Pennon Group Bundle

How Does Pennon Group Navigate the UK Water Industry?

Pennon Group, a key player in the UK's environmental infrastructure, provides essential water and wastewater services, primarily through its subsidiary, South West Water. Its operations are critical to millions, ensuring access to clean water and effective waste management. Understanding the Pennon Group SWOT Analysis is essential for any investor or stakeholder.

From its core Pennon Group operations to its evolving Pennon Group business model, this company's strategies directly impact both its financial performance and its ability to meet the growing demands of the UK water industry. This exploration will provide valuable insights into how Pennon Group manages water resources, its commitment to environmental sustainability, and its position within the broader market, including insights into South West Water and Bristol Water.

What Are the Key Operations Driving Pennon Group’s Success?

The core of Pennon Group's operations centers on providing clean water and wastewater services, mainly through its subsidiary, South West Water. This involves taking water from rivers and reservoirs, treating it to meet strict standards, and distributing it through a vast network of pipes. Simultaneously, the company collects and treats wastewater before returning it safely to the environment. This integrated approach is a key part of the Pennon Group business model.

The company serves a wide range of customers, including homes, businesses, and industries. Its operations are capital-intensive, requiring significant investment in infrastructure like water and wastewater treatment plants, pumping stations, and miles of pipes. The supply chain involves sourcing chemicals, energy, and materials essential for these processes. Pennon Group operations also leverage advanced technology for network optimization, leak detection, and incident management.

Pennon's commitment to environmental performance is a key differentiator. South West Water, for example, has aimed for a 30% reduction in pollution by 2025. This focus translates into benefits for customers, such as reliable access to high-quality drinking water and improved environmental health. This commitment is crucial in the UK water industry.

South West Water provides essential water and wastewater services. These include water abstraction, treatment, and distribution, as well as wastewater collection and treatment. The company ensures water quality and manages resources efficiently.

Pennon Group serves a diverse customer base. This includes residential customers, commercial businesses, and industrial users. The company's services are essential for daily life and business operations.

Operational processes are highly capital-intensive and technologically driven. This involves significant investment in water treatment works, wastewater treatment works, pumping stations, and the maintenance and upgrade of thousands of miles of water mains and sewers.

Pennon Group emphasizes environmental performance. South West Water aims to reduce pollution, ensuring sustainable practices. This focus enhances the company's reputation and benefits customers.

In 2024, South West Water invested significantly in its infrastructure. The company manages vast networks of water mains and sewers. Pennon Group's commitment to environmental targets, such as pollution reduction, is a core part of its strategy.

- South West Water serves approximately 1.7 million people.

- The company manages over 16,000 km of water mains and sewers.

- Pennon Group aims for continued improvements in water quality and environmental performance.

- Bristol Water, now part of Pennon Group, also contributes to the company's overall operations.

Pennon Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Pennon Group Make Money?

Pennon Group's primary revenue streams come from providing water and wastewater services. These services are offered to both household and non-household customers. The company's financial performance is heavily influenced by its regulated asset base (RAB) model.

The company is allowed to earn a return on its invested capital. This model provides a degree of revenue stability. Pennon Group's business model is centered around these regulated water utilities, with charges set to cover operational costs, capital expenditure, and a fair return for investors.

For the financial year ending March 31, 2024, Pennon Group reported a revenue of £867.7 million, reflecting its core focus on water and wastewater services. The company's operations are significantly shaped by regulatory reviews, such as Ofwat's Asset Management Plans (AMPs).

Pennon Group's revenue streams are primarily derived from its water and wastewater services. The company's monetization strategy is based on a regulated asset base (RAB) model. The company's focus is on regulated water utilities, and changes in revenue are driven by regulatory price reviews.

- Regulated Asset Base (RAB) Model: Allows Pennon to earn a return on its invested capital, providing stable revenue.

- Revenue Sources: Predominantly from household and non-household customers for potable water supply and wastewater services.

- Regulatory Influence: Revenue and investment targets are set by Ofwat through Asset Management Plans (AMPs), which occur every five years.

- Financial Data: Pennon Group reported a revenue of £867.7 million for the financial year ending March 31, 2024.

Pennon Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Pennon Group’s Business Model?

Pennon Group has undergone significant transformations, with key strategic moves shaping its current operations. A pivotal decision was the 2020 divestment of Viridor, a waste management business, for an enterprise value of £4.2 billion. This strategic shift allowed Pennon to concentrate on its core regulated water business, strengthening its financial position and enabling focused investments.

The company's operations are primarily centered around South West Water and Bristol Water, both of which provide essential water and wastewater services. These operations are subject to various challenges, including aging infrastructure, stringent leakage targets, and the need to meet evolving environmental performance standards. The UK water industry, in general, faces increasing regulatory scrutiny and public expectations regarding environmental responsibility and sustainability.

Pennon Group's business model is built on its regulated water operations, which provide a stable revenue stream. The company's focus on infrastructure investments and operational efficiencies supports its long-term growth strategy. For investors looking at Competitors Landscape of Pennon Group, understanding these key aspects is crucial.

The divestment of Viridor in 2020 was a major milestone, allowing Pennon to focus on its core water business. This strategic move resulted in a significant return of capital to shareholders. The company has also made substantial investments in its water infrastructure to improve services.

Pennon's strategic moves include a focus on regulated water operations, with substantial investment in infrastructure. The company is committed to improving environmental performance and meeting regulatory requirements. This includes initiatives to reduce pollution incidents and enhance water quality.

Pennon's competitive advantages include its status as a natural monopoly in its operating region. The company benefits from established brand strength, particularly through South West Water. Economies of scale in managing its vast network and treatment facilities also contribute to its competitive edge.

Pennon Group's financial performance is closely tied to its regulated water operations. The company's revenue is primarily derived from providing water and wastewater services. The financial results are influenced by factors such as infrastructure investments, regulatory decisions, and operational efficiencies.

Pennon Group has several ongoing initiatives to enhance its services and meet environmental standards. The WaterFit plan, for example, aims to improve bathing water quality and reduce storm overflows. The company is investing heavily in infrastructure to ensure long-term sustainability.

- £100 million investment in environmental improvements by April 2025.

- Focus on reducing leakage and improving water quality.

- Ongoing projects to upgrade and maintain water and wastewater infrastructure.

- Commitment to meeting evolving regulatory and societal expectations.

Pennon Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Pennon Group Positioning Itself for Continued Success?

Understanding the industry position, risks, and future outlook of the Pennon Group is crucial for investors and stakeholders. Pennon Group operations are primarily focused on providing essential water and wastewater services in the South West of England through its subsidiary, South West Water. Its position in the UK water industry is unique due to its monopoly in the region, which offers both stability and significant regulatory oversight.

The company's business model is centered around regulated assets, providing a predictable revenue stream. However, this model is also subject to various risks, including regulatory changes and environmental pressures. The future outlook depends on the company's ability to navigate these challenges while continuing to invest in infrastructure and customer service.

Pennon Group holds a strong regional market position, effectively controlling 100% of the water and wastewater services in the South West of England. This monopolistic position means high customer loyalty, as alternatives are unavailable. Customer satisfaction and service quality are constantly under regulatory and public scrutiny, making operational efficiency and environmental compliance critical. The company's primary subsidiary, South West Water, is a key player in the UK water sector, providing essential services to a large customer base.

Key risks for Pennon Group include regulatory changes, particularly outcomes from Ofwat's price reviews, which dictate allowed revenue and investment. Environmental regulations pose a significant threat, with increasing pressure to reduce pollution incidents and improve water quality, potentially leading to substantial capital expenditures and fines. Technological disruptions, such as smart metering, could impact demand. For detailed information on Pennon Group's ownership structure, consider reading this article: Owners & Shareholders of Pennon Group.

Pennon Group's future outlook is centered on its 'New Deal for Customers,' which aims to deliver improved services, environmental performance, and affordability. Strategic investments in resilience and environmental improvements are critical. The group plans to sustain its financial performance through efficient operation of its regulated asset base and navigating the regulatory landscape. South West Water is investing £150 million to achieve 100% excellent bathing water quality by the end of 2025.

Pennon Group's strategic initiatives are heavily focused on enhancing customer service and environmental performance. The company is investing significantly in its WaterFit plan, which targets improvements in river and bathing water quality. Leadership emphasizes sustainable growth, environmental stewardship, and value delivery for customers and shareholders. These initiatives are crucial for long-term success and maintaining a positive relationship with stakeholders.

Pennon Group's financial performance is closely tied to its ability to manage its regulated asset base efficiently and navigate regulatory changes. The company's dividend policy and financial performance analysis are key considerations for investors. The company's infrastructure projects and operational efficiency directly impact its profitability and ability to provide returns to shareholders.

- The company's dividend policy is a key factor for investors.

- Efficient management of the regulated asset base is critical for profitability.

- Investment in infrastructure projects is essential for long-term sustainability.

- Navigating regulatory landscapes is crucial for financial stability.

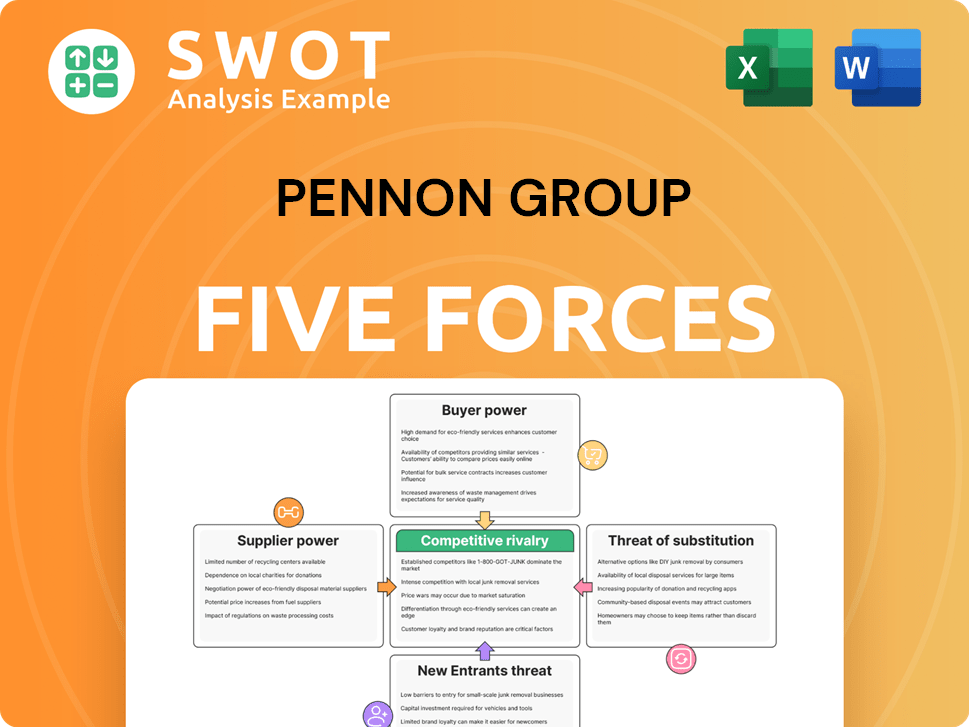

Pennon Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Pennon Group Company?

- What is Competitive Landscape of Pennon Group Company?

- What is Growth Strategy and Future Prospects of Pennon Group Company?

- What is Sales and Marketing Strategy of Pennon Group Company?

- What is Brief History of Pennon Group Company?

- Who Owns Pennon Group Company?

- What is Customer Demographics and Target Market of Pennon Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.