Pennon Group Bundle

What's the Story Behind Pennon Group's Success?

Ever wondered about the evolution of a leading UK utility company? Pennon Group, a FTSE 250 stalwart, has a fascinating history rooted in the privatization of the water industry. From its beginnings as South West Water Plc, the company has navigated significant changes to become a key player in water and waste management. Discover the key milestones that shaped this Pennon Group SWOT Analysis.

This deep dive into Pennon Group's history will uncover its strategic shifts, acquisitions, and the challenges it faced in the ever-evolving landscape of the UK utility sector. Explore how this Pennon Group SWOT Analysis has grown from its South West Water origins to its current diversified environmental infrastructure focus. Learn about the key milestones and the people who shaped this Pennon company.

What is the Pennon Group Founding Story?

The Pennon Group's story began in 1989, emerging from the privatization of the water industry in England. Originally named South West Water Plc, the company was a direct result of the Water Act of 1973 and the subsequent New Water Act of 1989, which privatized the regional water authorities. The company's roots are firmly planted in Exeter, England, where it was incorporated.

The core mission from the start was to deliver efficient and reliable water and wastewater services in the South West of England. This was a significant shift, moving from a public utility model to a privately-owned entity. The business model was straightforward: provide essential services to homes and businesses within its designated area.

In 1998, the company rebranded to Pennon Group Plc. This name change, inspired by the old English term for 'flag,' reflected a strategic shift towards building two distinct operational areas: South West Water and Viridor, its environmental division. A subsidiary, Pennon Limited, was established in Exeter in 1990.

Here's a look at the key events that shaped the Pennon Group:

- 1973: The Water Act established regional water authorities.

- 1989: South West Water Plc was formed through privatization.

- 1990: Pennon Limited, a subsidiary, was founded.

- 1998: The company changed its name to Pennon Group Plc.

The evolution of Pennon Group reflects significant changes in the UK utility landscape. The company's transformation from a regional water provider to a diversified utility and waste management group demonstrates its adaptability and strategic vision. For more details on the ownership structure, explore the Owners & Shareholders of Pennon Group.

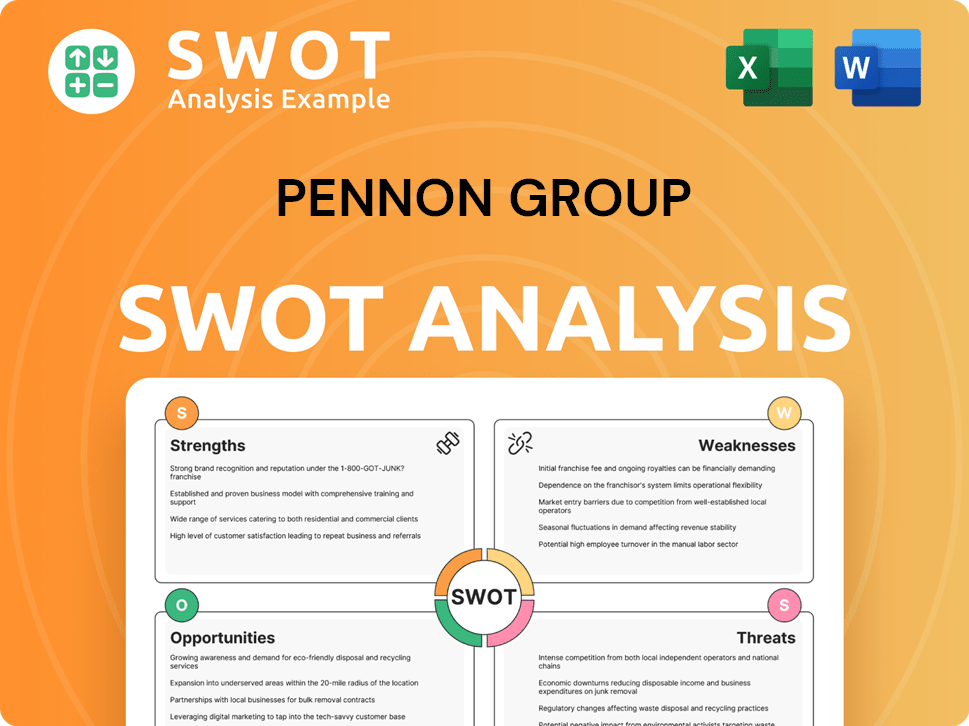

Pennon Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Pennon Group?

The early growth of the Pennon Group, initially known as South West Water Plc, involved significant diversification beyond its core water services. This expansion included strategic acquisitions in waste management and environmental services, transforming the company into a more diversified entity. These early moves were crucial in shaping Pennon's trajectory as a major UK utility company.

In 1993, Pennon entered the waste management sector by acquiring Haul Waste Group, later renamed Viridor Waste Management Limited. Further acquisitions in 1995, such as Blue Circle Waste Management, strengthened its position. By 1997, with the acquisitions of Greenhill Enterprises and Terry Adams, Pennon became the largest landfill operator in the UK.

In 1998, the company officially changed its name to Pennon Group Plc, establishing itself as a holding company. This rebranding marked a strategic shift towards becoming a diversified environmental services group. In 1999, Enviro-Logic launched Albion Water, the UK's first new private water company.

Throughout the 2000s, Pennon continued acquiring waste management companies, including Thames Waste Management in 2004, and Wyvern Waste in 2006. In 2016, it acquired Bournemouth Water for £100 million. The acquisition of Bristol Water in June 2021 cost $563 million (approximately £400 million).

In January 2024, Pennon acquired SES Water for £380 million, adding over 750,000 customers. This acquisition received clearance from the Competition and Markets Authority (CMA) in June 2024. Pennon's revenue for 2024/25 increased to £1,047.8 million from £907.8 million in 2023/24, with SES Water contributing £82.8 million to this increase. For more insights, explore the Growth Strategy of Pennon Group.

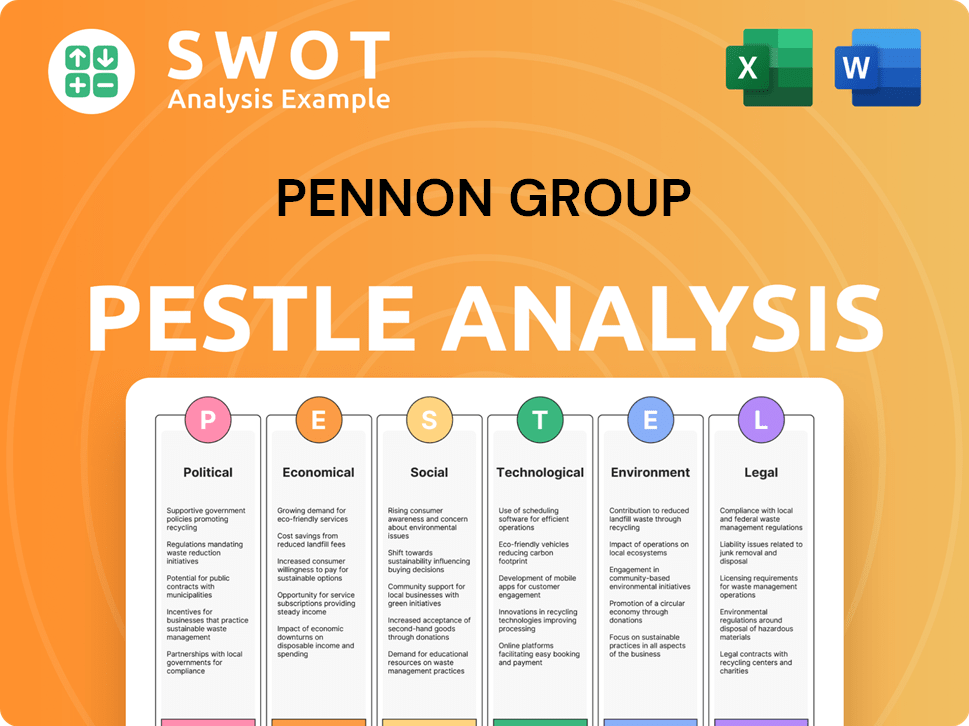

Pennon Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Pennon Group history?

The Pennon Group has a rich history marked by strategic shifts and significant achievements in the water and waste management sectors. A key element of the Pennon company's journey has been its ability to adapt and innovate within the UK utility company landscape.

| Year | Milestone |

|---|---|

| 1993 | Acquisition of Haul Waste Group, marking the beginning of diversification into waste management. |

| 1998 | Rebranding to Pennon Group Plc, with Viridor becoming its environmental division. |

| 1999 | Launch of Albion Water, the UK's first new private water company. |

| 2020 | Launch of the WaterShare+ scheme, empowering customers. |

| 2024/25 | Record capital investment of £652.5 million, including £610.2 million in water businesses. |

The company has consistently demonstrated innovation, particularly in infrastructure and customer engagement. Pennon Group's commitment to environmental initiatives is evident through projects like WaterFit, aimed at improving water quality in coastal and river areas.

Albion Water, launched in 1999, was the UK's first new private water company, showcasing an early innovative approach.

Record capital investment of £652.5 million in 2024/25, supporting projects like new treatment works.

Installation of 100% monitoring across all storm overflows ahead of schedule and the launch of WaterFit Live in early 2023.

Focus on increasing renewable energy provision through Pennon Power to support resilience and Net Zero ambitions.

The WaterShare+ scheme, launched in 2020, empowers customers and has been pivotal in achieving 100% affordability for customers.

Investment in environmental programs such as WaterFit, which aims to improve coastal and river water quality.

Despite its successes, the Pennon Group has faced challenges, including financial setbacks and environmental issues. The company reported a statutory pre-tax loss of £72.7 million in 2024/25, reflecting the impact of the Brixham water contamination incident and restructuring costs.

The company reported a statutory pre-tax loss of £72.7 million in 2024/25, compared to a £9.1 million loss in 2023/24.

A £16 million cost associated with the Brixham water contamination incident contributed to the financial challenges.

Additional restructuring expenses of £16 million further impacted the company's financial performance.

The Environmental Agency's performance assessment forecasted a 2-star rating due to pollution incidents.

Operational and financial resilience has been tested by extreme weather patterns and inflationary pressures.

The company has undertaken strategic pivots, including reshaping and resetting its cost base and delivering record capital investment.

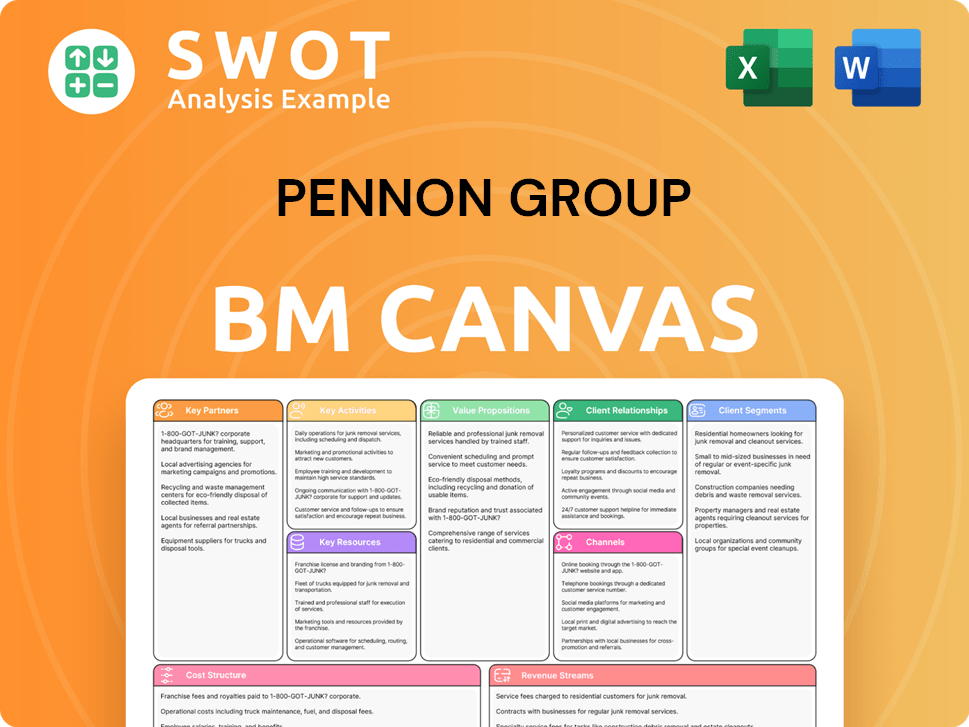

Pennon Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Pennon Group?

The Pennon Group, a prominent UK utility company, has a rich history marked by strategic acquisitions, name changes, and a focus on water and waste management. Established in 1989 as South West Water Plc, the company has evolved significantly, expanding its services and adapting to the changing landscape of the utility sector. This evolution showcases the company's commitment to providing essential services while navigating market dynamics and regulatory changes.

| Year | Key Event |

|---|---|

| 1989 | Pennon Group is founded as South West Water Plc following the privatization of the UK water industry. |

| 1993 | South West Water acquires Haul Waste Group, marking its entry into waste management. |

| 1998 | The company changes its name to Pennon Group Plc, with its waste management division renamed Viridor. |

| 1999 | Enviro-Logic, a Pennon subsidiary, launches Albion Water, the UK's first new private water company. |

| 2004 | Pennon successfully fends off a takeover bid from Terra Firma. |

| 2015 | Pennon acquires Bournemouth Water for £100 million. |

| 2020 | Global investment firm KKR completes its £4.2 billion acquisition of Viridor from Pennon Group. |

| 2021 | Pennon acquires Bristol Water for $563 million (approximately £400 million). |

| 2022 | Pennon announces its WaterFit plan for 2022-25, focusing on improving coastal and river water quality. |

| 2023 | Pennon acquires renewable energy generation projects, accelerating its Net Zero 2030 commitment. |

| January 2024 | Pennon acquires SES Water for £380 million, expanding its water services in Southern England. |

| January 2025 | Pennon announces a fully underwritten £490 million rights issue to support increased investment. |

| March 2025 | Pennon reports a record capital investment of £652.5 million for the 2024/25 financial year. |

Pennon Group plans to invest a record £3.2 billion by 2030, significantly increasing its investment from the expected £1.9 billion outturn for 2020-2025. This investment will tackle storm overflows, boost water resources, and expand nature recovery programs. The company is focusing on sustainable infrastructure and environmental improvements.

The company anticipates a return to profitability in 2025/26, with EBITDA expected to increase by two-thirds. Pennon aims to grow its rebased dividend per share in line with CPIH inflation from the financial year ending March 31, 2025, through March 31, 2030. The company is targeting approximately 7% Return on Regulated Equity (RORE) over the K8 period (2025-2030).

Pennon Group is enhancing its financial resilience through a strong balance sheet, with gearing in the water business expected to be 60-65%. The company aims to maintain a strong investment-grade credit rating of Baa1 for its water companies. These strategic moves support long-term sustainability.

The company's forward-looking strategy ties back to its founding vision of providing essential and sustainable environmental infrastructure. Pennon Group's focus on water infrastructure projects and renewable energy generation projects underscores its commitment to environmental sustainability. This commitment ensures continued service delivery and value for stakeholders.

Pennon Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Pennon Group Company?

- What is Growth Strategy and Future Prospects of Pennon Group Company?

- How Does Pennon Group Company Work?

- What is Sales and Marketing Strategy of Pennon Group Company?

- What is Brief History of Pennon Group Company?

- Who Owns Pennon Group Company?

- What is Customer Demographics and Target Market of Pennon Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.