Orix Bundle

How Does ORIX Navigate the Global Financial Battlefield?

ORIX Corporation, a financial services giant, has carved a significant niche in the global market since its inception in 1964. From its roots in innovative leasing to its current diversified portfolio, ORIX has continuously evolved. Understanding the Orix SWOT Analysis is key to grasping its strategic moves.

This exploration of the Orix competitive landscape will dissect its strategic positioning, examining its key competitors and the factors that drive its success. We'll analyze Orix's business strategy, market share, and how it navigates the complexities of the Orix industry. The goal is to provide a comprehensive Orix analysis, offering insights into its competitive advantages and challenges in today’s dynamic financial environment.

Where Does Orix’ Stand in the Current Market?

ORIX Corporation holds a strong and diverse market position, operating across various business segments and global markets. The company is recognized as a leader in several niches within its diversified portfolio, particularly in Japan, where it holds a significant position in corporate finance, especially in leasing and lending to small and medium-sized enterprises (SMEs). Globally, its asset management arm, ORIX Corporation USA, manages substantial assets, positioning it among key players in the alternative investments space. The real estate segment, including property development and management, also significantly contributes to its market standing, particularly in Asia.

The company's primary product lines and services include corporate financial services (leasing, lending), maintenance leasing, real estate (development, investment, operations), private equity, venture capital, and renewable energy. ORIX's extensive geographic presence spans the Americas, Asia, Europe, and Oceania. This global reach allows it to serve a wide range of customer segments, from individual investors and small businesses to large corporations and institutional clients. Over time, ORIX has strategically shifted its positioning, increasing its focus on principal investments and asset management, moving beyond traditional financing to capitalize on growth opportunities in alternative assets and sustainable energy.

Financially, ORIX demonstrates robust health compared to industry averages. As of March 31, 2024, ORIX reported a strong financial performance, underscoring its scale and stability within the financial services industry. The company's diversified revenue streams and prudent risk management contribute to its resilience. While ORIX holds a particularly strong position in Japan and parts of Asia across its various business lines, its expansion into the Americas and Europe continues to strengthen its global footprint, albeit facing more established competition in certain mature markets. For a deeper dive into the company's strategic direction, consider reading about the Growth Strategy of Orix.

ORIX's market share varies significantly across its business segments and geographic locations. In Japan, ORIX holds a leading position in leasing and lending to SMEs. Globally, its asset management arm manages substantial assets, positioning it among key players in the alternative investments space. The company's real estate segment also contributes significantly to its market standing, particularly in Asia.

ORIX operates within the financial services industry, with a diversified portfolio including corporate financial services, real estate, asset management, and renewable energy. Its industry presence is global, with significant operations in the Americas, Asia, Europe, and Oceania. This extensive reach allows ORIX to serve a wide range of customer segments.

ORIX's business strategy involves diversification across financial services, real estate, and renewable energy. The company focuses on principal investments and asset management, moving beyond traditional financing to capitalize on growth opportunities. Strategic acquisitions and partnerships are also key components of its business strategy, aimed at expanding its global footprint and enhancing its competitive position.

An ORIX analysis reveals a company with a strong and diversified market position, robust financial performance, and a strategic focus on growth. The company's ability to adapt to changing market conditions and its global presence contribute to its resilience. ORIX's diversified revenue streams and prudent risk management contribute to its resilience.

ORIX's competitive advantages include its diversified business model, global presence, and strong financial performance. Its extensive experience in various financial sectors, including leasing, lending, and asset management, allows it to serve a wide range of clients. Strategic investments in renewable energy and real estate further enhance its competitive edge.

- Diversified Business Model: Operations across multiple sectors reduce risk.

- Global Presence: Operations in the Americas, Asia, Europe, and Oceania.

- Strong Financial Performance: Demonstrated resilience and stability.

- Strategic Investments: Focus on alternative assets and sustainable energy.

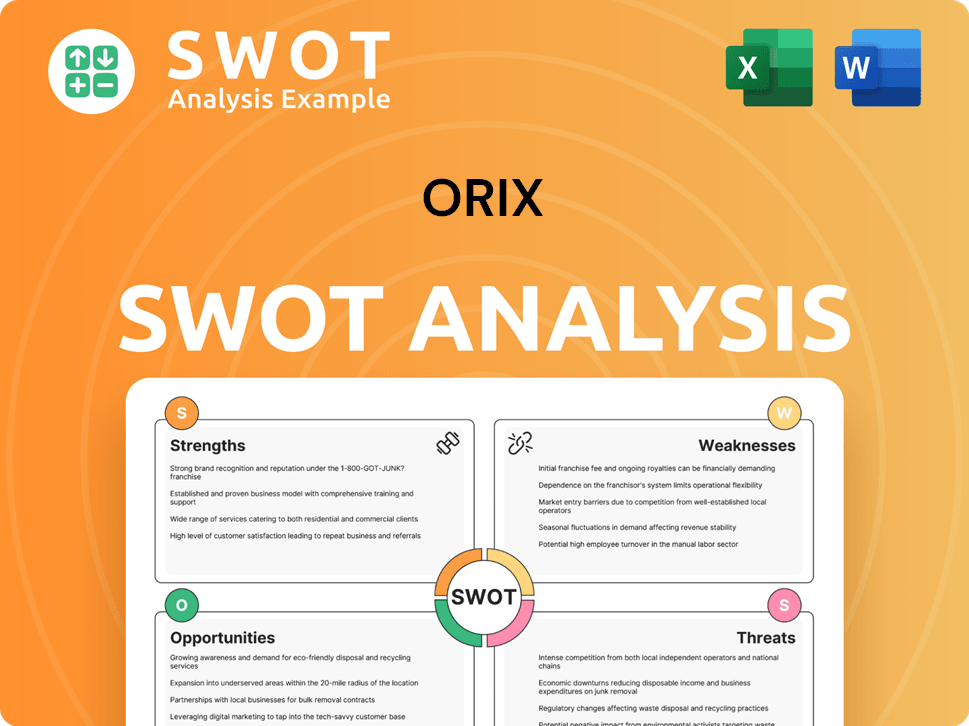

Orix SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Orix?

The Orix competitive landscape is characterized by a diverse range of players across its various business segments. These segments include corporate finance, leasing, asset management, real estate, and renewable energy. Understanding the competitive dynamics within each of these areas is crucial for assessing Orix's market share and overall financial performance.

Orix's ability to maintain a competitive edge depends on its strategic responses to challenges from both established and emerging competitors. The financial services sector is constantly evolving, with new technologies and business models reshaping the Orix industry. Analyzing Orix competitors provides insights into the strategies needed to navigate this dynamic environment.

In its core corporate finance and leasing operations, Orix faces strong competition from major Japanese banks. These banks, such as Mitsubishi UFJ Financial Group (MUFG), Sumitomo Mitsui Financial Group (SMFG), and Mizuho Financial Group, offer comprehensive financial services. They often leverage extensive branch networks and lower costs of capital, which can be significant advantages. Other leasing companies, including Tokyo Century Corporation and Sumitomo Mitsui Finance and Leasing, also compete directly in equipment leasing and financing.

Major Japanese banks like MUFG, SMFG, and Mizuho Financial Group compete with Orix. These banks have extensive networks and lower costs of capital.

Global asset managers such as BlackRock, Vanguard, and State Street Global Advisors are key rivals. They compete for institutional mandates and alternative investments.

Major property developers and real estate investment firms, including Mitsui Fudosan and Mitsubishi Estate, are direct competitors. These companies compete globally, including in Japan.

Utility companies, independent power producers, and infrastructure investors, such as Brookfield Asset Management, compete in renewable energy. They compete for market share in projects.

Fintech companies are disrupting traditional financial services. These companies present new competition through digital platforms and specialized lending models.

Mergers, acquisitions, and alliances continuously reshape the competitive landscape. Orix must remain agile and strategically responsive.

In the asset management sector, Orix competes with global players like BlackRock, Vanguard, and State Street Global Advisors. These firms have significant scale and brand recognition, attracting substantial institutional capital. The real estate segment faces competition from major property developers and real estate investment firms, such as Mitsui Fudosan and Mitsubishi Estate in Japan. In the renewable energy sector, Orix competes with utility companies, independent power producers, and infrastructure investors. These competitors vie for market share in renewable energy projects and infrastructure development. For a deeper dive into Orix's business strategy, you can refer to this article: 0.

Orix's competitive challenges include the need to differentiate itself from large banks and adapt to fintech disruption. The company must also navigate the complexities of real estate and renewable energy markets.

- Access to Capital: Large banks have lower costs of capital.

- Scale and Brand: Global asset managers have significant brand recognition.

- Market Dynamics: Real estate and renewable energy markets require specific expertise.

- Innovation: Fintech companies introduce new digital platforms.

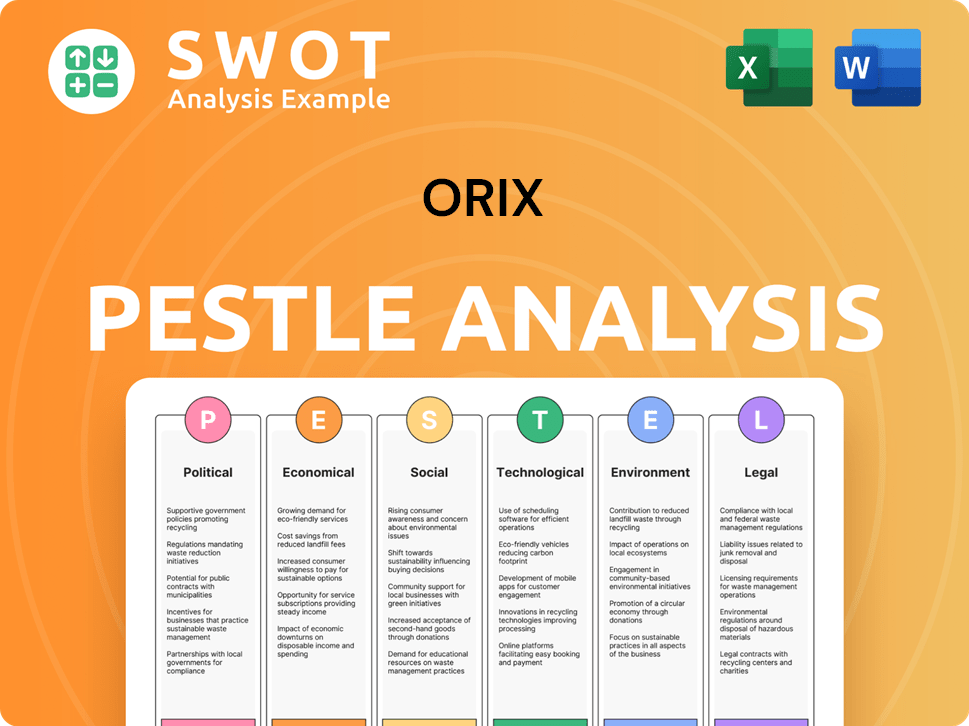

Orix PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Orix a Competitive Edge Over Its Rivals?

The competitive advantages of ORIX Corporation are rooted in its diverse business model, global reach, and financial strength, setting it apart from its rivals. Its multi-segment approach, encompassing corporate finance, leasing, real estate, asset management, and renewable energy, reduces reliance on any single market. This diversification allows for synergistic opportunities across its various business lines, offering integrated solutions to clients.

ORIX's extensive global network, especially its strong presence in Asia and North America, is a key advantage. This enables it to identify growth opportunities in diverse markets, access varied capital sources, and serve a wide range of international clients. Long-standing relationships and local market knowledge in these regions help it navigate complex regulatory environments and cultural nuances. A thorough Orix competitive landscape analysis reveals these strengths.

Furthermore, ORIX's expertise in principal investments and asset management generates returns from lending, leasing, and direct investments in assets like private equity and infrastructure. This capability provides higher return potential than traditional financial services. The company's strong balance sheet and access to diverse funding sources also provide a stable financial foundation. Understanding the Orix competitors is crucial for evaluating its market position.

ORIX's diversified business model spans corporate finance, leasing, real estate, asset management, and renewable energy. This diversification mitigates risk and creates synergistic opportunities. For instance, real estate expertise can be combined with financial services for project financing.

ORIX has a strong global presence, particularly in Asia and North America. This allows the company to identify growth opportunities and serve a wide range of international clients. Long-standing relationships and local market knowledge are key.

ORIX generates returns from traditional lending and leasing, as well as direct investments in assets like private equity and infrastructure. This capability provides a higher return potential compared to traditional financial services. This approach is a key aspect of its Orix analysis.

ORIX has a strong balance sheet and access to diverse funding sources. This enables the company to pursue large-scale projects and strategic acquisitions. Its commitment to sustainability also positions it favorably in the global economy.

ORIX's competitive advantages are multifaceted, including a diversified business model and a strong global presence. These factors allow the company to adapt to market changes and maintain a competitive edge. The company's strategic approach is detailed in the Marketing Strategy of Orix.

- Diversified Business Model: Reduces risk and creates synergies.

- Global Network: Enables access to diverse markets and clients.

- Principal Investments: Higher return potential.

- Financial Strength: Supports large-scale projects and acquisitions.

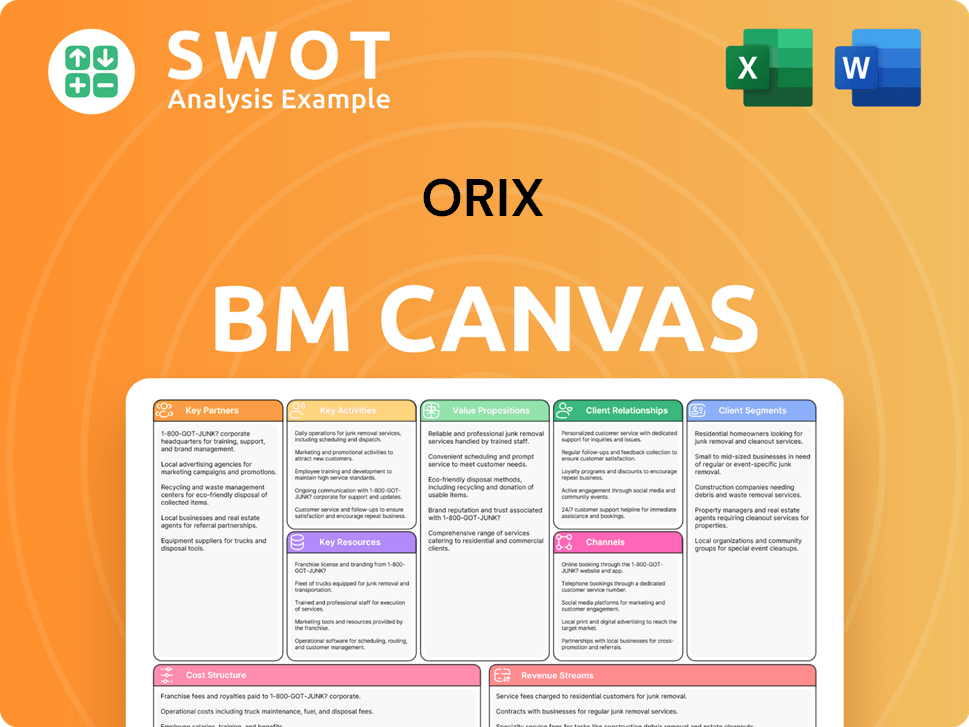

Orix Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Orix’s Competitive Landscape?

The financial services sector, where ORIX operates, is currently undergoing significant transformations, influenced by technological advancements, regulatory changes, and evolving consumer preferences. These factors are reshaping the competitive landscape, presenting both challenges and opportunities for ORIX. A thorough Orix competitive landscape analysis is crucial for understanding its position and future prospects.

Understanding the Orix industry dynamics is essential for assessing its strategic positioning. The company faces challenges from fintech companies and regulatory scrutiny, while also benefiting from the growth in sustainable finance and emerging markets. Navigating these complexities requires a robust Orix business strategy that leverages its strengths and adapts to market changes.

Digitalization and AI are transforming service delivery and risk assessment. Regulatory changes, including stricter compliance, are increasing. Consumer preference shifts towards digital channels and sustainable investments.

Increased competition from fintech companies and challenger banks. Stricter regulatory scrutiny, especially in cross-border transactions and data privacy. Global economic uncertainties, including inflation and geopolitical tensions.

Growing demand for sustainable finance and renewable energy investments. Continued digitalization to enhance customer experience and streamline operations. Significant growth potential in emerging markets, particularly in Asia.

Strategic capital deployment into renewable energy and private equity. Digital transformation across operations to improve efficiency. Leveraging a diversified business model and global reach to adapt to market changes.

ORIX's ability to adapt to market dynamics is crucial for maintaining its competitive edge. For more insights into ORIX's financial performance and strategic positioning, consider reading about Owners & Shareholders of Orix.

ORIX's competitive advantages include its diversified business model and global reach. It faces competition from both traditional financial institutions and newer fintech companies. The company's strategic focus on renewable energy and digital transformation is vital.

- Diversified Business Model: ORIX operates across various sectors, including leasing, lending, and asset management, providing resilience.

- Global Reach: ORIX's international presence allows it to tap into diverse markets and mitigate regional risks.

- Strategic Investments: The company is actively investing in growth areas like renewable energy and private equity.

- Digital Transformation: ORIX is focused on enhancing its digital capabilities to improve operational efficiency and customer experience.

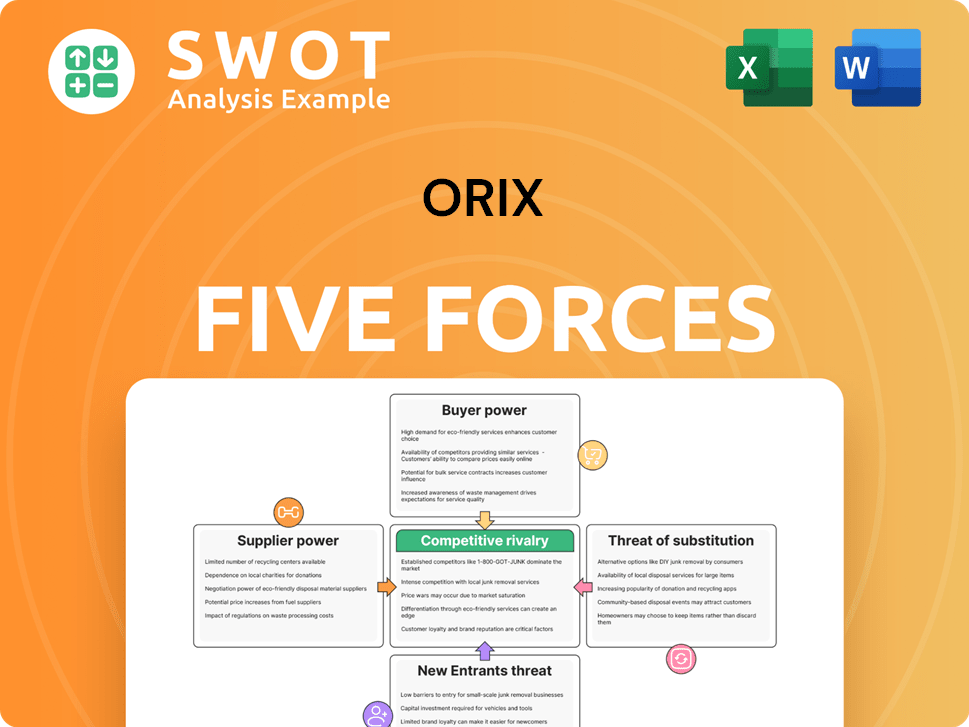

Orix Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Orix Company?

- What is Growth Strategy and Future Prospects of Orix Company?

- How Does Orix Company Work?

- What is Sales and Marketing Strategy of Orix Company?

- What is Brief History of Orix Company?

- Who Owns Orix Company?

- What is Customer Demographics and Target Market of Orix Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.