Public Storage Bundle

How Did Public Storage Revolutionize the Storage Industry?

The self-storage industry, often overlooked, has been fundamentally reshaped by Public Storage. This Public Storage SWOT Analysis reveals how a simple idea transformed into an industry giant. From its modest beginnings, the company identified a crucial need, forever changing how individuals and businesses manage their belongings.

Founded in 1972 by B. Wayne Hughes and Kenneth Volk Jr., Public Storage's journey from a temporary venture to a global leader in self-storage history is a testament to its adaptability and foresight. This brief history of Public Storage explores its evolution, key milestones, and innovative strategies that have solidified its position in the real estate market. Understanding the early days of Public Storage provides valuable insights into the company's enduring success and its impact on the storage company landscape.

What is the Public Storage Founding Story?

The story of Public Storage, a leading name in the self-storage industry, began on August 14, 1972. Founders B. Wayne Hughes and Kenneth Volk Jr. launched the company, marking the start of a significant chapter in the history of storage solutions. Their vision transformed how people manage their belongings, capitalizing on the growing need for extra space.

B. Wayne Hughes, a real estate developer, identified an opportunity in the self-storage market after observing its success in Texas. Partnering with Kenneth Volk Jr., they invested $50,000 to bring the concept to California. Initially named 'Private Storage Spaces Inc.', the company quickly evolved into what we know today as Public Storage.

The early days of Public Storage reveal a pragmatic approach to business. The initial plan was to use storage warehouses as a temporary land use. However, the market's immediate response proved the viability of the self-storage model. This pivot set the stage for the company's expansion and influence in the storage unit sector.

Public Storage was founded in 1972 by B. Wayne Hughes and Kenneth Volk Jr., starting with a $50,000 investment.

- The first warehouse, located in El Cajon, California, broke even within three months.

- Units were rented at competitive rates, offering a cost-effective alternative to other real estate options.

- The opening of the first location included a fiesta with mariachis, highlighting the company's innovative marketing approach.

- The initial customer was an STP Motor Oil distributor, showcasing the diverse needs the company aimed to meet.

The first Public Storage warehouse, built in El Cajon, California, achieved break-even within three months, with a 35% occupancy rate. This early success highlighted the profitability of the self-storage business model. The units were priced comparably to apartments or office space, yet cost significantly less to build and maintain, between 35% and 50%, demonstrating the inherent advantages of the business.

The founders' initial investment of $50,000, with each contributing $25,000, underscores their commitment. The company benefited from the economic and cultural context of the 1970s, as urbanization and consumerism increased the demand for storage. This period marked a pivotal moment for the self-storage industry.

Public Storage's early days are a testament to its innovative approach to the self-storage industry. The company's ability to identify and capitalize on market needs, as detailed in the Marketing Strategy of Public Storage article, played a crucial role in its early success. This early strategy laid the foundation for its future growth and dominance in the market.

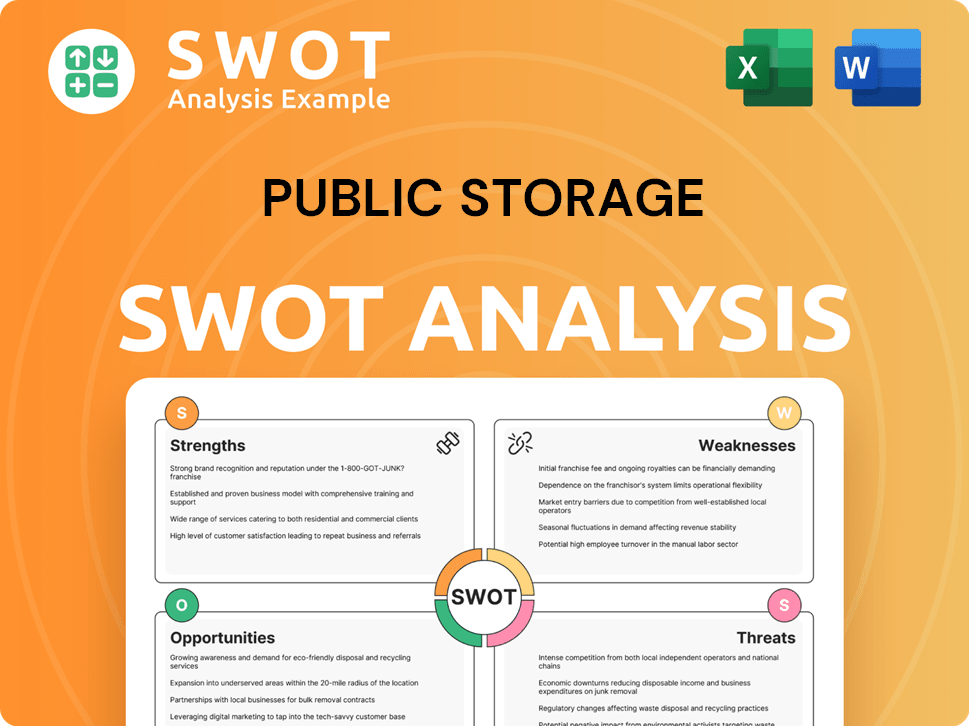

Public Storage SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Public Storage?

The early growth of Public Storage was marked by rapid expansion and strategic financial maneuvers. The company quickly established itself in the nascent self-storage market, capitalizing on the growing demand for storage units. This period saw the formation of key partnerships and the adoption of innovative financial strategies that fueled its aggressive growth trajectory. The company's early success laid the foundation for its future dominance in the self-storage industry.

In 1973, Public Storage created Public Storage Management Inc., a subsidiary for property management, streamlining its operational efficiency. By 1974, the company had already opened 20 locations, demonstrating the immediate appeal of its self-storage concept. The formation of Public Storage Partners Ltd. in 1975, a real estate limited partnership (RELP), was pivotal in securing capital for expansion, with its first $3 million deal closing in 1977.

The use of RELPs was a cornerstone of Public Storage's early financial strategy, enabling it to raise significant capital for rapid growth. Between 1978 and 1989, the company successfully raised approximately $3 billion from over 200,000 investors. This influx of capital allowed the company to build a vast network of miniwarehouses, reaching 1,000 locations by 1989.

A major shift occurred in 1980 when Public Storage established Storage Equities, a self-storage REIT, to acquire self-storage facilities. This transition to a real estate investment trust (REIT) model was a strategic move. The company concentrated its efforts on major metropolitan areas, targeting the 39 largest cities and opening as many as 100 new centers annually.

In 1995, Public Storage and its subsidiaries merged with Storage Equities Inc., restructuring as a single publicly traded REIT under the name Public Storage Inc. This consolidation strengthened its financial position and streamlined operations. By 1998, the company reported quarterly revenues of $141 million, with assets valued at $2 billion, and operated 1,200 facilities across 38 states. The company's strategic approach and financial acumen allowed it to achieve a dominant market position, as highlighted in this article about the Target Market of Public Storage.

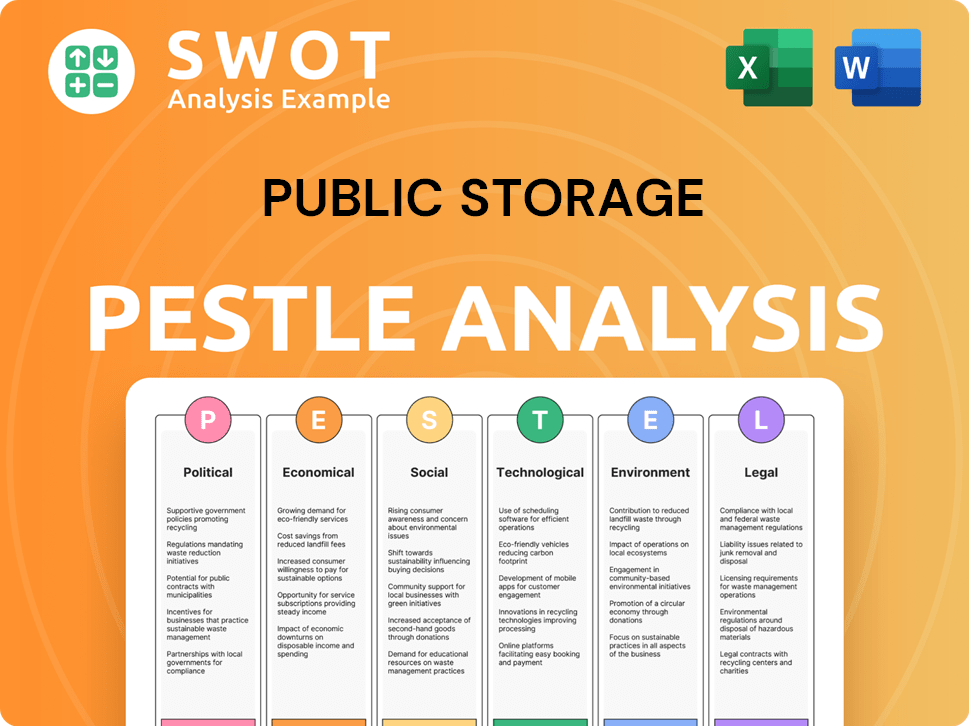

Public Storage PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Public Storage history?

The journey of Public Storage, a prominent player in the self-storage industry, has been marked by significant milestones, strategic innovations, and the navigation of various market challenges. From its early days, the company has evolved into a leading provider of storage units, shaping the self-storage history and impacting the broader real estate landscape. Understanding the Public Storage company timeline provides valuable insights into its growth and strategic decisions.

| Year | Milestone |

|---|---|

| 1980 | Public Storage went public with its Initial Public Offering (IPO), which provided capital for expansion. |

| 2006 | Acquired Shurgard Storage Centers for $5.5 billion, adding 624 locations, including 141 in Europe. |

| 2024 | Completed the multi-year, $600 million 'Property of Tomorrow' program. |

| 2025 | Added 4.7 million net rentable square feet to its portfolio for $750.9 million through acquisitions or contracting of 69 self-storage facilities since the start of the year. |

Public Storage has consistently embraced technological advancements to enhance its operational efficiency and customer experience. These efforts have been instrumental in improving customer satisfaction and reducing operational costs.

Recent digital transformation efforts have led to a 30% reduction in on-property labor hours. As of March 2025, 85% of customer interactions are digital, showcasing a strong commitment to leveraging technology.

The 'Property of Tomorrow' program, completed in 2024, is expected to increase annual retained cash flow from $400 million in 2024 to approximately $600 million in 2025. This demonstrates a focus on operational discipline and financial performance.

Technological investments have improved customer experience. The company's focus on digital interactions and streamlined processes enhances convenience for customers.

Despite its successes, Public Storage has faced challenges, including economic downturns and increased competition within the self-storage industry. The competitive landscape and fluctuating market conditions have prompted strategic adjustments.

In Q4 2024, the company experienced a decline in same-store revenues due to lower occupancy rates, a trend that continued into Q1 2025. Move-in rates decreased by 5% between Q4 2024 and Q1 2025, with an additional 8% drop in April 2025.

The self-storage industry has seen asking rents decline year-over-year in H2 2024, though signs of stabilization appeared in Q1 2025. Oversupply in certain markets has also put pressure on rental rates and occupancy.

Rising interest rates have increased borrowing costs for expansion and development, creating headwinds. These factors have influenced the company's strategic approach.

The competitive landscape within the self-storage sector has intensified. This has led to the need for strategic pricing initiatives and operational efficiencies to maintain market leadership.

Economic downturns have impacted revenue growth and occupancy rates. Public Storage has adapted to these challenges through strategic pricing and operational adjustments.

Public Storage focuses on strategic pricing initiatives and maintaining market leadership. The company's financial strength, demonstrated by its robust balance sheet and dividend payments, supports its resilience.

To overcome these challenges, Public Storage has focused on strategic pricing and maintaining market leadership. This aligns with broader industry trends. For more insights into the company's values and mission, explore Mission, Vision & Core Values of Public Storage.

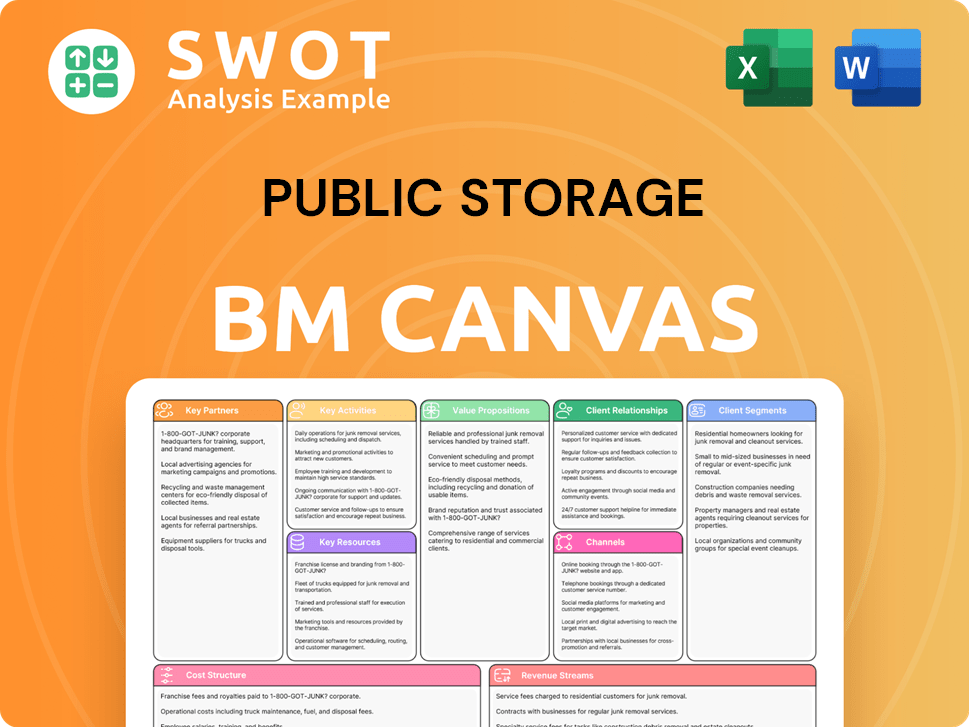

Public Storage Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Public Storage?

The Revenue Streams & Business Model of Public Storage has a rich history, marked by strategic expansions and financial milestones. From its inception in 1972 as Private Storage Spaces Inc. to becoming a leading self-storage company, the journey of this storage company showcases significant growth and adaptation within the storage units industry. Here's a brief history of Public Storage.

| Year | Key Event |

|---|---|

| 1972 | B. Wayne Hughes and Kenneth Volk Jr. founded Public Storage in Pomona, California, starting with the first self-storage warehouse in El Cajon, California. |

| 1973 | Public Storage Management Inc., a property management subsidiary, was established. |

| 1975 | The company formed its first real estate limited partnership (RELP), Public Storage Partners Ltd. |

| 1979 | Public Storage expanded internationally, opening its first location in Brampton, Ontario, Canada. |

| 1980 | Public Storage became a publicly traded company. |

| 1986 | PS Business Parks was organized as a division. |

| 1989 | Public Storage grew to 1,000 locations. |

| 1995 | Public Storage merged with Storage Equities Inc., restructuring as a single REIT, Public Storage Inc. |

| 2005 | Public Storage was added to the S&P 500. |

| 2006 | The company acquired Shurgard Storage Centers in a $5.5 billion transaction, adding 624 locations. |

| 2010 | Public Storage Canada became a fully independent Canadian enterprise. |

| 2024 | Public Storage reported total revenues of approximately $4.5 billion and completed the $600 million 'Property of Tomorrow' program. |

| Q1 2025 | The company reported net income of $2.04 per diluted share and Core FFO of $4.12 per diluted share, with revenues reaching $1.18 billion. |

| May 2025 | Public Storage acquired or contracted 69 self-storage facilities, adding 4.7 million net rentable square feet to its portfolio for $750.9 million since the start of 2025. |

Public Storage anticipates continued growth and operational efficiency. The company's guidance for 2025 indicates a core FFO per share range of $16.35 to $17.00, despite an expected 3.25% growth in same-store expenses driven by property taxes. The company plans to enhance growth through a $740 million development pipeline.

Strategic initiatives include continued investment in technology, such as digital transformation and AI-powered solutions, to streamline operations and enhance customer engagement. Public Storage is focusing on expanding its footprint and enhancing facility offerings, expecting to drive future growth and shareholder value.

The self-storage industry is poised for a strategic comeback in 2025, with national average street rates for self-storage units showing signs of stabilization and modest rebounds after trending downward through 2023. Occupancy levels have largely plateaued at healthy levels, with average occupancy at major self-storage REITs hovering around 91% by Q4 2024.

A survey in late 2024 revealed that 37% of Americans are planning or considering a move within the next 6-12 months, which is expected to drive a rebound in self-storage demand in 2025. Analyst sentiment towards Public Storage is cautiously optimistic, supported by its strong market position and growth potential.

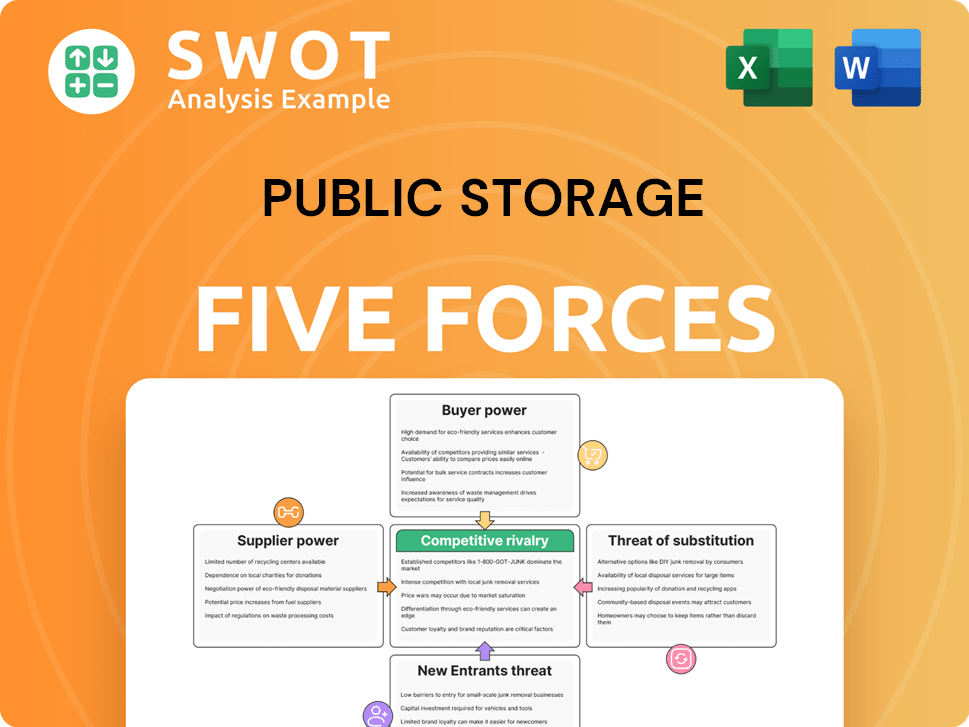

Public Storage Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Public Storage Company?

- What is Growth Strategy and Future Prospects of Public Storage Company?

- How Does Public Storage Company Work?

- What is Sales and Marketing Strategy of Public Storage Company?

- What is Brief History of Public Storage Company?

- Who Owns Public Storage Company?

- What is Customer Demographics and Target Market of Public Storage Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.