Public Storage Bundle

How Does Public Storage Thrive in the Self-Storage Market?

Public Storage, a powerhouse in the real estate investment trust (REIT) world, has redefined the self storage industry. With a market cap of approximately $52.88 billion as of Q1 2025, the company continues to innovate, offering flexible and secure storage solutions nationwide. Public Storage's impressive financial performance, with $4.7 billion in revenue for 2024, underscores its strategic adaptability and market dominance.

This in-depth analysis explores the inner workings of Public Storage, examining its core operations, revenue streams, and strategic initiatives. Investors and industry watchers alike need to understand the nuances of this successful Public Storage SWOT Analysis to make informed decisions. We'll cover everything from the public storage rental process to the various storage unit sizes and security features offered.

What Are the Key Operations Driving Public Storage’s Success?

Public Storage delivers value by offering diverse self-storage solutions to both individuals and businesses. It serves as a crucial resource during life transitions, decluttering, or business inventory management. The company's core offerings include a wide range of storage unit sizes and features, available on a monthly lease, catering to a broad customer base.

The company focuses on providing accessible and convenient storage options, typically operating facilities within a 3-5-mile radius of densely populated urban centers. This strategic placement enhances accessibility, making it easier for customers to access their stored belongings. The operational model is designed to meet the needs of a diverse customer base, from residential users needing extra space to businesses requiring inventory storage.

The company's operational strategy centers on owning and managing storage facilities. Key processes include site planning, land acquisition, facility development, and ongoing operations, which encompasses continuous maintenance and expansion. This approach allows for direct control over the quality of service and the customer experience, ensuring consistency across its locations. For more details on the company's origins, check out Brief History of Public Storage.

Public Storage provides a variety of storage unit sizes, from small lockers to large spaces, to accommodate different needs. These storage units are available on a monthly lease, offering flexibility for customers. The wide range of sizes ensures customers can find the perfect fit for their belongings, whether it's household items, business inventory, or seasonal equipment.

Locations are strategically placed near urban centers for easy access. This accessibility is a key factor in attracting and retaining customers. The convenient locations make it easier for customers to manage their storage needs without having to travel long distances.

The company utilizes advanced technology for security and management. This includes integrating surveillance systems and smart locks. User-friendly online platforms are provided for reservations, payments, and account management, enhancing the overall customer experience.

Additional services like packing supplies and insurance products are offered. These services provide customers with a comprehensive storage solution. This approach helps to meet a wider range of customer needs, making the company a one-stop shop for moving and storage.

The average rental duration is approximately 12.4 months, indicating a strong customer retention rate. The average monthly rental rate per unit is about $149.23. Digital customer interactions account for 85% in Q1 2025, showing a significant shift towards online services.

- Strategic location of facilities near urban centers enhances convenience and accessibility.

- Technological advancements include advanced security systems and user-friendly online platforms.

- Value-added services such as packing supplies and insurance products provide comprehensive storage solutions.

- Extensive network with thousands of locations across the United States.

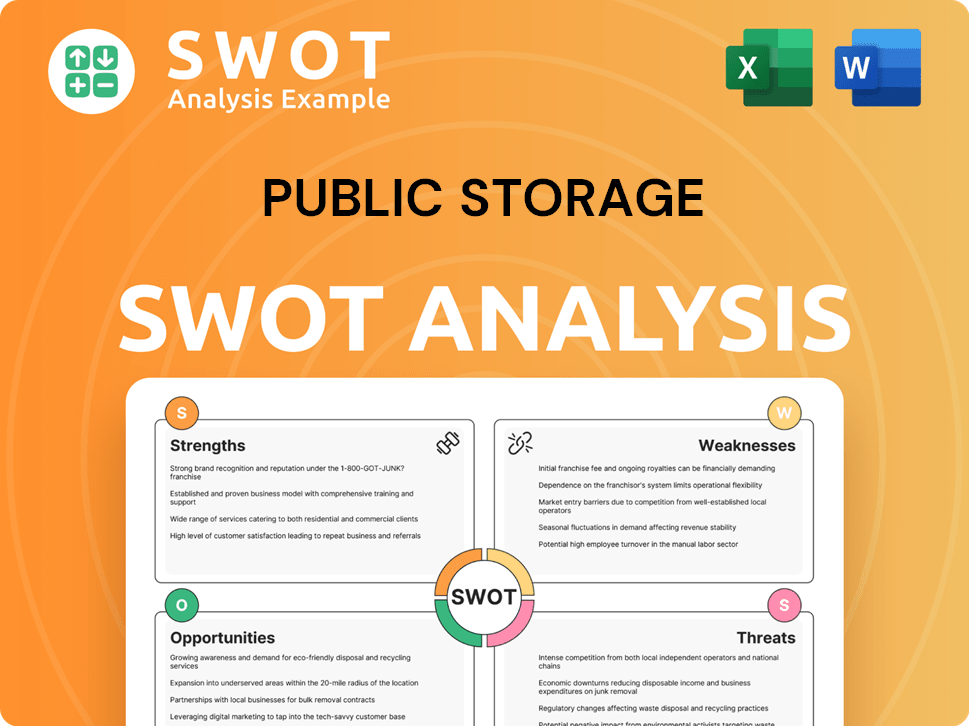

Public Storage SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Public Storage Make Money?

The core of [Company Name]'s financial success lies in its ability to generate revenue through self-storage units. These facilities provide secure spaces for individuals and businesses to store their belongings. Understanding how the company monetizes its services is key to evaluating its financial performance and growth potential.

In addition to rental income, [Company Name] has diversified its revenue streams to include ancillary services. These additional offerings enhance the customer experience and contribute significantly to the company's overall financial health. This strategy allows the company to capture more value from each customer interaction.

For the three months ended March 31, 2025, self-storage facilities brought in $1,102.99 million in revenue. Ancillary operations, such as packing supplies and tenant insurance, added $80.186 million to the top line during the same period. This is an increase from the $71.175 million generated in the first quarter of 2024.

- Promotional Offers: The company uses competitive introductory rates to attract new customers, such as 'first month free' for larger units or 50% off the first two months for online bookings. Administrative fees are also waived for new rentals.

- Rate Increases: While promotions attract new customers, the company also strategically implements rate increases for existing tenants to boost revenue.

- Digital Marketing: Digital marketing efforts are a key component of the monetization strategy, with an investment of $42.3 million in 2023. These campaigns target specific customer segments through platforms like Google Ads and Facebook Ads.

- Customer Acquisition: Approximately 67% of new storage customers in 2024 were sourced through 'unpaid' and 'paid' search campaigns on Google, demonstrating the effectiveness of the digital marketing strategy.

To learn more about the company's approach, consider reading about the Growth Strategy of Public Storage.

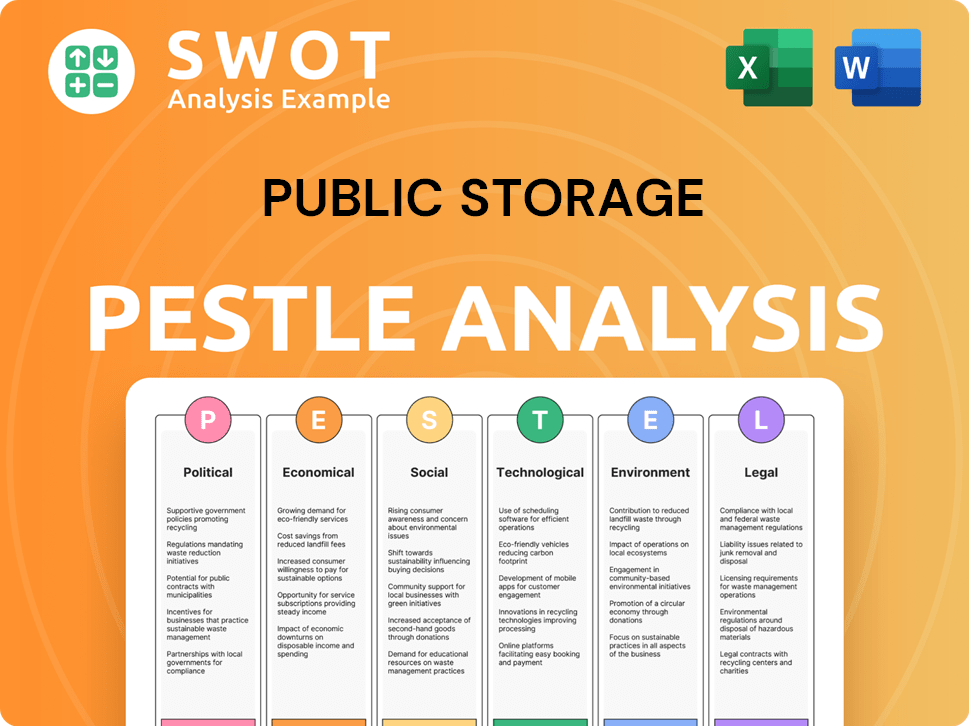

Public Storage PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Public Storage’s Business Model?

The evolution of Public Storage, a leader in the self storage industry, showcases strategic moves and significant milestones. Recent developments, such as the non-binding offer to acquire Abacus Storage King, highlight its ambition for geographical expansion. This, coupled with past acquisitions and internal initiatives, underscores its commitment to growth and operational excellence.

One of the most important moves was the acquisition of Simply Self Storage in September 2023 for $2.2 billion, adding a substantial number of properties and rentable square footage to its portfolio. Moreover, the completion of the 'Property of Tomorrow' program is expected to significantly boost annual retained cash flow, demonstrating a focus on future profitability and efficiency. These strategic actions are key components of how Public Storage works.

Despite facing challenges like a decline in move-in rates, Public Storage maintains a strong financial position. Its competitive edge stems from brand recognition, an extensive network, and technological integration, which collectively support its business model and ensure its continued success in the storage units market. Understanding these factors provides insight into the company's operational strategy and its approach to providing storage solutions.

The acquisition of Simply Self Storage in September 2023 for $2.2 billion added 127 properties to the Public Storage portfolio. The 'Property of Tomorrow' program, a $600 million investment, is projected to increase annual retained cash flow. Public Storage's strategic moves have been instrumental in shaping its market position.

The non-binding offer to acquire Abacus Storage King signals an intent to expand its footprint. The company's focus on technological integration, with digital property access at all locations, enhances operational efficiency. These moves are vital to understanding how does Public Storage work.

Public Storage benefits from strong brand recognition and an extensive network of over 2,800 properties. The company's high return on equity of 33% and a gross profit margin of 73% in Q1 2025 demonstrate its financial strength. These factors contribute to its competitive advantage in the self storage market.

The company's operational expense control has helped to maintain a robust gross profit margin. Despite a decline in move-in rates, Public Storage has maintained a strong financial position. The company's financial health is a key factor in its long-term success.

Public Storage's strategic initiatives and financial performance demonstrate its commitment to growth and operational excellence. The company's ability to adapt to market changes, such as the decline in move-in rates, while maintaining a strong financial position, highlights its resilience. For more insights into the company's financial structure, explore Owners & Shareholders of Public Storage.

- The company completed its 'Property of Tomorrow' program, enhancing operational efficiency.

- Public Storage has a strong brand recognition and a vast network of storage facilities.

- The company's high return on equity and gross profit margin reflect effective expense control.

- Technological integration, such as digital property access, improves customer experience.

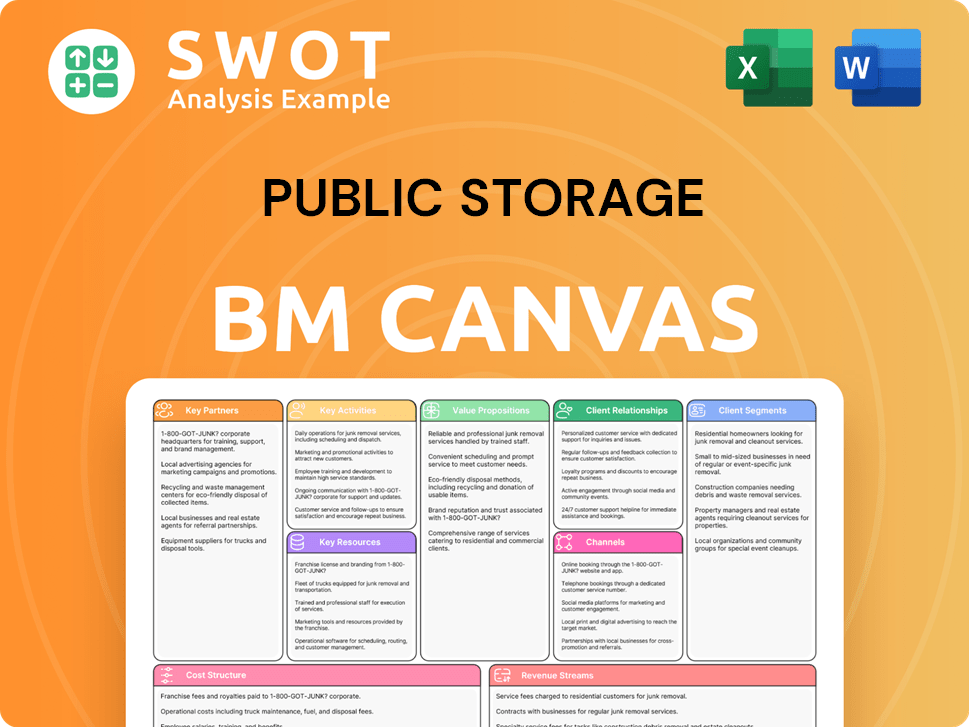

Public Storage Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Public Storage Positioning Itself for Continued Success?

As a leading player in the self storage industry, Public Storage holds a significant market position. It is one of the largest self-storage brands globally and the biggest owner of self-storage space in the U.S., with an impressive 11.4% market share among the top 10 companies. The company's strong brand recognition and extensive network contribute to high customer loyalty, with approximately 81% of users considering themselves loyal.

However, Public Storage faces several risks and headwinds. Macroeconomic factors, such as migration patterns and home affordability, can influence demand for storage units. The influx of new supply into the market could potentially reduce pricing power. Operational risks include rising wage costs, higher property taxes, and increased development expenses. Competitive pressures also play a role, with move-in rents expected to decrease by around 5% year-over-year in 2025. Furthermore, regulatory changes, such as pricing limitations in emergency situations, can negatively impact revenue.

Public Storage maintains a dominant position in the self storage sector. Its vast network and brand reputation foster customer loyalty. The company's extensive reach and brand recognition are key strengths in a competitive market.

The company faces macroeconomic challenges that can affect demand for storage units. Increased competition and operational costs pose risks. Regulatory changes can also impact revenue streams, creating uncertainty.

Public Storage plans portfolio optimization and expansion. The company anticipates higher acquisition volumes and a significant development pipeline. They aim to enhance operational efficiency and customer experience through technology.

Public Storage expects same-store net operating income growth between +0.2% to -2.9% in 2025. The company's 2025 outlook for core FFO per share is between $16.35 and $17.00. They will focus on development, strategic acquisitions, and operational improvements.

Public Storage's strategic focus for 2025 includes portfolio optimization and expansion. They are looking to increase acquisition volumes and have a robust development pipeline. The company is also focused on enhancing operational efficiency and customer experience through technology.

- Disciplined capital allocation for acquisitions and developments.

- Development pipeline expected to add 3.7 million square feet.

- Focus on improving customer experience through technological advancements.

- Continued development, strategic acquisitions, and operational enhancements.

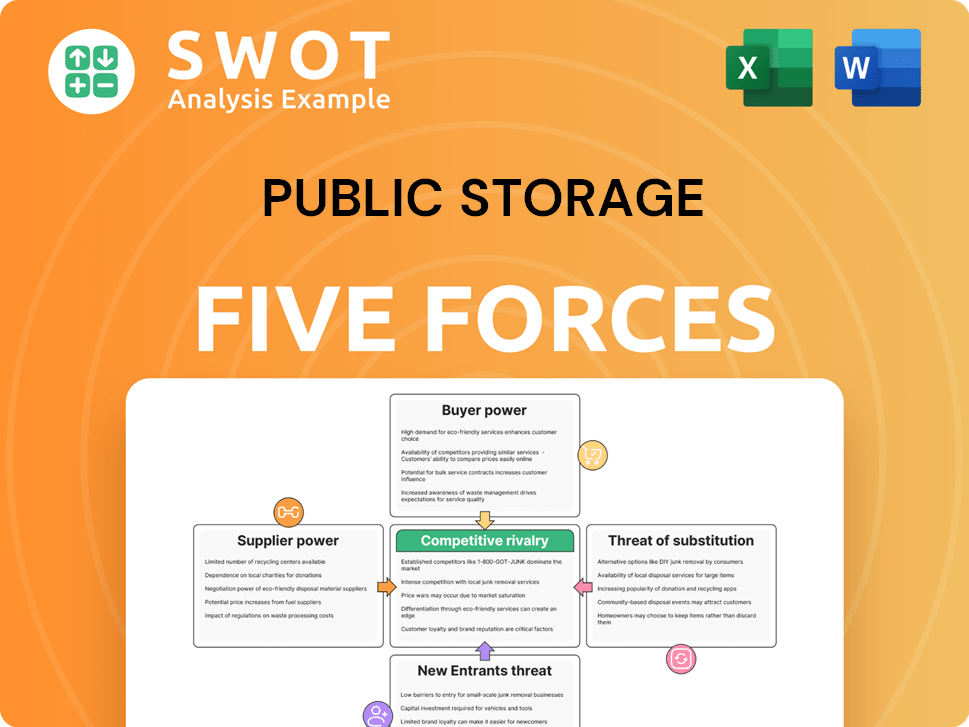

Public Storage Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Public Storage Company?

- What is Competitive Landscape of Public Storage Company?

- What is Growth Strategy and Future Prospects of Public Storage Company?

- What is Sales and Marketing Strategy of Public Storage Company?

- What is Brief History of Public Storage Company?

- Who Owns Public Storage Company?

- What is Customer Demographics and Target Market of Public Storage Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.