fourth-quarter operating earnings was reported due to impairment charges and revenue declines. The company has continued to navigate demand headwinds in 2024 and 2025.

The company has had to navigate market downturns and increased competition. These factors have impacted financial performance and required strategic adjustments.

In 2019, the company reported a sharp decline in fourth-quarter operating earnings. This was due to impairment charges and revenue declines, which necessitated strategic restructuring.

In 2024 and 2025, the company has faced demand headwinds for its discretionary products. These challenges have required strategic pivots and operational efficiencies.

The company divested non-core businesses to focus on its most attractive brands. This strategic move aimed to streamline operations and improve financial performance.

In January 2024, the company implemented an organizational realignment. This was done to strengthen commercial capabilities and drive efficiencies.

The company has invested nearly $2 billion in U.S. manufacturing since 2017. This investment aims to mitigate tariff impacts and enhance the supply chain.

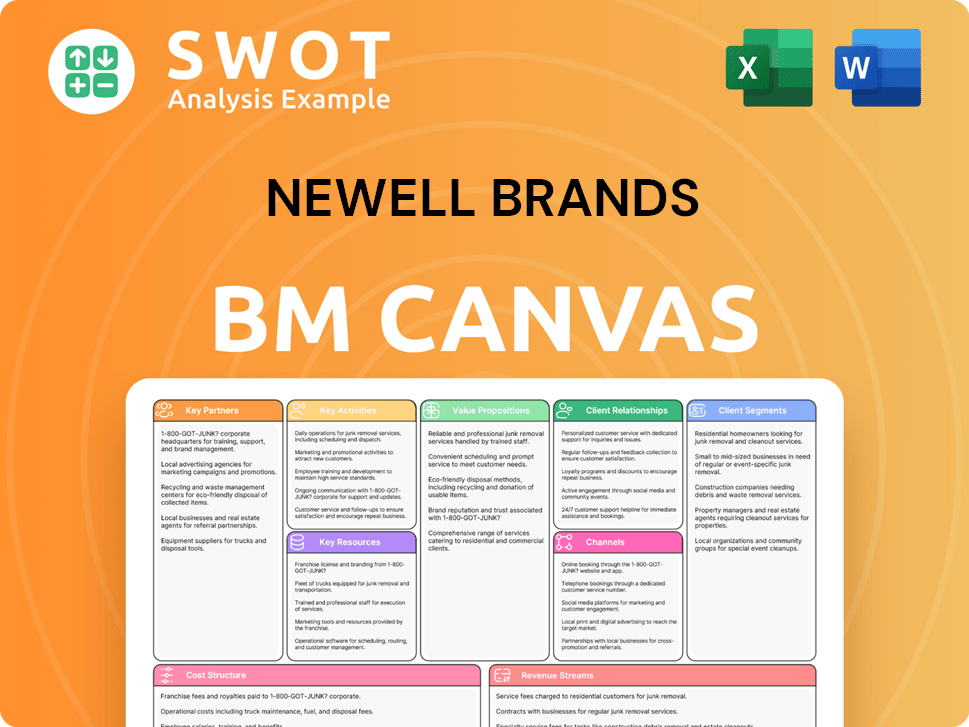

Newell Brands Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Newell Brands?

The Newell Brands Timeline showcases a journey of strategic growth through acquisitions and market adaptation, evolving from a metal curtain rod manufacturer to a diversified consumer goods company. This transformation, marked by key acquisitions and strategic shifts, reflects its commitment to meeting consumer needs and expanding its market presence.

| Year | Key Event |

|---|---|

| 1903 | Edgar Newell took control of the W.F. Linton Company, renaming it Newell Manufacturing Company, Inc., and began manufacturing metal curtain rods. |

| 1916 | F.W. Woolworth became the first national customer for Newell's products, marking the start of its mass merchandising strategy. |

| 1921 | Western Newell Manufacturing Company was formed in Freeport, Illinois, expanding manufacturing capabilities. |

| 1965 | Daniel C. Ferguson was named president, initiating a growth-by-acquisition strategy. |

| 1972 | Newell Manufacturing Company went public, listing on NASDAQ. |

| 1979 | Newell was listed on the New York Stock Exchange. |

| 1983 | Acquired Mirro Corporation, entering the cookware market. |

| 1992 | Acquired Sharpie. |

| 1999 | Acquired Rubbermaid Incorporated for $6 billion, and the company was renamed Newell Rubbermaid. |

| 2000 | Acquired Paper Mate, Parker, and Waterman. |

| 2016 | Merged with Jarden Corporation to form Newell Brands Inc., adding brands like Coleman, Yankee Candle, and Mr. Coffee. |

| 2024 | Announced an organizational realignment to strengthen commercial capabilities and reduce costs. |

| 2024 | Reported full-year net sales of $7.6 billion, a decline of 6.8% from the prior year, but noted significant gross and operating margin improvement. |

| 2025 (Q1) | Reported net sales of $1.6 billion, a decline of 5.3% year-over-year, with a normalized gross margin improvement to 32.5%. |

| 2025 (February) | Graco launched the EasyTurn 360° 2-in-1 Convertible Car Seat. |

| 2025 (June) | Leadership presented at the dbAccess Global Consumer Conference, outlining strategic turnaround and future growth plans. |

The company is focused on a strategic turnaround to achieve sustainable growth and improve profitability. This involves streamlining the brand portfolio and concentrating on core brands.

For 2025, net sales are expected to decline by 2% to 4%, with a normalized operating margin projected between 9% and 9.5%. Operating cash flow is anticipated to be between $400 million and $500 million.

The company is streamlining its brand portfolio from 80 to approximately 55, focusing on top-performing brands. Investment in innovation, brand-building, and go-to-market excellence is a priority.

Leveraging tariff advantages and resuming strategic purchases from China are part of the strategy. The debt leverage ratio is expected to improve to 4.3x by the end of 2025, strengthening the balance sheet.

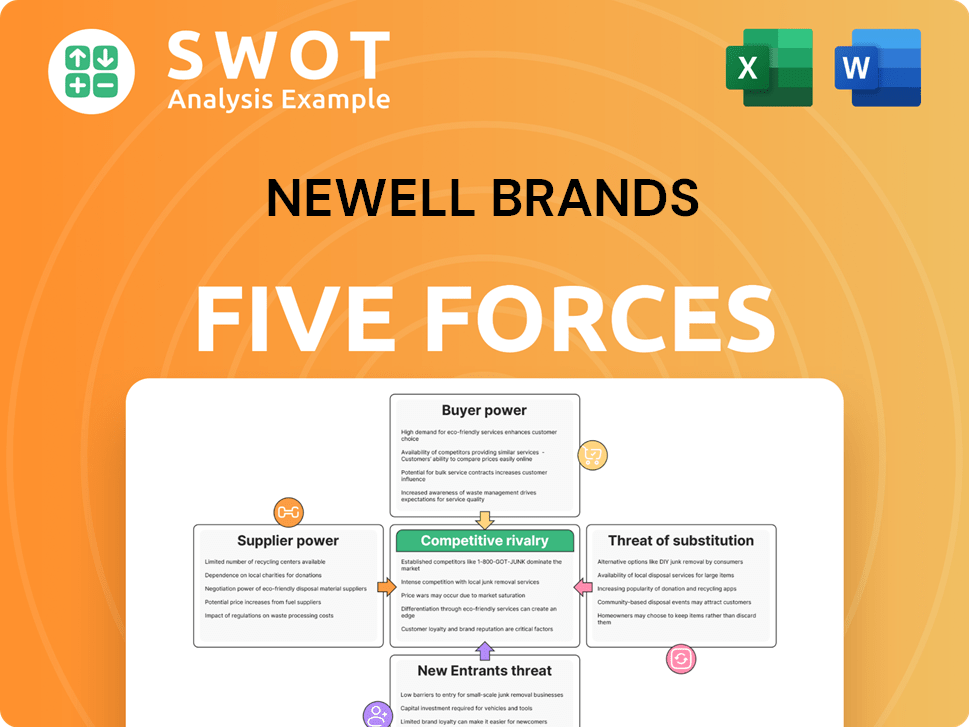

Newell Brands Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Newell Brands Company?

- What is Growth Strategy and Future Prospects of Newell Brands Company?

- How Does Newell Brands Company Work?

- What is Sales and Marketing Strategy of Newell Brands Company?

- What is Brief History of Newell Brands Company?

- Who Owns Newell Brands Company?

- What is Customer Demographics and Target Market of Newell Brands Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.