OneStream Bundle

Decoding OneStream: How Does It Revolutionize Finance?

In today's fast-paced business world, efficient financial management is paramount. OneStream company stands out as a leader in enterprise performance management (EPM), promising to transform how organizations handle their financial processes. But how does OneStream software actually work to deliver on this promise, and what makes it a game-changer?

This deep dive into the OneStream company will explore its core functionalities, from financial consolidation to advanced analytics, and how it competes with other CPM software solutions. Understanding the OneStream SWOT Analysis is crucial for grasping its market position and future potential. We'll also examine OneStream's features and benefits, implementation process, and pricing to help you determine if it's the right fit for your organization's needs, covering everything from financial planning and analysis to the financial close process.

What Are the Key Operations Driving OneStream’s Success?

The core of the OneStream company lies in its unified platform designed for Intelligent Finance. This platform merges several financial processes, which are often handled separately by other systems. By integrating financial close and consolidation, planning, budgeting, forecasting, reporting, analytics, and data quality management, OneStream software offers a streamlined solution.

This integrated approach eliminates the need for multiple, disconnected applications. This reduces data reconciliation issues, improves data integrity, and accelerates financial cycles. OneStream caters to large enterprises across various industries, including manufacturing, retail, healthcare, and financial services, all aiming to enhance their financial agility and decision-making.

The value proposition of OneStream is centered around providing a single, unified platform that simplifies and accelerates financial processes. This leads to more efficient operations, better data accuracy, and improved strategic planning capabilities for its clients.

OneStream focuses on continuous innovation and customer-centric development. The company invests heavily in research and development to enhance its platform's capabilities. This includes incorporating advanced features like artificial intelligence and machine learning.

Their operational processes also include a robust customer support and professional services arm. This ensures successful implementations and ongoing optimization for their clients. OneStream maintains strategic partnerships to extend its reach and provide specialized expertise.

OneStream's unique effectiveness stems from its 'Extensible Business Reporting Language' (XBRL) engine and its commitment to a single platform. This allows for greater transparency, auditability, and adaptability compared to competitors. This unified architecture translates directly into customer benefits.

Customers experience faster financial closes, more accurate forecasts, reduced operational costs, and improved strategic planning. This comprehensive approach makes OneStream a powerful tool for corporate performance management.

OneStream provides a unified platform that simplifies financial processes, offering significant advantages over traditional CPM software. The platform's integrated approach reduces the complexity of financial reporting and planning.

- Faster Financial Closes: Streamlined processes lead to quicker completion of financial close cycles.

- Improved Data Accuracy: A unified platform reduces data errors and improves data integrity.

- Enhanced Forecasting: Advanced analytics and AI capabilities enable more accurate forecasts.

- Reduced Costs: Automation and efficiency gains result in lower operational costs.

For further insights into the company, you can read more about the Owners & Shareholders of OneStream.

OneStream SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does OneStream Make Money?

The OneStream company's revenue model is built around a multi-faceted approach, primarily focusing on software subscriptions, professional services, and training. This strategy is designed to provide a comprehensive solution for its clients, ensuring both initial implementation success and ongoing platform optimization. The core of OneStream's financial strategy is centered on recurring revenue streams, which are a hallmark of the SaaS business model.

The primary revenue driver for OneStream software is its subscription model. These subscriptions are tailored to the specific needs of each client, varying based on the number of users, the modules utilized, and the overall scope of the customer's operations. This flexible approach allows OneStream to cater to a wide range of businesses, from smaller enterprises to large multinational corporations. The subscription model provides a predictable and stable foundation for the company's financial performance.

In addition to subscription fees, OneStream generates significant revenue through professional services. These services include implementation support, configuration, data migration, and ongoing technical assistance. Given the complexity and strategic importance of EPM implementations, these services are often critical for successful adoption and optimization of the platform. While specific percentages for 2024-2025 are not publicly disclosed, subscription revenue is generally the largest contributor to the company's top line, reflecting the software-as-a-service (SaaS) model prevalent in the enterprise software industry.

OneStream's revenue streams are diversified to support its growth and customer relationships. The company's monetization strategy focuses on long-term customer relationships and expanding its footprint within existing client organizations by offering additional modules and functionalities. This approach helps to ensure customer satisfaction and drive sustainable revenue growth. Learn more about the Target Market of OneStream.

- Subscription Revenue: Recurring fees based on user count, modules, and scale. This is the primary revenue source.

- Professional Services: Implementation, configuration, data migration, and technical support. Crucial for successful platform adoption.

- Training Programs: Courses to enhance user proficiency and maximize platform utilization. A smaller but valuable revenue stream.

OneStream PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped OneStream’s Business Model?

The evolution of the OneStream company has been marked by significant advancements and strategic expansions. Continuous platform enhancements, including advanced analytics and machine learning integrations, have been crucial in maintaining its technological edge. Furthermore, the company has strategically expanded its global footprint, solidifying its presence in key markets worldwide.

A key element of OneStream's strategy involves consistently releasing new platform capabilities. These include features like enhanced reporting and improved data integration, which are vital for maintaining a competitive advantage. While supply chain issues are less directly impactful on a software company, OneStream has successfully navigated the challenges of rapid growth and scaling operations to meet increasing demand.

OneStream has demonstrated resilience and adaptability in a dynamic market, focusing on innovation and customer satisfaction. This focus has enabled the company to not only meet but also exceed the evolving needs of its customer base, ensuring continued growth and market leadership. For more insights into the company's growth strategy, check out the Growth Strategy of OneStream.

OneStream has consistently released new platform capabilities, such as advanced analytics and machine learning integrations. These enhancements have been instrumental in maintaining its technological edge in the CPM software market. The company has expanded its global presence, establishing a strong foothold in key markets worldwide.

OneStream's strategic moves include a focus on a unified platform architecture, which provides a single source of truth for financial data. This approach eliminates complexities often found in multi-product EPM suites. The company has also emphasized customer success, driving referrals and repeat business.

OneStream's competitive advantages stem from its unified platform, which enhances data integrity and efficiency. Its strong brand reputation, built on customer success, drives referrals and repeat business. The company's focus on the finance function allows for deeper specialization and tailored solutions.

While supply chain disruptions are less impactful on software companies, OneStream has managed rapid growth and scaled its operations. The company has adapted to the increasing demand for cloud-based solutions and embedded AI. This adaptability ensures its platform remains competitive in the evolving EPM landscape.

OneStream excels due to its unified platform, which streamlines financial data management, and its strong reputation for customer satisfaction. This approach results in greater data integrity and operational efficiency for its clients. The company's focus on the finance function allows for specialized solutions.

- Unified Platform: Provides a single source of truth for financial data, reducing complexity.

- Customer Focus: Strong brand reputation built on customer success, driving referrals.

- Specialization: Dedicated focus on the finance function for tailored solutions.

- Adaptability: Continuous adaptation to cloud-based solutions and AI.

OneStream Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is OneStream Positioning Itself for Continued Success?

The OneStream company holds a strong position in the enterprise performance management (EPM) market, often competing with established players. Its market share is expanding, particularly among large enterprises seeking a unified EPM solution. The OneStream software benefits from high customer loyalty, driven by the value and efficiency gains its platform delivers. Its global reach is also increasing, with a growing international customer base and partner network.

Despite its strong position, OneStream faces risks, including intense competition in the EPM market. Rapid technological advancements require continuous investment in research and development. Economic downturns or shifts in enterprise IT spending could impact sales cycles and revenue growth. Regulatory changes related to data privacy or financial reporting could also necessitate platform adjustments. Looking ahead, OneStream is focused on strategic initiatives to enhance its platform's AI and machine learning capabilities, expand its cloud offerings, and deepen its industry-specific solutions.

OneStream is a recognized leader in the EPM space. It competes directly with major players like SAP, Oracle, and Anaplan. The company's unified platform approach and cloud-based solutions have contributed to its growing market share, especially among large enterprises.

OneStream differentiates itself through its unified platform, which integrates financial consolidation, planning, reporting, and analytics. This contrasts with the fragmented solutions offered by some competitors. Customer satisfaction is high, reflecting the value derived from the platform.

The EPM market is highly competitive, with established vendors and emerging players. Rapid technological changes require continuous investment in R&D. Economic downturns or shifts in IT spending could affect sales cycles and revenue. Regulatory changes could also impact the platform.

OneStream focuses on innovation in AI and machine learning to enhance its platform. Expansion of cloud offerings is a key priority. The company aims to deepen its industry-specific solutions to cater to specialized needs and drive further adoption.

The future for OneStream looks promising, with continued focus on innovation and market expansion. The company's ability to offer a unified platform and adapt to changing market demands will be critical. Strategic initiatives include enhancing AI capabilities, expanding cloud offerings, and deepening industry-specific solutions. For a broader view of the competitive landscape, consider reading about the Competitors Landscape of OneStream.

- Continued growth in the EPM market.

- Increased adoption of cloud-based solutions.

- Further development of AI and machine learning capabilities.

- Expansion into new geographic markets and industry verticals.

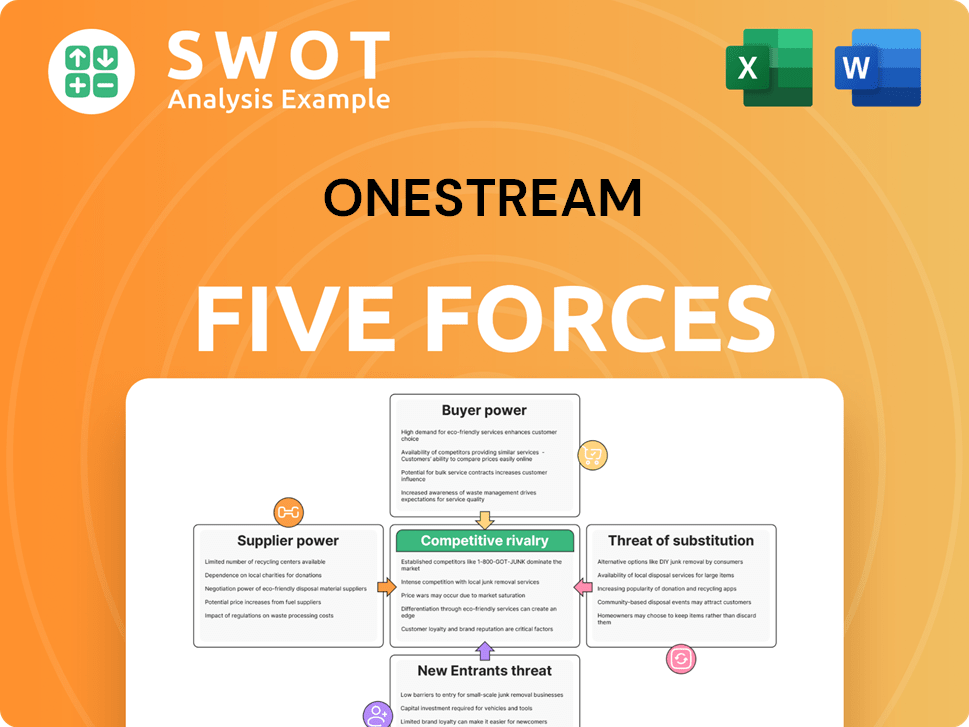

OneStream Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of OneStream Company?

- What is Competitive Landscape of OneStream Company?

- What is Growth Strategy and Future Prospects of OneStream Company?

- What is Sales and Marketing Strategy of OneStream Company?

- What is Brief History of OneStream Company?

- Who Owns OneStream Company?

- What is Customer Demographics and Target Market of OneStream Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.