OneStream Bundle

Who are the Key Players Driving OneStream's Success?

Understanding the OneStream SWOT Analysis is crucial, but even more vital is knowing who benefits most. OneStream's success hinges on its ability to cater to specific customer demographics and target markets. This deep dive explores the evolution of OneStream's customer base, revealing the strategic shifts that have fueled its growth.

The demand for sophisticated Corporate Performance Management (CPM) solutions has reshaped the financial landscape, and OneStream has strategically positioned itself to capitalize on this trend. This analysis will illuminate the OneStream company's focus on large enterprises, detailing their needs and how OneStream's unified Intelligent Finance platform addresses them. We'll explore the OneStream target market, including industry segmentation and the benefits realized, providing valuable insights for anyone evaluating financial planning software.

Who Are OneStream’s Main Customers?

Understanding the primary customer segments is crucial for analyzing the business model of the company. The company primarily focuses on mid-market and large enterprises, operating in a B2B environment across various industries. This strategic focus is evident in its customer base and the solutions it offers.

As of Q1 2025, the company had a customer base of 1,646, demonstrating a 16% increase from Q1 2024. The company has a strong presence among Fortune 500 companies, with 75 of them using their services, accounting for 15% of software revenue as of Q1 2024. The company's customer base is diverse, with a concentration in specific company sizes and industries.

The company's target market has evolved, shifting towards larger enterprises. This shift is driven by the increasing need for advanced financial planning software and the ability to handle complex data analysis. The company's SaaS transition, with over 90% of new contracts being SaaS as of Q3 2020, further reflects this adaptation to market trends.

The majority of customers for financial performance management fall within the 1,000 to 4,999 employee size (110 companies). This is followed by companies with 10,000+ employees (74 companies) and 5,000 to 9,999 employees (34 companies). These figures highlight the company's focus on serving a diverse range of enterprise clients.

The average ACV for customers acquired in 2023 was $300,000, increasing to an implied average ACV of $337,000 as of the last quarter. The segment of customers paying over $1 million in ARR is experiencing rapid growth, up 57% year-over-year. These figures indicate the company's ability to attract and retain high-value clients.

Industries heavily utilizing the company's financial performance management solutions include Financial Services, Cybersecurity, and Cloud Services. This industry focus helps the company tailor its offerings to meet specific needs. If you're interested in learning more about the company's marketing strategies, check out the Marketing Strategy of OneStream.

The company's target segments have shifted over time, moving further upmarket. This strategic move is driven by the increasing demands on CFOs and finance teams to analyze more data and make quick financial decisions. The transition to a SaaS model also reflects an adaptation to market trends.

The company's solutions are designed to meet the needs of its target markets by providing robust corporate performance management (CPM) capabilities. This includes financial planning software and tools for financial reporting.

- Financial Consolidation and Reporting: Streamlines the process of consolidating financial data.

- Budgeting and Forecasting: Enables accurate budgeting and forecasting.

- Financial Planning and Analysis (FP&A): Provides tools for in-depth financial analysis.

- Operational Planning: Supports operational planning processes.

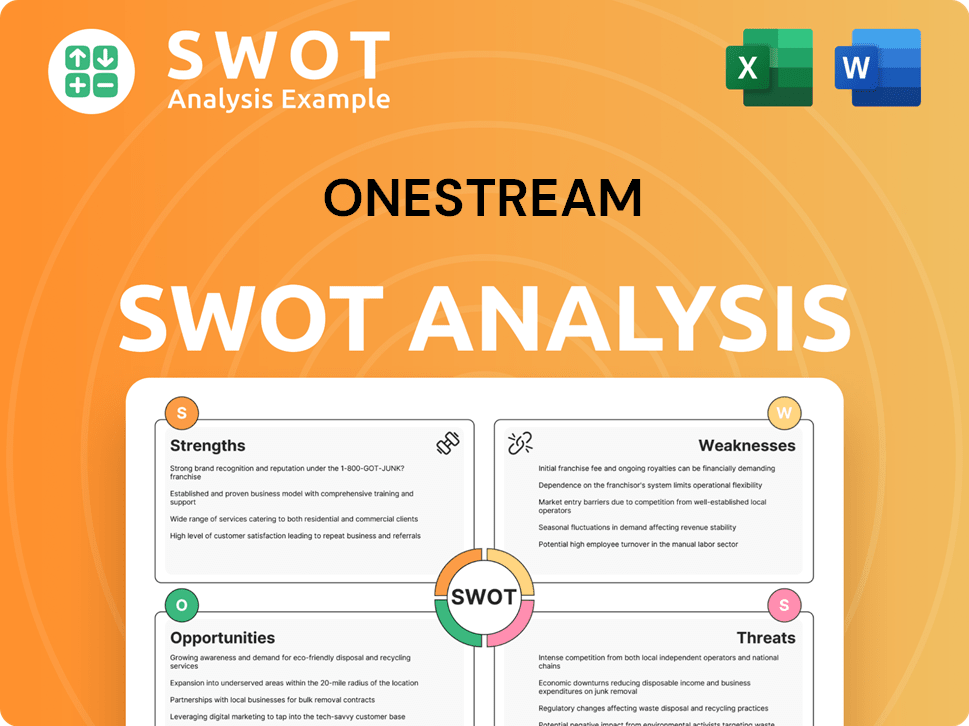

OneStream SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do OneStream’s Customers Want?

Understanding the customer needs and preferences is crucial for any company, and for OneStream, this involves a deep dive into how its solutions meet the demands of modern finance and operations. The company's success hinges on its ability to provide a unified platform that addresses the complex challenges faced by financial professionals. This approach helps OneStream maintain a strong position in the market.

The primary goal for many of OneStream's customers is to modernize their finance and operations functions. They seek to streamline complex financial processes, improve data accuracy, and gain deeper business insights. The demand for a unified platform that consolidates financial close, reporting, planning, and analytics is a key driver in their purchasing decisions. This shift empowers Chief Financial Officers (CFOs) to become strategic drivers of business strategy and execution, moving beyond just reporting on past performance.

OneStream's customers are looking for solutions that provide a single, comprehensive view of the business, enabling faster planning and more accurate forecasting. The company's commitment to continuous innovation and regular updates, including new features and AI-powered solutions, directly addresses evolving customer needs for cutting-edge technology. For instance, in 2024, OneStream introduced a suite of AI-powered solutions for real-time forecasting and a new product, CPM Express, designed to simplify reporting and forecasting.

Common pain points addressed by OneStream include managing decentralized processes, technology, data, and people spread across an organization. Customers often struggle with manual processes and disparate systems like Excel. The goal is to provide a single, comprehensive view of the business.

Customers value solutions that provide a single, comprehensive view of the business, enabling faster planning and more accurate forecasting. This unified approach helps in reducing complexity and improving data quality. The benefits extend to better decision-making.

OneStream's commitment to continuous innovation and regular updates, including new features and AI-powered solutions, directly addresses evolving customer needs for cutting-edge technology. This ensures that the platform remains relevant and competitive. This includes real-time forecasting.

OneStream tailors its offerings by providing a unified platform that is infinitely extensible, allowing customers to download and deploy additional solutions from its MarketPlace to address specific requirements. This flexibility is a key factor in customer decision-making. The MarketPlace offers a range of solutions.

The company emphasizes customer success, with a 98% gross retention rate, indicating how sticky the product is due to its reliability and ability to meet customer demands. This high retention rate is a testament to the platform's value. Customer satisfaction is a priority.

Customer feedback through platforms like Gartner Peer Insights highlights solid performance, exceptional support, and reliable consolidation capabilities as key loyalty factors. These reviews provide valuable insights. The feedback helps in improving the platform.

The ideal OneStream customer is looking for a comprehensive Corporate Performance Management (CPM) solution that streamlines financial processes and provides better insights. These customers often have complex financial reporting needs and are seeking to move away from manual processes. The focus is on improving data accuracy and gaining a unified view of the business. For more details, you can explore the insights in this article: Owners & Shareholders of OneStream.

- Unified Platform: Customers want a single platform for financial close, reporting, planning, and analytics.

- Data Accuracy: Improved data quality and accuracy are critical for better decision-making.

- Automation: Automation of manual processes to reduce errors and save time.

- Real-time Insights: The ability to access real-time data and insights for faster forecasting.

- Extensibility: The flexibility to add solutions as needed, to meet specific requirements.

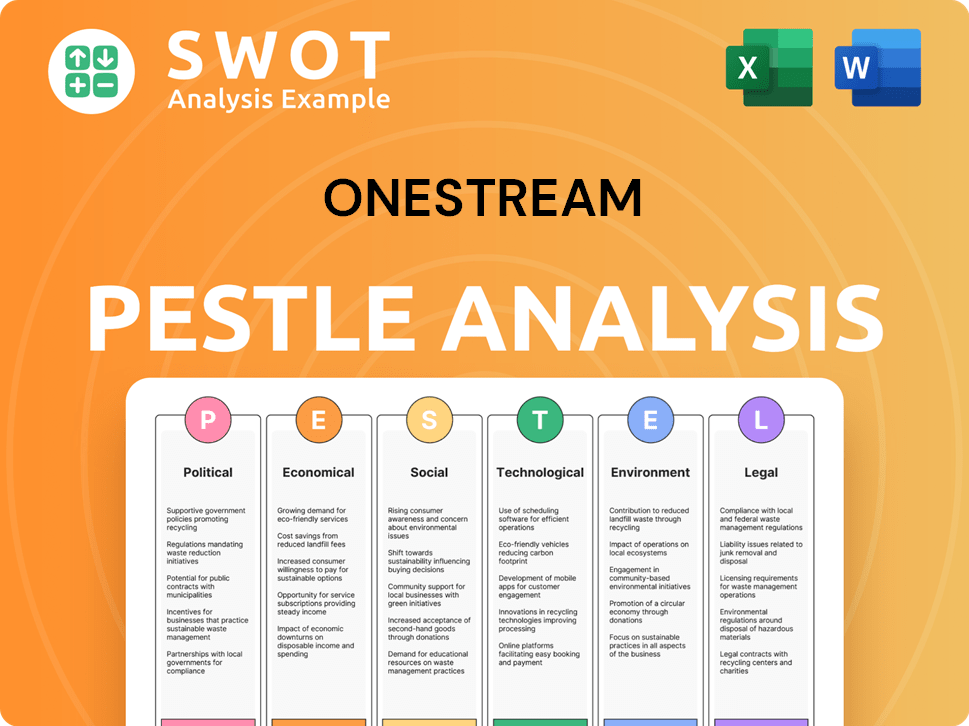

OneStream PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does OneStream operate?

The geographical market presence of the company is substantial, with a customer base spanning over 45 countries worldwide. The company's reach extends across North America, South America, Europe, the Middle East, Africa (EMEA), and the Asia-Pacific (APAC) regions. This widespread presence highlights the company's commitment to serving a global clientele and adapting to diverse market needs.

The United States represents the largest market for the company, with 68.98% of its financial performance management customers located there. Other significant markets include the United Kingdom, accounting for 8.39% of customers, and the Netherlands, with 7.66%. This concentration indicates a strong foothold in key financial hubs and a strategic focus on these regions for growth. International revenue contributed 27% and 30% of total revenue in 2022 and 2023, respectively, demonstrating the company's increasing global impact.

The company has strategically expanded its operations to key regions like Europe, Asia, and Australia to serve a diverse customer base across various industries and geographies. This expansion is supported by the growth of its physical presence, from six leased offices to 14, alongside the management of eight coworking spaces. The company's commitment to localizing its offerings and partnerships, such as adding new implementation partners like KPMG Switzerland, further solidifies its global market position.

The United States is the primary market, with a substantial percentage of customers. The United Kingdom and the Netherlands also represent significant markets for the company. This geographical distribution is crucial for understanding the company's customer demographics and its strategic approach to market penetration.

The company has strategically expanded its reach into Europe, Asia, and Australia. This expansion is facilitated by an increase in physical office spaces and coworking arrangements. The company's global footprint is designed to meet the needs of a diverse customer base.

The company focuses on localizing its offerings and establishing partnerships in diverse markets. The addition of implementation partners, such as KPMG Switzerland, enhances its go-to-market strategy. These partnerships are vital for adapting to regional demands and ensuring customer satisfaction.

International revenue contributed a significant portion of the company's total revenue in 2022 and 2023. This growth in international revenue highlights the company's expanding global presence. The company's financial success is increasingly tied to its ability to serve international markets.

The company's global strategy is designed to address the needs of its target market. The company's growth in key regions is supported by strategic partnerships and localized offerings. This strategy is crucial for its success in the competitive market of financial planning software.

- The United States accounts for the majority of the company's customer base.

- The company continues to expand its global footprint to meet market demand.

- Strategic partnerships are key to the company's success in diverse markets.

- The company focuses on customer satisfaction, especially in key markets.

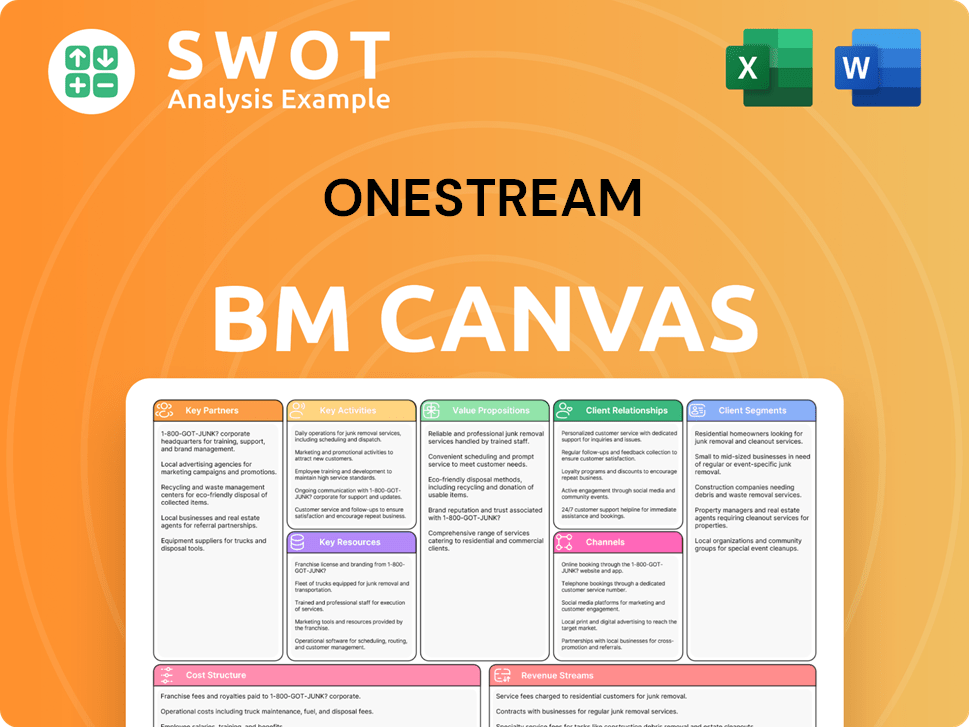

OneStream Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does OneStream Win & Keep Customers?

The [Company Name] employs a sophisticated approach to both acquiring and retaining customers, emphasizing a 'land and expand' strategy. This strategy is supported by a large sales and marketing team. They also focus heavily on ensuring customer success. This helps to foster long-term relationships and drive growth within their client base.

Their strategy involves a multi-faceted approach that includes direct sales, a robust partner network, and strategic technology integrations. The company's customer acquisition and retention strategies are designed to create a strong customer base. They aim to increase customer lifetime value. This approach contributes to their impressive retention rates and overall business success.

The company's commitment to customer success is evident in its high retention rates. The company's focus on understanding and meeting customer needs is key to its success. Their ability to adapt to evolving market demands further strengthens their market position.

The primary customer acquisition channels for the company include a substantial go-to-market team, with approximately 600 full-time employees dedicated to sales and marketing. This represents about 46% of their total workforce. They primarily sell their financial planning software directly to customers.

They leverage a robust network of over 250 partners, including major consulting firms like Accenture and IBM. These partners are crucial for implementing their complex solutions for large companies. They also have strategic technology integrations, such as a deepened relationship with Microsoft through integration with the Office 365 Suite.

The company boasts impressive retention figures, with a 98% gross retention rate and a 118% net dollar retention rate as of the last quarter. This indicates that customers not only stay but also expand their usage. In 2023, they retained 99% of subscription and license revenue that was up for renewal.

They attribute their high retention to a company-wide initiative focused on 100% customer success. Marketing, sales, and product teams align to acquire and serve the right customers who are likely to remain loyal and advocate for the brand. This focus on customer success is a key factor in their high retention rates.

The company actively gathers insights into customer needs, preferences, and pain points to guide product development. They regularly release updates and new features, including AI-powered solutions like Sensible AI Agents and Sensible AI Studio, to meet evolving customer demands and boost productivity. Their unified platform simplifies financial processes, providing a single source of truth, which resonates with finance leaders. The average sales cycle for new customers typically ranges from 4 to 8 months, reflecting the complexity and strategic nature of their solutions. For more insights into their growth strategy, you can read Growth Strategy of OneStream.

Their primary acquisition strategy involves a large go-to-market team and a network of over 250 partners. This approach allows the company to reach a wide range of potential customers. The company also focuses on direct sales and strategic partnerships to expand its customer base.

Customer retention is driven by a company-wide focus on customer success and a unified platform that simplifies financial processes. The company's high retention rates are a testament to its commitment to customer satisfaction. Their product's ability to provide a single source of truth also plays a crucial role.

The company leverages customer data and insights to tailor marketing, product features, and customer experiences. They regularly release updates and new features, including AI-powered solutions like Sensible AI Agents. This commitment to innovation helps meet evolving customer demands.

The average sales cycle for new customers typically ranges from 4 to 8 months. This reflects the complexity and strategic nature of their solutions. Some sales cycles can extend for years, highlighting the long-term commitment involved.

The company targets large enterprises with complex financial planning needs, often focusing on specific industries. Their solutions are designed to meet the needs of finance leaders. The company's focus on specific customer segments allows for tailored solutions.

Partners like Accenture and IBM play a key role in implementing the company's complex solutions for large companies. Their partner network significantly expands their market reach. This collaborative approach is essential for their success.

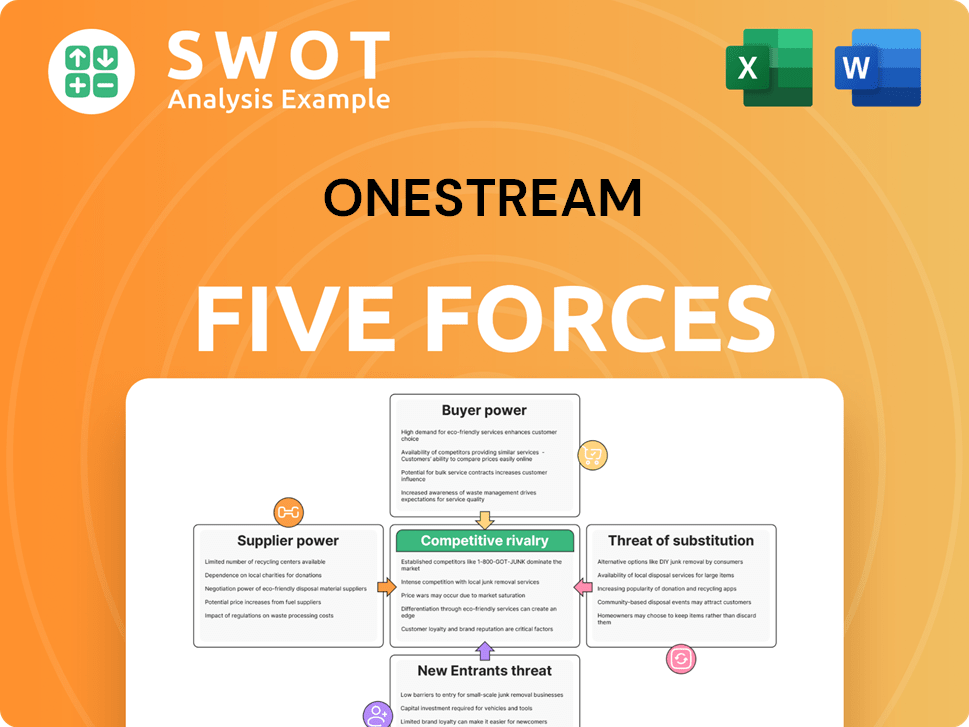

OneStream Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of OneStream Company?

- What is Competitive Landscape of OneStream Company?

- What is Growth Strategy and Future Prospects of OneStream Company?

- How Does OneStream Company Work?

- What is Sales and Marketing Strategy of OneStream Company?

- What is Brief History of OneStream Company?

- Who Owns OneStream Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.