Regal Rexnord Bundle

How Did Regal Rexnord Become an Industrial Powerhouse?

Embark on a journey through the Regal Rexnord SWOT Analysis and discover the captivating story of Regal Rexnord, a global leader in engineered motion control. From its foundational roots to its current status, the company's evolution is a testament to strategic foresight and a commitment to innovation. Explore the key milestones that have shaped this industrial manufacturing giant.

The Regal Rexnord history is a story of transformation, marked by strategic shifts and a relentless pursuit of excellence. This Rexnord company has evolved significantly, moving beyond its initial focus to become a major player in industrial power transmission and automation. Understanding the Regal Rexnord company background and company timeline reveals the factors behind its impressive financial performance and industry leadership.

What is the Regal Rexnord Founding Story?

The story of Regal Rexnord is one of strategic growth through mergers and acquisitions, shaping it into the industrial powerhouse it is today. While pinpointing a single founding date is complex, the company's modern form emerged significantly from the October 2021 merger of Regal Beloit Corporation and Rexnord Corporation's Process & Motion Control (PMC) business.

This union combined two established players in the industrial sector, bringing together their expertise in electric motors, power transmission, and motion control. The evolution of Regal Rexnord showcases a deliberate strategy to diversify its offerings and strengthen its market position.

The company's timeline reflects a series of strategic moves aimed at expanding its capabilities and market reach.

- 2021: Merger of Regal Beloit Corporation and Rexnord Corporation's PMC business, forming the current Regal Rexnord.

- 2004: Regal Beloit significantly expanded through acquisitions from General Electric.

- Ongoing: Continuous acquisitions and strategic partnerships to enhance its product portfolio and market presence.

Prior to the 2021 merger, Regal Beloit itself had a history of growth through acquisitions. A notable example is the 2004 expansion through acquisitions from General Electric, which effectively doubled the company's size. The strategic intent behind these combinations has been to create a more diversified and robust portfolio, moving from a primarily electric motor business to a broader industrial power transmission and automation solutions provider.

Regal Rexnord's current business model focuses on engineering and manufacturing industrial powertrain solutions, aerospace components, and automation subsystems. These offerings address critical needs across various end markets, demonstrating the company's commitment to providing essential components and systems for industrial applications. As of early 2024, the company continues to adapt and grow, leveraging its expanded capabilities to meet evolving market demands and technological advancements in industrial manufacturing.

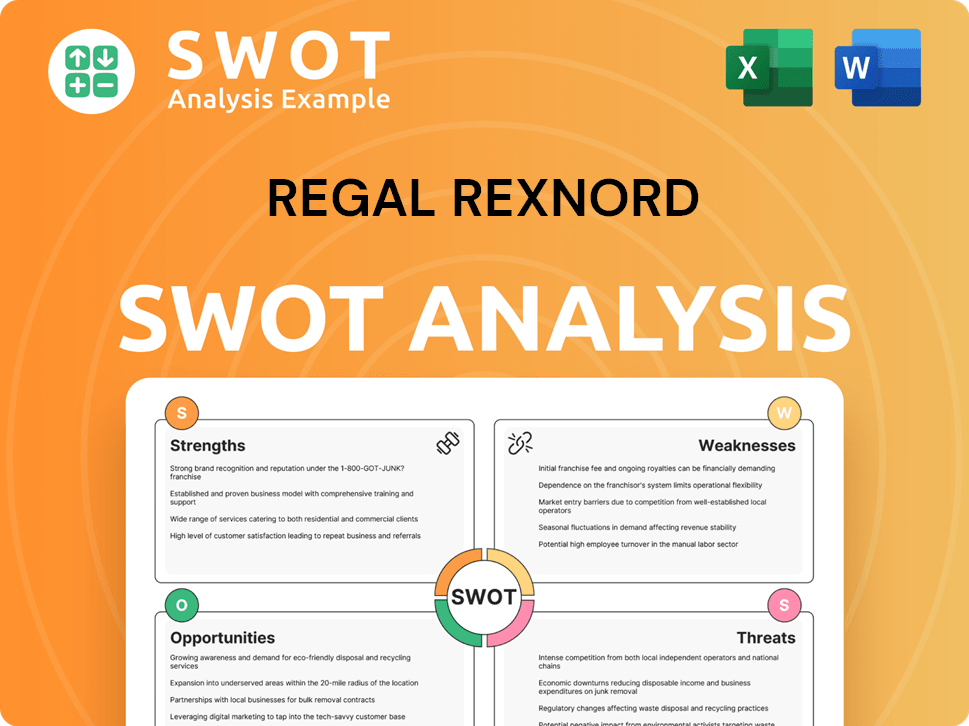

Regal Rexnord SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Regal Rexnord?

The early growth and expansion of Regal Rexnord have been shaped by strategic acquisitions and a focus on portfolio transformation. The company's journey involves significant mergers and acquisitions that have broadened its product offerings and market reach. These moves have been critical in shaping its position within the industrial manufacturing sector. This Regal Rexnord company background outlines the company's growth.

In 2004, Regal Beloit expanded significantly through two acquisitions from General Electric. Further acquisitions included Fasco electrical components in July 2007 for $220 million and Dutchi Motors B.V. in October 2008 for $34 million. These early acquisitions were foundational to the company's expansion.

A pivotal moment was the merger with Rexnord's Process & Motion Control (PMC) business in October 2021. This merger was a key step in transforming Regal Rexnord's portfolio. The goal was to shift from 75% electric motors to 75% industrial power transmission and automation.

In March 2023, Regal Rexnord acquired Altra Industrial Motion Corp. for approximately $5 billion, including debt. This acquisition strengthened its presence in industrial automation and power transmission. This strategic move further diversified the company's portfolio.

Regal Rexnord has focused on operational efficiencies through its Regal Rexnord Business System (RBS), re-launched in 2020. The RBS uses 80/20 principles and lean methodologies to streamline processes. As of March 31, 2025, the company reported a trailing twelve-month revenue of $5.90 billion.

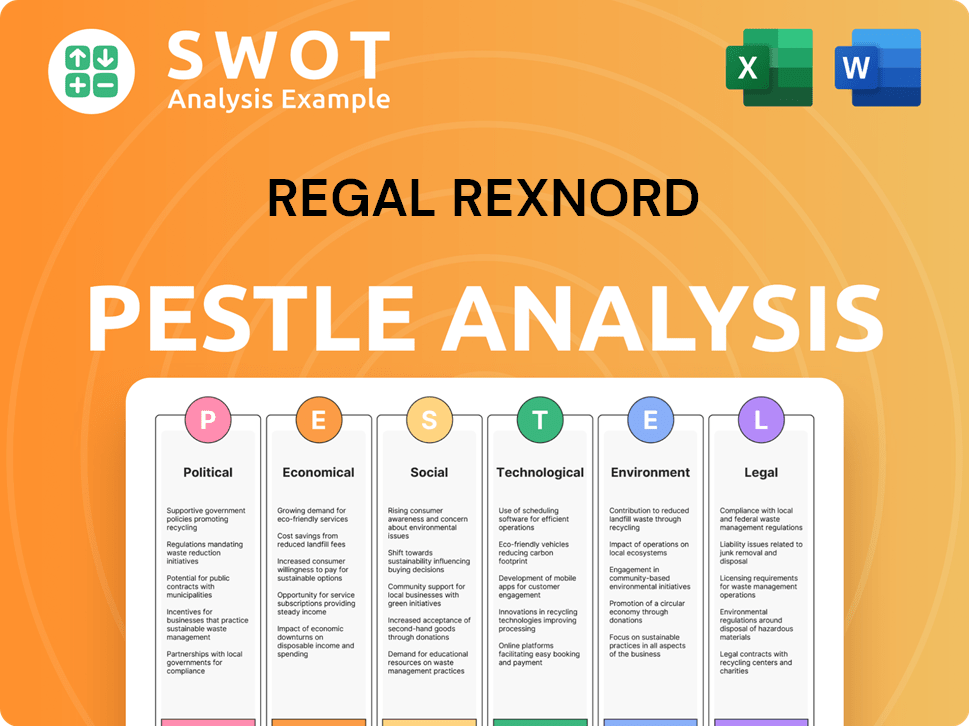

Regal Rexnord PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Regal Rexnord history?

The Regal Rexnord has achieved significant milestones, evolving from an electric motor manufacturer to a leading provider of industrial power transmission and automation solutions. This Regal Rexnord history reflects strategic shifts and significant acquisitions that have shaped its current business overview.

| Year | Milestone |

|---|---|

| October 2021 | Merger with Rexnord's Process & Motion Control business, solidifying its position in industrial manufacturing. |

| March 2023 | Acquisition of Altra Industrial Motion Corp., expanding its portfolio and market reach. |

| May 2025 | Introduction of new electro-mechanical actuator (EMA) subsystem capabilities for aerospace and defense, leveraging expertise from multiple brands. |

| February 2025 | Strategic partnership with Honeywell Aerospace to develop advanced air mobility solutions for the eVTOL aircraft market. |

Innovation is a core focus for Regal Rexnord, with aims to double its new product vitality by 2025, emphasizing energy efficiency and reduced environmental impact. These efforts are evident in the development of new technologies and strategic partnerships, positioning the company for future growth.

Regal Rexnord aims to double its new product vitality by 2025, focusing on energy efficiency and reduced environmental impact. This commitment drives the development of innovative solutions.

The introduction of new electro-mechanical actuator (EMA) subsystem capabilities for aerospace and defense in May 2025. This leverages expertise from Rexnord Aerospace, Kollmorgen, and Thomson.

Regal Rexnord announced a strategic partnership with Honeywell Aerospace in February 2025. This partnership aims to develop advanced air mobility solutions for the eVTOL aircraft market.

Despite these achievements, Regal Rexnord has faced challenges, including market headwinds and tariff impacts. The company has implemented mitigation plans, including supply chain realignments and pricing actions, to maintain financial health.

The company experienced a 1.4% organic sales decline in the fourth quarter of 2024. This reflects challenges in some end markets, impacting overall performance.

Regal Rexnord estimated an unmitigated annualized cost impact of approximately $60 million from current U.S. tariffs. The company has implemented mitigation plans to address these costs.

Regal Rexnord maintained its financial health, with an adjusted gross margin of 37.9% in Q1 2025. Disciplined cost management and operational efficiency are key.

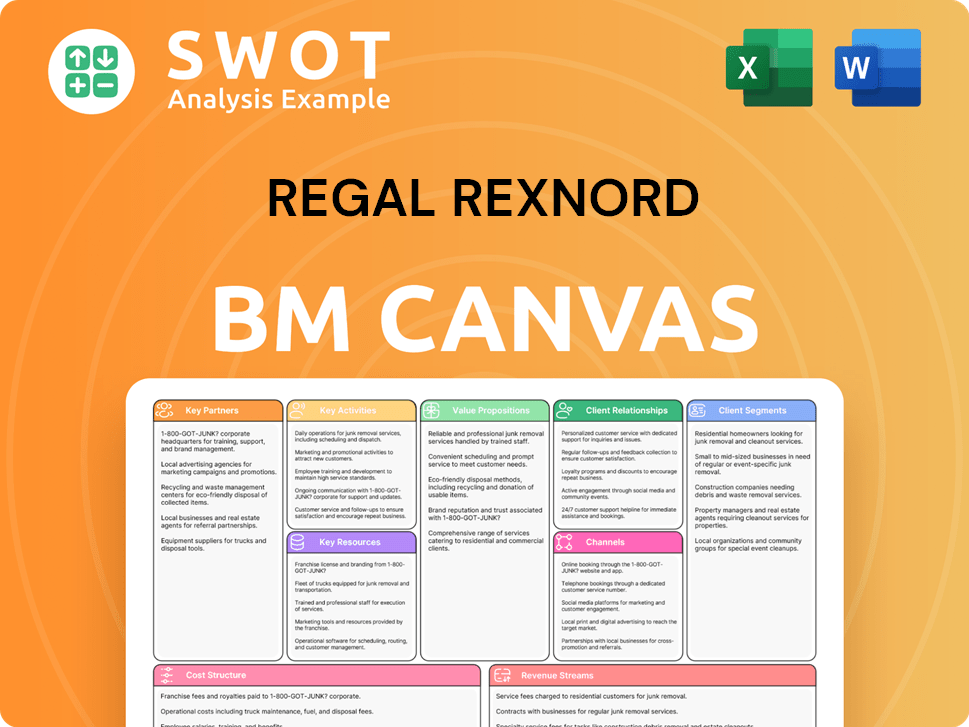

Regal Rexnord Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Regal Rexnord?

The Regal Rexnord history is marked by strategic acquisitions and mergers, shaping its evolution in the industrial manufacturing sector. From early acquisitions to the merger with Rexnord Corporation's Process & Motion Control business, the company has continually expanded its capabilities and market presence. Recent developments, including the acquisition of Altra Industrial Motion and the sale of its industrial motors and generators businesses, reflect its ongoing portfolio transformation and strategic focus.

| Year | Key Event |

|---|---|

| 2004 | Regal Beloit effectively doubles in size through two acquisitions from General Electric. |

| July 2007 | Regal acquires Fasco, a business specializing in electrical components. |

| October 2008 | Regal acquires Dutchi Motors B.V. |

| October 2021 | Regal Beloit Corporation merges with Rexnord Corporation's Process & Motion Control business, forming Regal Rexnord Corporation. |

| November 2021 | Regal Rexnord acquires Arrowhead Systems LLC. |

| March 2023 | The company acquires Altra Industrial Motion for approximately $5 billion, including debt. |

| April 30, 2024 | Regal Rexnord completes the sale of its industrial motors and generators businesses. |

| September 17, 2024 | Regal Rexnord hosts its 2024 Investor Day, introducing new three-year financial targets. |

| February 5, 2025 | Regal Rexnord reports fourth-quarter 2024 financial results, with adjusted diluted EPS of $2.34. |

| March 19, 2025 | Regal Rexnord presents at the Bank of America Global Industrials Conference, reiterating financial targets. |

| May 6, 2025 | Regal Rexnord reports strong first-quarter 2025 financial results, with adjusted diluted EPS of $2.15. |

Regal Rexnord targets a gross margin of 40% and an EBITDA margin of 25%. The company anticipates mid-teens EPS growth through 2027. It expects 2% to 5% organic sales growth CAGR from 2024 to 2027.

Regal Rexnord is investing in new product development. The company aims to double new product vitality by 2025, focusing on energy efficiency and sustainable solutions. It also plans to achieve tariff cost neutrality in 2025 and margin neutrality by mid-2026.

The company aims to reduce its net leverage to approximately 2.5x in 2025 and to 1.5–2.0x by 2027. These goals support the company's strategic portfolio transformation and financial health. The focus is on high-growth, high-margin opportunities.

Regal Rexnord focuses on high-growth markets such as factory automation, aerospace, and medical. These sectors align with the company's vision of creating impactful technology for a sustainable future. The strategic focus is on sustainable solutions.

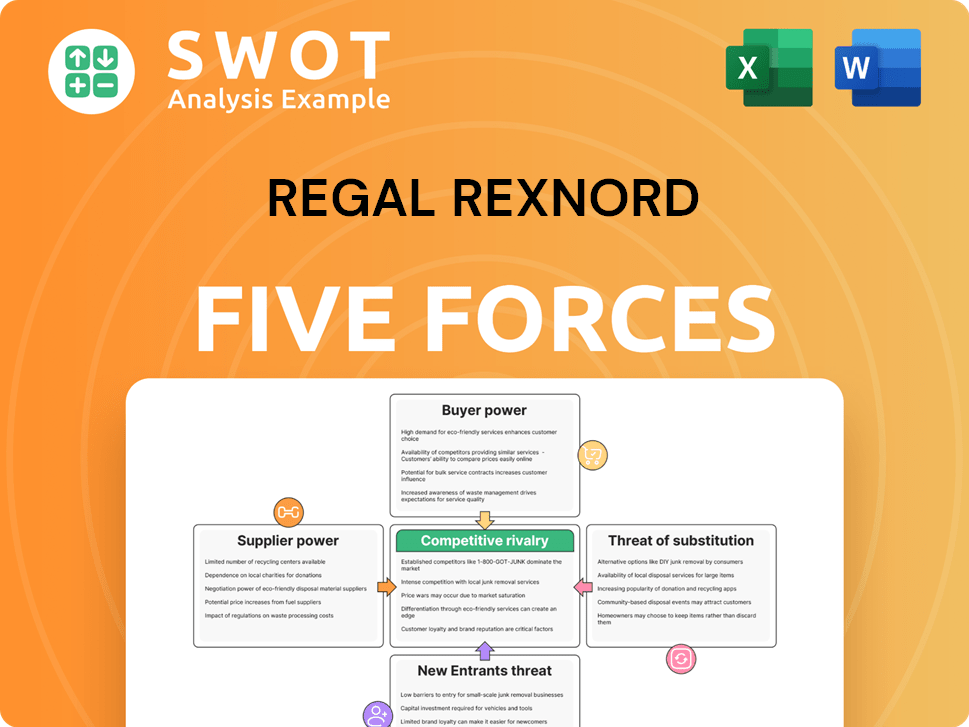

Regal Rexnord Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Regal Rexnord Company?

- What is Growth Strategy and Future Prospects of Regal Rexnord Company?

- How Does Regal Rexnord Company Work?

- What is Sales and Marketing Strategy of Regal Rexnord Company?

- What is Brief History of Regal Rexnord Company?

- Who Owns Regal Rexnord Company?

- What is Customer Demographics and Target Market of Regal Rexnord Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.