Orix Bundle

Who Really Owns ORIX Corporation?

Understanding the Orix SWOT Analysis is crucial, but have you ever wondered about the power structure behind this global financial giant? The ownership of Orix Company, a diversified financial services group, is a key factor in its strategic decisions and market influence. From its humble beginnings in Japan to its current global presence, the evolution of ORIX's ownership tells a fascinating story.

This deep dive into Orix Company Ownership will uncover the intricate details of Who owns Orix, examining the roles of institutional investors, public shareholders, and the historical shifts that have shaped the company's destiny. We'll explore the Orix Corporation ownership structure, including key stakeholders and how their influence impacts the company's direction. Discover the answers to questions like "Who are the main shareholders of Orix" and "How has Orix ownership changed over time" to gain a comprehensive understanding of this financial powerhouse. The Orix Group and its subsidiaries are also explored, answering questions such as "Is Orix a public company" and "Who controls Orix financial decisions."

Who Founded Orix?

The story of ORIX Corporation, formerly Orient Leasing Co., Ltd., begins on April 17, 1964. The company was established with a starting capital of 100 million yen. This marked the genesis of a significant player in the Japanese financial landscape.

The initial ownership of ORIX was a collaborative effort. Several key Japanese financial institutions and trading houses came together to launch the company. This collaborative approach set the stage for ORIX's early growth and development.

Key founders included Nichimen Corporation (now Sojitz Corporation) and Sanwa Bank (now MUFG Bank). They were joined by Nissho Corporation and Iwai Sangyo Company (now Sojitz Corporation), Toyo Trust Bank (now MUFG Bank), Japan Kangyo Bank (now Mizuho Bank), Kobe Bank (now Mitsui Sumitomo Bank), and the Industrial Bank of Japan (now Mizuho Bank).

The founding of ORIX involved a consortium of financial and trading entities.

This distributed ownership model was crucial in the early days.

The founders aimed to introduce a new financing method in Japan.

Their vision helped establish a strong foundation for the company.

Yoshihiko Miyauchi played a key role in expanding the leasing business.

His experience helped the company become a global player.

ORIX started with a capital of 100 million yen.

This initial investment was critical for launching the company.

Early agreements and specific founder exits are not extensively detailed.

The focus was on establishing a new financing method.

Distributed control among the founding institutions was instrumental.

This helped build the company's corporate foundation.

The initial ownership structure of ORIX Corporation, and the subsequent Target Market of Orix, showcases a strategic blend of financial and trading entities. This collaborative approach was instrumental in establishing the company and driving its early growth. The distributed ownership model among the founding institutions facilitated the building of a strong corporate foundation during a period of significant economic expansion in Japan. While specific equity splits are not publicly available, the collective involvement of these entities highlights a shared vision for pioneering the leasing business. Understanding the history of ORIX and its initial shareholders provides valuable context for analyzing the company's evolution and current ownership structure.

ORIX Corporation's initial ownership structure was a collaborative effort involving multiple Japanese financial institutions and trading houses.

- The primary founders included Nichimen Corporation and Sanwa Bank.

- Additional participants were Nissho Corporation, Iwai Sangyo Company, Toyo Trust Bank, Japan Kangyo Bank, Kobe Bank, and the Industrial Bank of Japan.

- This distributed ownership model was key to the company's early success.

- Yoshihiko Miyauchi, a key figure, helped expand the leasing business.

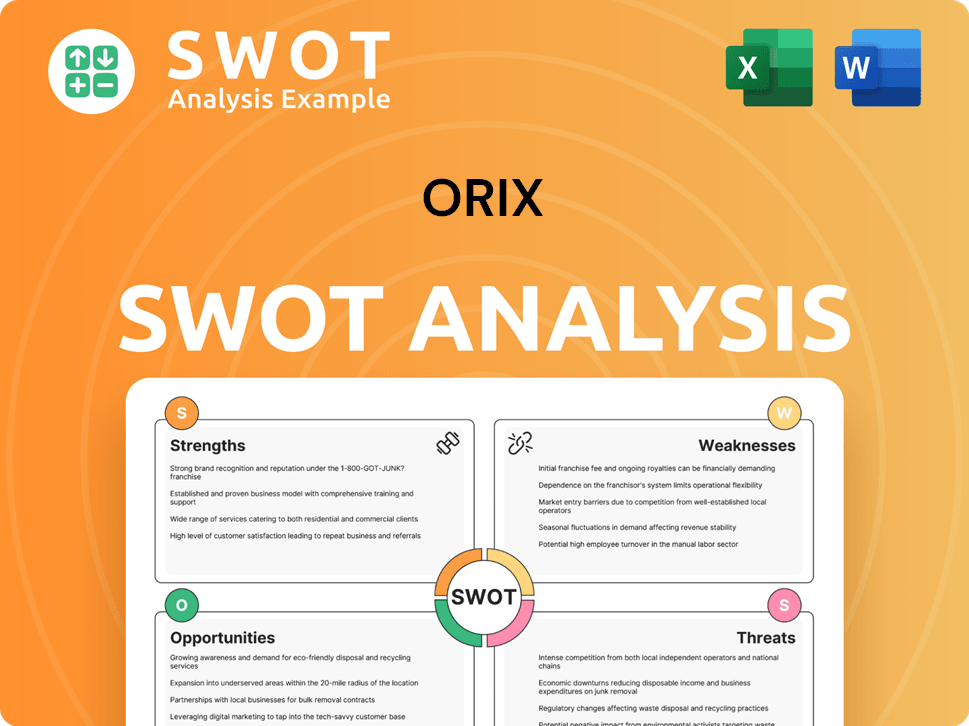

Orix SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Orix’s Ownership Changed Over Time?

The ownership structure of Orix Corporation has evolved significantly since its inception. Initially a private entity, it transitioned to a publicly traded company. This shift began with listings on the Osaka Securities Exchange in 1970 and the Tokyo Stock Exchange in 1971, followed by the first section in 1973. The company further expanded its reach by listing on the New York Stock Exchange in 1998. This move exposed it to a broader investor base and more stringent regulatory oversight, shaping its current ownership landscape.

As of June 13, 2025, the market capitalization of ORIX Corporation is approximately $24.40 billion. This valuation reflects the company's standing in the financial market and its appeal to investors. The evolution from a privately held firm to a publicly traded entity has been a key factor in its growth and expansion, allowing it to attract capital and broaden its operational scope. This transformation has also led to a more diverse shareholder base, primarily composed of institutional investors.

| Key Dates | Event | Impact on Ownership |

|---|---|---|

| 1970-1973 | Initial Public Offerings (IPOs) on Japanese Exchanges | Transition from private to public ownership; increased shareholder base. |

| 1998 | Listing on the New York Stock Exchange (NYSE) | Expanded global investor base; subjected to stricter regulations. |

| Ongoing | Institutional Investor Dominance | Significant influence on corporate decisions and strategic direction. |

The current ownership of ORIX Corporation is largely dominated by institutional investors. As of April 23, 2025, institutional investors collectively held over 50% of the company's shares, highlighting their considerable influence on corporate governance and strategic decisions. BlackRock, Inc. is the largest shareholder, holding 7.6% of the outstanding shares. Other major stakeholders include Sumitomo Mitsui Trust Asset Management Co., Ltd. with 6.6% and Nomura Asset Management Co., Ltd. with 4.7%. Nikko Asset Management Co., Ltd. also holds a notable stake of 2.53% (29,425,600 shares). The widespread ownership structure, with the top 25 shareholders controlling less than half of the company's shares, suggests no single entity has dominant control. This distribution, heavily influenced by institutional investors, has likely steered ORIX towards a diversified, global approach, evident in its expansion across various financial services and investments worldwide. The evolution of the Orix Company Ownership structure reflects its growth and adaptation in the financial sector.

Orix Corporation's ownership has evolved from a privately held entity to a publicly traded company, with a significant presence on global stock exchanges.

- Institutional investors are the primary stakeholders, holding over 50% of the shares.

- BlackRock, Inc. is the largest shareholder, with a 7.6% stake.

- The widespread ownership structure influences ORIX's global, diversified strategy.

- The company's market capitalization is approximately $24.40 billion as of June 13, 2025.

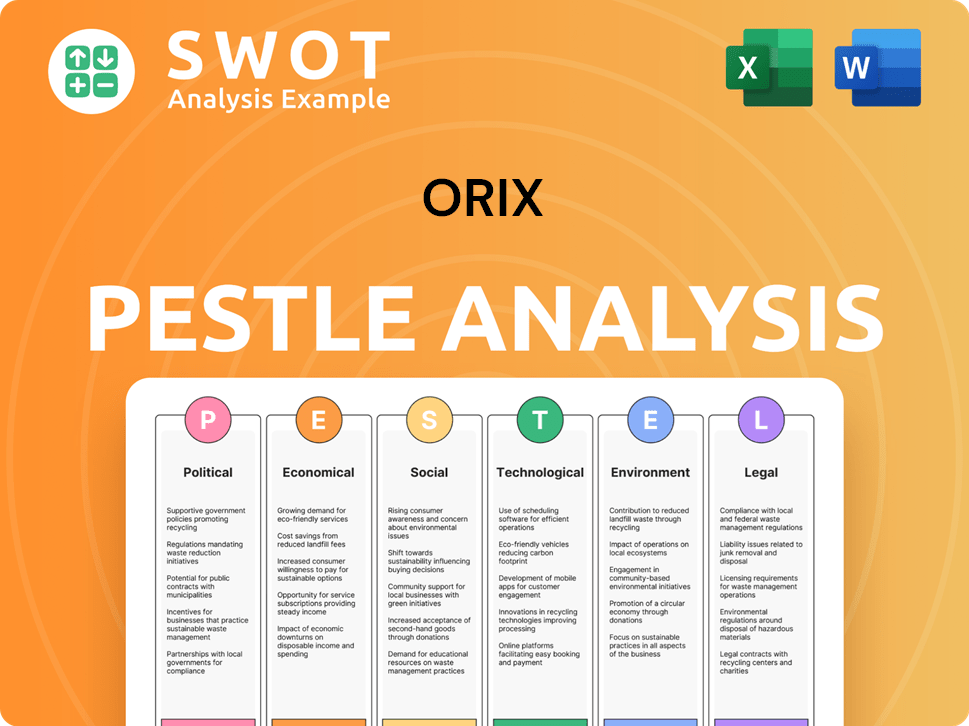

Orix PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Orix’s Board?

The current leadership of ORIX Corporation is vested in its Board of Directors, which is responsible for overseeing the company's strategic direction and ensuring the interests of its shareholders are represented. As of June 25, 2024, the board consists of eleven directors. The re-elected members include Makoto Inoue, Satoru Matsuzaki, Stan Koyanagi, Yasuaki Mikami, Michael Cusumano, Hiroshi Watanabe, Chikatomo Hodo, Noriyuki Yanagawa, Sakie Akiyama, and Aiko Sekine. Hidetake Takahashi joined the board as a newly appointed director.

The composition of the board reflects a blend of experience and expertise, which is crucial for navigating the complexities of the ORIX Group's diverse business operations. The board's role extends to making key decisions related to the company's financial strategies and overall governance. The strong approval rates for board candidates, ranging from 97.29% to 99.42% in June 2024, suggest a high degree of shareholder alignment with the board's nominations.

| Director | Title | Appointment Date |

|---|---|---|

| Makoto Inoue | Director, Chairman of the Board, Representative Executive Officer, President and CEO | June 2021 |

| Satoru Matsuzaki | Director, Representative Executive Officer, Deputy President | June 2018 |

| Stan Koyanagi | Director, Executive Officer | June 2016 |

| Yasuaki Mikami | Director, Executive Officer | June 2019 |

| Michael Cusumano | Director, Executive Officer | June 2020 |

| Hiroshi Watanabe | Director, Executive Officer | June 2021 |

| Chikatomo Hodo | Director, Executive Officer | June 2022 |

| Noriyuki Yanagawa | Director, Executive Officer | June 2022 |

| Sakie Akiyama | Director | June 2023 |

| Aiko Sekine | Director | June 2023 |

| Hidetake Takahashi | Director | June 2024 |

The voting structure at ORIX Corporation generally follows a one-share-one-vote principle. Resolutions at shareholder meetings are typically approved by a majority vote of the shares represented, provided a quorum is met. For special resolutions, such as amendments to the Articles of Incorporation, a higher threshold of two-thirds or more of the votes is required, with a quorum of more than one-third of the total voting rights. Institutional investors hold a significant portion of ORIX shares, accounting for over 50% as of April 23, 2025. This ownership structure underscores the importance of understanding the dynamics of Orix Company Ownership and the influence of various shareholder groups. For more insights into the company's operations, you can explore the Revenue Streams & Business Model of Orix.

Understanding Orix Corporation's ownership structure is key to assessing its governance and strategic direction.

- The board of directors is responsible for overseeing the company's operations.

- Institutional investors hold a significant portion of the shares.

- Voting typically follows a one-share-one-vote principle.

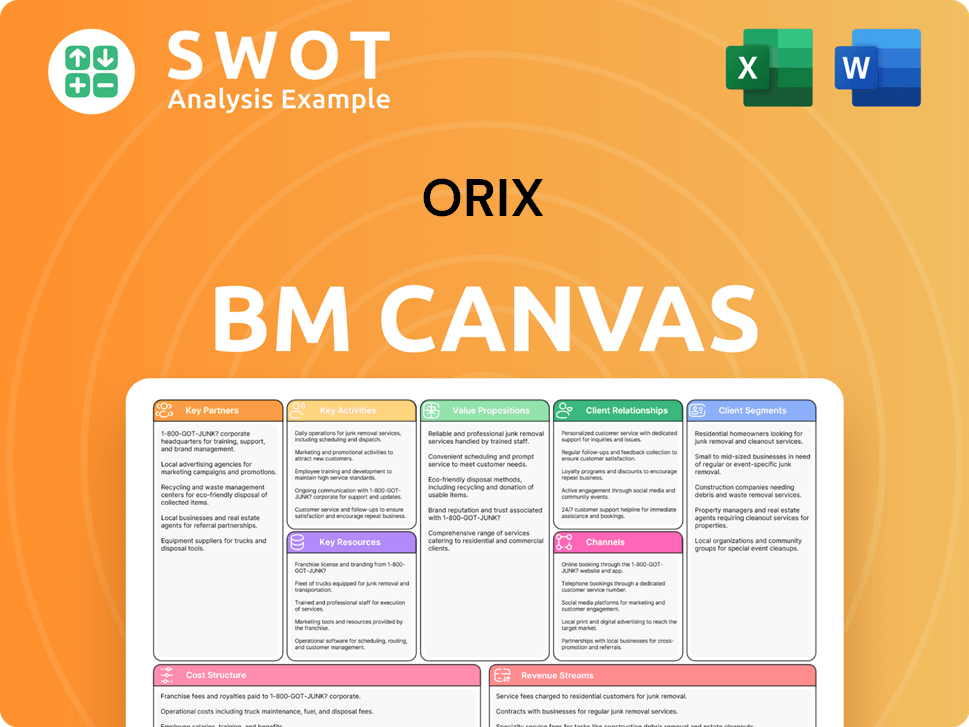

Orix Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Orix’s Ownership Landscape?

Over the past few years, Orix Corporation has actively managed its ownership profile through strategic financial actions and adapting to broader industry trends. A key strategy has been the ongoing share repurchase program designed to boost shareholder value. As of December 10, 2024, ORIX had repurchased a cumulative total of 14,649,500 shares for approximately JPY 49.99 billion, under a program authorized on May 8, 2024, with a maximum target of 40 million shares or JPY 50 billion by March 31, 2025. The company continues to show commitment to returning value to shareholders.

In May 2025, a new share repurchase program was authorized, allowing for the repurchase of up to 40 million shares (approximately 3.5% of outstanding shares) with a total purchase price capped at 100 billion yen, extending until March 31, 2026. As of May 31, 2025, 3,001,300 common shares had been repurchased for approximately JPY 8.98 billion under this new program. This indicates a proactive approach to managing capital and enhancing shareholder returns. ORIX's strategic investments, such as the intended acquisition of a majority stake in Hilco Global, also reflect its commitment to growth and diversification.

Industry trends, like increased institutional ownership, are evident in ORIX's profile, with institutional investors holding over 50% of the company. The company anticipates an expected dividend payout ratio of 39% for the fiscal year ending March 31, 2025, translating to an estimated dividend distribution of JPY 133.2 per share. ORIX's long-term vision aims for a Return on Equity (ROE) of 11% by FY28.3 and 15% by FY35.3, reflecting confidence in sustained growth and portfolio optimization. The company's strategy focuses on adapting to market dynamics and delivering value to shareholders.

ORIX has implemented share repurchase programs to enhance shareholder value. The company repurchased shares for approximately JPY 49.99 billion by December 10, 2024. A new program was authorized in May 2025, with a total purchase price capped at 100 billion yen.

ORIX continues to pursue strategic investments to expand its global footprint and diversify its business segments. ORIX Corporation USA (OCU) intends to acquire a majority stake in Hilco Global. These investments are key for future growth.

Institutional investors hold over 50% of ORIX. The company is committed to returning value to shareholders through dividends. ORIX aims for an ROE of 11% by FY28.3 and 15% by FY35.3.

The expected dividend payout ratio is 39% for the fiscal year ending March 31, 2025. This translates to an estimated dividend distribution of JPY 133.2 per share. ORIX demonstrates a strong commitment to financial performance.

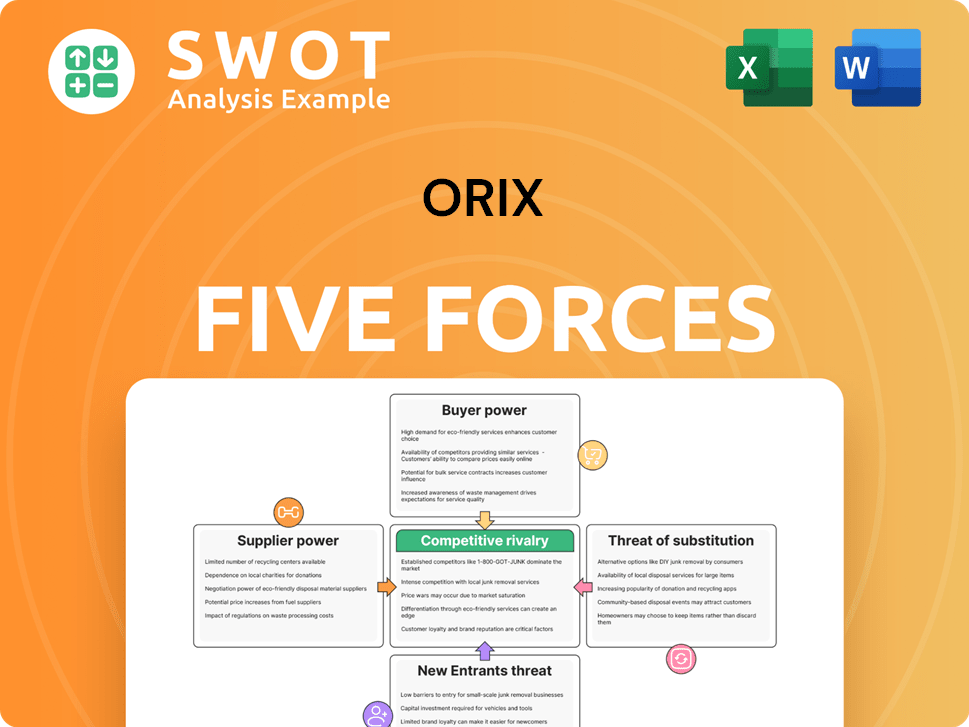

Orix Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Orix Company?

- What is Competitive Landscape of Orix Company?

- What is Growth Strategy and Future Prospects of Orix Company?

- How Does Orix Company Work?

- What is Sales and Marketing Strategy of Orix Company?

- What is Brief History of Orix Company?

- What is Customer Demographics and Target Market of Orix Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.