Prudential Bundle

How Does Prudential Navigate the Global Insurance Arena?

Prudential plc, a financial powerhouse with a rich history, is currently making waves with impressive financial results. With an 11% increase in new business profit and a strong capital position, the company is clearly demonstrating its resilience and strategic prowess. But in a fiercely contested market, how does Prudential truly stack up against its rivals?

This analysis delves into the Prudential SWOT Analysis to dissect the company's competitive landscape. We'll explore Prudential's competitors, conduct a thorough Prudential market analysis, and investigate its competitive advantages within the insurance industry and wider financial services sector. Understanding Prudential's position requires a deep dive into its financial performance and strategic initiatives, providing actionable insights for investors and industry observers alike.

Where Does Prudential’ Stand in the Current Market?

Prudential plc holds a prominent market position within the insurance and asset management sectors, with a strong focus on Asia and Africa. The company's core operations revolve around providing life insurance, health insurance, and asset management services, catering to a diverse customer base seeking long-term financial solutions. Its value proposition centers on delivering financial security and growth opportunities, especially in markets with increasing demand for insurance and investment products.

As of the end of 2024, Prudential reported robust financial results, including new business profit of $3.078 billion, an 11% increase, and an adjusted operating profit before tax of $3.129 billion, up 10%. This performance underscores its ability to generate substantial profits and maintain a strong financial foundation. The company’s strategic focus on these regions and its product offerings positions it well to capitalize on the growth potential in these markets.

Prudential's financial performance reflects its strong market position. In 2024, the company's adjusted operating profit after tax increased by 7% to $2.582 billion, and earnings per share based on adjusted operating profit were 89.7 cents, up 8%. These figures demonstrate Prudential's ability to generate substantial profits and maintain a strong financial foundation. The company's strategic focus on Asia and Africa, coupled with its product offerings, positions it well to capitalize on the growth potential in these markets.

Prudential operates across 24 markets in Asia and Africa, serving over 18 million customers. Its Hong Kong and Singapore businesses demonstrated double-digit growth in new business profit in Q1 2025, driven by higher volumes and margin expansion. The mainland China joint venture, CITIC Prudential Life, also delivered double-digit new business profit growth. This expansion highlights Prudential's ability to penetrate and grow within key markets, contributing to its overall market share.

Prudential's strong capital position is a key indicator of its financial health and resilience. The company's free surplus ratio stood at 234% and a shareholder GWS coverage ratio over GPCR of 280% in 2024. These figures reflect Prudential's ability to meet its financial obligations and withstand market fluctuations. This robust capital base supports its strategic initiatives and long-term growth prospects.

Prudential is focused on improving operational capabilities and delivering growth in its target markets. The company is investing in modernizing its IT infrastructure to achieve economies of scale and improve operational delivery. While agency new business profit saw a decrease in the first half of 2024, Prudential is intensifying efforts on quality recruitment and digital platforms like PRUForce to enhance agency growth. Bancassurance performed strongly in the first half of 2024, with a 28% growth in new business profit.

The Prudential competitive landscape is shaped by its focus on the insurance industry and financial services, particularly in Asia and Africa. A Prudential market analysis reveals that the company competes with both global and regional players. Understanding Prudential's competitors is crucial for assessing its position and strategies. The company's strategic initiatives and operational efficiency are vital for maintaining its competitive edge.

- Prudential's strengths include its strong capital position, robust financial performance, and focus on high-growth markets.

- The company's challenges involve navigating competitive pressures and adapting to changing market dynamics.

- Prudential's growth strategies focus on expanding its presence in Asia and Africa, leveraging digital platforms, and enhancing operational efficiency.

- For more insights, see Brief History of Prudential.

Prudential SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Prudential?

The competitive landscape for Prudential is dynamic, encompassing a wide array of both direct and indirect rivals across its key markets in Asia and Africa. A thorough Prudential market analysis reveals that the company faces competition from global financial services and insurance giants, as well as regional players with deep local market knowledge. This competition plays out across various fronts, including pricing, product innovation, and brand recognition, influencing Prudential's competitive strategy.

Prudential's competitors challenge the company through various means, such as extensive global networks, diversified portfolios, and established distribution channels. The insurance industry is constantly evolving, with new players, particularly insurtechs, disrupting the traditional landscape. Mergers and acquisitions also shape the competitive dynamics, leading to larger entities and potential shifts in market share. For more insights into the company's operational structure, you can explore Revenue Streams & Business Model of Prudential.

While specific market share data for direct competitors in Asia and Africa wasn't available, Prudential's primary rivals span the financial services and insurance sectors, from global powerhouses to regional specialists. Understanding the competitive environment is crucial for assessing Prudential's position and future prospects. This includes evaluating its strengths and weaknesses in relation to its key competitors.

Several global entities compete with Prudential. These competitors leverage their scale and diversified offerings to challenge Prudential. Identifying these players is crucial for a comprehensive Prudential competitive landscape analysis.

Regional competitors often possess deep local market expertise and established distribution networks. These factors can significantly impact customer acquisition and retention. Understanding these regional dynamics is key to a detailed competitive analysis.

Insurtechs and other new players are constantly disrupting the market with digital-first solutions. These companies often offer personalized services and innovative approaches. Monitoring these emerging trends is vital for assessing Prudential's position in the insurance market.

Mergers and alliances play a crucial role in reshaping the competitive dynamics. These activities can lead to consolidation and the creation of larger, more formidable entities. Staying informed about these changes is essential for evaluating Prudential's financial performance compared to rivals.

Prudential's own strategic moves, such as the potential listing of its India asset management business, can alter the competitive landscape. These initiatives can influence the company's market position and growth prospects. Analyzing these strategies is key to understanding Prudential's growth strategies in a competitive market.

Identifying and leveraging competitive advantages is critical for success in the insurance industry. This includes factors such as brand recognition, product innovation, and technological advancements. Understanding competitive advantages of Prudential is essential for a comprehensive analysis.

Prudential faces competition from a diverse group of companies. These rivals challenge Prudential through various means, including pricing strategies, product innovation, and technological advancements. Here's a glimpse into the key players:

- ICICI Lombard: A major competitor in the Indian market, offering a range of insurance products.

- AXA: A global insurance giant with a broad portfolio and extensive international presence.

- HUB International: A significant player in the insurance brokerage and consulting space.

- MetLife: Another global insurance provider with a substantial market share.

- ING: A multinational financial services company with a strong presence in insurance.

- Lincoln Financial: A well-known provider of insurance and retirement solutions.

- Allianz SE: A global leader in insurance and asset management.

- Aviva Plc: A major insurance, pensions, and asset management group.

- Manulife Financial Corp.: A leading international financial services group.

Prudential PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Prudential a Competitive Edge Over Its Rivals?

Analyzing the Prudential competitive landscape reveals several key advantages. The company has a deep-rooted presence and extensive distribution networks across 24 markets in Asia and Africa. This strategic positioning allows it to capitalize on the growing demand for long-term savings and protection products in regions where insurance penetration rates are relatively low. This focus on high-growth markets is a cornerstone of its competitive strategy.

Prudential's strategic moves include significant investments in technology and refining its operating model to strengthen distribution channels. Bancassurance, for example, saw a 28% increase in new business profit in the first half of 2024. This commitment to innovation and operational efficiency is crucial for maintaining a competitive edge. A detailed Prudential market analysis shows these efforts are paying off.

The company's focus on product innovation, especially in health and protection, is another key differentiator. Prudential's pioneering use of Google Cloud's MedLM, a generative AI solution, to enhance the accuracy and efficiency of medical insurance claims, is a prime example. This technology, initially launched in Singapore and Malaysia, has doubled the automation rate of claim reviews and assessments, leading to faster processing and improved customer experience. This demonstrates how Prudential is leveraging proprietary technologies to gain an edge in the insurance industry.

Prudential's extensive network across 24 markets in Asia and Africa gives it a significant advantage. This strong presence allows the company to tap into the growing demand for insurance products in these regions. The company's distribution channels, including its agency force and bancassurance partnerships, are continually being strengthened.

The company's commitment to product innovation, particularly in health and protection, sets it apart. Prudential's use of Google Cloud's MedLM to improve medical insurance claims processing is a prime example. This focus on leveraging technology and operational efficiencies enhances its competitive position.

Prudential's robust financial health and disciplined capital management provide a strong foundation. In 2024, the company reported an 11% increase in new business profit to $3.078 billion. The company's free surplus ratio of 234% further underscores its financial stability.

Prudential actively works to improve operational variances, enhance persistency, and modernize its IT infrastructure. These efforts help to leverage economies of scale and improve overall service delivery. These improvements are key to maintaining a competitive advantage in the financial services sector.

Prudential's competitive advantages are multifaceted, encompassing a strong distribution network, product innovation, financial strength, and operational efficiency. These elements work together to create a sustainable competitive edge.

- Extensive presence in high-growth markets.

- Pioneering use of technology for claims processing.

- Robust financial health and disciplined capital management.

- Continuous efforts to improve operational efficiencies.

For more insights into Prudential's strategic approach, consider reading about the Marketing Strategy of Prudential.

Prudential Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Prudential’s Competitive Landscape?

The Prudential competitive landscape is significantly influenced by industry trends, regulatory changes, and global economic conditions. The insurance and asset management sectors are undergoing rapid transformation, driven by technological advancements and evolving customer expectations. This dynamic environment presents both challenges and opportunities for Prudential plc, requiring strategic adaptation to maintain and enhance its market position.

Prudential's future outlook is shaped by its ability to navigate these complexities and capitalize on growth opportunities, particularly in Asia and Africa. Strategic initiatives, including investments in technology and market expansion, are crucial for sustaining its competitive edge. The company's performance and strategic decisions will be key in determining its success in the evolving financial services industry.

Technological advancements, especially in AI and generative AI, are reshaping the insurance industry. Prudential is leveraging these technologies to enhance customer experiences and streamline operations. Regulatory changes, including those in mainland China, and global economic shifts also significantly impact the landscape. These factors require continuous adaptation and strategic planning.

Key challenges include navigating regulatory changes and managing the impacts of economic uncertainties. Increased regulation concerning capital and solvency standards could affect profitability. Geopolitical risks and shifts in interest rates present further challenges. These factors could affect policyholder behavior and product affordability, influencing Prudential's financial performance.

Significant growth opportunities exist in Asia and Africa, where insurance penetration rates are low, and demand for financial products is rising. Prudential is well-positioned to benefit from these structural growth drivers. The company's focus on quality growth and shareholder returns, supported by initiatives like the share buyback program, further enhances its prospects.

Prudential's strategies include a focus on quality growth, disciplined capital allocation, and enhancing shareholder returns. The accelerated $2 billion share buyback program, expected to complete by the end of 2025, is a key initiative. The potential listing of its India asset management business also highlights strategic portfolio optimization and capital return efforts.

Prudential's competitive environment is characterized by both challenges and opportunities. The company's proactive approach to technology and market expansion is crucial for its continued success. The Prudential market analysis indicates a focus on growth in key markets and strategic initiatives to enhance shareholder value.

- Prudential's AI Lab, in partnership with Google Cloud, focuses on enhancing customer, agent, and employee experiences.

- The company anticipates new business profit, earnings per share, and operating free surplus to grow by more than 10% in 2025, with a dividend increase of at least 10%.

- The accelerated $2 billion share buyback program is expected to complete by the end of 2025.

- The company's resilient performance in the first half of 2024 and strategic investments underscore its commitment to remain a growing force.

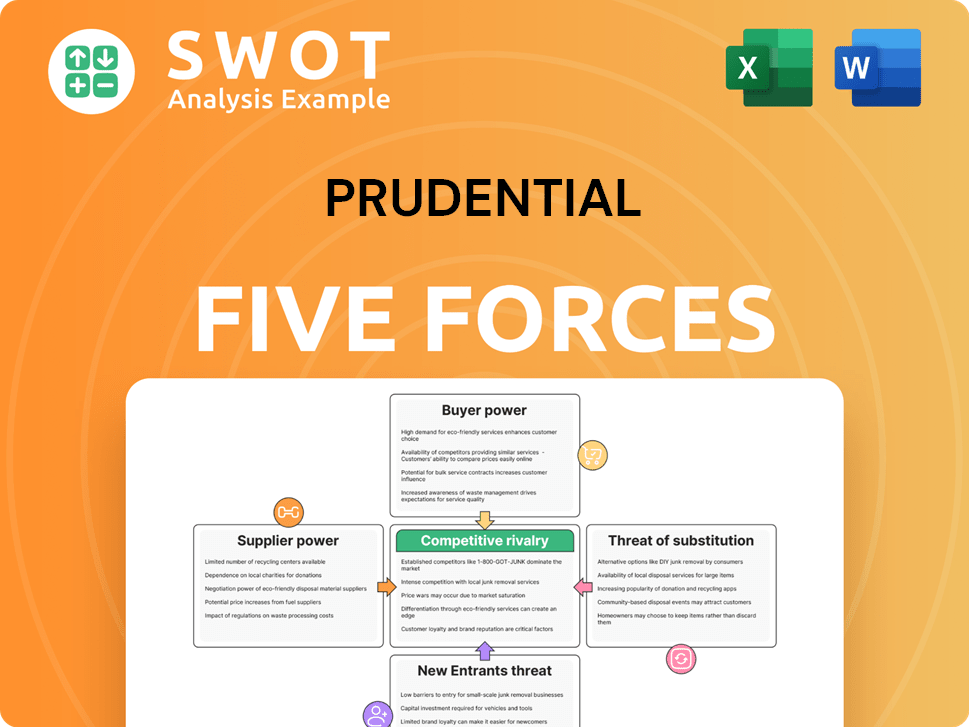

Prudential Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Prudential Company?

- What is Growth Strategy and Future Prospects of Prudential Company?

- How Does Prudential Company Work?

- What is Sales and Marketing Strategy of Prudential Company?

- What is Brief History of Prudential Company?

- Who Owns Prudential Company?

- What is Customer Demographics and Target Market of Prudential Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.