Orix Bundle

Who Does ORIX Corporation Serve?

Delving into the Orix SWOT Analysis reveals the importance of understanding its customer base. Grasping the intricacies of customer demographics and the Orix target market is vital for any financial institution. This exploration unveils the strategic approach ORIX Corporation employs to cater to a diverse clientele across various financial sectors.

Understanding the Orix customer profile is essential to understand its success. This analysis will dissect ORIX's market segmentation, revealing how the company identifies and caters to its target audience. We will also examine the demographic data for Orix clients, including customer age range, income levels, and geographical location, to understand Orix's customer behavior patterns and acquisition strategies in a competitive landscape.

Who Are Orix’s Main Customers?

Understanding the customer demographics and Orix target market is crucial for analyzing the company's strategic positioning. ORIX Corporation operates in both Business-to-Consumer (B2C) and Business-to-Business (B2B) segments, serving a diverse client base globally. This dual approach allows ORIX to cater to a wide range of financial needs, from corporate services to individual consumer products.

The Orix customer profile encompasses various entities, including small and medium-sized enterprises (SMEs) seeking corporate financial services and maintenance leasing. Larger corporations also form a significant part of ORIX's clientele, especially those requiring financing for large-ticket items like ships, airplanes, and technology equipment. This diversified customer base reflects ORIX's adaptability and broad market reach.

In the B2B sector, ORIX serves companies across multiple industries. ORIX Capital Partners, for instance, focuses on private equity investments in North American middle-market companies with EBITDA between $10 million and $75 million, targeting investments ranging from $75 million to $250 million. The company also anticipates growth in the automotive leasing market in India, which is projected to increase to 7-8% in the next 5-7 years.

The B2B segment includes SMEs seeking corporate financial services and maintenance leasing. Larger corporations needing financing for significant assets like ships and aircraft are also key customers. ORIX Capital Partners targets North American middle-market companies in sectors like automation solutions and environmental services.

B2C customers include individuals served through services like life insurance and banking. ORIX Life Insurance and ORIX Bank cater to individual financial needs. The company's expansion into B2C services reflects its strategy to diversify its revenue streams.

ORIX operates globally, with a significant presence in North America, India, and Japan. The company's investments and services are tailored to meet the specific needs of each regional market. ORIX's strategic focus includes expanding its automotive leasing market in India.

ORIX serves diverse industries, including financial services, real estate, and investment. The company's focus on sectors like automation solutions and environmental services highlights its adaptability. Financial Services contributed 32.6% of total revenue in fiscal year 2023.

Analyzing the target audience analysis for ORIX reveals a strategic focus on both B2B and B2C segments. ORIX leverages its expertise in financial services to cater to diverse customer needs. The company's ability to adapt to changing market demands and create new value is a key driver of its success.

- Market segmentation Orix demonstrates a broad reach across various industries and customer types.

- ORIX's strategic shifts are influenced by market demands and a continuous effort to create new value.

- The automotive leasing market in India is expected to grow to 7-8% in the next 5-7 years.

- Financial Services, Maintenance Leasing, Real Estate, and Investment contribute to ORIX's total revenue.

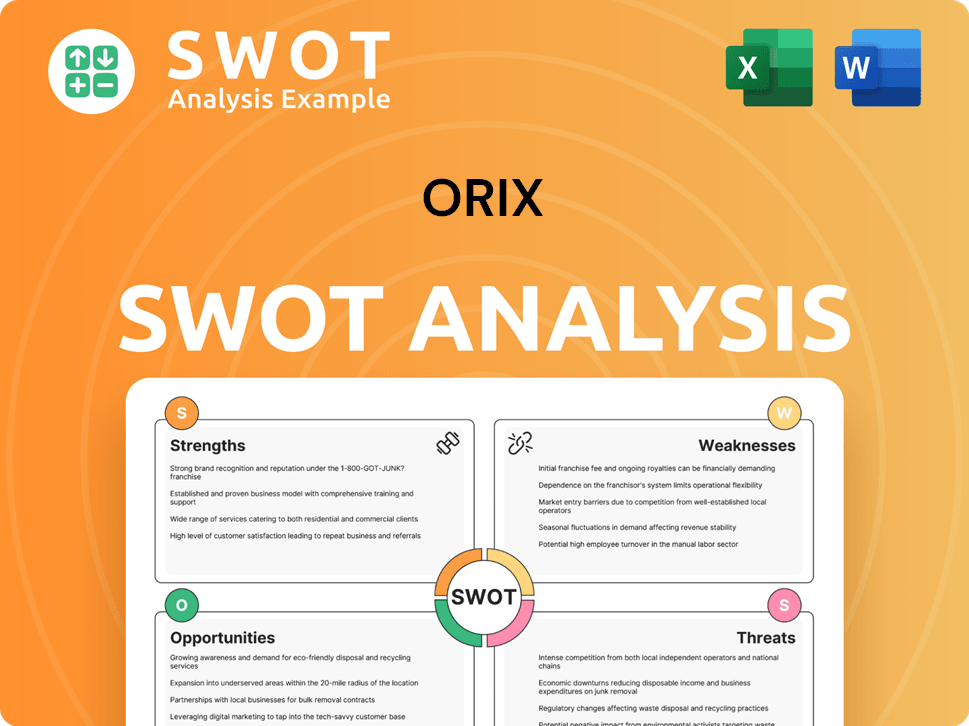

Orix SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Orix’s Customers Want?

Understanding the customer needs and preferences is crucial for the success of any business. For the company, this involves a deep dive into the diverse needs of its clientele across various financial and operational services. The company's ability to adapt and innovate based on these insights drives customer loyalty and market share.

The company's customer base is broad, encompassing businesses and individuals with varied financial requirements. These customers seek tailored financial solutions, access to capital, and dependable services. Meeting these diverse needs requires a customer-centric approach, focusing on flexibility, reliability, and ease of use.

The company's approach to its target market involves understanding the specific needs of different customer segments. This includes providing flexible leasing options for businesses, fast and reliable lending services, and secure, easy-to-understand financial products for individuals. The company's commitment to innovation and customer satisfaction is key to its long-term success.

Businesses often require leasing solutions for equipment and machinery to manage capital expenditure efficiently. The company provides these services, addressing a key need for small and medium-sized enterprises. This approach allows businesses to acquire necessary assets without large upfront investments.

In the lending and corporate finance segments, customers need quick access to capital for business liquidity, expansion, and specific projects. The company focuses on providing fast and reliable service. This includes quick credit approval turnaround times and robust after-sales support.

Individual customers, particularly those using life insurance and banking services, prioritize security and reliability. The company's customer-oriented business operation policies ensure high-quality services. This approach builds trust and meets customer expectations.

The company's ability to adapt to changing market dynamics and offer innovative solutions is a significant factor in customer loyalty. This is evident in its strategic investments in high-growth sectors like renewable energy. These investments cater to businesses seeking sustainable practices.

The company is committed to understanding customer needs and continuously enhancing its professional expertise. This customer-centric approach is essential for building and maintaining strong customer relationships. The company's focus on understanding customer needs and enhancing its expertise is key.

The company's success relies on understanding the specific needs of each customer segment. This involves providing tailored financial solutions and ensuring ease of use across all services. This includes providing easy-to-understand information and developing products that meet customer expectations.

The company's target market is diverse, and understanding its customer demographics is crucial. The company's customer profile includes businesses of various sizes and individuals seeking financial services. Key aspects of this analysis include identifying the customer age range, income levels, and geographical locations. For example, the company's leasing services target businesses needing equipment financing, while its financial products cater to a broader audience. Understanding these factors helps the company tailor its services effectively. The company's customer acquisition strategies are also critical, with a focus on building long-term relationships. To learn more about the company's strategic approach, you can read about the Growth Strategy of Orix.

The company's customer base is driven by several core needs and preferences. These include the need for flexible and tailored financial solutions, timely access to capital, and secure, reliable services. The company's ability to meet these needs directly impacts customer satisfaction and loyalty.

- Flexible Financial Solutions: Businesses require leasing options for equipment and machinery.

- Timely Access to Capital: Customers in lending segments need quick access to funds.

- Security and Reliability: Individuals prioritize secure and dependable services.

- Ease of Use: Customers prefer easy-to-understand products and services.

- Innovation: Customers value the company's ability to adapt and offer new solutions.

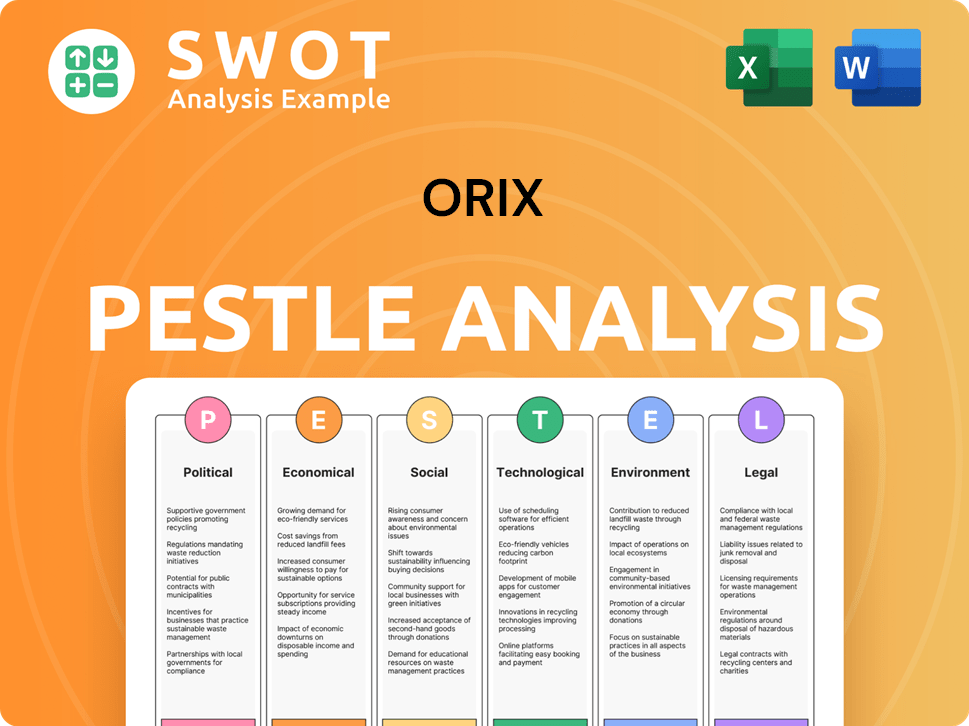

Orix PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Orix operate?

ORIX Corporation maintains a substantial global presence, operating in approximately 30 countries and regions worldwide. This extensive geographical reach is supported by a workforce of around 34,000 employees. Its international operations significantly contribute to its financial performance, with overseas business profit reaching ¥194.8 billion in fiscal year 2024.

The company's major markets include Japan, where it originated, alongside key regions in Asia (excluding Japan), North America, and Europe. As of March 31, 2024, ORIX had a presence in 28 countries and regions, demonstrating its commitment to global expansion. Understanding the Revenue Streams & Business Model of Orix is crucial to grasping its market strategies.

In fiscal year 2023, revenue distribution showed Japan contributing 62.4%, Asia (excluding Japan) 22.7%, North America 10.3%, and Europe 4.6%. This distribution highlights the importance of diversification across different geographical segments for ORIX's revenue generation. ORIX's strategic moves, such as the renaming of the Global Business Group to the Asia and Australia Business Group effective January 1, 2025, reflect its focus on these regions.

ORIX USA, established in 1981, operates in North America as a diversified investment and asset management firm. It specializes in private credit, real estate, and private equity solutions. ORIX Capital Partners, a subsidiary of ORIX Corporation USA, is based in New York City and focuses on investments in North American middle-market companies. This demonstrates ORIX's commitment to the North American market.

ORIX has identified significant financial service potential in emerging markets, particularly in the Asia Pacific region. The projected annual market growth is around 7.5%. India's financial services market, estimated at $1.8 trillion by 2025, is considered strategically important. ORIX sees strong growth opportunities in consumer car leasing in India.

ORIX localizes its offerings and marketing strategies to succeed in diverse markets. This includes localized management to enable proactive business development aligned with local needs. This approach is essential for effectively targeting the Orix target market and ensuring customer satisfaction.

ORIX continues to make strategic investments and divestitures globally to optimize its portfolio. An example of this is the investment in AM Green in April 2025. These strategic moves help ORIX adapt to changing market conditions and capitalize on new opportunities.

The renaming of the Global Business Group to the Asia and Australia Business Group reflects a strategic focus on these regions. This change, effective from January 1, 2025, indicates a shift in strategy towards these high-growth markets. This is part of ORIX's broader strategy to identify Orix's customer profile.

India's financial services market is an important area for ORIX, with an estimated value of $1.8 trillion by 2025. ORIX sees this as a strategically important market due to low penetration and strong growth opportunities, especially in consumer car leasing. This helps in analyzing the Orix customer age range.

ORIX's market segmentation strategy involves targeting different geographical regions with tailored financial products and services. This approach allows ORIX to better meet the specific needs of its diverse customer base and enhance its market share analysis. This is a key aspect of Orix's customer acquisition strategies.

The company's competitive landscape target markets include various financial service providers across different regions. ORIX's ability to adapt and offer localized services helps it compete effectively in these diverse markets. Understanding the competitive landscape is crucial for Orix's ideal customer profile.

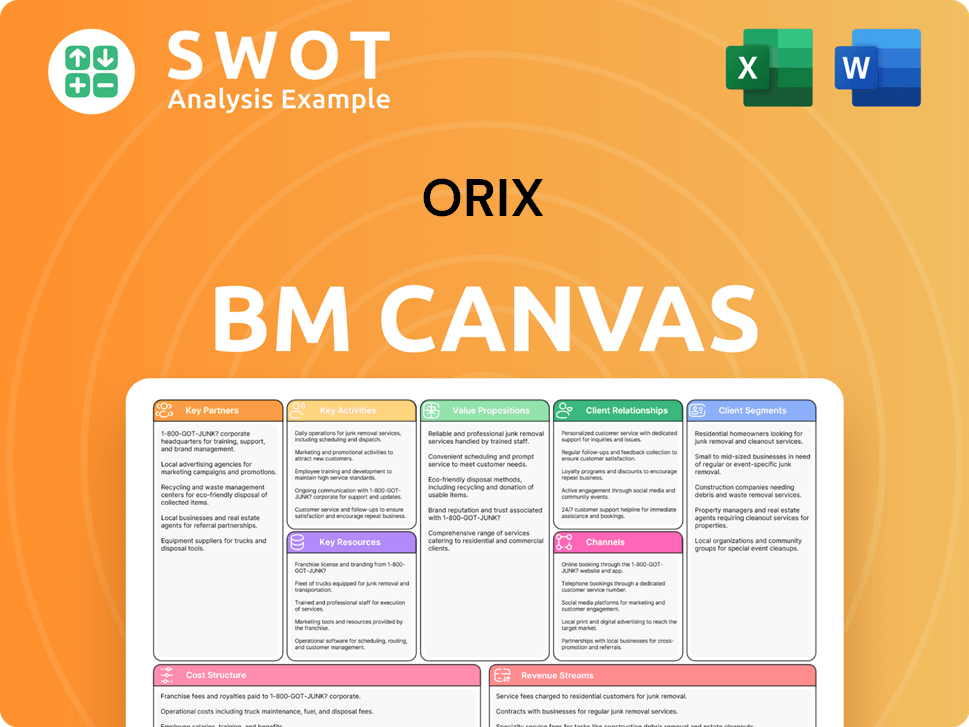

Orix Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Orix Win & Keep Customers?

ORIX Corporation employs a comprehensive approach to customer acquisition and retention, crucial for its success in the financial services sector. Their strategies are designed to understand and meet the diverse needs of their clients, fostering long-term relationships. This customer-centric approach is evident in the tailored financial solutions they offer, aiming to support their clients' business growth.

For Orix customer profile, the company utilizes various channels to attract new clients. The Corporate Financial Services division relies on its extensive sales network to reach potential customers, including manufacturing, service, and real estate companies. Digital marketing and strategic partnerships are also key components, with a focus on both corporate and individual client segments. The company's commitment to customer satisfaction is further demonstrated through its efforts to continuously improve services.

Customer retention at ORIX is built on consistent, high-quality service and the cultivation of enduring relationships. This is supported by a focus on offering flexible financial solutions and adapting to market changes, which enhances customer confidence. The company's strategic focus on capital recycling and asset monetization also contributes to its financial strength and ability to adapt to changing market conditions, which indirectly supports customer confidence and retention. To learn more about the company's origins, you can read a Brief History of Orix.

ORIX uses multiple channels for customer acquisition. These include a strong sales network for Corporate Financial Services and targeted digital marketing campaigns across various platforms.

In 2023, ORIX invested $18.7 million in digital advertising. This generated a social media engagement rate of 4.3% and reached 250,000 professional connections on LinkedIn.

ORIX actively forms strategic alliances to expand its network. In 2023, the company established 7 new partnerships with global financial institutions, enhancing its market reach.

ORIX focuses on providing consistent, high-quality service and building long-term relationships. This includes offering flexible financial solutions and adapting to market changes.

ORIX's customer acquisition and retention strategies are supported by several key initiatives.

- Customer-Oriented Business Operation Policies implemented by ORIX Life Insurance and ORIX Bank.

- Focus on analyzing and addressing customer feedback to improve services.

- Capital recycling strategy, realizing ¥5,200 billion and investing ¥6,200 billion in key projects in 2024.

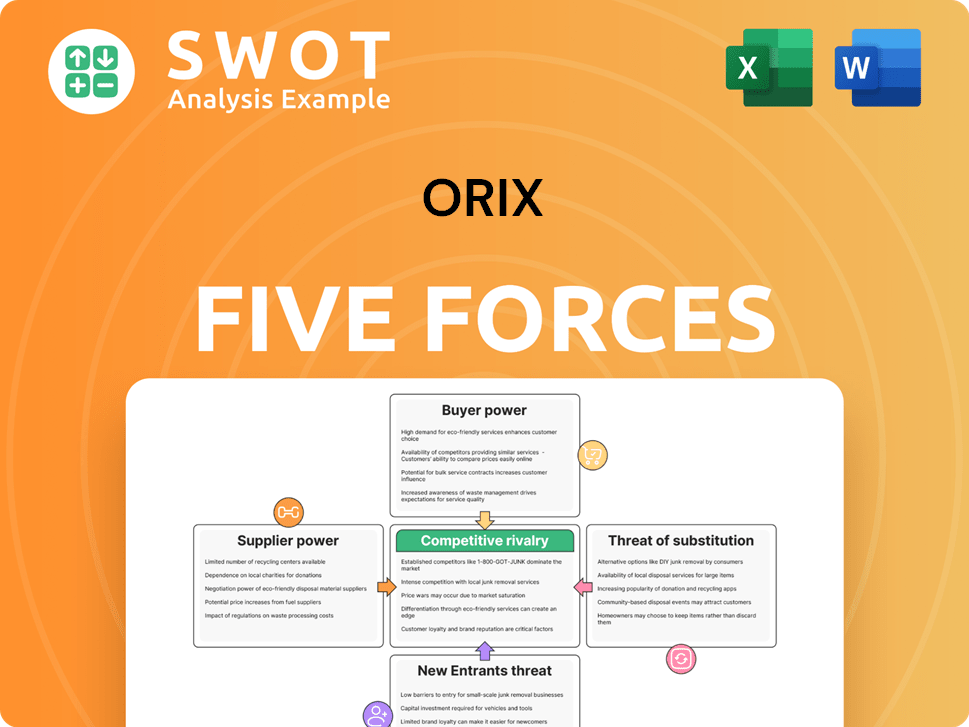

Orix Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Orix Company?

- What is Competitive Landscape of Orix Company?

- What is Growth Strategy and Future Prospects of Orix Company?

- How Does Orix Company Work?

- What is Sales and Marketing Strategy of Orix Company?

- What is Brief History of Orix Company?

- Who Owns Orix Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.