Regal Rexnord Bundle

How Does Regal Rexnord Dominate the Industrial Motion Control Arena?

Regal Rexnord Corporation is reshaping the industrial landscape, but who are its main rivals? This in-depth analysis unveils the Regal Rexnord SWOT Analysis, providing a comprehensive overview of its competitive positioning in 2025. We'll explore the strategies driving its growth, the key players challenging its dominance, and the market trends shaping its future.

Understanding the Regal Rexnord competitive landscape is crucial for investors and industry professionals alike. This report offers a detailed Regal Rexnord market analysis, examining its financial performance against Regal Rexnord competitors and assessing its Regal Rexnord business strategy. From Regal Rexnord industry dynamics to its Regal Rexnord overview, we provide actionable insights into how Regal Rexnord is navigating the complexities of the industrial sector.

Where Does Regal Rexnord’ Stand in the Current Market?

Regal Rexnord Corporation is a significant player in the industrial sector, specializing in industrial powertrain solutions, aerospace components, and automation subsystems. The company operates through three main segments: Industrial Powertrain Solutions (IPS), Power Efficiency Solutions (PES), and Automation & Motion Control (AMC). This structure allows the company to serve a diverse range of industries, from factory automation to aerospace.

The company's value proposition lies in its ability to provide critical components and systems that enhance the efficiency and performance of its customers' operations. With a global manufacturing footprint and a broad product portfolio, Regal Rexnord is well-positioned to meet the evolving needs of its diverse customer base. For more details, see Owners & Shareholders of Regal Rexnord.

As of March 2025, Regal Rexnord's market capitalization is approximately $8 billion. In Q1 2025, the company's total sales were $1.42 billion, though organic sales saw a 0.7% increase. The company's adjusted gross margin was 37.9% in Q1 2025, up 50 basis points year-over-year.

The Power Efficiency Solutions (PES) segment demonstrated strong performance with 8.0% organic sales growth. The Industrial Powertrain Solutions (IPS) segment faced challenges, with organic sales declining 3.4% year-over-year. The Automation & Motion Control (AMC) segment maintained stability with 0.4% organic growth.

Regal Rexnord's adjusted EBITDA margin was 21.8% in Q1 2025, showing a 30-basis-point improvement. The company significantly reduced net debt by $164 million in Q1 2025, lowering their net debt/adjusted EBITDA ratio to 3.6x. Regal Rexnord aims for a 40% adjusted gross margin exiting 2025 and a $1 billion annual free cash flow run rate in the next two years.

Regal Rexnord serves a diverse global customer base across various industries, including factory automation, food & beverage, and aerospace. The company's global manufacturing presence, with facilities in North America, Europe, and Asia Pacific, allows it to effectively serve multinational customers. This widespread presence is key to its competitive positioning.

The Regal Rexnord competitive landscape includes companies that offer similar products and services within the industrial sector. Understanding the Regal Rexnord competitors is crucial for assessing the company's market position.

- Key competitors likely include companies involved in industrial powertrain solutions, automation, and motion control.

- The company's Regal Rexnord market analysis reveals its strengths in specific segments, such as Power Efficiency Solutions.

- Regal Rexnord's business strategy focuses on organic growth and margin improvements.

- The company's financial performance, including adjusted EBITDA margins and debt reduction, indicates a strong financial position.

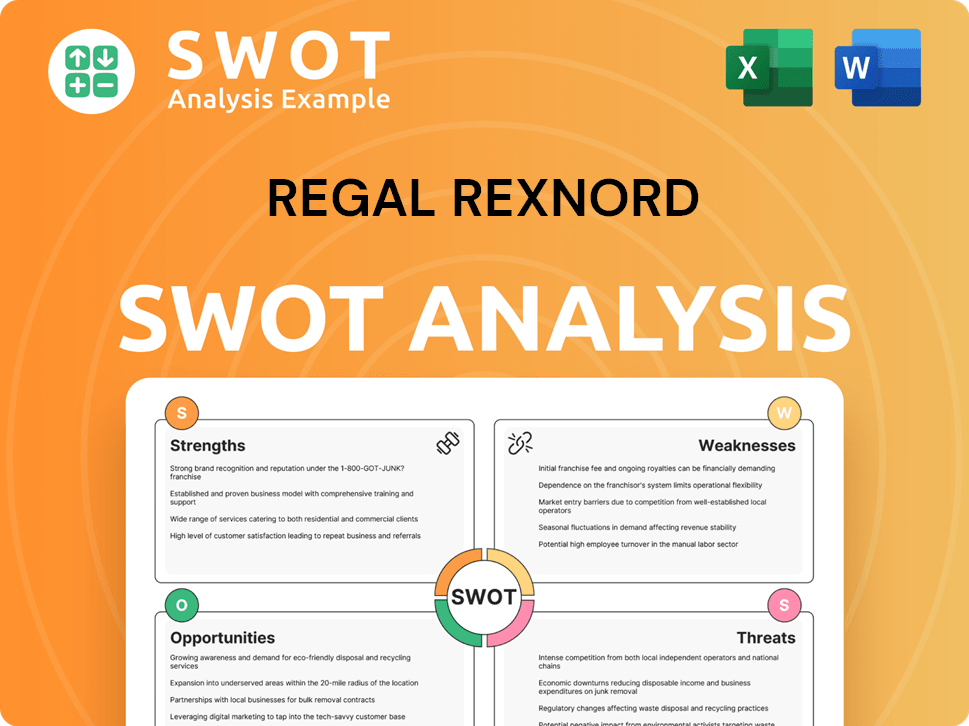

Regal Rexnord SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Regal Rexnord?

The Regal Rexnord competitive landscape is shaped by a diverse group of companies vying for market share in the industrial sector. This analysis provides a detailed look at the key players challenging its position, focusing on the dynamics that define the industry. Understanding these competitive pressures is crucial for assessing the company's strategic positioning and future prospects.

The Regal Rexnord market analysis reveals a complex interplay of established global corporations and specialized firms. These competitors operate across various segments, including electrical equipment, industrial machinery, and power transmission solutions. The competitive environment is further influenced by emerging technologies and shifts in business models, requiring continuous adaptation and strategic innovation to maintain a competitive edge.

Regal Rexnord competitors face challenges from a wide array of companies. These competitors span various sectors, from electrical equipment to industrial machinery. Key players include both global giants and specialized firms, each impacting Regal Rexnord's market position in different ways.

The Regal Rexnord industry faces competition from various companies. These include established players like Siemens, WEG, and The Timken Company. These companies compete across multiple segments, challenging Regal Rexnord's market position.

Siemens is a major competitor, particularly in industrial automation and motion control. Siemens offers comprehensive solutions, competing directly with Regal Rexnord in several key areas. This global powerhouse challenges Regal Rexnord's market share through its extensive product portfolio and global reach.

WEG and Nidec are significant competitors in the electric motors market. They directly challenge Regal Rexnord's Power Efficiency Solutions segment. Their competitive strategies focus on efficiency, cost-effectiveness, and global distribution networks.

The Timken Company competes with Regal Rexnord in the Industrial Powertrain Solutions segment. As a manufacturer of bearings and power transmission products, Timken offers a direct challenge. Their focus is on providing robust, reliable solutions for industrial applications.

Honeywell competes in various industrial and aerospace components, including a strategic partnership with Regal Rexnord on electric aircraft (eVTOL). This partnership highlights the competitive overlap in emerging technologies. Honeywell’s broader portfolio includes components that overlap with Regal Rexnord's offerings.

The power electronics market is experiencing significant expansion, particularly with the rise of Chinese manufacturers. This leads to intense cost pressure. Mergers and acquisitions, such as Regal Rexnord's acquisition of Altra Industrial Motion Corp. in 2023, are key to shaping competitive dynamics. New business models, like direct-to-consumer and connected product ecosystems, are also changing the competitive environment.

The competitive landscape is dynamic, influenced by factors such as technological advancements, market consolidation, and the emergence of new business models. For a deeper dive into Regal Rexnord's business strategy and how it navigates these challenges, consider exploring the Growth Strategy of Regal Rexnord.

Regal Rexnord's competitive positioning is influenced by its ability to innovate and adapt. The company faces challenges across multiple segments, requiring strategic responses to maintain market share and drive growth. Key strategies include:

- Focus on Efficiency: Improving operational efficiency to reduce costs and enhance profitability.

- Technological Innovation: Investing in research and development to create new products and solutions.

- Strategic Acquisitions: Expanding its product portfolio and market reach through mergers and acquisitions.

- Global Expansion: Strengthening its presence in key markets worldwide.

- Customer-Centric Approach: Building strong relationships with customers to understand and meet their needs.

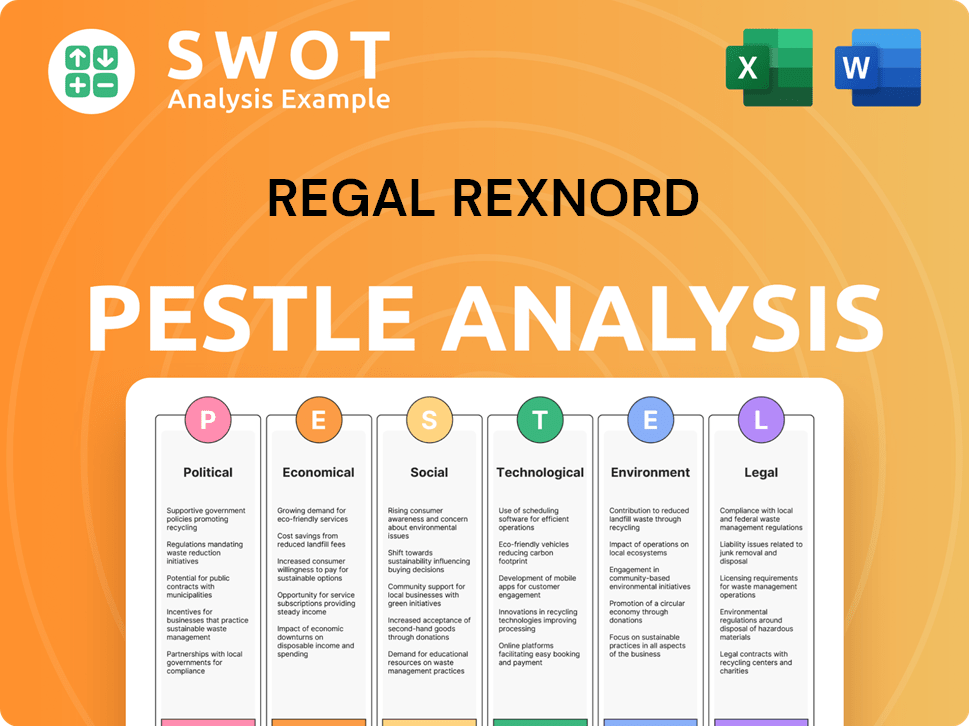

Regal Rexnord PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Regal Rexnord a Competitive Edge Over Its Rivals?

Understanding the Regal Rexnord competitive landscape involves recognizing its strategic moves and core strengths. The company has consistently focused on enhancing its market position through acquisitions and divestitures, such as the acquisition of Altra Industrial Motion Corp., aimed at bolstering its presence in key industrial markets. These strategic actions, combined with a focus on operational efficiency, have significantly shaped its competitive edge.

Key milestones reflect the company's commitment to innovation and market expansion. For example, the company's advancements in high-efficiency electric motors demonstrate a commitment to sustainability and cost savings for clients. These initiatives, along with a strong emphasis on technological differentiation, are central to its business strategy.

The company's competitive advantages are multifaceted, contributing to its strong market position. A deep dive into these advantages provides valuable insights for anyone conducting a Regal Rexnord market analysis or assessing its long-term growth potential.

The company offers a wide array of powertrain solutions, aerospace components, and automation subsystems. This includes electric motors, mechanical power transmission components, and automation offerings. This integrated approach is highly valued by customers, securing significant wins in areas like humanoid robotics.

The company emphasizes technology-differentiated products, investing heavily in research and development. They are developing new products leveraging IoT and AI, positioning themselves at the forefront of industry trends. Their high-efficiency electric motors achieved a 15% reduction in energy consumption across product lines in fiscal year 2024.

With manufacturing, sales, and service facilities worldwide, the company has a strong global footprint. This presence enables effective service to multinational customers and helps in navigating geopolitical and supply chain disruptions. This is crucial for maintaining a competitive edge in the global market.

The company has demonstrated robust financial performance, with adjusted gross and EBITDA margins of 37.8% and 22.1% respectively in 2024. Strategic focus on cost management and operational efficiency has led to margin expansion across all segments. They are targeting $700 million in free cash flow for 2025.

The company's long-standing presence and focus on delivering reliable and efficient solutions contribute to strong brand equity and customer loyalty. The ability to provide integrated solutions that meet evolving customer needs further solidifies these relationships. For more on how the company approaches the market, see Marketing Strategy of Regal Rexnord.

- Strong brand recognition in the industrial sector.

- Focus on delivering reliable and efficient solutions.

- Integrated solutions that meet evolving customer needs.

- Continuous investment in innovation and strategic portfolio management.

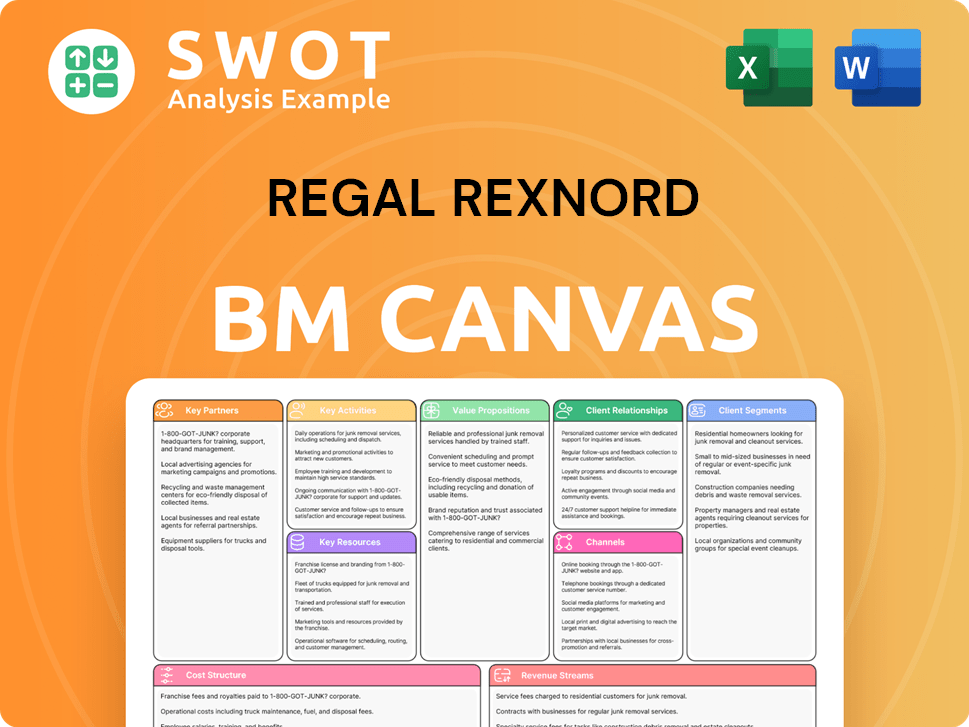

Regal Rexnord Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Regal Rexnord’s Competitive Landscape?

The Regal Rexnord competitive landscape is dynamic, shaped by industry trends and the strategic positioning of its rivals. The company navigates a market characterized by technological advancements, regulatory changes, and fluctuating demand. Understanding the Regal Rexnord market analysis is essential for investors and stakeholders to assess its growth potential and resilience.

As a global leader in power transmission, motion control, and electric motors, the company faces both challenges and opportunities. The increasing demand for sustainable solutions and automation presents significant growth prospects. However, the company must also address operational efficiencies and adapt to evolving market dynamics, as detailed in the Brief History of Regal Rexnord.

The industry is seeing a shift towards electrification and sustainable solutions, especially in automotive and industrial applications. Technological advancements in automation, AI, and connectivity are reshaping manufacturing processes. Regulatory changes, including emissions standards, continue to influence product design and market strategies.

The general industrial sector's demand environment remains choppy, impacting recent financial performance. High development costs for new technologies and the complexity of integrating them pose challenges. Increasing competition in emerging markets, such as humanoid robotics, could also pressure margins.

Regal Rexnord is well-positioned to capitalize on the growing demand for energy-efficient products and solutions. Growth opportunities exist in emerging markets, product innovations, and strategic partnerships. The company is focusing on debt reduction, margin improvement, and investing in high-growth areas.

The company's portfolio transformation, with approximately 50% weighted to markets with secular growth drivers, supports long-term EPS growth. Strategies include supply chain reconfigurations and pricing adjustments to mitigate the impact of tariffs. Early 2025 data shows a 4% increase in daily orders, indicating potential for top-line growth.

The company’s competitive advantages stem from its diverse product portfolio, global presence, and focus on innovation. The company's ability to adapt to changing market conditions and invest in high-growth areas is crucial for maintaining its competitive edge. The company's strategic partnerships and acquisitions also play a vital role in expanding its market reach and technology capabilities.

- Focus on electrification and sustainable solutions.

- Technological advancements in automation and connectivity.

- Strategic responses to regulatory and geopolitical challenges.

- Investment in high-growth markets such as humanoid robotics.

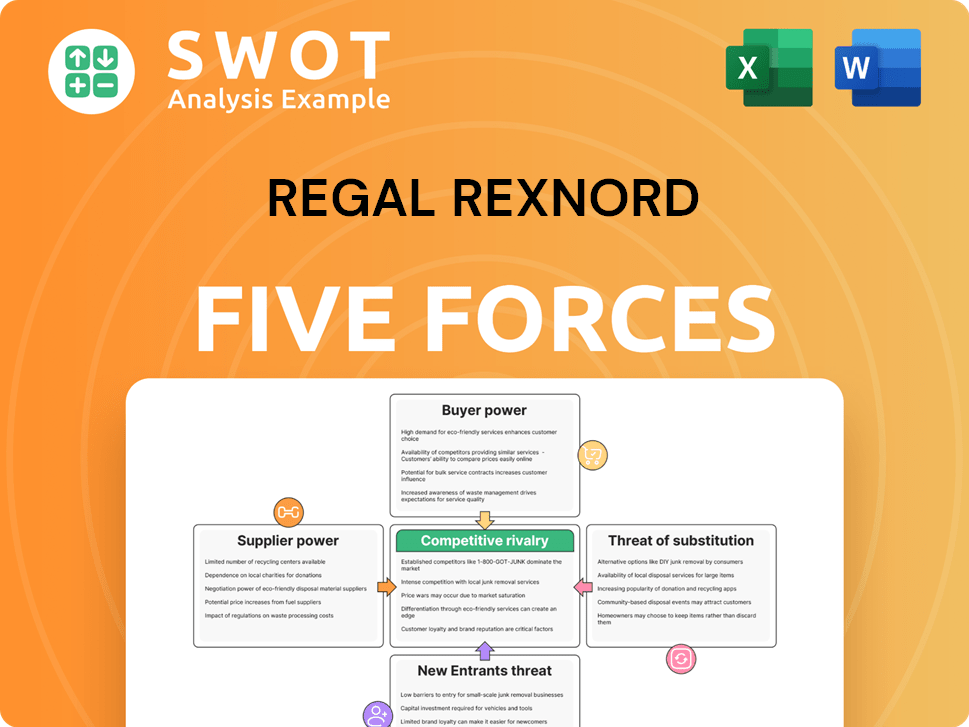

Regal Rexnord Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Regal Rexnord Company?

- What is Growth Strategy and Future Prospects of Regal Rexnord Company?

- How Does Regal Rexnord Company Work?

- What is Sales and Marketing Strategy of Regal Rexnord Company?

- What is Brief History of Regal Rexnord Company?

- Who Owns Regal Rexnord Company?

- What is Customer Demographics and Target Market of Regal Rexnord Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.