Public Storage Bundle

Can Public Storage Maintain Its Dominance in the Self-Storage Sector?

Public Storage, a leading Public Storage SWOT Analysis, has long been synonymous with secure and convenient storage solutions. But how has this real estate investment trust (REIT) achieved such remarkable growth, and what strategies will it employ to stay ahead? This exploration dives into the core of Public Storage's expansion, examining its historical successes and forward-looking plans.

From its inception in 1972, Public Storage has strategically navigated the self-storage industry, consistently adapting to changing market dynamics. Its impressive growth is a result of smart acquisitions and a keen focus on market expansion, setting the stage for continued success. Understanding the company's future prospects requires a deep dive into its growth strategy, technological advancements, and financial planning. This Self-Storage Company Analysis provides insights into how Public Storage intends to capitalize on Self-Storage Industry Trends and solidify its position as a leader in the Storage Market Expansion.

How Is Public Storage Expanding Its Reach?

The Public Storage Growth Strategy heavily relies on a multi-faceted approach to expansion. This includes entering new markets, strategic acquisitions, and developing new facilities. The company continually seeks out new geographical markets, particularly those with strong population growth and favorable demographic trends, to attract new customers. This strategy is crucial for the company's long-term success in the Self-Storage Industry Trends.

A key aspect of their expansion strategy involves acquiring existing self-storage facilities. This approach allows for rapid portfolio growth and increased market presence. Furthermore, the company is actively involved in developing new self-storage facilities and expanding existing ones. These initiatives are aimed at diversifying revenue streams and enhancing market density in key regions, ensuring the company stays ahead of evolving industry changes.

The company also focuses on redeveloping existing properties to optimize space utilization and improve the customer experience. Public Storage's international presence, particularly in Europe through its Shurgard brand, also represents a significant avenue for future expansion. The company is consistently adapting to changing consumer needs, which is a key factor in its Self-Storage Company Analysis.

Public Storage actively identifies and enters new geographical markets. This is particularly true for areas with strong population growth and favorable demographics. This strategy helps to access new customer bases and broaden the company's reach. This expansion is a key part of their strategy for Storage Market Expansion.

A significant part of Public Storage's growth involves acquiring existing self-storage facilities. In 2024, the company acquired Simply Self Storage from Blackstone Real Estate Income Trust, Inc. (BREIT) for $2.2 billion. This added 127 properties across 18 states. This acquisition added 17.5 million net rentable square feet to their portfolio.

Public Storage is actively engaged in developing new self-storage facilities and expanding existing ones. In the first quarter of 2024, the company invested $156.0 million in development and expansion activities. This investment demonstrates a continued commitment to organic growth. These initiatives are driven by the desire to diversify revenue streams.

Public Storage's international presence, particularly in Europe through its Shurgard brand, represents a significant avenue for future expansion. Shurgard is opening new stores and expanding existing ones in major European cities. The company plans to open 24 new stores in Europe in 2024, adding 1.3 million net rentable square feet.

Public Storage's expansion strategy involves multiple key initiatives, including market penetration, strategic acquisitions, and facility development. These strategies are designed to drive revenue growth and increase market share. The company's focus on acquisitions and new developments is key to its long-term success as a Real Estate Investment Trusts (REITs).

- Acquiring existing properties to quickly expand the portfolio.

- Developing new facilities to meet growing demand.

- Expanding existing facilities to optimize space and increase revenue.

- Focusing on international expansion, particularly in Europe.

The company's expansion plans are also influenced by the broader economic environment. Factors such as interest rates, consumer spending, and overall economic growth can impact the demand for self-storage services. Public Storage's ability to adapt to changing market conditions is crucial for its continued success. For more insights into the company's core values and mission, consider reading Mission, Vision & Core Values of Public Storage.

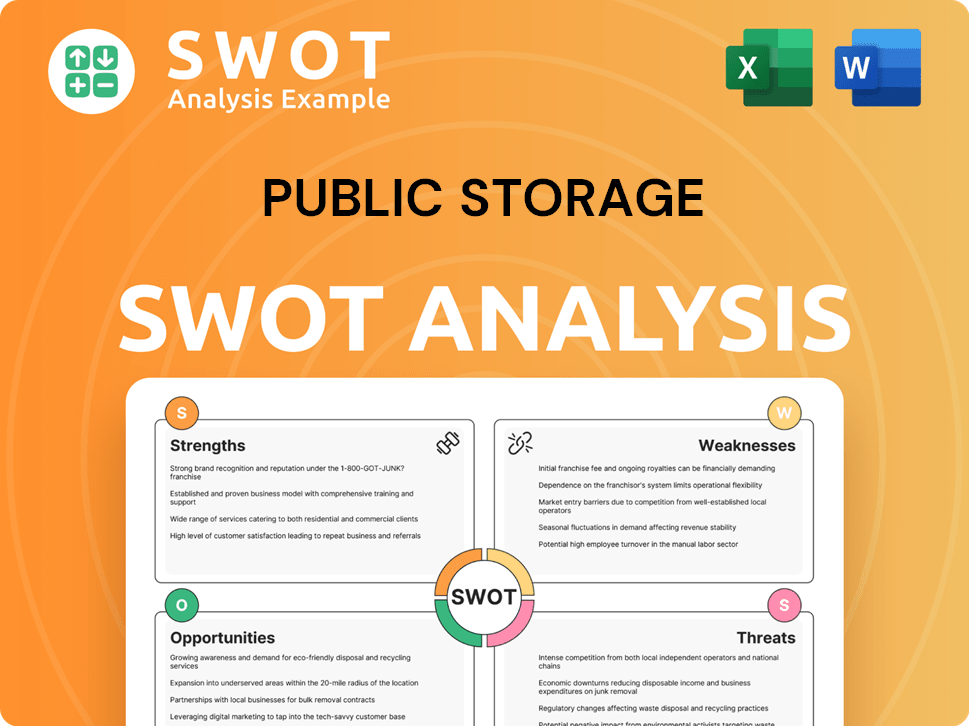

Public Storage SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Public Storage Invest in Innovation?

The company strategically uses technology and innovation to foster growth, boost operational efficiency, and improve customer experience. Its digital transformation is evident in its online presence and customer-facing technologies. This includes online rental platforms, digital payment systems, and mobile applications, streamlining the customer journey.

These digital tools support growth objectives by making storage more accessible and convenient, attracting a broader customer base. The focus on operational efficiency suggests ongoing investment in smart facility management, security systems, and potentially AI-driven demand forecasting. The company's commitment to sustainability is also a growing area of focus, implementing energy-efficient solutions and environmentally friendly practices.

This approach aligns with corporate social responsibility and can lead to cost savings, attracting environmentally conscious customers. Continuous investment in digital infrastructure and operational technology underpins its ability to manage its vast portfolio efficiently and provide a seamless customer experience, which are crucial for sustained growth in a competitive market. For more insights, consider reading about Owners & Shareholders of Public Storage.

The company offers robust online rental platforms. These platforms allow customers to easily browse available units, check prices, and complete the rental process from anywhere, at any time.

Digital payment systems are integrated to offer convenience. Customers can make payments online, through mobile apps, or via automated systems, ensuring a smooth and efficient payment process.

Mobile applications enhance customer experience. These apps provide features such as account management, payment scheduling, and access to facility information, making it easier for customers to manage their storage needs.

Smart facility management systems are used to optimize operations. This includes automated access control, security monitoring, and energy management, enhancing efficiency and security.

AI-driven demand forecasting helps in optimizing occupancy rates and pricing strategies. By analyzing market trends and customer behavior, the company can better predict demand and adjust its offerings accordingly.

Sustainability initiatives include implementing energy-efficient solutions and environmentally friendly practices. These efforts not only reduce costs but also appeal to environmentally conscious customers, enhancing the company's brand image.

The company's focus on technology and innovation is crucial for its

The company's approach to innovation and technology is multifaceted, focusing on enhancing operational efficiency, improving customer experience, and promoting sustainability. These strategies are critical for maintaining a competitive edge and driving long-term growth within the

- Digital Transformation: Investments in online rental platforms, digital payment systems, and mobile applications to streamline the customer journey.

- Smart Facility Management: Implementation of automated access control, security monitoring, and energy management systems to optimize operations and reduce costs.

- AI and Data Analytics: Utilization of AI-driven demand forecasting and data analytics to improve occupancy rates, pricing strategies, and overall decision-making.

- Sustainability Initiatives: Adoption of energy-efficient solutions and environmentally friendly practices to reduce environmental impact and attract eco-conscious customers.

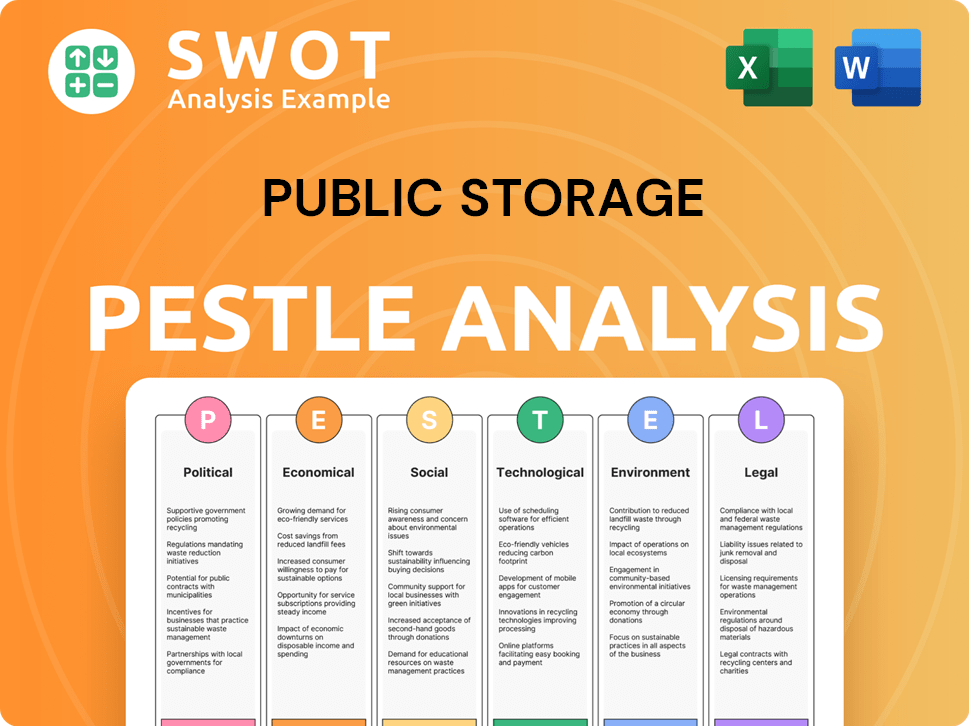

Public Storage PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Public Storage’s Growth Forecast?

The financial outlook for Public Storage is robust, supported by strong revenue growth and strategic capital allocation. In Q1 2024, the company demonstrated its financial strength with a 1.6% increase in total revenues, reaching $1.03 billion compared to the same period in 2023. This growth was primarily driven by increased rental income per occupied square foot, showcasing effective management of its existing portfolio.

The company's net income attributable to common shareholders in Q1 2024 was $548.8 million, or $3.12 per diluted common share, reflecting solid profitability. Public Storage's strategy includes leveraging its strong financial position for acquisitions and development, as evidenced by the $2.2 billion acquisition of Simply Self Storage in early 2024. This acquisition is a key element of its Public Storage Growth Strategy.

Funds from Operations (FFO), a critical metric for REITs, were $3.46 per diluted common share in Q1 2024, indicating a healthy cash flow generation. This financial performance positions the company well for future expansion and navigating potential economic fluctuations. The company's disciplined approach to growth, coupled with its ability to generate strong cash flows, supports its long-term investment outlook.

Public Storage's Q1 2024 revenue reached $1.03 billion, a 1.6% increase year-over-year. Net income for the same period was $548.8 million. These figures highlight the company's ability to maintain and grow its revenue streams.

The acquisition of Simply Self Storage for $2.2 billion in early 2024 is a significant step in expanding the company's portfolio. This move is a key component of the company's Storage Market Expansion strategy.

FFO per diluted common share was $3.46 in Q1 2024. This metric is crucial for assessing the financial health of REITs, demonstrating Public Storage's strong cash flow generation.

The company is focused on maximizing shareholder value through consistent dividend payments. This strategy is supported by its strong financial performance and disciplined capital allocation.

Public Storage's revenue growth is primarily driven by higher average realized annual rent per occupied square foot. This reflects effective pricing strategies and strong demand within the Self-Storage Industry Trends.

The company's strong balance sheet allows for strategic acquisitions and continued development. The Simply Self Storage acquisition is a prime example of capital deployment for expansion.

Public Storage is committed to maximizing shareholder value through consistent dividend payments. This is a key element of its financial strategy, supported by its robust financial performance.

Public Storage's financial ambitions align with its historical performance and industry benchmarks. The company maintains a disciplined approach to growth, balancing expansion with profitability.

The company's ability to generate strong cash flows positions it well to fund future expansion initiatives. This financial strength allows it to navigate potential economic fluctuations effectively.

The company's strategic acquisitions and disciplined financial management support its Public Storage Future Prospects. The focus remains on sustainable growth and maximizing returns.

Public Storage's financial performance is underpinned by several key metrics. These metrics provide insights into the company's operational efficiency and strategic direction.

- Revenue Growth: A 1.6% increase in total revenues in Q1 2024.

- Net Income: $548.8 million in net income attributable to common shareholders in Q1 2024.

- Funds From Operations (FFO): $3.46 per diluted common share in Q1 2024.

- Strategic Acquisitions: The acquisition of Simply Self Storage for $2.2 billion.

- Dividend Payments: Consistent dividend payments to maximize shareholder value.

For a deeper dive into the company's marketing strategies, consider exploring the Marketing Strategy of Public Storage.

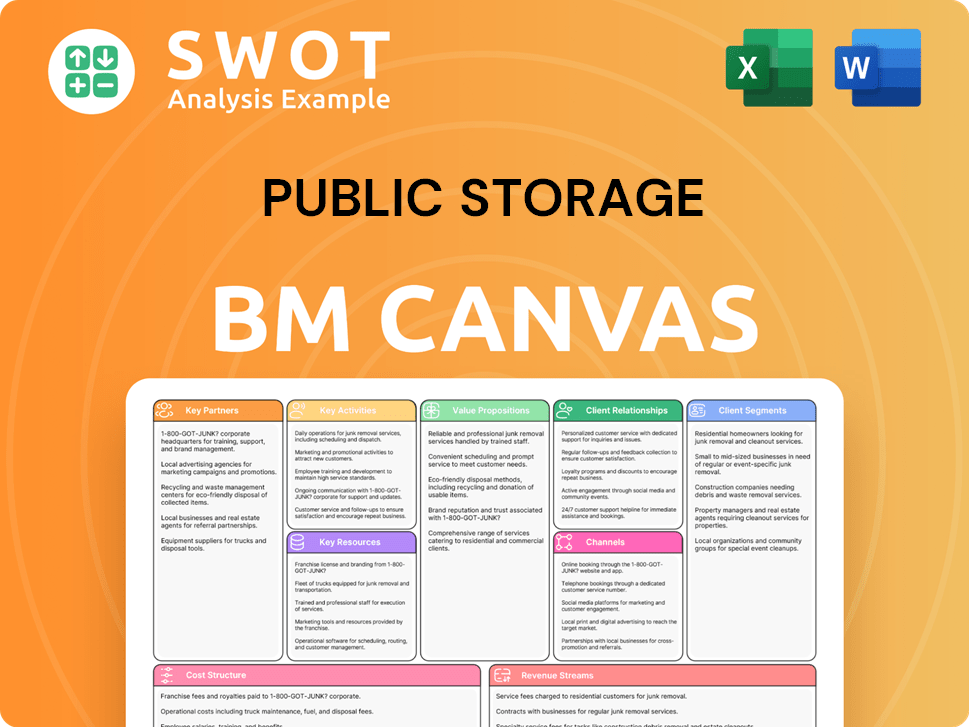

Public Storage Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Public Storage’s Growth?

The self-storage industry, despite its growth, presents several challenges for companies like Public Storage. These challenges range from intense competition to the need to adapt to technological changes and evolving customer demands. Understanding these risks is crucial for assessing the long-term viability and growth potential of Public Storage.

Market competition remains a significant hurdle. The presence of numerous smaller players and other large REITs can lead to pricing pressures and impact occupancy rates. Additionally, regulatory changes and economic downturns can also pose risks to Public Storage's expansion and financial performance.

Public Storage faces potential obstacles that could influence its future trajectory. These include competition, regulatory hurdles, technological disruptions, and economic fluctuations. The company's ability to navigate these challenges will be critical to its continued success.

The self-storage market is highly fragmented, with numerous competitors, including smaller local operators and other large REITs. This intense competition can lead to pricing wars and decreased occupancy rates, affecting revenue. Public Storage's market share, while significant, is constantly challenged by these competitors.

Local zoning laws, permit requirements, and environmental regulations can create obstacles for new developments and expansions. These regulatory hurdles can increase project costs and delays, impacting the company's growth plans. Compliance with these regulations is essential for Public Storage to maintain its operations.

The self-storage industry is increasingly influenced by technological advancements, including online booking systems and automated access. Failure to adopt and integrate these technologies could lead to a loss of competitiveness. Public Storage must invest in technology to meet evolving customer expectations and maintain market relevance.

Economic downturns can impact consumer spending and demand for storage, leading to lower occupancy rates and reduced revenue. Shifts in remote work trends, affecting urban migration patterns, could also influence demand. Public Storage must be prepared to adapt to economic fluctuations.

Supply chain issues can affect construction timelines and costs for new facilities. Delays in obtaining materials or increased construction expenses can hinder expansion plans. Public Storage needs to manage these risks to ensure timely completion of its projects.

Availability of skilled personnel for property management and development can be a constraint. Finding and retaining qualified staff is crucial for efficient operations and expansion. Public Storage must invest in employee training and development to mitigate this risk.

Public Storage mitigates these risks through diversification across geographic markets and property types. They have robust risk management frameworks and employ scenario planning to anticipate market shifts. The company's extensive portfolio offers some protection from localized market downturns.

The company's long-standing success in a dynamic market demonstrates its ability to adapt and overcome challenges. Public Storage consistently adjusts its strategies to meet changing consumer needs and market conditions. They have been actively involved in Revenue Streams & Business Model of Public Storage.

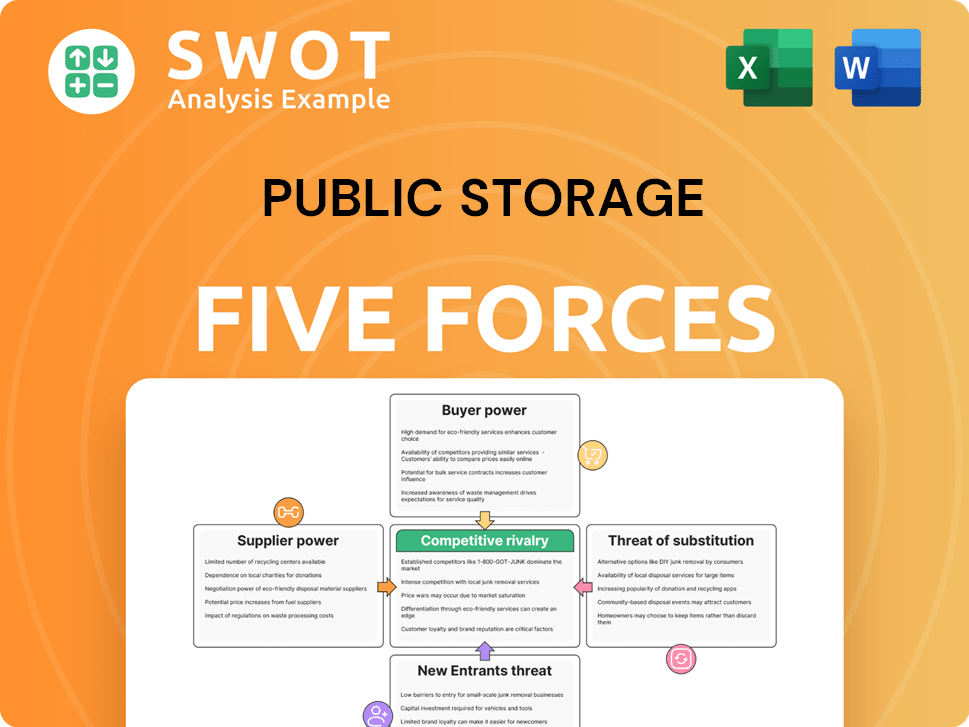

Public Storage Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Public Storage Company?

- What is Competitive Landscape of Public Storage Company?

- How Does Public Storage Company Work?

- What is Sales and Marketing Strategy of Public Storage Company?

- What is Brief History of Public Storage Company?

- Who Owns Public Storage Company?

- What is Customer Demographics and Target Market of Public Storage Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.