Orix Bundle

Decoding Orix: How Does This Financial Giant Operate?

ORIX Corporation, a global financial services powerhouse, has strategically evolved to become a major player across diverse sectors. With operations in over 30 countries, ORIX's influence on the global financial landscape is undeniable. Understanding the Orix SWOT Analysis can provide valuable insights into its strategic positioning.

This exploration into the Orix Company delves into its multifaceted approach to value creation, spanning leasing, lending, and asset management. By examining Orix's business model and its commitment to diversification, we can better understand its sustained growth and profitability. Furthermore, we will look into Orix's operations, revenue generation strategies, and strategic trajectory to provide a comprehensive overview of this financial conglomerate. Key aspects of Orix services and its historical performance will also be discussed.

What Are the Key Operations Driving Orix’s Success?

The Orix Company operates as a diversified financial services and real asset investment firm, offering a wide array of services globally. Its core business revolves around leasing, lending, insurance, asset management, and investment banking, alongside substantial ventures in real estate, renewable energy, and private equity. The company's operational structure is designed to integrate financial expertise with asset management across various sectors, providing comprehensive solutions to a diverse client base.

The value proposition of the Orix business model lies in its ability to create and deliver value through a diverse portfolio. Orix focuses on providing tailored financial solutions, operational expertise, and cultivating long-term partnerships. This approach differentiates Orix from more narrowly focused financial institutions, offering clients a unique blend of financial services and operational involvement.

Orix's operational effectiveness is enhanced by its capability to identify and capitalize on market trends. For example, in renewable energy, Orix is involved in financing, investing in, and operating solar, wind, and geothermal power plants. The company's supply chain and distribution networks are diverse, ensuring broad market reach and tailored solutions for different client needs. This multi-channel approach ensures broad market reach and tailored solutions for different client needs.

Orix provides a wide range of services including leasing, lending, insurance, and asset management. It also engages in investment banking, real estate development and management, and renewable energy projects. These services are offered globally, catering to both individual and corporate clients.

Orix integrates its financial expertise with deep industry knowledge to capitalize on market trends. The company's approach involves a multi-channel strategy, including direct sales, partnerships, and specialized subsidiaries. This enables Orix to provide customized solutions and maintain a broad market reach.

The company's 'finance + services' model offers comprehensive solutions that often involve direct operational involvement. This integrated approach translates into customer benefits such as customized financial solutions, operational expertise, and long-term partnerships. This is a key aspect of the Marketing Strategy of Orix.

Orix has a global presence, serving clients worldwide. The company's diverse portfolio and integrated approach allow it to adapt to various market conditions and client needs. This global reach is supported by its diversified operational structure.

Orix's operational model is characterized by its diversified portfolio and integrated approach, which allows it to adapt to various market conditions. The company's ability to combine financial services with operational expertise is a key differentiator.

- Diversified financial services, including leasing, lending, and investment banking.

- Significant investments in real estate, renewable energy, and private equity.

- A global presence with operations in multiple countries.

- Emphasis on long-term partnerships and customized solutions.

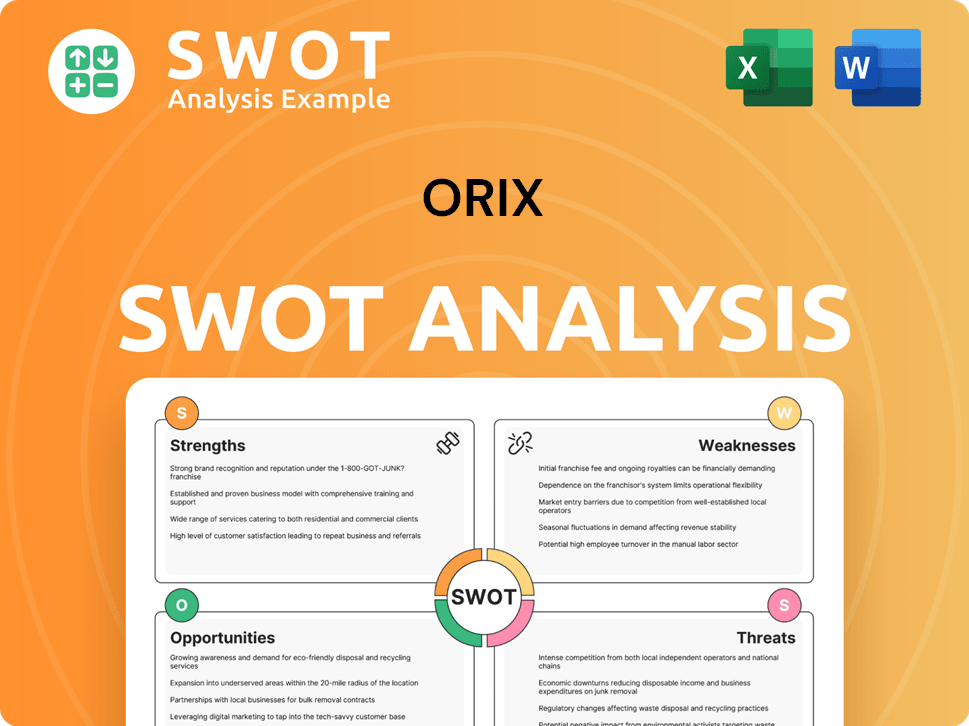

Orix SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Orix Make Money?

The Orix Company generates revenue through a multifaceted approach, reflecting its diverse Orix business model. Its primary revenue streams include income from leasing and lending activities, asset management, and real estate operations. These diverse sources contribute to the company's robust financial performance.

Orix's asset management segment earns fees from managing various funds, including private equity, real estate, and infrastructure funds. The real estate segment contributes through property sales, rental income, and management fees. Furthermore, Orix's ventures into renewable energy contribute through electricity sales from its power generation facilities. For the fiscal year ended March 31, 2024, Orix reported total revenues of JPY 2,933.2 billion (approximately USD 18.7 billion).

The company employs innovative monetization strategies, such as bundled services, and cross-selling across its various segments. Orix has strategically expanded its revenue sources, particularly emphasizing growth in non-lending businesses like asset management and renewable energy. To learn more about the company's origins, you can read a Brief History of Orix.

Orix's revenue streams are diversified, contributing to its overall financial health and stability. These streams include income from leasing and lending, asset management fees, real estate operations, and renewable energy initiatives. The company's operations span various industries, reflecting its broad market presence.

- Leasing and Lending: Interest income and lease payments from assets like aircraft, ships, and equipment.

- Asset Management: Fees from managing funds in private equity, real estate, and infrastructure.

- Real Estate: Property sales, rental income, and management fees.

- Renewable Energy: Electricity sales from power generation facilities.

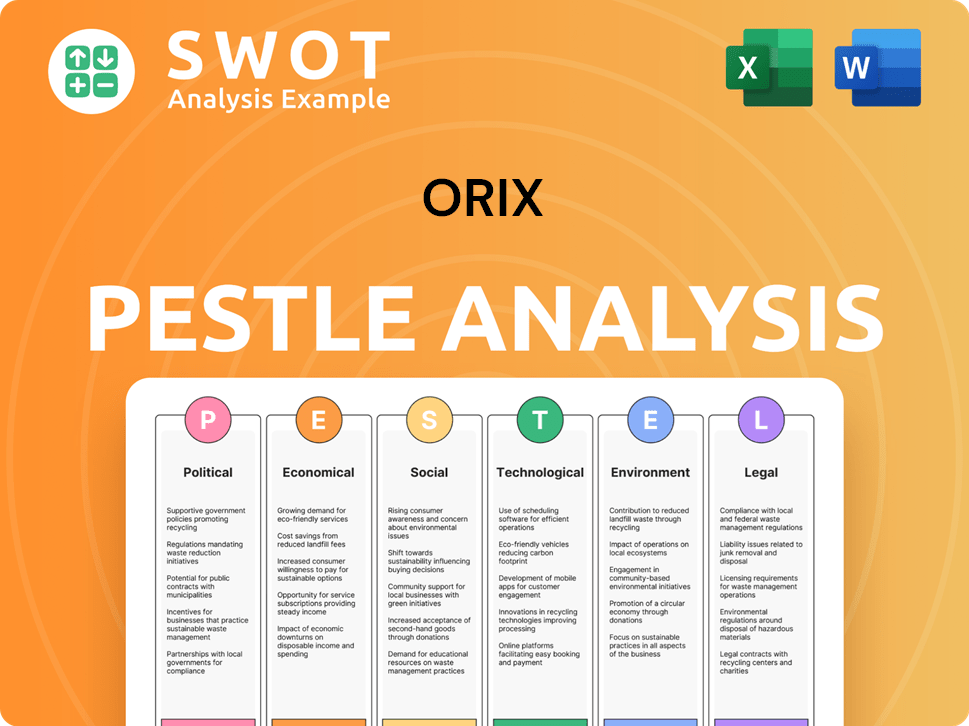

Orix PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Orix’s Business Model?

ORIX Corporation has evolved significantly since its inception, marked by strategic shifts and expansions. Initially rooted in leasing, the company has broadened its scope to encompass diverse financial services and real asset investments, showcasing a dynamic Orix business model. This evolution reflects its adaptability and strategic foresight in navigating market changes and capitalizing on emerging opportunities.

A key aspect of ORIX's strategy involves its continuous expansion into international markets, particularly in Asia and the Americas. This move has broadened its revenue base and mitigated regional economic risks. The company's proactive approach to diversification and global expansion has been crucial in maintaining its competitive edge and resilience.

ORIX's competitive advantages are multifaceted, contributing to its sustained success. Its strong brand recognition and extensive global network provide a significant edge in originating deals and attracting clients. Its deep expertise across various industries, from aviation to real estate and energy, enables it to offer specialized and integrated solutions that competitors may not match. Furthermore, its 'finance + services' model allows it to capture value at multiple points in the asset lifecycle, providing a more comprehensive and sticky relationship with clients.

ORIX's journey includes pivotal moments of growth and strategic realignment. Early success in leasing laid the foundation for expansion. Strategic acquisitions and partnerships have broadened its service offerings. International ventures have expanded its global footprint, diversifying revenue streams and reducing regional risks.

ORIX has consistently made strategic moves to adapt to changing market conditions. Diversification into financial services and real asset investments has been a core strategy. Expansion into international markets, especially in Asia and the Americas, has been crucial. Investments in renewable energy and digital transformation reflect its forward-looking approach.

ORIX's competitive edge stems from several factors. Strong brand recognition and an extensive global network facilitate deal origination. Deep industry expertise enables the provision of specialized solutions. The 'finance + services' model enhances client relationships. Adaptability to market trends, such as digitalization and sustainability, is also key.

ORIX's operations are structured to capitalize on diverse opportunities. The company's structure allows for flexibility and responsiveness to market changes. It leverages its global presence to serve clients worldwide. The "finance + services" model integrates financial products with value-added services. ORIX's adaptability has been key to its sustained success.

ORIX's financial performance reflects its strategic initiatives and market positioning. The company's diversified business model has allowed it to navigate economic cycles effectively. In recent years, ORIX has focused on expanding its asset management business and investing in sustainable projects. The company's future outlook remains positive, with continued growth expected in key sectors.

- Orix financial performance is influenced by global economic trends and strategic investments.

- The company's focus on sustainable investments and digital transformation is expected to drive future growth.

- ORIX's adaptability and diversified portfolio position it well for long-term success.

- The company's global presence and strong brand recognition provide a competitive advantage.

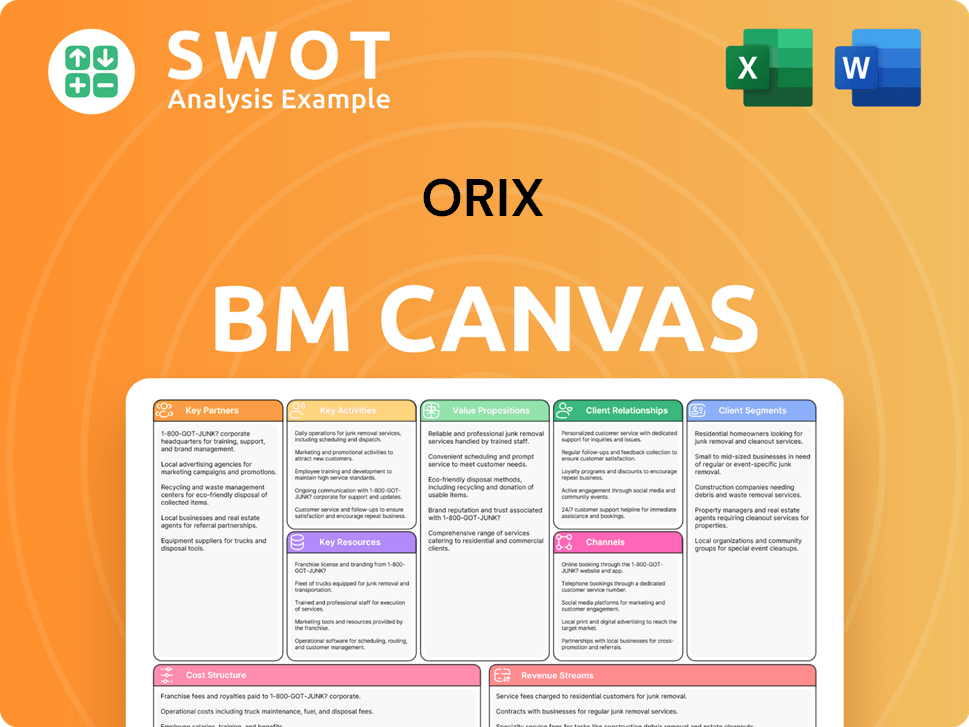

Orix Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Orix Positioning Itself for Continued Success?

The ORIX Corporation holds a significant position in the global financial services industry, differentiating itself through a diverse portfolio that encompasses financial services, real estate, and renewable energy. Its global presence spans over 30 countries and regions, underscoring its international reach and diverse customer base. While direct market share comparisons are complex due to its varied segments, ORIX is a leader in niche markets, particularly in corporate finance and aircraft leasing. Understanding the Target Market of Orix is key to understanding its strategic positioning.

ORIX's business model is subject to risks such as regulatory changes, economic downturns, and competition from fintech firms and specialized renewable energy players. The company must also manage technological disruption, which requires continuous investment to maintain its competitive edge. Despite these challenges, ORIX continues to focus on strategic initiatives, including investment in growth areas like renewable energy and infrastructure, leveraging its asset management expertise, and exploring digital solutions to enhance service offerings and operational efficiencies.

ORIX operates in multiple sectors, including financial services, real estate, and renewable energy. It is a leader in corporate finance, aircraft leasing, and certain real estate sectors. The company has a strong global presence, operating in over 30 countries and regions, indicating its international reach.

ORIX faces risks from regulatory changes in financial services and energy. Economic downturns pose a risk to its lending and investment portfolios. Competition from fintech companies and specialized players in renewable energy is also a concern. Technological disruption necessitates continuous investment.

ORIX is focused on strategic initiatives to sustain and expand revenue generation. This includes investment in renewable energy and infrastructure. The company is exploring new digital solutions to enhance service offerings. Leadership emphasizes diversification and global expansion to capitalize on market trends.

ORIX operations are diversified across financial services, real estate, and renewable energy. The company's operations are spread over 30 countries and regions. ORIX leverages its expertise in asset management and explores digital solutions for operational efficiency.

ORIX is focused on expanding its renewable energy and infrastructure businesses. It is leveraging its expertise in asset management to enhance its service offerings. The company is exploring new digital solutions to improve operational efficiencies and customer service.

- Investment in growth areas like renewable energy and infrastructure.

- Leveraging asset management expertise.

- Exploring new digital solutions.

- Further diversification and global expansion.

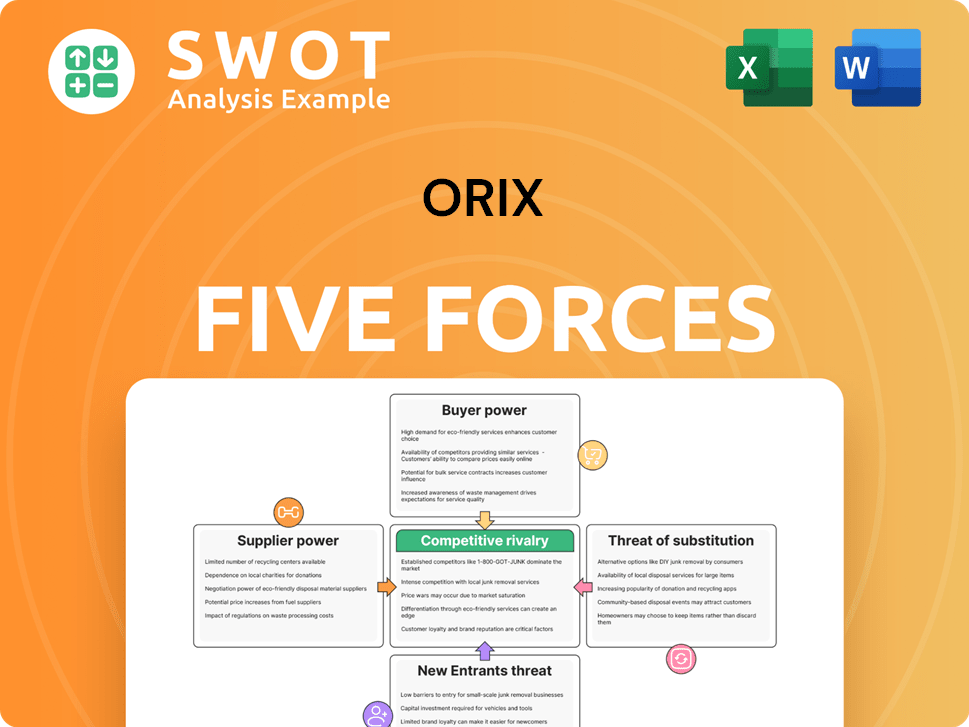

Orix Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Orix Company?

- What is Competitive Landscape of Orix Company?

- What is Growth Strategy and Future Prospects of Orix Company?

- What is Sales and Marketing Strategy of Orix Company?

- What is Brief History of Orix Company?

- Who Owns Orix Company?

- What is Customer Demographics and Target Market of Orix Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.