OneStream Bundle

How did OneStream transform the finance world?

Embark on a journey through the remarkable OneStream SWOT Analysis, a company that has reshaped financial operations. From its inception in 2010, OneStream has carved a niche in the financial software industry. This brief history of OneStream company background reveals how a vision for unified financial planning blossomed into a global leader.

The founders of OneStream, driven by the need to simplify corporate performance management (CPM) processes, set out to create a comprehensive solution. Their mission was to empower CFOs with a single platform, a goal that has propelled OneStream software to the forefront of financial innovation. Today, OneStream's impressive growth trajectory and financial performance, including a substantial ARR and customer base, underscore its success in a competitive market.

What is the OneStream Founding Story?

The story of OneStream Software began in 2010, driven by a vision to transform the financial planning and analysis sector. Tom Shea, Bob Powers, and Craig Colby joined forces to create a comprehensive software solution. Their goal was to streamline and simplify financial processes for organizations, marking the start of the OneStream company's journey.

The founders brought a wealth of experience to the table. Tom Shea, with over 25 years in the software industry, served as CEO. Bob Powers, the Chief Technology Officer, had a background in developing innovative financial management solutions. Craig Colby, the Chief Customer Officer, offered insights into the challenges faced by finance professionals. This collective expertise set the stage for the development of OneStream software.

The founders had previous experience in the CPM space, with Craig and Tom co-founding UpStream Software, which was acquired by Hyperion (and then Oracle), becoming Oracle Hyperion Financial Data Quality Management (FDM). Bob Powers was also a key inventor of Hyperion Financial Management.

The founders identified that businesses often relied on multiple, disconnected applications for planning, financial consolidation, and reporting, leading to complexity and data transparency issues. Their solution was to create a single, unified platform.

- The platform was designed to replace numerous systems.

- This approach led to the name 'OneStream,' reflecting the idea of 'one platform with infinite expansion.'

- The company officially launched its platform in 2012, with its headquarters in Rochester, Michigan.

- In its early days, OneStream was bootstrapped by the founders.

The initial office in Rochester, Michigan, was located above a sporting goods store. The early team often worked virtually, with co-founders in different states. The company focused on building a sustainable business by prioritizing customer needs. OneStream's evolution is a testament to its founders' vision and dedication. To understand more about their business model, you can read about it in Revenue Streams & Business Model of OneStream.

OneStream SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of OneStream?

The early growth of the OneStream company, a provider of CPM software, was marked by strategic partnerships and product expansions. OneStream's early days focused on establishing a strong customer base and broadening its software capabilities. This phase saw the company rapidly evolving its product offerings and expanding its market presence.

OneStream software officially launched in 2012, with its first client being Tenneco. This initial partnership was important for refining the software based on client needs. Following this, OneStream added AAA Life Insurance and other clients, building a solid foundation for future growth. The company's mission focused on simplifying corporate performance management.

In 2014, OneStream introduced its initial applications designed to enhance the platform beyond finance. This was followed by a planning application in 2015 and an account reconciliation application in 2016. The financial close and consolidation core solution was released in 2017. By 2018, OneStream had introduced an updated reporting and analytics core solution and acquired its 250th customer.

OneStream expanded its physical presence, moving its US headquarters in 2014 and opening offices in Europe. In 2019, KKR invested in the company, valuing it at over $1.0 billion. OneStream's ARR surpassed $200 million in 2021 and $300 million in 2022. The company's Marketing Strategy of OneStream played a key role in its growth.

In 2023, OneStream's ARR exceeded $450 million, and it launched the OneStream Solution Exchange. As of March 31, 2024, ARR reached $480 million, with 1,423 customers. The company's total revenue for fiscal year 2024 was $489.4 million, a 31% increase year-over-year. For the first quarter of 2025, OneStream reported total revenue of $136.31 million, showing a 23.59% growth.

OneStream PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in OneStream history?

The journey of the OneStream company has been marked by significant achievements and strategic moves. From its inception, the company has rapidly grown, achieving key milestones that have solidified its position in the CPM software market. The company's evolution showcases its adaptability and commitment to innovation within the financial planning landscape, impacting its OneStream software offerings.

| Year | Milestone |

|---|---|

| 2010 | Founded with a vision to revolutionize financial planning and analysis. |

| 2015 | Launched the Solutions MarketPlace, an 'apps store' concept to extend platform value. |

| 2016 | Achieved the milestone of acquiring its 100th customer. |

| 2022 | Commercially released Sensible ML, its first AI-enabled application. |

| 2024 | Acquired DataSense for approximately $30 million to enhance AI-driven solutions, and unveiled a suite of AI-powered solutions. |

OneStream has consistently introduced innovative features to enhance its platform. A key innovation was the introduction of Extensible Dimensionality™, allowing users to operate at different levels of detail across all dimensions. This unified approach eliminated the need for multiple applications, streamlining financial processes.

This feature allows users to operate at different levels of detail across all dimensions. It eliminates the need for multiple applications for financial planning, consolidation, and reporting, streamlining processes.

The launch of OneStream XF as a unified platform for budgeting, forecasting, reporting, and financial consolidation revolutionized financial planning and analysis. This integrated approach provided a comprehensive solution for financial management.

The Solutions MarketPlace, launched in 2015, offers an 'apps store' concept. This enables customers and partners to download and deploy additional solutions, extending the platform's value and functionality.

The development and release of AI-enabled applications, such as Sensible ML in 2022, marked a significant advancement. These applications provide enhanced financial insights and real-time forecasts.

The acquisition of DataSense in 2024 for approximately $30 million furthered the development of AI-enabled solutions. This strategic move strengthened OneStream's capabilities in data analytics and AI.

In 2024, the unveiling of a suite of AI-powered solutions, including GenAI and machine learning, enabled real-time forecasts and enhanced financial insights. This suite aims to improve the efficiency and accuracy of financial planning.

Despite its successes, OneStream has encountered several challenges. As a newer player in the market, it initially faced limited brand recognition in a competitive environment. The transition to a SaaS model also presented hurdles, although OneStream has adapted, with over 90% of new customer contracts being SaaS in 2023. The company competes with established players like Oracle, SAP, and others, which requires continuous innovation and a strong focus on customer satisfaction.

As a relatively new entrant, OneStream initially faced challenges in building brand recognition. This required strategic marketing and demonstrating the value of its platform to gain market share.

The shift to a SaaS model, which began in Q3 2020, presented operational and strategic adjustments. The company has successfully transitioned, with the majority of new contracts being SaaS.

Operating in a highly competitive market against established players like Oracle and SAP poses a constant challenge. OneStream addresses this through continuous innovation and customer focus.

Maintaining high levels of customer satisfaction is crucial for retaining customers and gaining new ones. This is achieved through excellent service and continuous platform improvements.

Consistent innovation is essential to stay ahead of the competition and meet evolving customer needs. This includes the development of new features and AI-powered solutions.

OneStream's consistent recognition as a Leader in the Gartner Magic Quadrant for Financial Close and Consolidation Solutions, and for Financial Planning Software, demonstrates its market leadership. This recognition helps to build trust and attract customers.

For more information on the ideal customer profile, consider reading Target Market of OneStream.

OneStream Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for OneStream?

The Growth Strategy of OneStream has been marked by significant milestones. Founded in 2010 by Tom Shea, Bob Powers, and Craig Colby, the company launched its platform in 2012 and has since achieved substantial growth. OneStream software has expanded its product offerings, customer base, and financial performance, establishing itself as a key player in the CPM software market.

| Year | Key Event |

|---|---|

| 2010 | OneStream Software is founded. |

| 2012 | The OneStream platform is officially launched. |

| 2014 | OneStream launches its first platform-built applications. |

| 2015 | The first planning application is launched, alongside the Solutions MarketPlace. |

| 2016 | OneStream introduces its account reconciliation application and acquires its 100th customer. |

| 2017 | The financial close and consolidation core solution is released, and development of a machine learning-powered application begins. |

| 2018 | OneStream introduces an updated reporting and analytics core solution and acquires its 250th customer. |

| 2019 | KKR acquires a majority stake in OneStream, valuing the company at over $1.0 billion. |

| 2020 | OneStream acquires its 500th customer. |

| 2021 | OneStream surpasses $200 million in ARR and receives a $200 million investment. |

| 2022 | OneStream surpasses $300 million in ARR, commercially releases its first AI-enabled application, Sensible ML, and acquires its 1,000th customer. |

| 2023 | OneStream surpasses $450 million in ARR and launches the OneStream Solution Exchange. |

| 2024 | OneStream acquires DataSense and reports $489.4 million in total revenue. The company also announces its IPO on Nasdaq under the ticker 'OS' in July. |

| 2025 | OneStream is named a Leader in the 2025 Gartner Magic Quadrant and reports first-quarter 2025 financial results with $136.31 million in revenue. |

OneStream is focused on becoming the operating system for modern finance. The company aims to unify core financial functions. This strategic direction empowers the CFO and their teams.

OneStream plans to bring new products to market in 2025, with a focus on AI-powered solutions. These solutions are designed to transform the office of the CFO. The company is investing in GenAI and machine learning.

OneStream anticipates total revenue for fiscal year 2025 to be between $583 million and $587 million. This reflects continued growth and market expansion. The company's financial performance is a key indicator.

OneStream aims to expand its market presence and customer base globally. The company's vision is to be the leading provider of unified financial planning and analysis software. This aligns with its founding vision.

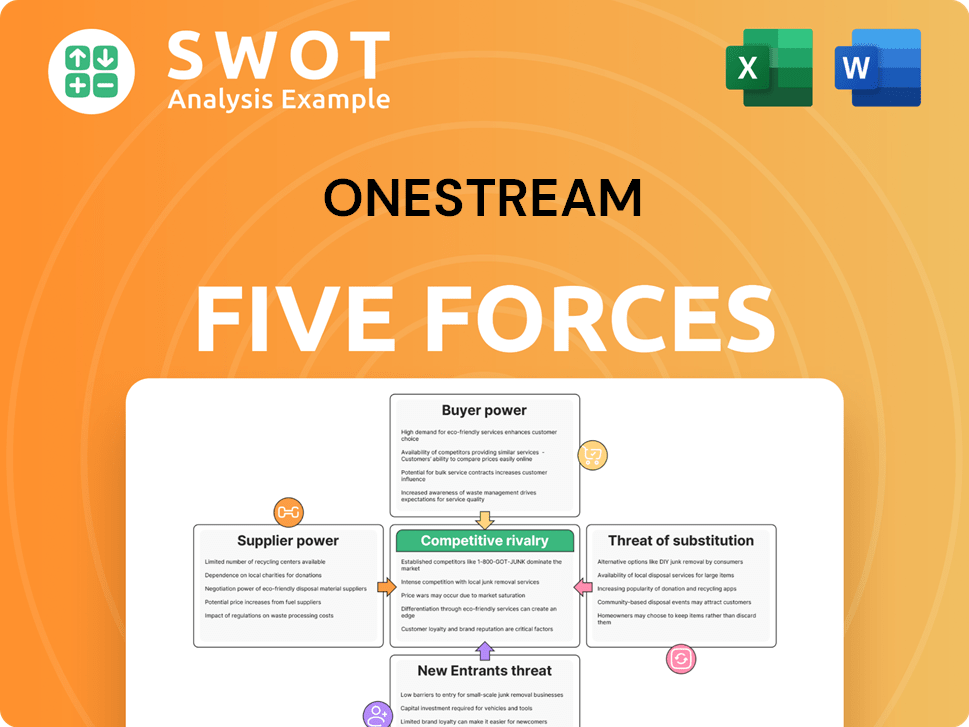

OneStream Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of OneStream Company?

- What is Growth Strategy and Future Prospects of OneStream Company?

- How Does OneStream Company Work?

- What is Sales and Marketing Strategy of OneStream Company?

- What is Brief History of OneStream Company?

- Who Owns OneStream Company?

- What is Customer Demographics and Target Market of OneStream Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.