Newell Brands Bundle

How Does Newell Brands Thrive in the Consumer Goods Arena?

Newell Brands, a global titan in the consumer products sector, captivates with its strategic brand acquisitions and market diversification. With a portfolio brimming with household names, from home essentials to outdoor recreation, the Newell Brands SWOT Analysis reveals the company's intricate operations and revenue generation. Understanding the Newell Brands business model is paramount for investors, consumers, and industry analysts alike.

This exploration of the Newell Brands company delves into its core operations, value proposition, and diverse revenue streams, offering a comprehensive Newell Brands company overview. We'll dissect key milestones, strategic initiatives, and competitive advantages that shape its market position. From its extensive retail presence to its ability to adapt to evolving consumer preferences, discover how Newell Brands navigates the dynamic consumer goods landscape, examining its financial performance and future outlook.

What Are the Key Operations Driving Newell Brands’s Success?

The Newell Brands company operates by designing, manufacturing, and distributing a wide array of consumer products. Their core offerings span categories like Home & Commercial, Learning & Development, and Outdoor & Recreation. This approach allows them to reach a broad spectrum of customers, from individual consumers to commercial enterprises, with a diverse portfolio of Newell Brands products.

The Newell Brands business model focuses on providing trusted, innovative, and high-quality solutions. They aim to enhance daily life, simplify tasks, and inspire creativity and outdoor enjoyment. This value proposition is supported by a robust operational framework that includes a global supply chain and multi-channel distribution.

Their operational processes are meticulously managed across a global supply chain, ensuring efficient production and cost-effectiveness. Distribution includes direct sales, e-commerce, and wholesale partnerships. This multi-channel approach ensures widespread availability of their products, fostering strong brand loyalty and market differentiation within the Newell Brands brands.

The company's product portfolio is divided into key categories. These include Home & Commercial (e.g., Rubbermaid), Learning & Development (e.g., Sharpie), and Outdoor & Recreation (e.g., Coleman). This diversified approach allows Newell Brands to cater to various consumer needs and market segments.

Their distribution strategy involves multiple channels. These include direct sales to large retailers, e-commerce platforms, and wholesale partnerships. This ensures products are readily available to consumers through various purchasing options, enhancing accessibility and sales potential.

The value proposition revolves around providing trusted, innovative, and high-quality solutions. This includes enhancing daily life, simplifying tasks, and inspiring creativity and outdoor enjoyment. This focus helps build and maintain strong brand loyalty.

Operational efficiency is achieved through a global supply chain and optimized production. This includes strategic sourcing of raw materials and a sophisticated logistics network. Leveraging scale helps optimize production efficiency and cost-effectiveness.

The company's operational uniqueness integrates a diverse portfolio of brands under a unified framework. This allows each brand to maintain its distinct market identity. This approach translates into reliable product availability and consistent quality.

- Global Supply Chain: Manages manufacturing facilities and strategic sourcing.

- Multi-Channel Distribution: Utilizes direct sales, e-commerce, and wholesale partnerships.

- Brand Portfolio: Maintains distinct market identities while operating under a unified framework.

- Customer Benefits: Offers reliable product availability, consistent quality, and a wide selection.

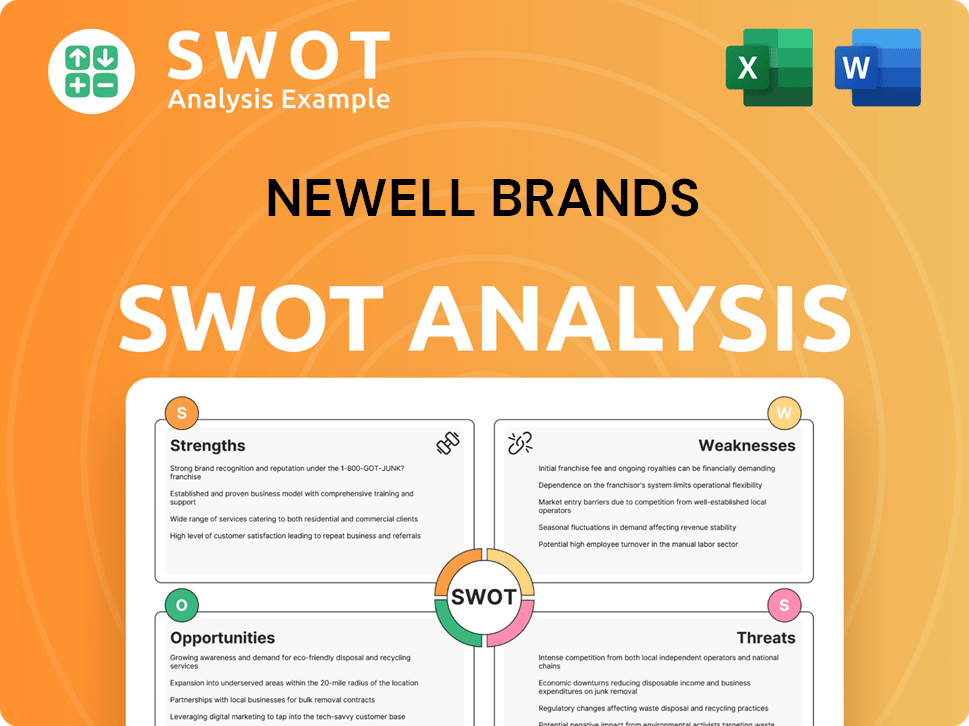

Newell Brands SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Newell Brands Make Money?

The primary revenue stream for the Newell Brands company is the sale of its manufactured consumer products. The Newell Brands business model is centered on a diversified portfolio of brands spanning various consumer goods categories. This approach allows the company to tap into multiple markets and mitigate risks associated with relying on a single product or segment.

The Newell Brands structure includes several operating segments, each contributing to the overall revenue. These segments include Commercial Solutions, Home Appliances, Home Solutions, Learning and Development, and Outdoor and Recreation. Product sales across these segments constitute the vast majority of the company's total revenue.

In fiscal year 2023, the Newell Brands company reported net sales of approximately $8.1 billion, demonstrating the significant scale of its operations. The company's ability to generate substantial revenue is a key indicator of its market position and operational efficiency. Understanding the financial performance of Newell Brands is crucial for investors and stakeholders alike.

The company employs a variety of monetization strategies to maximize revenue generation. These strategies include direct product sales, e-commerce, and tiered pricing. Furthermore, licensing agreements and continuous brand portfolio optimization contribute to its overall financial performance. To understand more about the consumers, read about the Target Market of Newell Brands.

- Direct Product Sales: Selling products directly to major retailers forms a significant portion of revenue.

- E-commerce: Utilizing brand websites and online marketplaces for direct-to-consumer sales.

- Tiered Pricing: Implementing different price points across product lines to cater to various customer segments.

- Licensing Agreements: Generating income through licensing brand assets.

- Brand Portfolio Optimization: Continuously evaluating and refining the brand portfolio to focus on high-growth categories.

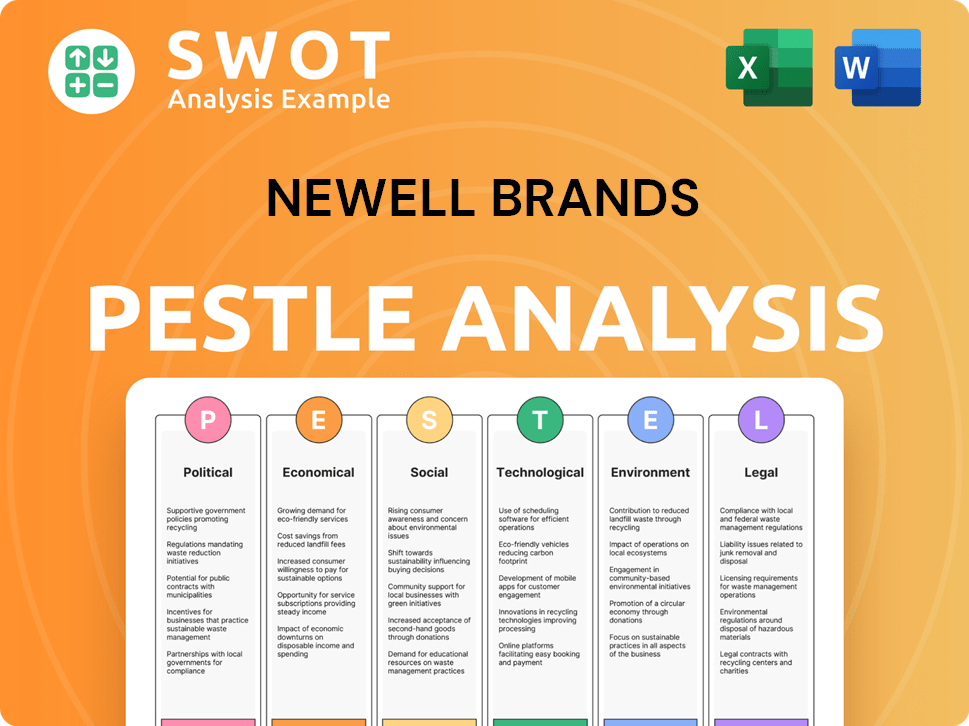

Newell Brands PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Newell Brands’s Business Model?

The history of the Newell Brands company is marked by strategic acquisitions that have reshaped its operations and financial performance, transforming it into a diversified consumer goods company. A key milestone was the acquisition of Jarden Corporation in 2016, significantly expanding its portfolio into outdoor and recreation products. Over the decades, the integration of numerous well-known brands has been a core strategy.

These strategic moves have allowed Newell Brands to achieve economies of scale in manufacturing, distribution, and marketing. The company has navigated operational and market challenges, including supply chain disruptions and the need to adapt to evolving consumer preferences and digital commerce trends. Its response involves optimizing the supply chain, investing in e-commerce, and divesting non-core assets to focus on its most profitable brands.

The company's competitive advantages include strong brand equity across its diverse portfolio, fostering consumer trust and loyalty. Its extensive global distribution network provides a significant reach advantage. The company benefits from economies of scale in sourcing, manufacturing, and marketing, allowing for competitive pricing and efficient operations. To maintain its relevance, Newell Brands continues to invest in product innovation, digital transformation, and sustainable practices.

The acquisition of Jarden Corporation in 2016 was a pivotal moment, expanding the company's reach into outdoor and recreation products. Over time, Newell Brands has integrated numerous well-known brands into its portfolio. These acquisitions have been instrumental in shaping the company's diverse product offerings.

Newell Brands has focused on optimizing its supply chain, particularly in response to global events. Investment in e-commerce capabilities has been a key strategic move. The company has divested non-core assets to streamline its portfolio and concentrate on its most profitable brands. These actions are aimed at enhancing operational efficiency and market responsiveness.

Strong brand equity across the diverse portfolio fosters consumer trust and loyalty. The extensive global distribution network provides a significant reach advantage. Economies of scale in sourcing, manufacturing, and marketing contribute to competitive pricing and efficient operations.

Newell Brands continues to invest in product innovation and digital transformation to maintain its competitive edge. Sustainable practices are integrated into its operations. These efforts are crucial for staying relevant in a dynamic market environment and ensuring long-term growth. Learn more about the Growth Strategy of Newell Brands.

In recent financial reports, Newell Brands has demonstrated its ability to adapt to market challenges. The company's focus on streamlining its portfolio and investing in key growth areas has yielded positive results. The company's strategic moves and brand strength have positioned it well for future growth.

- In Q1 2024, the company reported net sales of approximately $1.8 billion.

- The company has been actively managing its portfolio through divestitures and strategic investments.

- Newell Brands continues to focus on innovation and sustainability initiatives.

- The company's diverse brand portfolio and global distribution network provide a solid foundation for future performance.

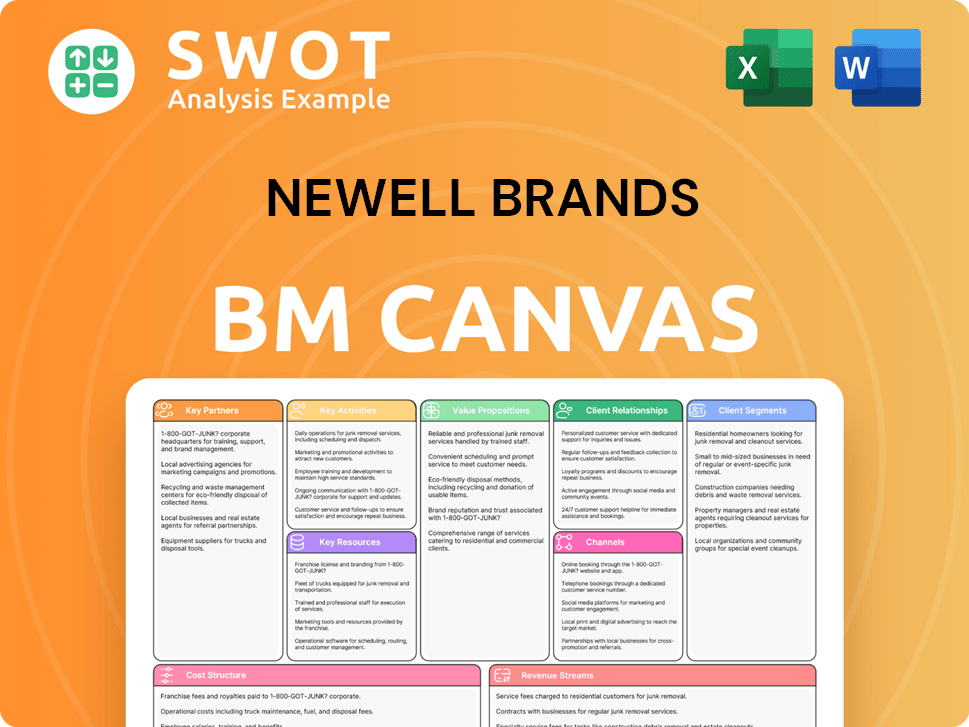

Newell Brands Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Newell Brands Positioning Itself for Continued Success?

The Newell Brands company holds a prominent position in the consumer goods industry, competing with both large multinational corporations and smaller, specialized businesses. Its diverse portfolio includes products in several categories, such as home goods and outdoor equipment, giving it a broad presence across various market segments. The company's market share and customer loyalty are boosted by its portfolio of well-known brands.

Despite its strengths, Newell Brands faces several risks, including supply chain disruptions and fluctuating raw material costs. It also faces competition and evolving retail models, requiring continuous adaptation. Regulatory changes and shifting consumer preferences are additional challenges. Looking forward, the company focuses on streamlining its portfolio and investing in innovation to sustain and expand revenue generation, particularly through e-commerce and adapting to changing consumer behaviors.

Newell Brands competes in a highly competitive global consumer goods market. It has a wide range of Newell Brands products that cater to various consumer needs. The company's market share is influenced by its brand recognition and distribution network.

Key risks include supply chain disruptions, raw material cost fluctuations, and currency exchange rate impacts. Changing consumer preferences and intense competition also pose challenges. Regulatory changes could affect operations and costs. The company must adapt to evolving retail models and consumer behaviors.

The company is focused on streamlining its portfolio, optimizing operational efficiency, and investing in innovation. It aims to leverage its brand equity and global distribution. E-commerce growth and adapting to evolving consumer behaviors are key priorities. The company's ability to generate revenue will be crucial for its future success.

Strategic initiatives include portfolio streamlining and operational optimization. Investment in innovation within core categories is a priority. The company is focused on leveraging its brand equity and global distribution. Adapting to evolving consumer behaviors and growing e-commerce sales are also key.

In recent years, Newell Brands' financial performance has reflected its strategic efforts to streamline its portfolio and improve operational efficiency. The company has been actively managing its brand portfolio through acquisitions and divestitures to focus on core categories. For instance, in 2023, the company reported net sales of approximately $8.4 billion. The company is also focusing on sustainability initiatives to meet consumer demands and regulatory requirements.

- Focus on Core Categories: The company is concentrating on its most profitable and strategically important brands.

- E-commerce Growth: Expanding online sales channels to reach a wider customer base.

- Operational Efficiency: Implementing cost-saving measures and improving supply chain management.

- Sustainability: Integrating sustainable practices into its operations and product offerings.

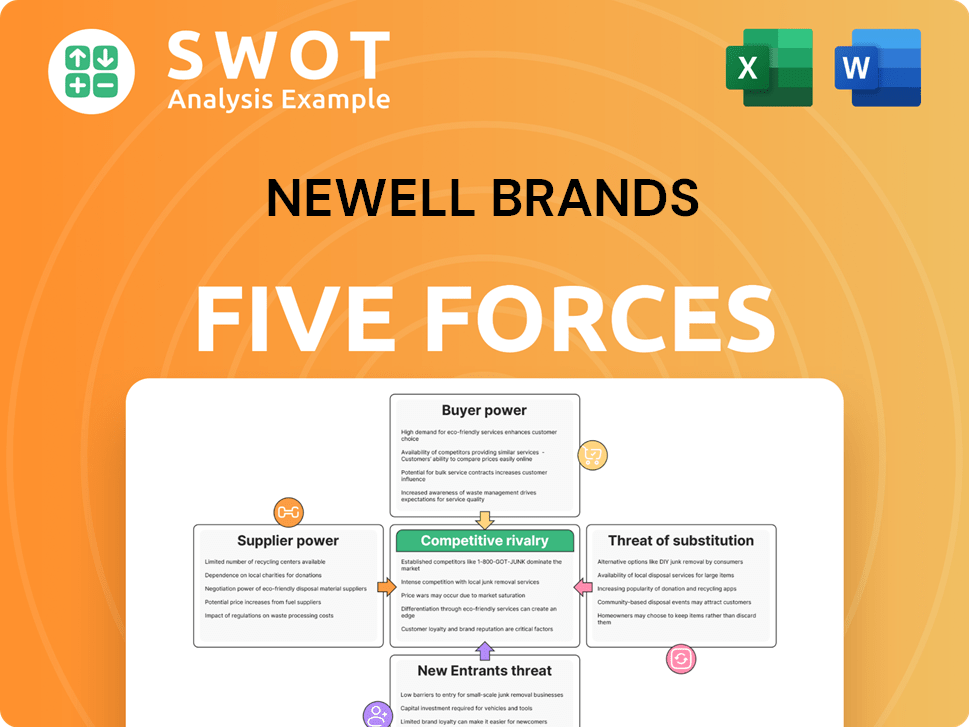

Newell Brands Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Newell Brands Company?

- What is Competitive Landscape of Newell Brands Company?

- What is Growth Strategy and Future Prospects of Newell Brands Company?

- What is Sales and Marketing Strategy of Newell Brands Company?

- What is Brief History of Newell Brands Company?

- Who Owns Newell Brands Company?

- What is Customer Demographics and Target Market of Newell Brands Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.