OneStream Bundle

Who Really Calls the Shots at OneStream Software?

Understanding the OneStream SWOT Analysis begins with knowing its ownership. The ownership structure of a company like OneStream significantly shapes its strategic direction and market influence. Founded in 2010, OneStream, a leader in Intelligent Finance platforms, has rapidly become a key player in the corporate performance management (CPM) software market.

This deep dive into OneStream ownership will explore the evolution of the OneStream company, from its founders and early investors to its current stakeholders. Knowing who owns OneStream is crucial for grasping its operational priorities and future strategies. We'll examine the founder's stakes, key institutional OneStream investors, and any shifts in ownership, providing a comprehensive view of the entities that hold power within OneStream Software.

Who Founded OneStream?

The origins of the OneStream company trace back to its founding in 2010 by Tom Shea and Bob Powers. Tom Shea, with his extensive experience in financial software, took on the role of CEO. Bob Powers, also a seasoned expert, played a key role in shaping the platform's architecture and product vision.

Details about the initial equity split are not publicly available, as is typical for privately held companies in their early stages. However, their combined expertise was fundamental to the company's early development. Their shared vision was key to the company's early development.

In its initial phase, OneStream was primarily bootstrapped, relying on the founders' capital and early revenues. This approach allowed the founders to maintain significant control over the company's direction and product development in the early years.

OneStream's early ownership was concentrated with its founders, Tom Shea and Bob Powers. The company initially relied on founder capital and early revenues, indicating a strong founder-led approach. There are no public records of significant early investors, suggesting a focus on internal funding during the initial phase.

- The company's early funding strategy allowed the founders to maintain control.

- Early agreements likely included standard vesting schedules for founder shares.

- The founders' vision was directly reflected in the distribution of control.

- OneStream's approach to its Marketing Strategy of OneStream focused on organic growth.

OneStream SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has OneStream’s Ownership Changed Over Time?

The ownership structure of OneStream Software has undergone significant changes, primarily driven by investment rounds that brought in major private equity firms. A critical shift occurred in 2019 when KKR invested $500 million, acquiring a substantial minority stake. This influx of capital supported OneStream's expansion and product development. This investment marked a pivotal moment in the company's evolution, transforming it from a founder-led entity to one backed by significant institutional investors.

Further investment followed in April 2021 with a $200 million Series B round, led by D1 Capital Partners, which included participation from Tiger Global Management and existing investors like KKR. This round valued OneStream at over $6 billion. These investments highlight a move toward institutional ownership, providing capital for growth while maintaining the company's private status. The shift in ownership has enabled OneStream to expand its market reach and invest in its cloud-based platform, influencing its strategic focus on enterprise-level solutions and global market penetration.

| Event | Date | Impact |

|---|---|---|

| KKR Investment | 2019 | $500 million investment; significant minority stake acquired. |

| Series B Funding | April 2021 | $200 million raised, led by D1 Capital Partners; valuation exceeding $6 billion. |

| Current Ownership | 2024-2025 | Major stakeholders include KKR, D1 Capital Partners, Tiger Global Management, and founders Tom Shea and Bob Powers. |

Currently, the major stakeholders in OneStream Software include KKR, D1 Capital Partners, and Tiger Global Management, alongside founders Tom Shea and Bob Powers. These private equity firms aim to drive growth and eventually realize returns through a future liquidity event, such as an IPO or a strategic acquisition. The company's focus remains on enterprise-level solutions and global market penetration, supported by its cloud-based platform. For more information on the company, you can read this article about OneStream.

OneStream's ownership structure has evolved significantly, with major investments from private equity firms. KKR's 2019 investment and the 2021 Series B round led by D1 Capital Partners were pivotal. The company is now backed by institutional investors, focusing on growth and global expansion.

- KKR's initial investment in 2019 was a major turning point.

- The Series B funding in 2021 valued the company at over $6 billion.

- Major stakeholders include KKR, D1 Capital Partners, and Tiger Global Management.

- The company is expanding its market reach and investing in its cloud-based platform.

OneStream PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on OneStream’s Board?

The Board of Directors at OneStream reflects its current ownership structure, featuring representatives from its major private equity investors alongside the company's founders and independent members. While a public list of all board members and their affiliations with specific shareholding percentages is not readily available for this privately held company, it is common for major investors like KKR and D1 Capital Partners to have significant representation on the board. These representatives typically play a crucial role in strategic decision-making, governance, and oversight, aligning the company’s direction with the investors' objectives. Understanding the Growth Strategy of OneStream is also key to understanding the board's focus.

Tom Shea, as the CEO and co-founder, likely holds a prominent position on the board, representing the founder's vision and operational leadership. The voting structure for private companies like OneStream typically involves one-share-one-vote, though specific agreements with private equity investors might include provisions for preferred shares or special voting rights that grant them additional influence. While details of any dual-class shares or golden shares are not public, private equity firms often negotiate for certain control provisions or veto rights on significant corporate actions. The board's composition and voting power are primarily geared towards supporting OneStream's growth trajectory and preparing for potential future liquidity events, ensuring alignment between management and major shareholders.

OneStream's board includes representatives from major investors like KKR and D1 Capital Partners, alongside founders and independent members.

- The CEO and co-founder, Tom Shea, likely plays a key role on the board.

- Voting structures are typically one-share-one-vote, but private equity agreements may grant additional influence.

- The board focuses on supporting OneStream's growth and preparing for future liquidity events.

OneStream Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped OneStream’s Ownership Landscape?

Over the past few years, the ownership of OneStream Software has seen significant developments, primarily driven by private equity investments. The company has continued to grow rapidly, solidifying its position in the corporate performance management market. A major indicator of investor confidence was the $200 million Series B funding round in April 2021. This round valued the company at over $6 billion, with D1 Capital Partners leading the investment, alongside Tiger Global and existing investor KKR. This influx of capital has allowed OneStream to focus on long-term growth and product innovation without the immediate pressure of a public listing.

The trend of private equity firms investing in high-growth software companies, especially those in the enterprise solutions space, is evident in OneStream's ownership structure. While these investments can lead to founder dilution, founders often retain significant influence through board representation and operational leadership. OneStream's strategic moves, such as expanding its global presence and enhancing its cloud platform, are supported by its investor base. The company's focus remains on organic growth, strategic partnerships, and potential acquisitions to strengthen its market position. Considering the landscape, you might find insights in the Competitors Landscape of OneStream.

| Metric | Details | Data |

|---|---|---|

| Funding Round | Series B | $200 million (April 2021) |

| Valuation | Post-money valuation | Over $6 billion (April 2021) |

| Key Investors | Lead Investors | D1 Capital Partners, Tiger Global, KKR |

OneStream's ownership structure is primarily influenced by private equity backing. While the company has not announced any plans for an IPO, the substantial investments suggest a public listing remains a potential future event, likely when market conditions are optimal. The company's focus on strategic initiatives and financial performance continues to be a key factor in its ownership dynamics.

OneStream Software's ownership is largely shaped by private equity firms. Key investors include D1 Capital Partners, Tiger Global, and KKR. The company's valuation exceeded $6 billion in 2021 following a significant funding round.

The $200 million Series B funding round in April 2021 was a pivotal moment. This investment allowed OneStream to focus on long-term growth. The company's financial performance continues to be a key factor in its ownership dynamics.

A public listing remains a potential future event for OneStream investors. The company is focused on organic growth, strategic partnerships, and potential acquisitions. Market conditions and the company's scale will influence the timing of any IPO.

OneStream's ownership is heavily influenced by private equity investments. The company's valuation and funding rounds highlight investor confidence. The focus remains on strategic growth and market expansion.

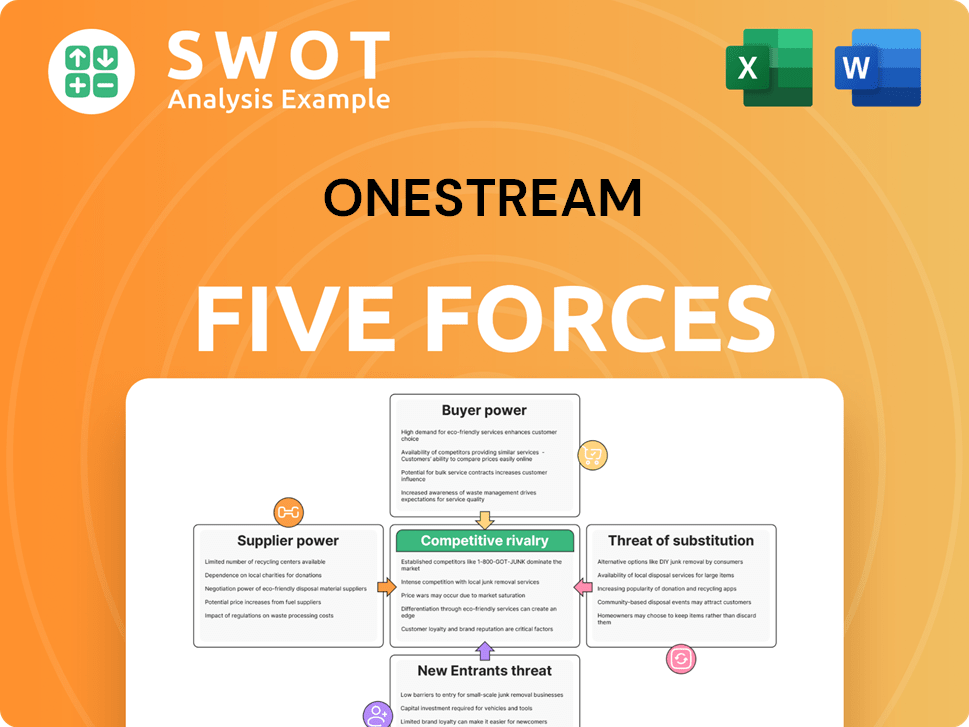

OneStream Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of OneStream Company?

- What is Competitive Landscape of OneStream Company?

- What is Growth Strategy and Future Prospects of OneStream Company?

- How Does OneStream Company Work?

- What is Sales and Marketing Strategy of OneStream Company?

- What is Brief History of OneStream Company?

- What is Customer Demographics and Target Market of OneStream Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.