Prudential Bundle

How Well Do You Know Prudential's Past?

Journey back in time to uncover the Prudential SWOT Analysis, a company whose legacy spans over 175 years. From its humble beginnings in London, this insurance giant has weathered economic storms and global shifts. Discover the Prudential history and the Prudential company that has shaped the history of insurance.

This exploration into the Prudential insurance company's past will reveal pivotal moments, from its early days in Prudential UK to its present-day focus. Understanding the Prudential financial evolution provides crucial insights for investors and strategists. Explore the brief history of Prudential plc and gain a deeper appreciation for its enduring impact.

What is the Prudential Founding Story?

The Prudential history begins in 1848, marking the inception of what would become a global financial powerhouse. Founded in London, the company initially focused on providing financial services to the working class, a novel approach at the time. This focus on accessibility and security laid the groundwork for its future expansion and influence within the Prudential insurance industry.

Established on May 30, 1848, in Hatton Garden, London, the company was initially named 'The Prudential, Investment, Loan, and Assurance Association.' The name was soon adapted to 'The Prudential Mutual Assurance, Investment, and Loan Association' in September 1848. The founders aimed to offer loans to professional and working individuals, recognizing the need for financial stability in the mid-19th century. The symbol of Prudence was adopted to represent the company's values of prudence, integrity, and security, a symbol that continues to be associated with the Prudential company today.

In its early years, Prudential UK distinguished itself through its innovative business model. The company expanded its offerings in 1854 with 'Industrial Branch' insurance policies, also known as 'penny policies.' These policies, with premiums as low as a penny a week, were designed to be affordable for the working class. This approach involved a network of door-to-door agents, known as the 'Man from the Pru,' who collected premiums directly from households. This direct sales model was a key factor in the company's early growth, setting it apart from competitors and making insurance accessible to a broader demographic. Read more about the Growth Strategy of Prudential.

The early years of Prudential were marked by innovation and a commitment to financial inclusion.

- 1848: Prudential is founded in London, initially offering loans and assurance services.

- 1854: The introduction of 'Industrial Branch' insurance policies, making insurance accessible to the working class.

- Early 20th Century: Prudential becomes a major player in the UK insurance market, expanding its reach and influence.

- Mid-20th Century: Prudential continues to grow, adapting to changing economic and social landscapes.

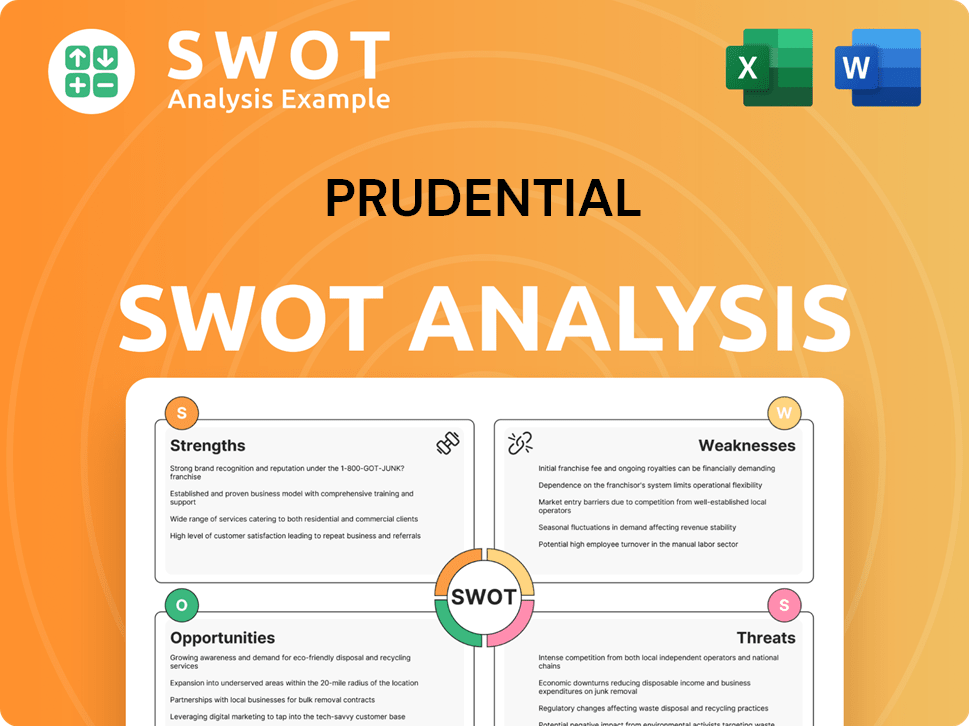

Prudential SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Prudential?

The early growth of the Prudential company, a significant chapter in Prudential history, was marked by innovative strategies. This period saw the company's rapid expansion, particularly in the UK, fueled by its pioneering approach to industrial insurance. The company's reach extended globally, establishing a strong foundation for its future as a leading Prudential financial institution.

The Prudential insurance company's early success was significantly influenced by its industrial insurance model, which began in 1854. This involved offering 'penny policies' and utilizing a network of door-to-door agents, famously known as the 'Man from the Pru'. This approach allowed the company to rapidly expand its reach, particularly among the working class population, leading to phenomenal growth.

By 1898, Prudential UK had become the leading life assurance company in the UK, accumulating £30 million in funds. This growth reflected the effectiveness of its business model and the increasing demand for insurance products. By 1914, approximately one in three British households held a policy with the company, demonstrating its widespread impact on British society.

The 1920s marked the beginning of Prudential's international expansion, starting with its first overseas life operation in Calcutta, India, in 1923. General insurance agencies were subsequently opened in China and the Philippines during the 1920s. Life insurance businesses expanded to Malaya and Singapore. This was a strategic move to tap into new markets and diversify its geographical footprint.

In the 1930s, the company ventured into Africa, establishing a head office in Johannesburg in 1931 and a branch in Nairobi in 1933. By 1939, the new net business from overseas life branches was rivaling that of the UK. In 1994, Prudential established Prudential Corporation Asia to capitalize on the region's high growth potential, expanding operations in Indonesia, Thailand, Vietnam, and the Philippines. For more details on the company's ownership and financial structure, you can explore Owners & Shareholders of Prudential.

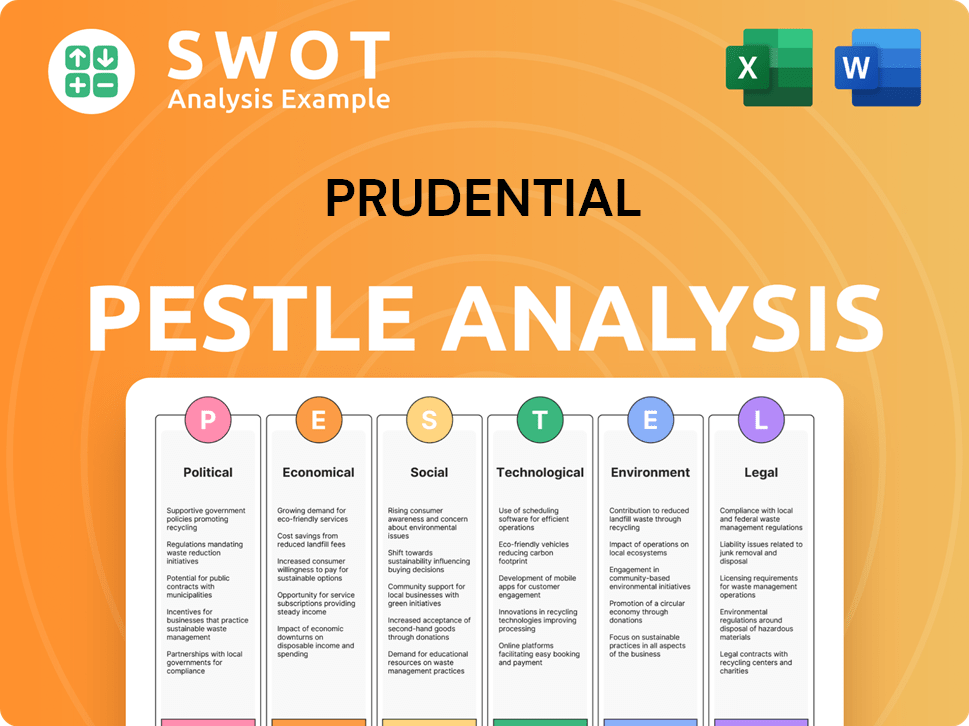

Prudential PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Prudential history?

The Prudential company has a rich history marked by significant milestones. These achievements reflect its evolution and adaptation within the financial landscape.

| Year | Milestone |

|---|---|

| 1854 | Introduction of 'penny policies', making insurance accessible to the working class. |

| 1898 | Became the leading UK life assurance company. |

| 1924 | First listed on the London Stock Exchange. |

| 1998 | Launched Egg, an internet bank in the UK. |

| 2000 | Entered the Mainland China market through a joint venture with CITIC Group. |

| 2012 | Launched Eastspring Investments, its asset management business. |

| 2014 | Entered the African life insurance industry. |

| 2019 | Demerger of M&G plc to focus on Asia and Africa. |

Throughout its history, the

The introduction of 'penny policies' in 1854 made insurance affordable for the working class. This door-to-door sales model was a pioneering approach.

Prudential's early success was significantly driven by its innovative door-to-door sales strategy. This approach built trust and expanded its customer base.

In 1998, Prudential launched Egg, an internet bank, showcasing its early adoption of digital channels. This initiative demonstrated the company's foresight in embracing technology.

The launch of Eastspring Investments in 2012 marked a significant expansion into asset management. This business has since established a strong presence across Asia.

Prudential's strategic moves into Asia, including its joint venture in China, have been key to its growth. These expansions have strengthened its global footprint.

The acquisition of companies in Ghana and Kenya in 2014 marked Prudential's entry into the African life insurance market. This expansion highlights its commitment to emerging markets.

The

The collapse of the housing market in the south of England in 1989 significantly affected Prudential Property Services. This event led to substantial losses and branch closures.

Intense competition in the insurance and asset management industries presents ongoing challenges. This requires continuous adaptation and innovation.

Navigating complex regulatory environments across diverse markets is a constant challenge. Compliance and adaptation are crucial for success.

Macroeconomic uncertainties and market volatility pose significant risks. These factors require strategic financial planning and risk management.

Prudential's recent demerger of M&G plc in 2019 to focus on Asia and Africa demonstrates its strategic adaptability. This refocusing aims to drive growth in key markets.

In 2024, Prudential reported an 11% increase in new business profit and a 10% rise in adjusted operating profit before tax. The company's robust free cash flow, approximately $3.7 billion as of May 2025, further solidifies its financial health.

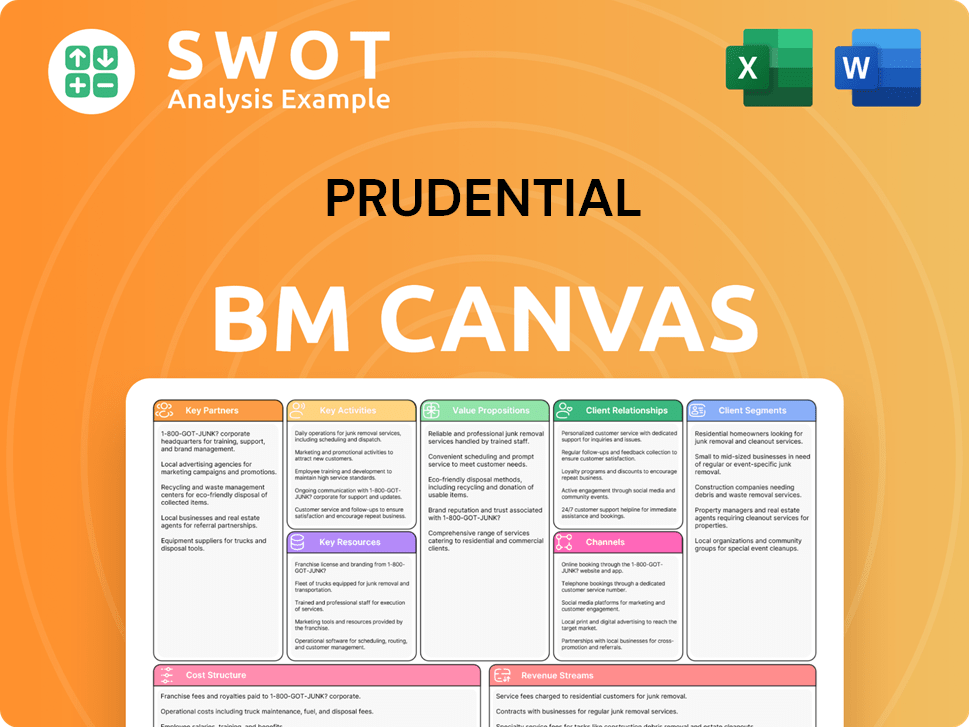

Prudential Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Prudential?

The Prudential's history is marked by significant milestones, from its inception in London to its expansion across the globe, becoming a major player in the financial sector. This evolution reflects its adaptability and strategic focus on emerging markets.

| Year | Key Event |

|---|---|

| May 1848 | Founded in London as 'The Prudential, Investment, Loan, and Assurance Association'. |

| September 1848 | Renamed 'The Prudential Mutual Assurance, Investment, and Loan Association'. |

| 1854 | Began selling 'Industrial Branch' insurance policies with door-to-door agents. |

| 1898 | Became the leading UK life assurance company. |

| 1923 | Opened first overseas life operation in Calcutta, India. |

| 1924 | First listed on the London Stock Exchange. |

| 1931 | Established a head office in Johannesburg, South Africa. |

| 1994 | Prudential Corporation Asia was established in recognition of growth potential in Asia. |

| 1997 | Acquired Scottish Amicable for £1.75 billion. |

| 1998 | Launched Egg, an internet bank in the UK. |

| 1999 | Acquired M&G, a UK fund management company, for £1.9 billion; company name changed to Prudential plc. |

| 2000 | Became the first UK life insurer to enter the Mainland China market through a joint venture with CITIC Group. |

| 2012 | Launched Eastspring Investments, its asset management business. |

| 2014 | Entered the African life insurance industry by acquiring companies in Ghana and Kenya. |

| 2019 | Completed demerger of M&G plc to focus on Asia and Africa. |

| 2023 | Celebrated 175th anniversary and 100 years in Asia; established Macau branch. |

| 2024 | Reported new business profit of $3,078 million, up 11%. |

The company is strategically focused on the growth markets of Asia and Africa. Its mission is to be the most trusted partner and protector for current and future generations by providing simple and accessible financial and health solutions.

In 2024, the company reported a new business profit of $3,078 million, an increase of 11%. The robust free cash flow of over $3.7 billion in 2025 provides flexibility for future growth initiatives and shareholder returns.

The company plans to continue investing in broadening its presence in life and asset management markets, particularly in regions with low insurance penetration and pension funding gaps. Prudential is also considering a partial divestment of its shares in ICICI Prudential Asset Management Company Limited in India.

Analysts project a positive trajectory for the company, anticipating steady improvement in free cash flow and returns over time. This forward-looking strategy aligns with its founding vision of providing financial security, now adapted to the significant opportunities in emerging markets.

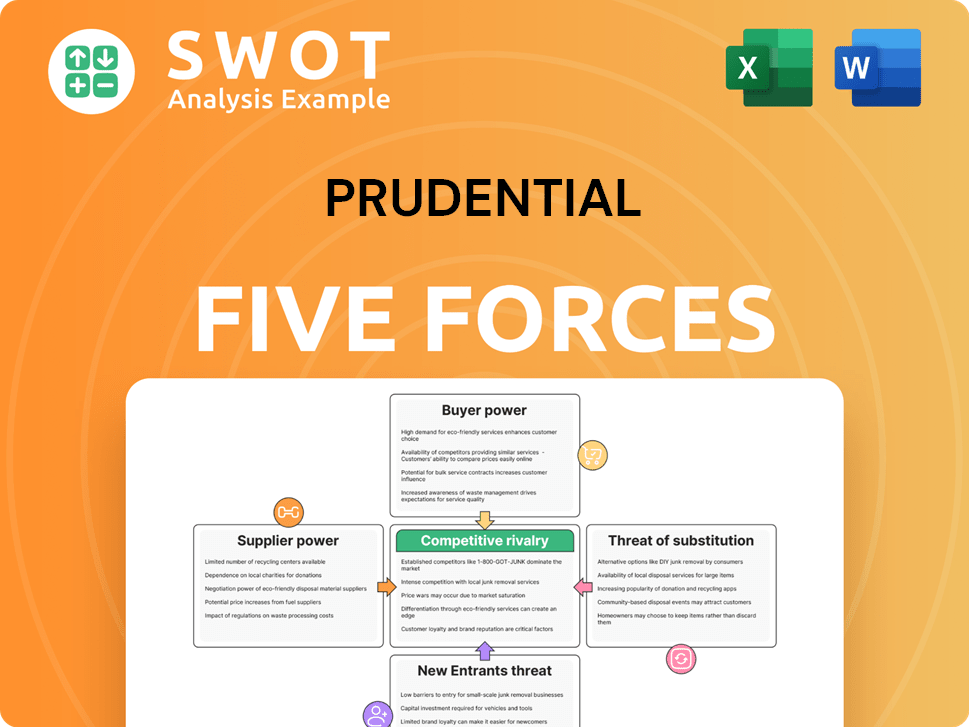

Prudential Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Prudential Company?

- What is Growth Strategy and Future Prospects of Prudential Company?

- How Does Prudential Company Work?

- What is Sales and Marketing Strategy of Prudential Company?

- What is Brief History of Prudential Company?

- Who Owns Prudential Company?

- What is Customer Demographics and Target Market of Prudential Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.