Renco Group Bundle

How Did Ira Rennert Build the Renco Group Empire?

Established in 1975, The Renco Group, founded by Ira Rennert, has quietly amassed a diverse portfolio spanning metals, auto parts, and defense. This private holding company's journey from a focused investment strategy to a multi-industry conglomerate is a testament to its adaptability. Understanding the Renco Group SWOT Analysis is crucial to grasp the company's strategic moves.

Delving into the Renco Company History reveals a strategic approach centered on acquiring and restructuring businesses, often with a focus on operational improvements. The Rennert family's influence has shaped Renco Industries, building an industrial empire with an estimated $5 billion in annual revenue as of April 2025. From its early days to its current status, Renco Group's business ventures have left a significant mark on various sectors, including its involvement with Magnesium Corporation of America.

What is the Renco Group Founding Story?

The Renco Group, Inc. was established in 1975 by Ira Rennert, marking the beginning of a significant player in the corporate world. This marked the start of a business journey that would span several decades and involve numerous acquisitions and ventures.

Ira Rennert's background as a credit analyst on Wall Street provided a foundation for his future endeavors. This experience, combined with his entrepreneurial spirit, shaped the early strategies of the Renco Group. His approach to business, particularly in the 1980s, would come to define much of the company's trajectory.

Rennert, born on May 31, 1934, brought a unique perspective to the business world. His prior experience, including founding I. L. Rennert & Co. in 1962, set the stage for his later successes. The company's initial vision was to create a permanent home for its acquired businesses, building value by retaining earnings and reinvesting in each entity.

Ira Rennert founded the Renco Group in 1975, leveraging his financial background to build a diversified conglomerate.

- Rennert's prior experience included a stint as a credit analyst and the founding of I. L. Rennert & Co. in 1962.

- The business model involved acquiring and investing in various companies, often focusing on restructuring and operational improvements.

- Renco Group's headquarters is located in One Rockefeller Plaza, New York, NY.

- Since its founding, Renco has completed over 40 acquisitions.

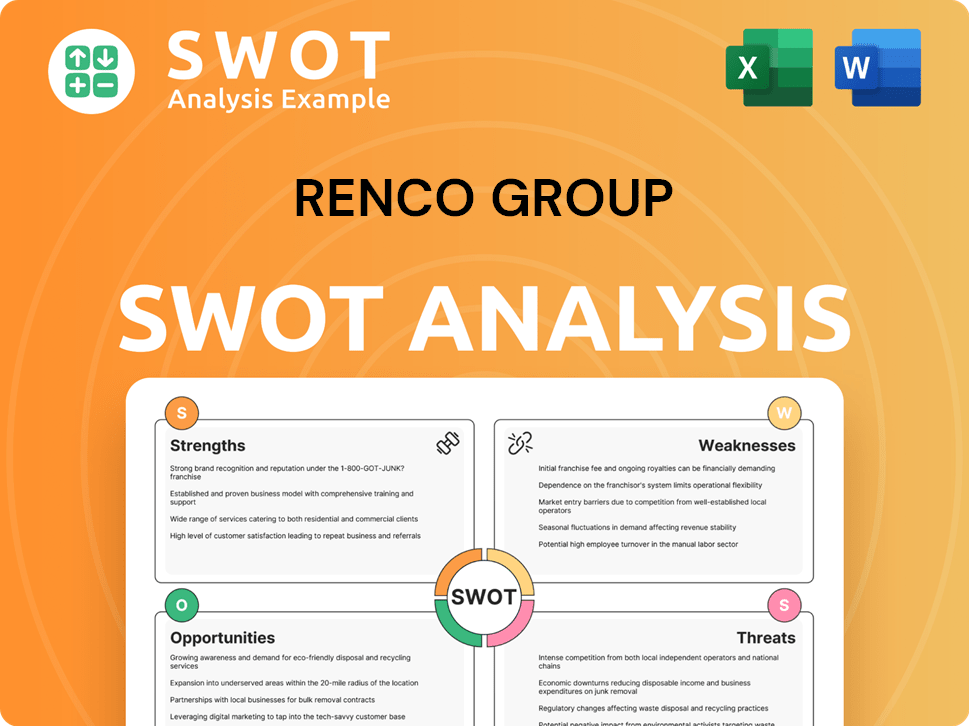

Renco Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Renco Group?

The early growth of the Renco Group involved a strategic approach to acquiring and managing companies across various sectors. Since its founding in 1975, the company, led by Ira Rennert, has expanded significantly through over 40 acquisitions. This strategy helped establish Renco Industries as a diversified industrial entity. The Rennert family played a key role in shaping the company's early trajectory.

Early acquisitions included companies in metals manufacturing, auto parts, and defense. Notable acquisitions include Inteva Products, LLC in March 2008, and Renfro Brands in June 2021. In November 2024, the company acquired Coach USA, expanding its portfolio further. This acquisition strategy is a key element in understanding the Growth Strategy of Renco Group.

The Renco Group operates with a decentralized business model, providing subsidiaries with autonomy. This structure is supported by capital investment and skilled management. This allows each subsidiary to operate independently while benefiting from the group's resources and strategic oversight. This model has been critical to the company's expansion.

As of April 2025, Renco Group is a significant industrial entity. It has estimated annual revenues of approximately $5 billion and employs around 15,000 people. This growth reflects a long-term investment philosophy focused on building value through reinvesting earnings within its businesses. The company's success is also reflected in its diverse portfolio and strategic acquisitions.

The company's investments have spanned various sectors, including metals, auto parts, and consumer goods. One notable investment was Magnesium Corporation of America. The company's history includes both successful ventures and facing controversies, which have shaped its current standing. The strategic acquisitions and diversified portfolio are key indicators of its growth.

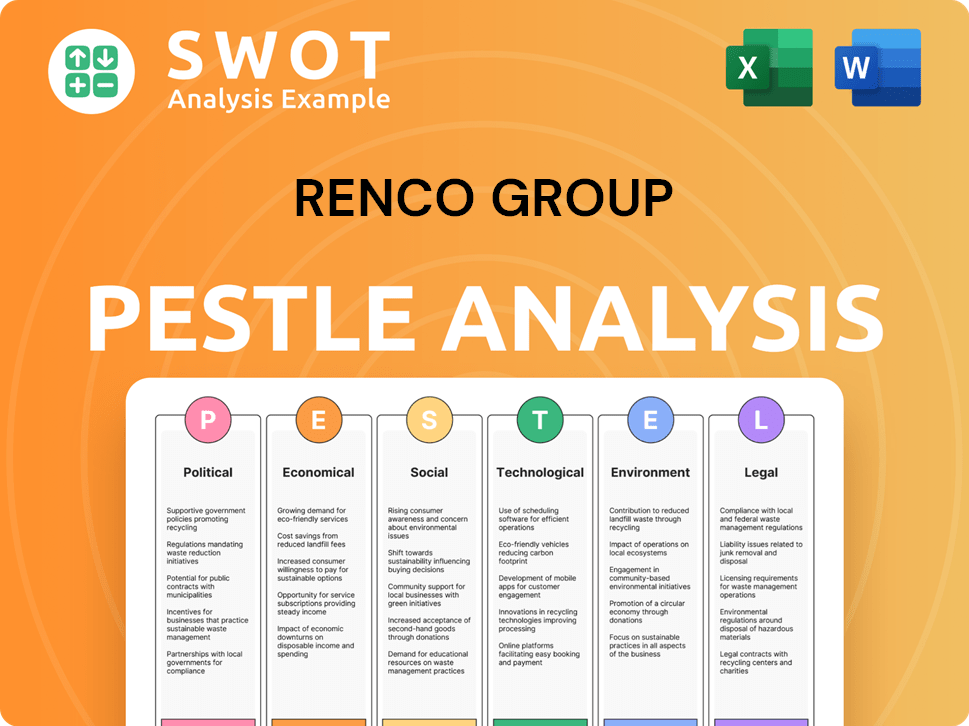

Renco Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Renco Group history?

The Renco Group, under the leadership of Ira Rennert, has a history marked by significant acquisitions and business ventures. The company's strategy has been to acquire and manage a diverse portfolio of businesses across various sectors.

| Year | Milestone |

|---|---|

| March 2008 | Inteva Products, LLC, a Renco Group subsidiary, acquired Delphi's Global Interiors and Closures businesses. |

| June 2021 | Renco Group purchased Renfro Brands, a designer, manufacturer, and marketer of socks and legwear products. |

| November 2024 | The group acquired Coach USA, following its bankruptcy proceedings. |

While specific innovations are not widely publicized, Renco Group's approach involves operational improvements and financial strategies within its subsidiaries. The company's decentralized model allows each subsidiary to operate with independent management teams, focusing on financial returns.

Renco Group has a history of strategic acquisitions, with over 40 acquisitions since its inception, expanding its business portfolio. These acquisitions have been a key driver of the company's growth and diversification across various industries.

The decentralized business model allows independent management teams to operate each subsidiary. This approach enables focused operational improvements and financial strategies tailored to each business unit.

Renco Group emphasizes strong financial returns and operational improvements across its subsidiaries. The company's focus is on enhancing the financial performance of each business within its portfolio.

Renco Group has faced considerable challenges, particularly concerning environmental issues at some of its properties. Subsidiaries like US Magnesium have faced accusations of pollution, leading to legal battles and significant penalties.

Subsidiaries like US Magnesium have faced accusations of polluting the Great Salt Lake in Utah. Doe Run Company, another subsidiary, has been linked to elevated levels of lead, arsenic, and cadmium in Herculaneum, Missouri, and La Oroya, Peru.

Environmental issues have led to public outcry, lawsuits, and significant penalties for Renco Group. A lawsuit filed in 2007 on behalf of children from La Oroya, Peru, highlights ongoing legal battles that could result in hundreds of millions of dollars in fines, potentially exceeding $1 billion with additional cases.

In 2015, Ira Rennert paid $118 million to creditors of Magnesium Corp. of America (MagCorp) in connection with past issues. This highlights the financial impact of the challenges faced by the company.

Renco Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Renco Group?

The Renco Group, a company founded by Ira Rennert, has a history marked by strategic acquisitions and diversification across various industries. The company's journey, from its inception in 1975 to its present-day operations, showcases a commitment to long-term investments and value creation. The Renco Company History involves a series of strategic moves that have shaped its current standing in the business world.

| Year | Key Event |

|---|---|

| 1975 | The Renco Group, Inc. was founded by Ira Rennert in New York City. |

| 1988 | Renco acquired WCI Steel from LTV Steel Co., marking an early significant acquisition. |

| 2007 | Renco Group lost ownership of its bankrupt subsidiary, WCI Steel, to its lenders. |

| 2015 | Ira Rennert paid $118 million to the creditors of Magnesium Corp. of America (MagCorp). |

| June 2021 | Renco Group acquired Renfro Brands, expanding its portfolio. |

| November 2024 | Renco Group acquired Coach USA following its bankruptcy proceedings. |

| April 2025 | Renco Holdings Group Limited reported a significant reduction in losses for 2024, with a loss of HKD 23.3 million compared to HKD 376.3 million in 2023. |

| May 2025 | Renco Group SpA's 2025 economic outlook forecasts production of approximately €660 million and a gross operating margin (EBITDA) of approximately €77 million for construction sites in progress. |

The Renco Group continues to focus on long-term investments across various industries. The company's strategy involves building value by retaining earnings and reinvesting in its portfolio companies. This approach is central to the vision of Ira Rennert.

Renco Group SpA is strategically positioned in the global engineering and construction industry, with operations spanning over 50 countries and revenues exceeding EUR 2.84 billion as of May 2025. This related entity aims to capitalize on infrastructure investments and renewable energy projects.

The engineering and construction market is projected to grow with a compound annual growth rate (CAGR) of approximately 5.2% over the next five years. Renco Group SpA prioritizes energy efficiency and adheres to green building certifications, reflecting a commitment to sustainability.

Renco USA is revolutionizing the construction industry with sustainable, eco-friendly composite blocks, aiming to address housing shortages and climate change impacts. Their proprietary material has 82% less embodied carbon than structural steel. In early 2025, Renco USA opened its first American factory in Jupiter, Florida, capable of producing materials for 9,000 homes or apartment units annually.

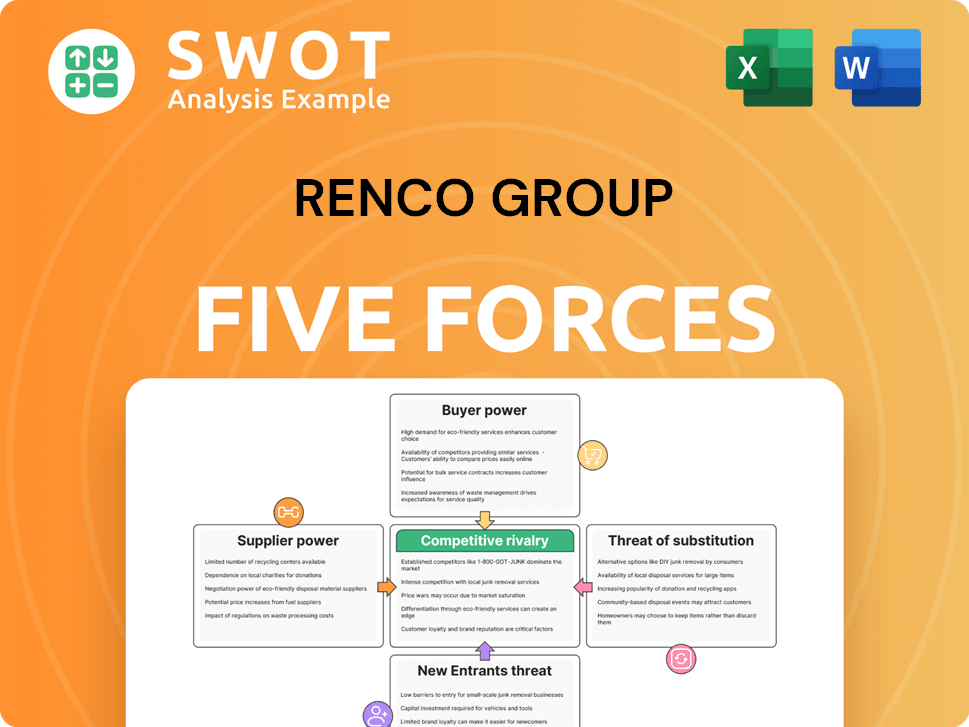

Renco Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Renco Group Company?

- What is Growth Strategy and Future Prospects of Renco Group Company?

- How Does Renco Group Company Work?

- What is Sales and Marketing Strategy of Renco Group Company?

- What is Brief History of Renco Group Company?

- Who Owns Renco Group Company?

- What is Customer Demographics and Target Market of Renco Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.