Regal Rexnord Bundle

How Does Regal Rexnord Thrive in Today's Market?

Regal Rexnord Company, a titan in engineered motion control, has reshaped the industrial landscape through strategic acquisitions and a commitment to innovation. Its 2023 acquisition of Altra Industrial Motion, following the 2021 merger with Rexnord's industrial power transmission business, has significantly broadened its reach and product portfolio. This transformation positions Regal Rexnord as a key player in diverse sectors, including aerospace and energy.

With net sales exceeding $6 billion in 2024, understanding Regal Rexnord SWOT Analysis is crucial for investors and industry watchers. This article explores the company's core operations, revenue streams, and strategic advantages, providing a comprehensive overview of How Regal Rexnord Works. We'll examine its business model, including its diverse Regal Rexnord products and manufacturing process, to understand its competitive position and future growth prospects.

What Are the Key Operations Driving Regal Rexnord’s Success?

The Regal Rexnord Company operates by providing engineered solutions that control and transmit motion across various industrial applications. Their core business revolves around three primary segments: Industrial Powertrain Solutions (IPS), Power Efficiency Solutions (PES), and Automation & Motion Control (AMC). These segments offer a diverse range of products and services, from mechanical power transmission components to electric motors and automation solutions, catering to a wide array of industries.

The value proposition of Regal Rexnord centers on delivering comprehensive solutions that enhance efficiency and productivity for its customers. By offering complete industrial powertrains and customized solutions, the company helps customers optimize their operations, reduce downtime, and improve overall equipment effectiveness. Their strong supply chain and technological expertise further solidify their ability to meet customer demands effectively.

Their primary focus is on providing energy-efficient and technologically advanced products. This positions them well within the industry's current trends, including the Internet of Things (IoT) and artificial intelligence (AI). The company's diversified product portfolio, global presence, and strong customer relationships contribute to their competitive advantage. To understand their approach, you can read about the Marketing Strategy of Regal Rexnord.

IPS focuses on mechanical power transmission components, systems, and related services. This includes bearings, couplings, gearboxes, and clutches. These products are essential for various industrial applications, ensuring efficient power transmission.

PES designs and produces electric motors and electronic controls. These products are designed to enhance energy efficiency. They serve diverse applications, focusing on sustainable and efficient power solutions.

AMC offers conveyor products, aerospace components, and precision motion control solutions. Their offerings include controls, actuators, drives, and precision motors. These are used in factory automation to surgical tools.

Their products serve industries like factory automation, food and beverage, aerospace, medical, and data centers. They also cater to warehouses, alternative energy, and residential and commercial buildings. The company's products have a wide reach.

Regal Rexnord differentiates itself through its 'solutions mindset' and ability to provide complete industrial powertrains. This approach allows the company to offer customized, end-to-end solutions, optimizing conveyor lines and increasing overall equipment effectiveness.

- Strong supply chain with a robust inventory of raw materials.

- North American manufacturing for certain components, like Link-Belt cylindrical roller bearings.

- Diversified product portfolio and global footprint.

- Technological expertise and strong customer relationships.

Regal Rexnord SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Regal Rexnord Make Money?

The Regal Rexnord Company generates revenue through the sale of its engineered industrial powertrain solutions, power efficiency solutions, and automation and motion control products. Understanding the Regal Rexnord business model is crucial for investors and stakeholders alike. For the fiscal year 2024, the company reported net sales of $6.03 billion, highlighting its significant market presence and operational scale.

The company's revenue streams are primarily categorized into three key segments, each contributing differently to the overall financial performance. These segments reflect the diverse range of Regal Rexnord products and their applications across various industries. This structure allows for a focused approach to market strategies and resource allocation, driving efficiency and growth.

The Regal Rexnord Company employs several monetization strategies to maximize its revenue potential. It focuses on providing energy-efficient products, offering customized solutions, and strategically acquiring companies to broaden its market reach. These strategies are integral to the company's long-term growth and profitability.

The primary revenue sources are categorized by its three main segments, each playing a crucial role in the company's financial performance. In Q1 2025, the Power Efficiency Solutions (PES) segment reported $409.1 million in sales, demonstrating an 8.0% organic growth. The Automation & Motion Control (AMC) segment reported net sales of $396.3 million, showing a 0.4% organic growth.

- Industrial Powertrain Solutions (IPS): This segment was the highest-performing source in 2024, contributing $2.60 billion to the total revenue.

- Power Efficiency Solutions (PES): This segment focuses on electric motors, drives, and controls. In Q1 2025, PES reported $409.1 million in sales, demonstrating 8.0% organic growth, driven by strong demand in North American residential HVAC markets.

- Automation & Motion Control (AMC): This segment includes conveyor products, aerospace components, and precision motion control solutions. In Q1 2025, AMC net sales were $396.3 million, showing a 0.4% organic growth, with particular strength in aerospace and defense markets.

Geographically, the United States was the greatest contributor to Regal Rexnord's revenue in the last year, bringing in $3.64 billion. The company's strategic portfolio transformation has led to significant shifts in revenue sources over time. Five years ago, electric motors constituted over 70% of sales; however, following strategic divestitures and acquisitions, industrial power transmission now accounts for just under 45% of sales, with factory automation solutions and high-efficiency electric motors and air moving subsystems each making up roughly 27.5%. This shift signifies a move towards higher-growth, durable, and secular markets. For more detailed insights, you can read this article about Regal Rexnord.

Regal Rexnord PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Regal Rexnord’s Business Model?

The Regal Rexnord Company has undergone significant strategic shifts, marked by key mergers and acquisitions that have reshaped its operational focus and financial performance. A pivotal move was the 2021 merger with Rexnord's industrial power transmission business, followed by the 2023 acquisition of Altra Industrial Motion Corporation, which brought in approximately $1.9 billion in sales.

These strategic actions have diversified the company's portfolio, shifting its sales composition. The company is transforming into a more innovative, higher-margin, and cash-generative enterprise. The company's focus is on markets experiencing secular demand tailwinds, with industrial power transmission, factory automation solutions, high-efficiency electric motors, and air moving subsystems each contributing significantly.

Operationally, the company completed the sale of its industrial motors and generators businesses on April 30, 2024, further streamlining its focus on core segments. The company faces challenges such as raw material price volatility and reliance on key suppliers, leading to potential cost increases or supply shortages. The company is working on strategies such as supply chain realignments and pricing actions to mitigate the impact of tariffs, aiming for tariff cost neutrality in 2025 and margin neutrality by mid-2026.

The 2021 merger with Rexnord's industrial power transmission business and the 2023 acquisition of Altra Industrial Motion Corporation were significant milestones. These moves expanded the company's portfolio and market presence. The sale of the industrial motors and generators businesses in April 2024 further streamlined the company's focus.

The company has strategically shifted its focus from electric motors to industrial power transmission and automation solutions. This shift aims to enhance profitability and capitalize on growing market trends. The company is also implementing supply chain adjustments and pricing strategies to manage economic challenges.

The company's diversified product portfolio and global footprint provide a competitive advantage. Strong customer relationships and significant R&D investments drive innovation and market leadership. The company's 'solutions mindset' and ability to offer complete industrial powertrains are key differentiators.

The company's focus on industrial power transmission and automation is aimed at improving financial outcomes. The Altra acquisition, for example, added approximately $1.9 billion in sales. The company is targeting tariff cost neutrality in 2025 and margin neutrality by mid-2026.

The company benefits from a diversified product portfolio, a global presence, and strong customer relationships. Investments in research and development, totaling over $80 million, drive innovation. The company's 'solutions mindset' and ability to provide complete industrial powertrains are also key differentiators. If you want to know more about the company, you can read the article: Owners & Shareholders of Regal Rexnord.

- Diversified product portfolio reduces market dependence.

- Global footprint mitigates regional economic risks.

- Strong customer relationships ensure recurring revenue.

- Investments in R&D drive innovation.

Regal Rexnord Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Regal Rexnord Positioning Itself for Continued Success?

Regal Rexnord Corporation holds a strong position in the industrial sector, focusing on highly-engineered solutions. This strategic shift has placed the company in markets with strong demand, such as factory automation, food and beverage, and alternative energy. The company's 2024 net sales of $6.03 billion demonstrate its significant market presence.

The company faces risks including intense competition and dependence on suppliers. Volatility in raw material prices and global economic uncertainties also pose challenges. Specifically, tariffs are estimated to have a gross, unmitigated annualized cost impact of approximately $60 million.

Regal Rexnord strategically focuses on industrial powertrain solutions, power efficiency solutions, and automation and motion control. This focus places the company in markets with strong growth potential. The company's commitment to high-quality products and customer service fosters customer loyalty.

Key risks include intense competition and dependence on suppliers. Volatility in raw material prices and global economic uncertainties can also impact the company. The company estimates a gross, unmitigated annualized cost impact from currently imposed tariffs at approximately $60 million.

Regal Rexnord aims for sustained growth and profitability. The company reaffirmed its adjusted diluted earnings per share guidance in the range of $9.60 to $10.40 for 2025. Strategic initiatives include targeting 2% to 5% organic sales growth annually from 2024 to 2027.

The company aims for a 40% gross margin and 25% EBITDA margin by the end of 2025. Debt reduction is a priority, with $938 million of gross debt paid down in 2024 and an additional $164 million in Q1 2025. Regal Rexnord anticipates generating approximately $700 million in free cash flow in 2025.

Regal Rexnord is focused on sustained growth and profitability, targeting 2% to 5% organic sales growth annually from 2024 to 2027. The company is also aiming for a 40% gross margin and 25% EBITDA margin by the end of 2025, demonstrating its commitment to financial health. Further insights can be found in the Competitors Landscape of Regal Rexnord.

- The company plans to achieve tariff cost neutrality in 2025.

- Debt reduction is a key priority, with significant debt paid down in 2024 and Q1 2025.

- Regal Rexnord anticipates approximately $700 million in free cash flow in 2025.

- Continuous investment in research and development is ongoing.

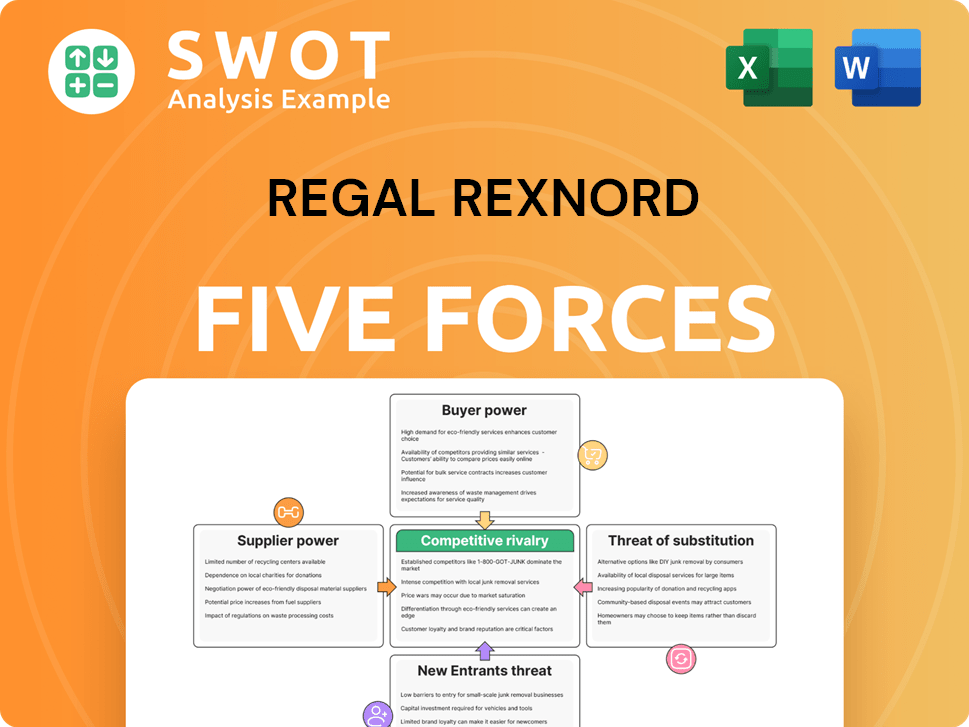

Regal Rexnord Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Regal Rexnord Company?

- What is Competitive Landscape of Regal Rexnord Company?

- What is Growth Strategy and Future Prospects of Regal Rexnord Company?

- What is Sales and Marketing Strategy of Regal Rexnord Company?

- What is Brief History of Regal Rexnord Company?

- Who Owns Regal Rexnord Company?

- What is Customer Demographics and Target Market of Regal Rexnord Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.