Newell Brands Bundle

Who Really Controls Newell Brands?

Newell Brands Inc. has undergone a dramatic transformation, significantly shaped by shifts in its ownership and strategic direction. The 2016 acquisition of Jarden Corporation for $15.4 billion was a pivotal move, reshaping its portfolio and solidifying its market position. This merger created a global consumer-products giant, highlighting how ownership changes can profoundly influence a company's scope and strategic focus.

Founded in 1903, Newell Brands has evolved from a curtain rod manufacturer to a leading global consumer goods company with over 50 iconic brands. Understanding the Newell Brands SWOT Analysis is crucial for grasping its strategic choices. This exploration will uncover the intricate ownership evolution of the Newell Brands company, from its founding to the influence of key investors, public shareholders, and recent ownership trends, providing insights into who owns Newell Brands and how it impacts its future. The company's history, including its Newell Brands SWOT Analysis, is key to understanding its current structure.

Who Founded Newell Brands?

The story of Newell Brands, and the question of 'Who owns Newell Brands?', begins in 1903. Edgar A. Newell acquired a struggling curtain rod company in Ogdensburg, New York. He then renamed it Newell Manufacturing Company, Inc., marking the official start of what would become a major player in the consumer goods industry.

Initially, Edgar Newell focused on enhancing production efficiency. While the exact initial ownership details are not fully available, his acquisition demonstrates his control over the company. This was the foundation upon which Newell Brands was built.

Early on, Edgar Newell brought his son, Allan Newell, into the company, and also established Newell Manufacturing Company Ltd. in Canada to expand distribution. A significant shift in the founding ownership structure occurred in the late 1930s when Daniel C. Ferguson, who would later become a pivotal figure in the company's growth, was given a small stake in Newell Manufacturing. This effectively began to transition the company out of exclusive Newell family ownership, although the Newell brothers maintained voting control rights into the late 1940s. The early vision of the founding team, particularly under Daniel Ferguson's guidance from the 1960s, shifted towards a growth-by-acquisition strategy and a multi-product focus, moving beyond just curtain rods.

Edgar A. Newell's acquisition of the bankrupt curtain rod company in 1903 gave him complete control. He invested in machinery to improve production efficiency. This early focus set the stage for future growth.

Allan Newell, Edgar's son, joined the company early on to help manage operations. His involvement was key to the company's initial expansion. This family involvement was crucial in the early stages.

The establishment of Newell Manufacturing Company Ltd. in Canada expanded the company's distribution network. This move was a strategic step towards broader market reach. This expansion helped to solidify the company's presence.

Daniel C. Ferguson's stake in the late 1930s marked the beginning of the transition away from exclusive family ownership. His influence was critical in shaping the company's future. Ferguson’s vision drove the company’s growth.

Under Ferguson, the company adopted a growth-by-acquisition strategy, diversifying its product offerings. This shift moved Newell beyond its original focus. This strategy helped build the company's portfolio.

The company expanded beyond curtain rods to include a variety of products. This diversification was a key element of its long-term strategy. This multi-product approach helped to stabilize the company.

The early history of Newell Brands, and who owns Newell Brands, shows a transition from family ownership to a broader structure. The company's evolution is a story of strategic decisions and key individuals. For more details on the company's journey, consider reading a Brief History of Newell Brands. This early history laid the groundwork for the company's future success. The shift towards acquisitions and a diverse product line was critical.

The initial ownership was centered on Edgar A. Newell, who founded the company. Allan Newell and Daniel C. Ferguson played crucial roles in expanding the business. The company moved from a single product focus to a multi-product strategy.

- Edgar A. Newell's acquisition established the company.

- Allan Newell helped with early management and expansion efforts.

- Daniel C. Ferguson influenced the shift towards acquisitions.

- The company expanded its product range beyond curtain rods.

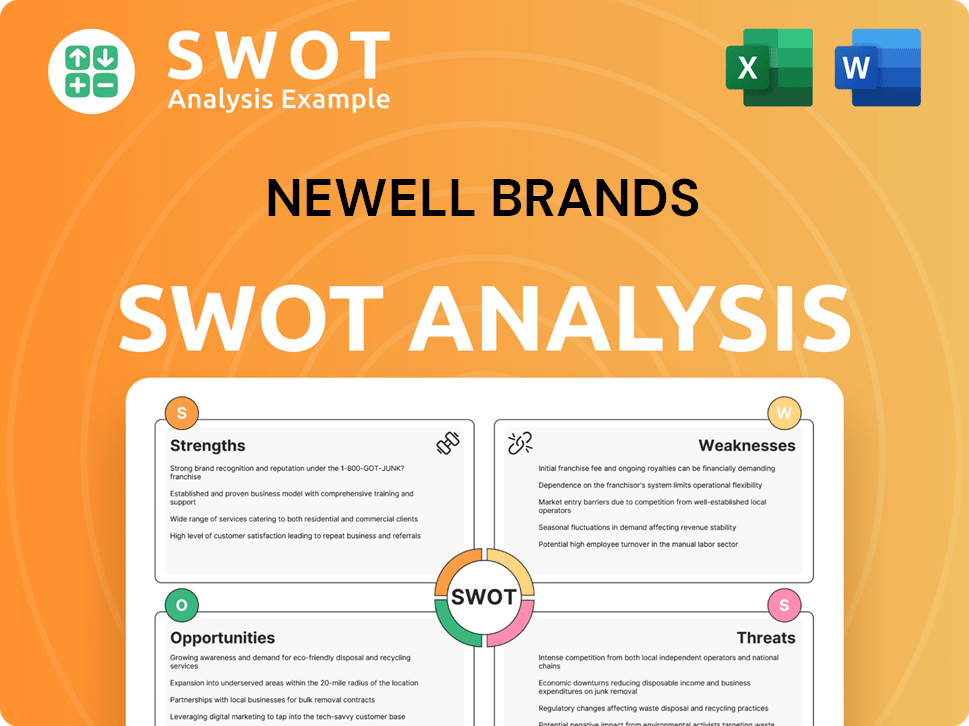

Newell Brands SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Newell Brands’s Ownership Changed Over Time?

The evolution of ownership for Newell Brands, a publicly traded company, has been marked by significant milestones since its initial public offering (IPO) in 1972. The company, initially listed on NASDAQ and later on the New York Stock Exchange, transitioned from a private entity to a publicly traded corporation. This shift set the stage for a series of acquisitions that would reshape its ownership structure and business portfolio. The company's history is characterized by strategic moves aimed at expanding its market presence and product offerings.

A pivotal moment in the company's history was the 1999 acquisition of Rubbermaid and Graco for $5.8 billion. This merger nearly doubled the company's size and led to its renaming as Newell Rubbermaid. However, this initial merger resulted in significant shareholder value loss. The most recent and impactful ownership evolution was the 2016 acquisition of Jarden Corporation, a $15.4 billion deal that led to the company being renamed Newell Brands Inc. Following this merger, Newell Rubbermaid shareholders owned approximately 55% of the combined company, while Jarden shareholders and convertible note holders owned 45%. These acquisitions have been instrumental in shaping the company's current ownership landscape and strategic direction.

| Event | Year | Impact on Ownership |

|---|---|---|

| Initial Public Offering (IPO) | 1972 | Transitioned from private to public ownership. |

| Acquisition of Rubbermaid and Graco | 1999 | Increased the company's size and led to renaming. |

| Acquisition of Jarden Corporation | 2016 | Resulted in a new company name and reshaped shareholder distribution. |

As of May 2025, institutional investors hold a substantial portion of Newell Brands' stock, with approximately 100.36% institutional ownership, and 730 institutional owners collectively holding 511,695,624 shares. Key institutional shareholders include BlackRock, Inc., Pzena Investment Management LLC, Vanguard Group Inc, and State Street Corp. Insiders have a smaller but increasing stake, with insider holdings rising from 0.33% to 0.35% in May 2025. Retail investors hold approximately 10.11% of the stock. These shifts have significantly impacted the company's strategy, influencing its focus on operational excellence and innovation. Understanding the competitors landscape of Newell Brands is crucial for investors.

The ownership structure of Newell Brands has evolved significantly through acquisitions and market dynamics.

- Institutional investors are the primary owners of Newell Brands stock.

- Insider ownership is present but relatively small.

- Retail investors also hold a portion of the company's shares.

- Major acquisitions have reshaped the company's portfolio and ownership landscape.

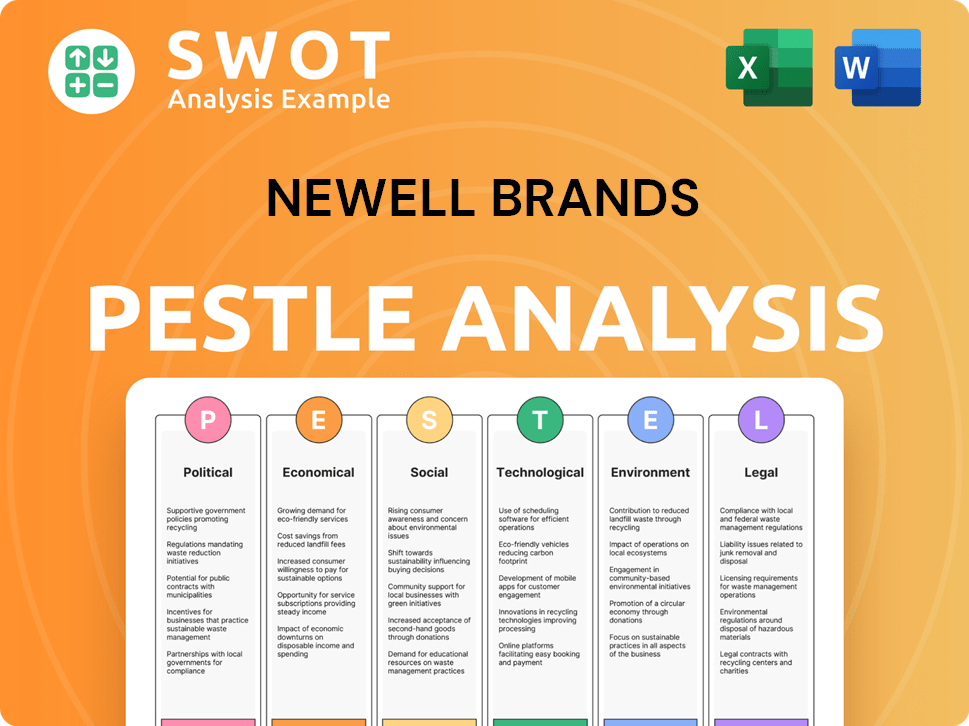

Newell Brands PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Newell Brands’s Board?

The current Board of Directors of Newell Brands Inc. is pivotal to the company's governance and strategic direction. According to the 2025 proxy statement, shareholders are set to elect nine directors at the annual meeting scheduled for May 8, 2025. The board typically includes independent directors and those representing significant shareholder interests. Detailed affiliations of board members with major shareholders are available in proxy statements filed with the SEC.

The composition of the board and its influence are crucial for understanding the dynamics of Newell Brands' ownership. The board's decisions impact the company's strategic direction, financial performance, and shareholder value. Understanding the board's structure and the voting power of its members is essential for anyone interested in Marketing Strategy of Newell Brands.

| Board Member | Role | Affiliation |

|---|---|---|

| To be determined by the 2025 Proxy Statement | Director | To be determined by the 2025 Proxy Statement |

| To be determined by the 2025 Proxy Statement | Director | To be determined by the 2025 Proxy Statement |

| To be determined by the 2025 Proxy Statement | Director | To be determined by the 2025 Proxy Statement |

Newell Brands operates under a one-share-one-vote structure, ensuring equal voting power for each common share. There are no indications of dual-class shares or other mechanisms that would grant disproportionate control to specific entities. Shareholder voting can be done in person, by telephone, or online. In 2018, activist investors, such as Carl C. Icahn, held significant voting power, leading to board nominations. These events highlight the influence of major shareholders and the potential for changes in company strategy and operations. The 2025 proxy statement includes proposals related to executive compensation and incentive plans, which are subject to shareholder approval.

The Board of Directors plays a key role in Newell Brands' governance. The company operates with a one-share-one-vote structure. This structure ensures that all shareholders have equal voting power.

- The 2025 proxy statement will provide details on the board's composition.

- Activist investor influence can lead to changes in strategy.

- Shareholders vote on important matters like executive compensation.

- Understanding the board's structure is essential for investors.

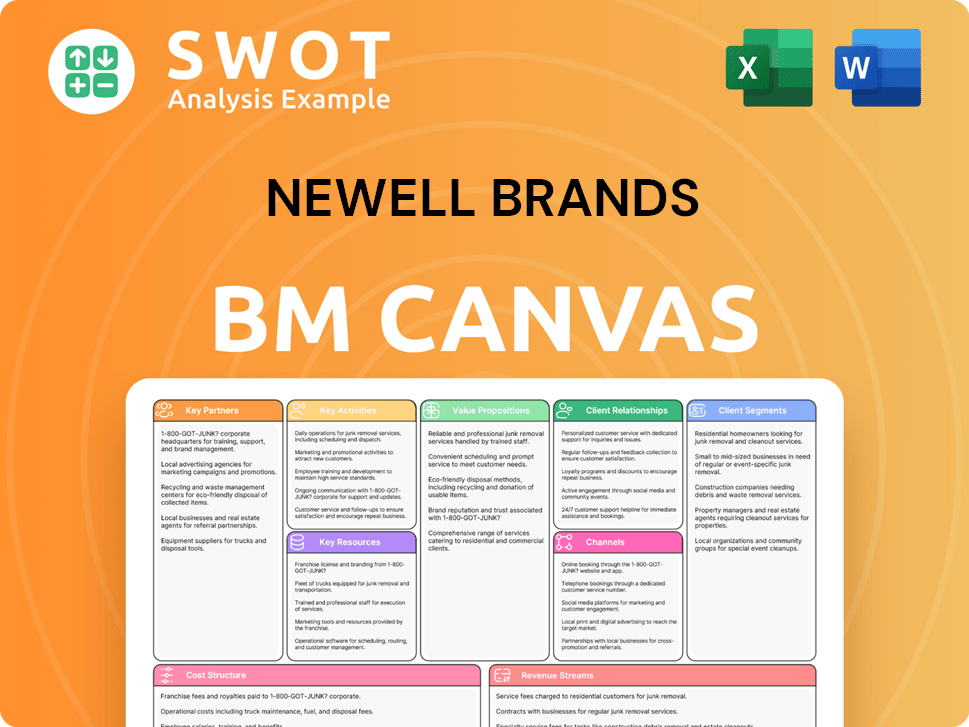

Newell Brands Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Newell Brands’s Ownership Landscape?

Over the past few years, Newell Brands has been adapting to market changes, which has influenced its ownership structure. For the full year ending December 31, 2024, the company reported net sales of $7.6 billion, a 6.8% decrease compared to the prior year. However, the first quarter of 2025 showed some improvement, with a normalized gross margin of 32.5%, marking the seventh consecutive quarter of year-over-year improvement, even though sales declined by 5.3% compared to the same period last year, reaching $1.6 billion.

In May 2025, institutional investors held approximately 100.36% of Newell Brands' stock, highlighting the significant role of institutional investment. Insider holdings have seen a slight increase, moving from 0.33% to 0.35% in May 2025. The company has also actively managed its debt profile, issuing notes in October 2024 and May 2025 to refinance existing debt. These financial strategies are key aspects of understanding the current Newell Brands ownership landscape.

| Metric | 2024 | Q1 2025 |

|---|---|---|

| Net Sales | $7.6 billion | $1.6 billion |

| Sales Decline | 6.8% | 5.3% |

| Normalized Gross Margin | N/A | 32.5% |

| Institutional Ownership (May 2025) | N/A | 100.36% |

The company's strategic focus on becoming 'simpler, faster, and stronger' reflects a broader industry trend towards operational efficiency. Newell Brands owner and leadership are leveraging manufacturing capabilities in North America to mitigate the impact of tariffs and anticipate stronger performance in the second half of 2025, driven by innovation and streamlining product offerings. Analysts predict a return to profitability in 2025 for the Newell Brands company, indicating a positive outlook for the future.

Institutional investors maintain a strong presence, holding approximately 100.36% of the company's stock as of May 2025, showcasing confidence from major financial entities.

The company actively manages its debt, issuing senior notes in late 2024 and early 2025 to refinance existing obligations, which is a key element of Newell Brands stock performance.

Focus is on streamlining operations and leveraging manufacturing in North America to mitigate tariffs, with expectations for improved performance in the second half of 2025.

Analysts predict a return to profitability in 2025, reflecting positive expectations for the Newell Brands history and future financial health of the company.

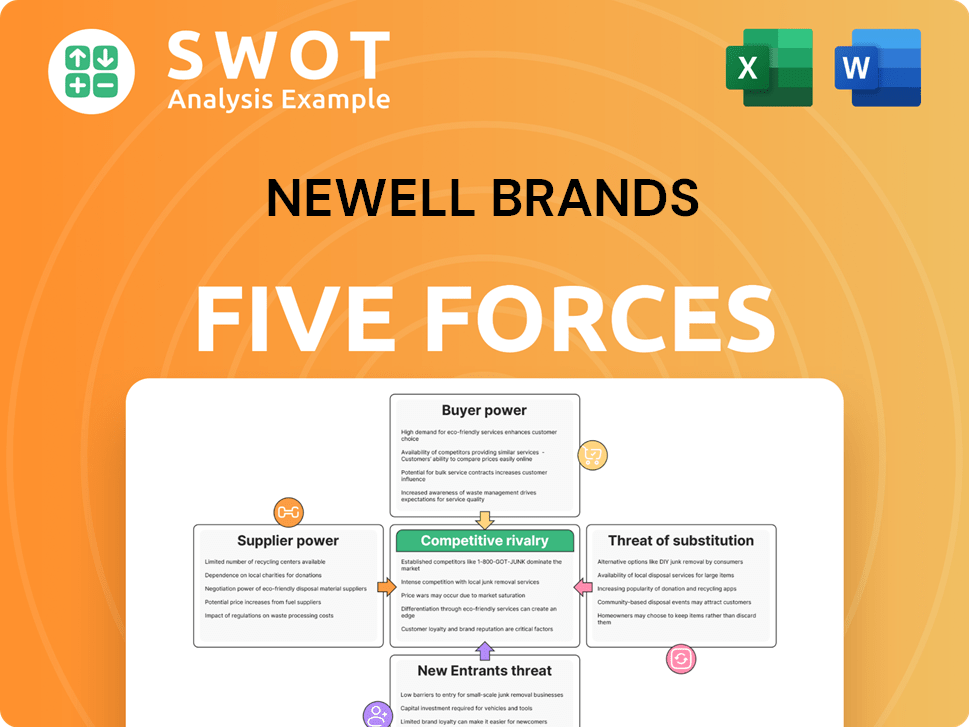

Newell Brands Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Newell Brands Company?

- What is Competitive Landscape of Newell Brands Company?

- What is Growth Strategy and Future Prospects of Newell Brands Company?

- How Does Newell Brands Company Work?

- What is Sales and Marketing Strategy of Newell Brands Company?

- What is Brief History of Newell Brands Company?

- What is Customer Demographics and Target Market of Newell Brands Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.