Orix Bundle

How did Orix Company become a global financial powerhouse?

Embark on a journey through the Orix SWOT Analysis, and discover the remarkable evolution of Orix Company, a Japanese financial services giant. From its inception in post-war Japan to its current status as a diversified global leader, Orix's story is one of strategic innovation and impressive growth. Explore how Orix has navigated the complexities of the financial world and established a significant global presence.

This corporate overview will examine the brief history of Orix Corporation, tracing its origins as Orient Leasing Co., Ltd. in 1964, and its expansion into various sectors. The Orix Group's journey showcases its ability to adapt and thrive, making it a compelling case study for understanding the dynamics of the financial industry. We will delve into Orix's key milestones, acquisitions, and subsidiaries, providing a comprehensive understanding of its business model and financial performance.

What is the Orix Founding Story?

The story of Orix Company, a prominent player in the Japanese financial services sector, began on April 17, 1964. Initially named Orient Leasing Co., Ltd., the company's foundation was laid by Yoshihiko Miyauchi, who played a pivotal role in shaping its trajectory. Orix's early years were marked by a focus on addressing a crucial gap in the Japanese economy: the need for flexible financing options for businesses.

The company's establishment coincided with Japan's rapid economic growth following World War II. This period of industrialization created a strong demand for capital investment, which Orix was positioned to facilitate. The company's core business model was rooted in equipment leasing, providing businesses with an alternative to traditional financing methods. This innovative approach, however, required significant market education to convince companies of its benefits.

Orix's initial funding came from a combination of its founding partners and early institutional investors. These investors recognized the potential of the leasing model in a rapidly expanding economy. The cultural and economic context of post-war Japan, with its strong emphasis on economic recovery and growth, was instrumental in creating a favorable environment for Orix's establishment and early success. The company's focus on equipment leasing allowed businesses to access essential assets without the need for upfront capital, which was a significant advantage at the time.

Orix's founding was a direct response to the limited financing options available to Japanese businesses in the 1960s. The company's early success was driven by its ability to offer equipment leasing services, a novel concept that quickly gained traction. The leadership of Yoshihiko Miyauchi was crucial in navigating the challenges of introducing a new financial model.

- Founding Date: April 17, 1964.

- Original Name: Orient Leasing Co., Ltd.

- Founder: Yoshihiko Miyauchi.

- Initial Business Model: Equipment leasing.

The company's evolution, from its inception to its current status as a diversified financial services group, reflects its ability to adapt to changing market conditions and expand its service offerings. For a deeper understanding of the competitive environment that Orix operates in, you can explore the Competitors Landscape of Orix.

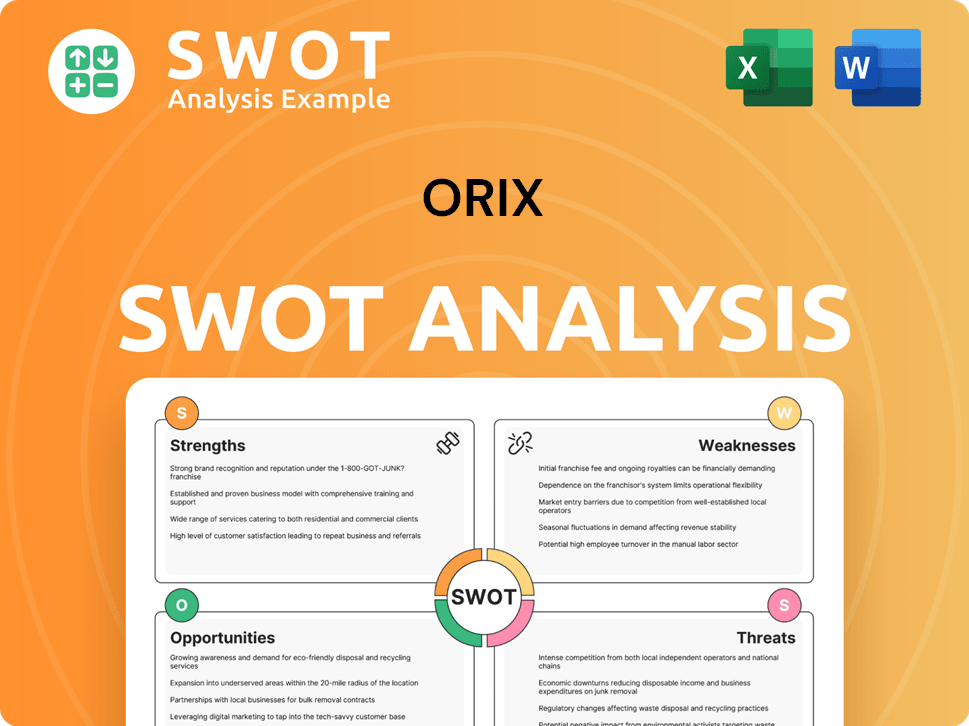

Orix SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Orix?

The early growth of the Orix Company, a key player in Japanese financial services, was marked by strategic expansion and diversification. Following its establishment in 1964, Orix quickly became a leader in the Japanese leasing market. The company's focus on leasing equipment to various industries drove early sales. This period laid the foundation for its future as a comprehensive financial group.

Orix initially focused on expanding its leasing services, starting with equipment for manufacturing and transportation. The company's ability to offer cost-effective leasing solutions attracted major clients. By demonstrating the advantages of leasing, Orix achieved significant sales milestones.

The company expanded its operations across Japan by establishing additional offices. A pivotal moment was the entry into international markets, beginning with Hong Kong in 1971. This marked the start of Orix's global presence, followed by expansion into Asia, North America, and Europe. The Growth Strategy of Orix included overseas ventures.

In the late 1970s and 1980s, Orix broadened its service portfolio through acquisitions and mergers. This expansion moved beyond leasing into real estate financing and investment. Major capital raises, including public listings, provided the necessary funding for this aggressive expansion.

Yoshihiko Miyauchi's leadership guided Orix through these developmental phases. The market generally responded positively as Orix adapted its offerings to meet evolving client needs. Strategic shifts included a move towards diversified financial services, preparing the company for its future.

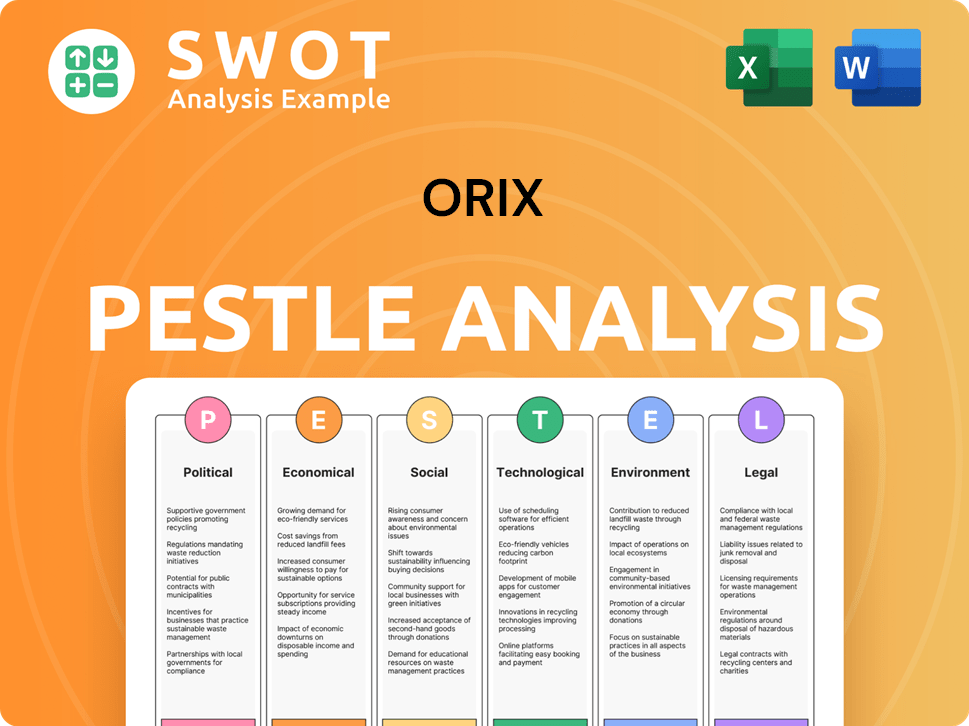

Orix PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Orix history?

The Orix Company, a prominent player in Japanese financial services, has a rich Orix history marked by significant achievements and strategic shifts. This Orix Group has evolved considerably since its inception, navigating both successes and challenges to establish its global presence. Understanding the Orix Company timeline provides valuable insights into its adaptability and resilience.

| Year | Milestone |

|---|---|

| 1964 | Founded as Orient Leasing Co., Ltd., marking the beginning of its journey in the financial sector. |

| 1970s | Expanded operations, venturing into new business areas and broadening its financial services offerings. |

| 1980s | Expanded its global footprint, establishing a presence in international markets. |

| 1989 | Changed its name to Orix Corporation, reflecting its diversified business model. |

| 1990s | Navigated the Asian Financial Crisis, demonstrating resilience and strategic adaptation. |

| 2000s | Continued to expand its business portfolio and global reach, including acquisitions and strategic partnerships. |

| 2020s | Focus on sustainable business practices, particularly in renewable energy, and continued global expansion. |

Orix has consistently demonstrated innovation in the financial sector. A key innovation was its introduction of equipment leasing to Japan, which boosted capital expenditure for Japanese businesses. The company has also developed industry-first financial products tailored to specific market needs, showcasing its commitment to adapting to changing financial landscapes.

Orix pioneered equipment leasing in Japan, significantly impacting capital expenditure for businesses. This innovation provided a new avenue for companies to acquire essential equipment without large upfront costs.

Orix has consistently developed financial products tailored to specific market needs. This includes products designed to meet the evolving demands of its diverse clientele, from corporate clients to individual investors.

Major partnerships with leading corporations globally have cemented its position. These collaborations have expanded Orix's reach and enhanced its service offerings, creating a competitive advantage.

Recent years have seen Orix recognized for its sustainable business practices, particularly in renewable energy. This reflects a strategic shift towards environmentally friendly investments and operations.

Orix has diversified its services to include leasing, lending, investment, and insurance. This diversification strategy has helped it navigate economic fluctuations.

Orix has expanded its operations globally, establishing a presence in various countries. This expansion has allowed it to diversify its revenue streams and reduce its reliance on any single market.

Despite its successes, Orix has faced significant challenges. The Asian Financial Crisis and the 2008 Global Financial Crisis impacted its asset values and investment portfolios. Moreover, competition from traditional banks and fintech companies has required continuous innovation and adaptation.

The Asian Financial Crisis and the 2008 Global Financial Crisis significantly impacted Orix's asset values. These events necessitated strategic adjustments to maintain financial stability.

Competition from traditional banks and emerging financial technology companies has consistently required Orix to innovate. This has driven the need for continuous improvement in its services and offerings.

Economic downturns have required Orix to strategically pivot its investment focus and risk management frameworks. This has been crucial for maintaining profitability during challenging times.

Changes in financial regulations have necessitated adjustments to Orix's business practices. Adapting to new regulatory environments is essential for compliance and operational efficiency.

Geopolitical risks have presented challenges to Orix's global operations. These risks require careful risk management and strategic planning to mitigate potential impacts.

Market volatility has consistently required Orix to refine its risk management strategies. This includes adjusting investment portfolios and hedging against potential losses.

For more details on the ownership structure and key stakeholders, you can explore the article about Owners & Shareholders of Orix.

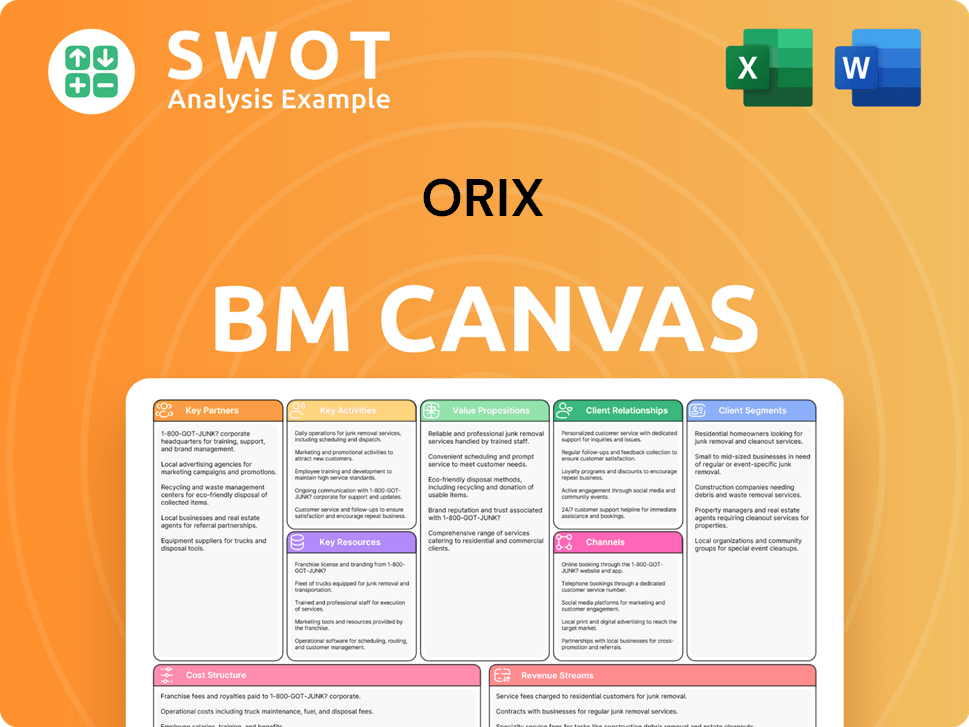

Orix Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Orix?

The Orix Company has a rich history, marked by strategic expansions and a focus on financial services. Founded in Japan, it has grown into a global entity with diverse business interests. Key milestones include early international ventures, name changes to reflect its global status, and significant moves into renewable energy and asset management.

| Year | Key Event |

|---|---|

| 1964 | Founded as Orient Leasing Co., Ltd. in Japan, marking the beginning of Orix's journey in financial services. |

| 1971 | Established its first overseas office in Hong Kong, signaling the start of international expansion for the company. |

| 1989 | Changed its name to Orix Corporation, reflecting its diversified global operations and broader scope. |

| 1997 | Expanded into the renewable energy sector, initially with solar power projects, demonstrating a commitment to sustainable investments. |

| 2006 | Entered the U.S. asset management market through strategic acquisitions, broadening its financial services portfolio. |

| 2010s | Accelerated global expansion in real estate, private equity, and infrastructure, increasing its international footprint. |

| 2020 | Continued strategic investments in sustainable businesses, including offshore wind power, reinforcing its commitment to sustainability. |

| 2023 | Reported strong financial results, demonstrating resilience in a volatile global economy and solidifying its market position. |

| 2024 | Orix Corporation's stock performance showed a 16.51% increase year-to-date as of May 29, 2024, reflecting positive investor sentiment. |

Orix plans to increase its renewable energy investments, particularly in offshore wind and solar projects. This aligns with global trends toward decarbonization and sustainable infrastructure. The company aims to contribute significantly to a greener future through these strategic investments.

The company intends to expand into emerging markets and strengthen its presence in key regions like Asia and North America. This will involve strategic partnerships and acquisitions to enhance its global footprint. Orix aims to diversify its revenue streams through this expansion strategy.

Orix is focused on leveraging technology to enhance its financial services. This includes digital transformation initiatives to improve efficiency and customer experience. The company aims to stay competitive by adopting the latest technological advancements.

In its 2024 outlook, Orix highlighted its commitment to global investments and its robust financial health. The company’s focus remains on sustainable growth, diversification, and enhancing shareholder value. The company's future direction remains rooted in its founding vision of providing essential financial services.

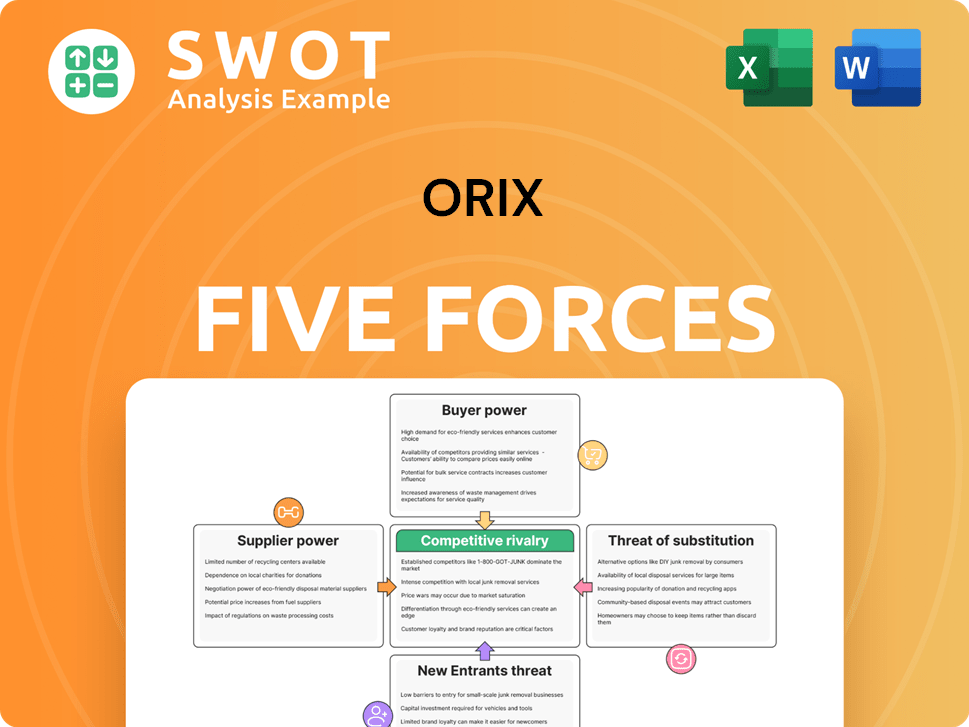

Orix Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Orix Company?

- What is Growth Strategy and Future Prospects of Orix Company?

- How Does Orix Company Work?

- What is Sales and Marketing Strategy of Orix Company?

- What is Brief History of Orix Company?

- Who Owns Orix Company?

- What is Customer Demographics and Target Market of Orix Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.