Newell Brands Bundle

Can Newell Brands Recapture Its Growth Momentum?

From curtain rods to a vast empire of consumer goods, Newell Brands' journey is a testament to strategic evolution. Founded in 1903, the company has continuously adapted, expanding its Newell Brands SWOT Analysis through acquisitions like Sharpie and Rubbermaid. However, recent financial headwinds have prompted a critical reassessment of its future direction.

This exploration delves into the Newell Brands Growth Strategy and examines the Newell Brands Future Prospects amid a challenging market environment. We'll dissect the Newell Brands Company's strategic initiatives, from its turnaround plan launched in 2023 to its long-term growth outlook, providing a comprehensive Newell Brands Market Analysis and insights into its brand portfolio.

How Is Newell Brands Expanding Its Reach?

The expansion initiatives of Newell Brands are designed to drive top-line growth, building on a 'Where to Play' and 'How to Win' strategy initiated in 2023. This strategy focuses on product and commercial innovation, distribution expansion, and international market penetration. The company's approach includes prioritizing investment in its largest and most profitable brands and expanding into faster-growing channels and retailers. This approach is particularly focused on the U.S. market, while also targeting Millennial and Gen Z consumers.

A key element of the 'Where to Play' strategy involves a focus on the U.S. market and targeting Millennial and Gen Z consumers. These efforts are supported by streamlining operations and focusing on the most profitable assets. This is a critical part of the Newell Brands Growth Strategy, aiming to increase revenue and improve financial performance. The company's strategic initiatives for 2024 are geared toward achieving these goals.

The company is also working on its brand portfolio overview to focus on the most profitable assets. This strategic shift is part of a broader effort to enhance consumer understanding and drive operational efficiencies. The company anticipates sequential improvement in core sales, with the second half of 2025 turning slightly positive. The Learning & Development segment and international business are expected to achieve a second consecutive year of core sales growth in 2025. For a deeper understanding of the business model, consider exploring the Revenue Streams & Business Model of Newell Brands.

New product launches are a cornerstone of Newell Brands' expansion strategy. These launches are designed to capture new customers and stay ahead of industry changes. The focus is on mid- and high-price point segments to drive revenue growth.

Newell Brands is investing in commercial innovation to enhance consumer understanding and drive operational efficiencies. This includes efforts to streamline operations and strengthen front-end commercial capabilities. These initiatives are expected to improve core sales and overall financial performance.

Expanding distribution channels is a key component of the company's growth strategy. This involves reaching new customers through various retail channels and online platforms. The goal is to increase market share and enhance brand visibility.

Newell Brands is focused on expanding its presence in international markets. This includes adapting products and strategies to meet the needs of different regions. The company aims to leverage its global brand portfolio to drive growth.

New product launches are a key part of Newell Brands' strategy to drive growth. These new products are designed to capture new customers and stay ahead of industry trends. The initiatives aim to focus on mid- and high-price point segments.

- Graco SmartSense Soothing Bassinet and Swing, planned for 2025.

- EXPO enhanced dry erase markers, planned for 2025.

- Oster Extreme Mix Professional Blender, planned for 2025.

- Sharpie Creative Marker line with new Earth Tones colors launched in Q1 2025.

- Sharpie Fine Tip markers in 24 colors set for Q3 2025.

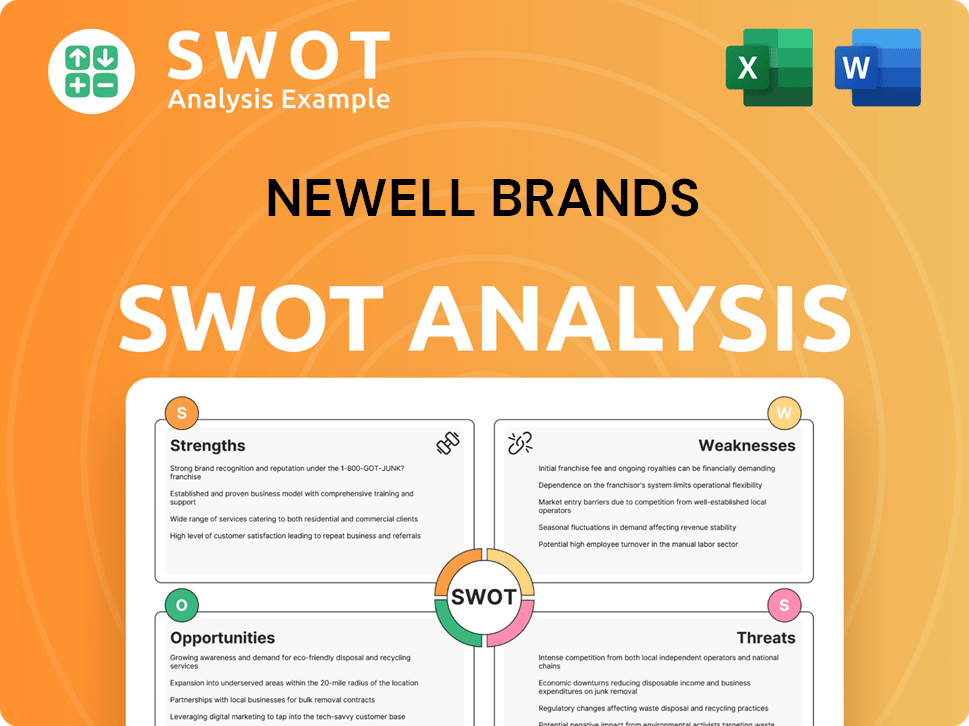

Newell Brands SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Newell Brands Invest in Innovation?

The Newell Brands Company is strategically leveraging technology and innovation to drive sustained growth, focusing on consumer-driven innovation and digital transformation. Their 'How to Win' approach emphasizes proprietary consumer understanding, brand building, shopper expertise, and supply chain optimization. This approach is central to their Newell Brands Growth Strategy.

A key aspect of the Newell Brands Business strategy involves investing in innovation and brand building for their largest and most profitable brands. This focus is evident in their refined innovation pipeline and new product launches planned for 2025. This strategy is designed to bolster sales and overall profitability, contributing to the Newell Brands Future Prospects.

Newell Brands' commitment to innovation is further demonstrated through its use of advanced tools and operational excellence initiatives. These efforts aim to strengthen capabilities and drive long-term, profitable growth through technological advancement and a disciplined approach to innovation. For more insights, consider reading about Owners & Shareholders of Newell Brands.

Newell Brands focuses on understanding consumer needs to drive innovation. This involves proprietary consumer insights and a project tiering system to prioritize new product development. The goal is to create products that resonate with consumers and drive sales.

Planned launches include the Graco SmartSense Soothing Bassinet and Swing, EXPO enhanced dry erase markers, and the Oster Extreme Mix Professional Blender. The Sharpie Creative Marker line will expand with new Earth Tones colors and Fine Tip markers. These launches are part of the Newell Brands product innovation strategy.

Newell Brands is deploying a new generative AI tool from Stravito. This tool consolidates all company strategy and research documents. It enables natural language conversational queries to access both qualitative insights and quantitative data. This enhances the Newell Brands digital transformation strategy.

The company is driving operational excellence through complexity reduction, technology standardization, and SKU optimization. They are also expanding U.S. manufacturing to leverage competitive advantages and mitigate tariff risks. By the end of 2025, China-sourced goods are expected to drop below 10% of cost of goods sold.

Newell Brands channels R&D investments into a refined innovation pipeline. They have reinvented their consumer insights approach and implemented a project tiering system. This approach helps concentrate new product development on its top 25 brands.

The company's strategic initiatives include a focus on consumer-driven innovation, digital transformation, and operational excellence. These initiatives are designed to drive long-term, profitable growth. These initiatives are part of Newell Brands strategic initiatives 2024.

Newell Brands is focusing on innovation and technology to enhance its Newell Brands Market Analysis and drive growth. This involves several key strategies:

- Consumer-driven innovation with a focus on understanding consumer needs.

- New product launches, including the Graco SmartSense Soothing Bassinet and Swing and new Sharpie markers.

- Deployment of a generative AI tool from Stravito to improve access to insights.

- Operational excellence through complexity reduction and technology standardization.

- Expansion of U.S. manufacturing to mitigate risks.

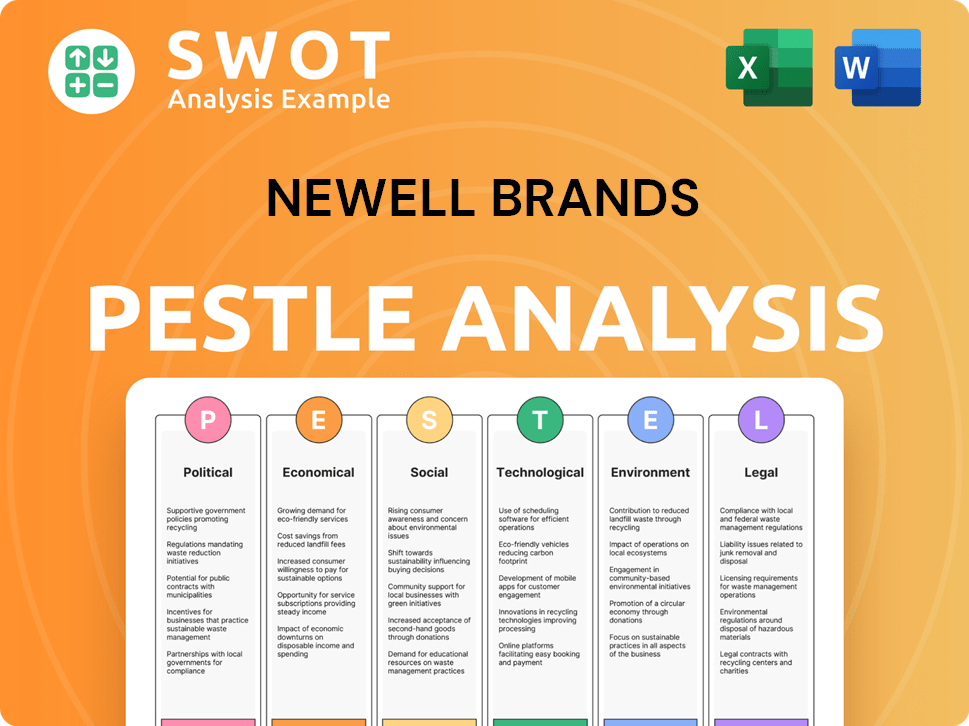

Newell Brands PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Newell Brands’s Growth Forecast?

The financial outlook for Newell Brands in 2025 centers on strategic margin expansion and debt reduction, despite facing anticipated challenges in top-line growth. The company's strategic initiatives for 2024 and beyond are geared towards enhancing profitability and strengthening its financial position. This approach is crucial for navigating the competitive landscape of Newell Brands and ensuring long-term sustainability.

For the full year 2025, the company anticipates a decline in net sales, projecting a range of a 4% to 2% decrease. Core sales are expected to range from a 2% decline to a 1% increase. This outlook includes a roughly 1% headwind due to category exits, reflecting ongoing adjustments to its brand portfolio. The Q1 2025 results showed net sales of $1.6 billion, a 5.3% decrease compared to the prior year period, with core sales declining 2.1%.

Despite the expected sales declines, Newell Brands is focused on improving its financial performance. The company is working on its digital transformation strategy to adapt to changing consumer behavior and market trends.

Newell Brands has demonstrated significant gross margin expansion. Reported gross margin increased to 34.2% in Q4 2024 compared to 29.9% the prior year. Normalized gross margin reached 34.6% from 31.1% in the prior year, marking the sixth consecutive quarter of year-over-year improvement. For Q1 2025, reported gross margin improved to 32.1% from 30.5% in the prior year period.

The company projects a normalized operating margin for full year 2025 between 9% and 9.5%. This represents an improvement of approximately 110 basis points from 2024. This improvement is more than double their evergreen target of a 50 basis point improvement each year. This shows how Newell Brands plans to increase revenue.

Newell Brands anticipates a normalized diluted EPS range of $0.70 to $0.76 for full year 2025. The company expects to generate operating cash flow of $450 million to $500 million for full year 2025. In Q1 2025, there was an operating cash outflow of $213 million, compared to a positive cash flow of $32 million in the prior year, though Q1 is typically a cash-take quarter due to seasonality.

The company successfully refinanced $1.25 billion of debt in Q4 2024, and at the end of 2024, had $4.6 billion in debt outstanding. Analysts anticipate the company's leverage ratio to improve from 4.8x to 4.3x by the end of 2025, as they aim for investment grade debt issuer status. This aligns with the focus on long-term growth outlook.

The financial performance of Newell Brands reflects a strategic emphasis on profitability and debt management. The company's ability to expand gross margins and manage its debt are critical to its future prospects. The company is facing challenges, but is also showing resilience and strategic foresight.

- Net sales decline expected in 2025: -4% to -2%

- Normalized operating margin target: 9% to 9.5%

- Normalized diluted EPS range: $0.70 to $0.76

- Operating cash flow forecast: $450 million to $500 million

- Leverage ratio target by end of 2025: 4.3x

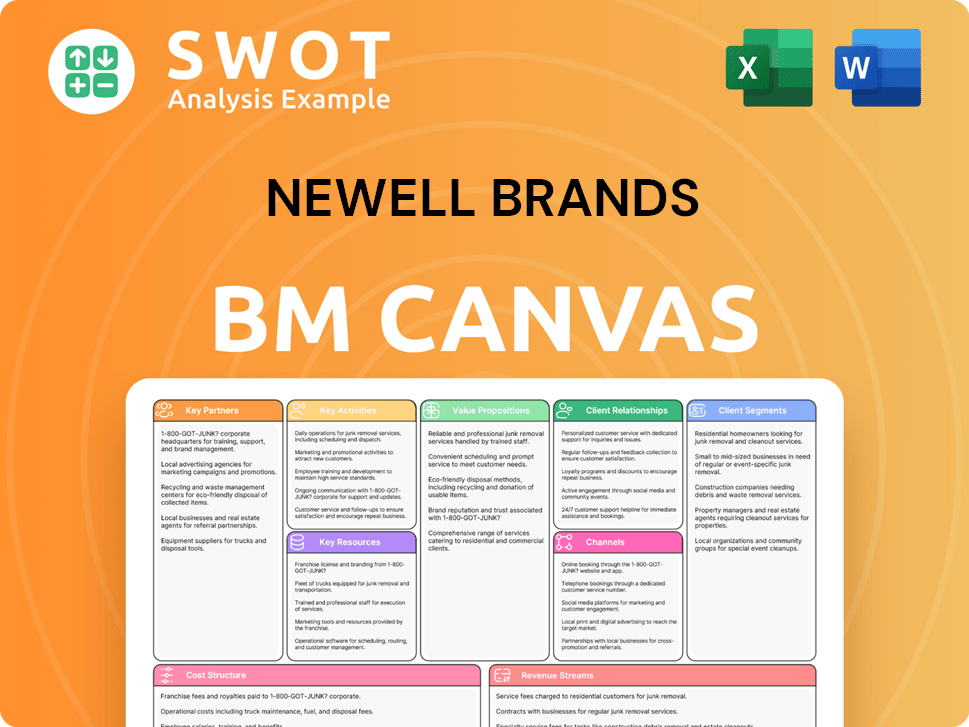

Newell Brands Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Newell Brands’s Growth?

The success of the Newell Brands Company and its growth strategy faces several potential risks and obstacles. These challenges range from external economic pressures to internal operational issues. Understanding these risks is crucial for assessing the Newell Brands future prospects and its ability to deliver on its strategic goals.

External factors, such as tariffs and global demand, significantly impact the company’s performance. Internal challenges related to debt management and achieving consistent sales growth also pose considerable hurdles. A thorough market analysis reveals the complexities the company must navigate to maintain its position and drive future expansion.

The company's ability to mitigate these risks through strategic initiatives and operational excellence will determine its overall success. The focus on improving top-line performance, expanding margins, and enhancing cash flow is critical. However, the company must consistently execute its plans to achieve its long-term growth outlook.

One of the primary risks for Newell Brands Business is tariff uncertainty, particularly the potential impact of tariffs on Chinese imports. The company has worked to mitigate this risk by reducing its reliance on China-sourced goods. However, the full impact of these tariffs, especially in the second half of 2025, could still negatively affect earnings.

Weak global demand and macroeconomic pressures pose significant challenges. Category contraction, particularly affecting lower-income consumers, has led to a decline in net sales. The company has revised its market growth assumption to a decline for 2025 due to these factors.

Debt management is a critical area of concern for the company. Net debt rose to $4.9 billion as of Q1 2025. S&P Global Ratings downgraded the company in May 2025, citing weak demand and tariff risks. The company needs to address its debt obligations to avoid further financial strain.

Operating cash flow turned negative in Q1 2025, with a $213 million outflow, raising liquidity concerns. This situation could worsen if macroeconomic conditions deteriorate. The company must improve its cash flow generation to maintain financial stability.

Achieving consistent sales growth across all business units remains a challenge. Segments like Outdoor & Recreation have struggled to maintain sales momentum. The company needs to find ways to boost sales across all its divisions to achieve its growth targets.

The company has $1.23 billion of senior unsecured notes due in April 2026. Failure to refinance this debt could lead to a further rating downgrade. Successfully managing its debt obligations is crucial for maintaining investor confidence.

Newell Brands strategic initiatives 2024 include diversification and operational excellence to address these risks. The company's multi-year turnaround strategy, initiated in 2023, focuses on improving top-line performance, expanding margins, and enhancing cash flow. This approach includes a simplification agenda that has reduced headcount by 20% (from 29,000 in March 2022 to 24,000 in December 2024).

Newell Brands financial performance analysis reveals the impact of these challenges. Net sales declined by 5.3% in Q1 2025 and 7% in 2024 due to lower demand, business exits, and unfavorable foreign currency. The company's ability to maintain its financial health is crucial. A detailed analysis of the Newell Brands market share and trends is essential for understanding its position.

The company's debt levels and operating cash flow present significant challenges. S&P expects adjusted leverage to remain above 5x in 2025. The negative operating cash flow in Q1 2025 raises concerns about liquidity, particularly if macroeconomic conditions worsen. Addressing these financial metrics is vital for the company's long-term viability.

Newell Brands Business is also focused on maintaining a robust U.S. manufacturing base to manage tariff-related sourcing dislocations. The company's efforts to reduce its reliance on China-sourced goods are a key part of its strategy. The company's ability to adapt its sourcing and manufacturing processes is critical for mitigating tariff risks and ensuring profitability.

For a deeper dive into the Newell Brands Company, consider reading an overview of its strategy and potential, which provides additional insights into its operations and future direction.

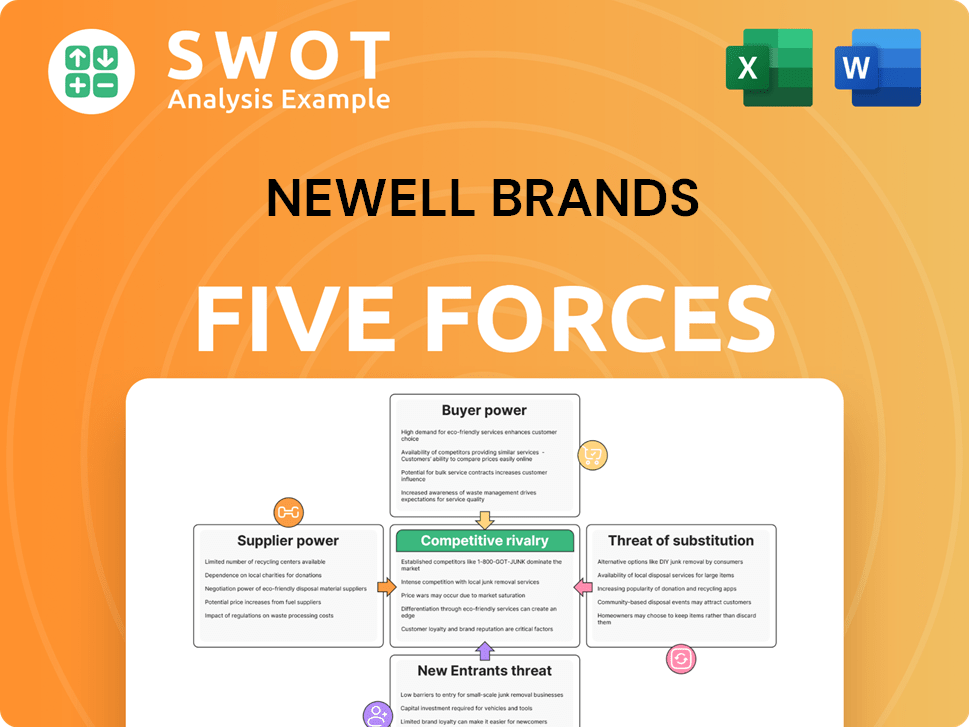

Newell Brands Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Newell Brands Company?

- What is Competitive Landscape of Newell Brands Company?

- How Does Newell Brands Company Work?

- What is Sales and Marketing Strategy of Newell Brands Company?

- What is Brief History of Newell Brands Company?

- Who Owns Newell Brands Company?

- What is Customer Demographics and Target Market of Newell Brands Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.