Pennon Group Bundle

How Does Pennon Group Stack Up in the UK Water Wars?

The UK's water industry is a complex arena, constantly evolving under the pressures of environmental regulations and infrastructure demands. Pennon Group, a key player in this sector, provides essential water and wastewater services, but how does it truly measure up against its rivals? Understanding the Pennon Group SWOT Analysis is crucial to grasping its position.

This exploration of Pennon Group's competitive landscape will dissect its market share, financial performance, and strategic positioning within the UK utilities sector. We'll examine Pennon Group's competitors, its competitive advantages, and the challenges it faces in a highly regulated environment. Furthermore, this analysis will offer insights into Pennon Group's future outlook, considering its sustainability initiatives and potential investment opportunities within the water industry.

Where Does Pennon Group’ Stand in the Current Market?

Pennon Group's core operations revolve around the provision of essential water and wastewater services in the UK, primarily through its subsidiary, South West Water. This focus on regulated utility services forms the backbone of its business model, ensuring a consistent demand for its offerings. The company's value proposition centers on delivering reliable and high-quality water services while managing wastewater effectively, contributing to public health and environmental protection.

The company's geographic focus is the South West of England, where it serves approximately 1.7 million customers. This regional concentration allows for a deep understanding of local needs and environmental challenges. Pennon's strategic direction emphasizes its core regulated water business, streamlining operations and investments to enhance efficiency and service delivery.

The provision of clean drinking water and the collection and treatment of wastewater are Pennon's primary product lines. Its market position is strengthened by its regional monopoly in the South West, where it is the sole provider of these essential services. This regional dominance is a characteristic of the UK's privatized water sector, providing a stable foundation for its business.

South West Water holds a regional monopoly within its operational area, serving approximately 1.7 million customers. This market share is a key aspect of the competitive landscape for Pennon Group. The company's position is further solidified by the regulatory framework in the UK's water industry.

In the interim results for the six months ended September 30, 2023, Pennon Group reported an underlying profit before tax of £144.5 million, up 15.6%. This financial performance reflects the company's robust position within the water industry. The company's commitment to significant capital investment is also noteworthy.

Pennon Group plans to invest £2.8 billion in the current Asset Management Period (AMP8) from 2025 to 2030. This investment underscores its commitment to improving infrastructure and service resilience. The long-term investment strategy is a key element of its competitive advantage.

The Revenue Streams & Business Model of Pennon Group highlights the company's strategic focus on its core regulated water business. This focus allows Pennon to concentrate on operational efficiencies and investments within its primary utility services. The company faces competition from other UK water utilities.

Pennon Group's strengths include its regional monopoly, strong financial performance, and significant investment plans. Challenges include the regulatory environment and the need for continuous infrastructure improvements.

- Regional Monopoly: Sole provider in its operational area.

- Financial Health: Underlying profit before tax up 15.6% to £144.5 million (for the six months ended September 30, 2023).

- Investment: £2.8 billion planned for AMP8 (2025-2030).

- Challenges: Regulatory environment, infrastructure demands.

Pennon Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Pennon Group?

The Marketing Strategy of Pennon Group and its subsidiary, South West Water, operates within a unique competitive landscape. While direct competition for customers is limited due to regional monopolies in the UK water and wastewater industry, several factors influence the company's performance and position. These factors include regulatory compliance, financial performance, and public perception, which create a competitive environment with other UK water utilities.

Pennon Group's competitive standing is shaped by its ability to secure investor confidence, attract and retain talent, and navigate regulatory discussions. The company's performance is regularly benchmarked against its peers, influencing its market position and strategic decisions. This necessitates a focus on operational excellence, customer satisfaction, and infrastructure investment to maintain a strong competitive edge.

The UK water industry's competitive dynamics are primarily driven by the need to meet regulatory standards, reduce operational costs, and enhance customer service. This environment fosters a competitive spirit among the major players, even in the absence of direct customer acquisition battles within specific service areas. The following are the key competitors of Pennon Group.

Severn Trent is a major competitor, serving a large customer base in the Midlands and Wales. It competes with Pennon Group in areas such as environmental performance, customer service, and operational efficiency. Severn Trent's financial performance and strategic initiatives directly impact the overall competitive landscape.

United Utilities, operating in the North West of England, is another significant player in the UK water industry. It competes with Pennon Group for investor confidence, talent, and influence within regulatory discussions. United Utilities' infrastructure investments and operational strategies influence the overall industry dynamics.

Yorkshire Water, owned by Kelda Group, is a key competitor in the UK water market. It competes with Pennon Group in areas such as performance benchmarking and regulatory compliance. Yorkshire Water's financial results and strategic decisions impact the competitive environment.

Thames Water, a privately owned entity, is a major player in the UK water industry. While not directly competing for South West Water's customers, it influences investor confidence and regulatory discussions. Thames Water's operational performance and strategic initiatives are important factors in the competitive landscape.

Anglian Water, another privately owned entity, is a significant competitor. It competes with Pennon Group in areas such as performance benchmarking and regulatory compliance. Anglian Water's operational strategies and financial results affect the overall competitive dynamics.

Independent Water Providers (IWPs) can supply water to new developments, representing an emerging form of competition. Although their scale is currently limited compared to the established regional monopolies, they can influence the competitive environment. IWPs are important to consider as their influence grows over time.

The competitive environment in the UK water industry is shaped by several key factors. These factors influence the strategic decisions and operational performance of companies like Pennon Group. These factors include regulatory compliance, operational efficiency, and customer service.

- Regulatory Compliance: Meeting and exceeding regulatory standards set by Ofwat is crucial. This includes targets for leakage reduction, water quality, and environmental protection.

- Operational Efficiency: Companies strive to reduce operational costs, optimize infrastructure, and improve overall efficiency to enhance profitability and competitiveness.

- Customer Service: Providing excellent customer service, addressing complaints effectively, and maintaining high levels of customer satisfaction are essential for building a strong reputation and retaining customers.

- Investment in Infrastructure: Continuous investment in infrastructure, including upgrades to water and wastewater treatment plants and networks, is essential for maintaining service quality and meeting future demand.

- Financial Performance: Strong financial performance, including profitability, revenue growth, and efficient capital allocation, is critical for attracting investors and ensuring long-term sustainability.

Pennon Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Pennon Group a Competitive Edge Over Its Rivals?

The competitive landscape for Pennon Group is shaped by its position as a regulated utility, primarily focused on water and wastewater services. Understanding its competitive advantages is crucial for assessing its market position and future prospects. This analysis considers factors such as market share, financial performance, and strategic initiatives.

Pennon Group's strengths lie in its regulated status, geographic focus, and commitment to sustainability. These elements create a robust foundation for long-term value creation. The company's performance is closely tied to regulatory frameworks and its ability to adapt to evolving environmental and social expectations.

Analyzing the Growth Strategy of Pennon Group reveals how the company navigates the complexities of the water industry. Key aspects include its approach to capital expenditure, operational efficiency, and stakeholder engagement, all of which contribute to its competitive edge.

South West Water operates as a legally mandated monopoly for water and wastewater services in the South West of England. This provides a stable revenue stream and a predictable regulatory asset base (RAB). This regulated environment creates a significant barrier to entry for potential competitors.

Pennon’s deep understanding and long-standing presence in the South West region is a key advantage. This includes intimate knowledge of local hydrology, environmental conditions, and community needs. This enables tailored service delivery and effective stakeholder engagement.

Pennon actively leverages its 'Green Recovery' program, a £85 million investment package approved by Ofwat. The focus on sustainability and environmental stewardship enhances its brand reputation and customer loyalty. The company aims to achieve Net Zero by 2030.

Pennon's financial strength and access to capital markets are significant competitive advantages. This allows it to fund infrastructure upgrades and environmental enhancements. The company's stable financial performance supports its ability to invest in long-term resilience and innovation.

Pennon Group's competitive advantages are multifaceted, stemming from its regulated status, geographic focus, and sustainability efforts. These factors contribute to a strong market position within the UK utilities sector. The company's ability to manage capital expenditure and adapt to regulatory changes is crucial.

- Regulated Monopoly: Provides a stable revenue stream and barriers to entry.

- Geographic Focus: Deep understanding of the South West region.

- Sustainability: Investments in environmental improvements and Net Zero targets.

- Financial Strength: Access to capital for infrastructure upgrades.

Pennon Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Pennon Group’s Competitive Landscape?

The competitive landscape for Pennon Group within the UK water industry is shaped by evolving trends, challenges, and opportunities. Understanding these elements is crucial for assessing Pennon Group's market position and future prospects. This analysis considers the technological advancements, regulatory changes, and consumer preferences influencing the sector, alongside the company's strategic responses and performance indicators.

The UK water industry is under increasing pressure to address environmental concerns and meet stringent regulatory standards. This includes managing storm overflows, improving water quality, and investing in infrastructure upgrades. The financial implications of these changes, coupled with climate change impacts, present significant challenges for Pennon Group and its competitors. However, these challenges also create opportunities for innovation and sustainable practices.

The water industry is experiencing rapid technological advancements, including smart networks and AI-driven analytics, enhancing operational efficiency. Regulatory changes, particularly Ofwat's PR24 price review and stricter environmental standards, are increasing pressure. Consumer preferences are shifting towards greater transparency and environmental responsibility.

Addressing environmental performance, especially storm overflows, is a major challenge, with associated reputational and financial risks. Substantial capital investment for infrastructure upgrades, estimated at £2.8 billion for Pennon in AMP8 (2025-2030), poses financial hurdles. Climate change impacts necessitate greater resilience in water supply and wastewater treatment systems.

Investment in nature-based solutions and advanced treatment technologies can drive efficiency and innovation. The focus on 'Green Recovery' initiatives and achieving Net Zero by 2030 offers growth potential. Enhancing customer engagement through digital platforms can improve satisfaction. Strategic partnerships can accelerate innovative solutions.

Pennon Group's competitive position is influenced by its ability to meet regulatory targets and manage capital investments. The company's strategic focus on its core water business and environmental improvements is key. The company's performance is also affected by market share and operational efficiency.

Pennon Group's future outlook depends on its ability to navigate industry trends, manage challenges, and capitalize on opportunities. Effective capital allocation and technological adoption are crucial for success. Strategic initiatives to enhance customer service and environmental performance will be key.

- Regulatory Compliance: Meeting Ofwat's standards and environmental regulations.

- Financial Performance: Managing capital expenditure and ensuring profitability.

- Operational Efficiency: Implementing smart technologies and optimizing processes.

- Customer Engagement: Enhancing digital platforms and improving service delivery.

For a deeper understanding of the company's ownership structure and financial background, consider reading about the Owners & Shareholders of Pennon Group. This article provides insights into the financial performance and the strategic direction of the company.

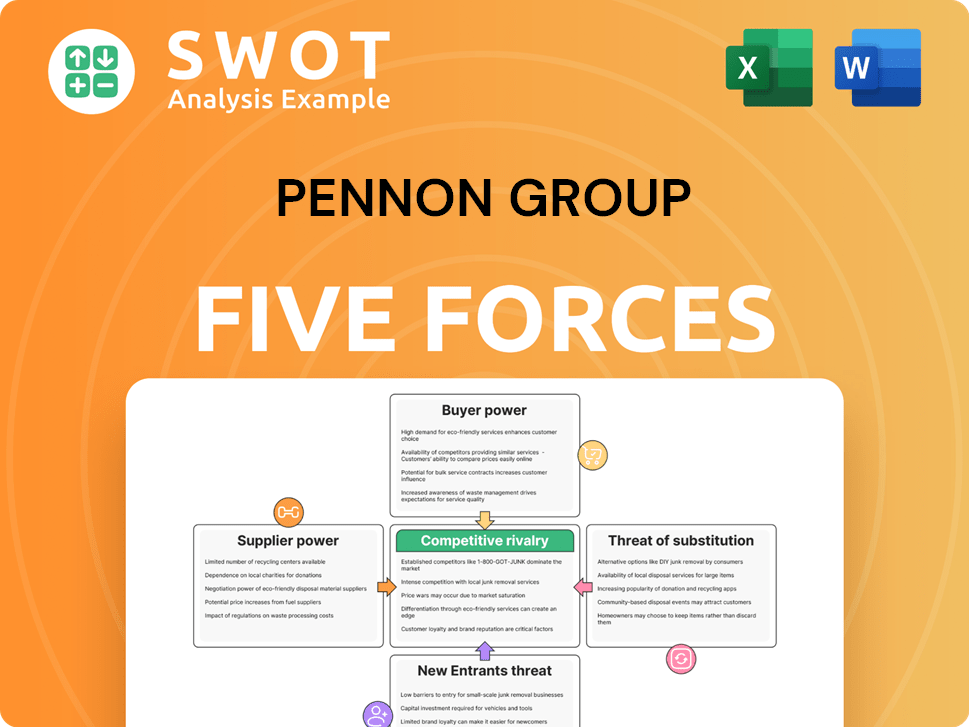

Pennon Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Pennon Group Company?

- What is Growth Strategy and Future Prospects of Pennon Group Company?

- How Does Pennon Group Company Work?

- What is Sales and Marketing Strategy of Pennon Group Company?

- What is Brief History of Pennon Group Company?

- Who Owns Pennon Group Company?

- What is Customer Demographics and Target Market of Pennon Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.