Renco Group Bundle

Who Really Controls The Renco Group?

Understanding the ownership of a company is paramount for investors and strategists alike. The Renco Group, a privately held industrial giant, offers a fascinating case study in how ownership shapes business strategy and market influence. Uncover the key players behind this diversified conglomerate and explore the dynamics that drive its operations.

Founded by Ira Rennert in 1975, The Renco Group's ownership structure has been central to its evolution. This analysis will explore the Renco Group SWOT Analysis, its subsidiaries, and the impact of its owner, Ira Rennert, on its strategic direction. We'll examine the company's history, its current business holdings, and the potential implications of its ownership on its future, including any controversies or legal challenges. Discover the financial status and the companies owned by Renco Group.

Who Founded Renco Group?

The Renco Group, Inc., a private holding company, was established in 1975. The founder of the company was Ira Leon Rennert, who played a pivotal role in shaping its initial ownership and strategic direction.

Ira Rennert, born in 1934, brought a background in finance to the company. His early career included roles as a credit analyst and the establishment of his own firm, I. L. Rennert & Co., in 1962. This experience laid the groundwork for his later ventures with The Renco Group.

The company's early ownership structure was highly concentrated. By 1998, Rennert and his family held a significant 98% stake in the company, as revealed in SEC filings. This concentrated ownership gave Rennert considerable control over the company's operations and strategic decisions.

The early strategy of Renco Group ownership involved acquiring struggling or undercapitalized companies. This approach was often financed using high-yield junk bonds. This strategy allowed Rennert to acquire companies like AM General in 1992 with a relatively small down payment.

- The use of junk bonds enabled Renco Group to borrow substantial amounts, with a portion of the funds being transferred to the parent company as dividends.

- This financial maneuverability supported the acquisition of diverse industrial assets.

- Rennert's vision included providing a 'permanent home' for its companies, focusing on long-term value creation through reinvestment.

- The concentrated ownership structure gave Ira Rennert significant decision-making power.

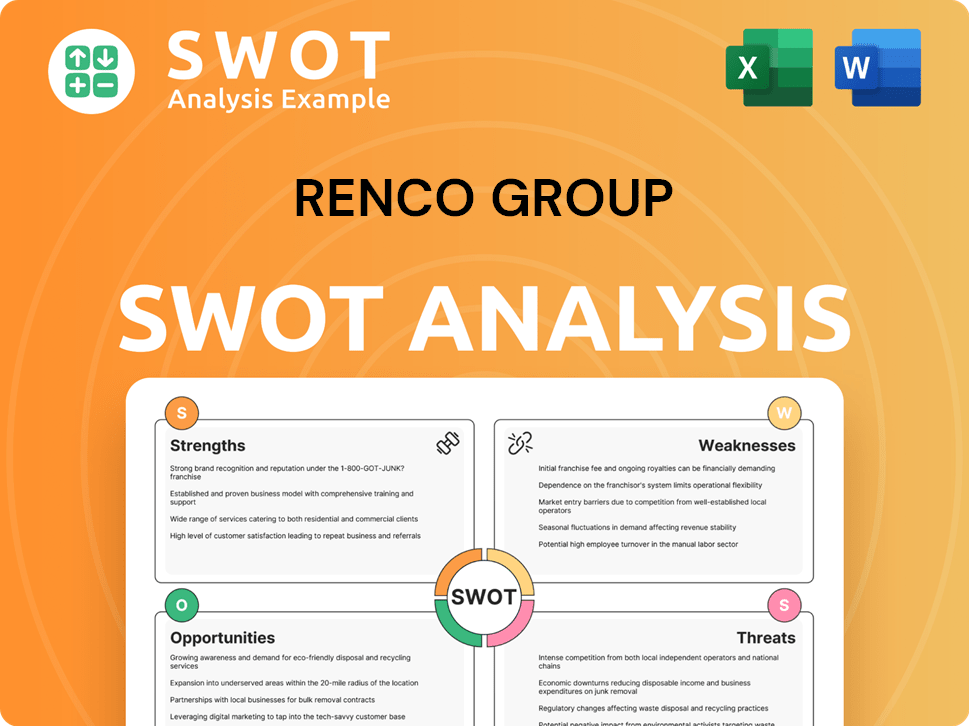

Renco Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Renco Group’s Ownership Changed Over Time?

The ownership of The Renco Group, a company that is the focus of this article, is primarily held privately and controlled by its founder, Ira Rennert, and his family. As of December 31, 2024, the ultimate controlling party of Renco Group, Inc. remains Ira Rennert. This structure has allowed the company to maintain a long-term investment strategy.

Ira Rennert's control is maintained through trusts established for himself and his family. This structure allows Renco to acquire and manage a diverse portfolio of businesses. The decentralized model gives each subsidiary's management team significant autonomy. Understanding the Target Market of Renco Group provides further insight into the company's strategic direction.

| Event | Year | Impact |

|---|---|---|

| AM General Joint Venture | 2004 | Joint venture with MacAndrews & Forbes Holdings, giving Ronald Perelman 70% ownership of AM General. |

| WCI Steel Bankruptcy | 2007 | Renco Group lost ownership of WCI Steel to its lenders. |

| Acquisition of Renfro Brands | June 2021 | Renco Group purchased Renfro Brands. |

| Acquisition of Coach USA | November 2024 | Renco Group acquired Coach USA. |

Key events such as acquisitions and divestitures have shaped the portfolio of Renco Group companies. These changes highlight a dynamic portfolio while reinforcing the consistent private, family-controlled nature of the overarching Renco Group. The focus remains on the strategic management of its diverse business holdings.

Ira Rennert and his family primarily control Renco Group.

- Ownership is maintained through family trusts.

- Renco Group has a history of acquisitions and divestitures.

- The company operates with a decentralized business model.

- The ultimate controlling party remains Ira Rennert.

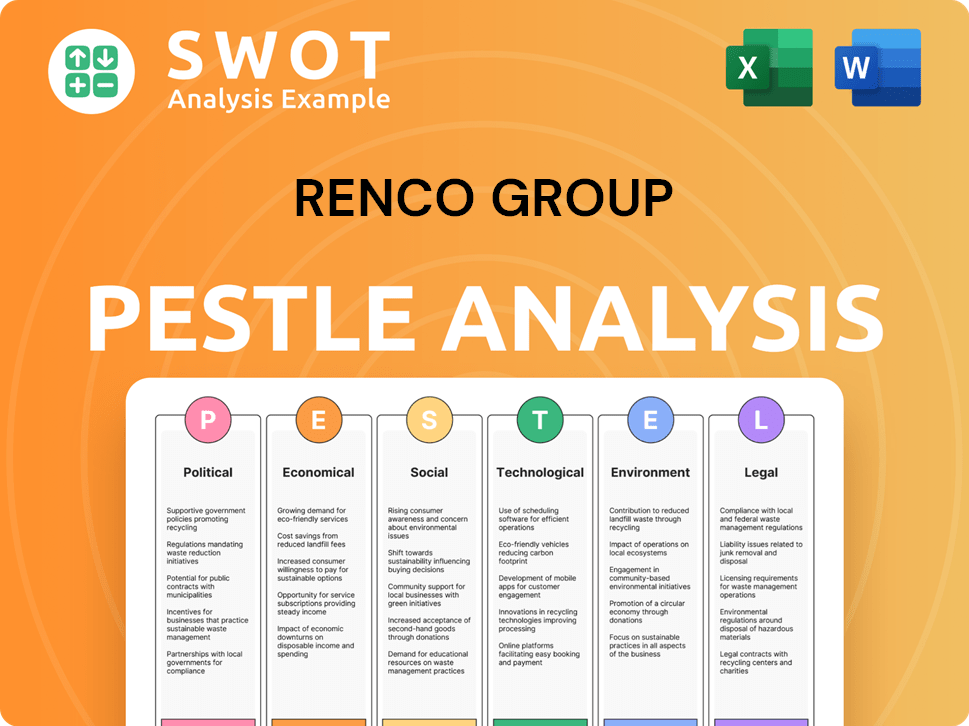

Renco Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Renco Group’s Board?

The Renco Group's ownership structure is primarily controlled by Ira Rennert, the founder, through trusts established for himself and his family. As of November 2024, the key leadership positions within the company reflect this control, with Ira L. Rennert serving as Chairman and CEO. His son, Ari Rennert, holds the position of President, and Roger L. Fay is the VP of Finance. This structure highlights a strong family influence in the company's decision-making processes.

Given that Renco Group is a privately held company, detailed information about its board of directors and voting structures is not extensively available to the public. However, the available information indicates that Ira Rennert maintains significant control. The company's operations are managed as a 'family owned, private holding company', which means decision-making power is concentrated within the family and its appointed leadership. This model typically reduces the likelihood of formal proxy battles or activist investor campaigns, which are more common in public companies.

| Position | Name | Date |

|---|---|---|

| Chairman and CEO | Ira L. Rennert | November 2024 |

| President | Ari Rennert | November 2024 |

| VP Finance | Roger L. Fay | November 2024 |

It's important to note the distinction between The Renco Group, Inc., and Renco Holdings Group Limited, a separate entity listed on the Hong Kong Stock Exchange. As of December 31, 2024, Renco Holdings Group Limited had a different board of directors, including Oriana Silvestrelli as Chairman. This public entity reported a consolidated net loss of approximately HK$23,331,000 for the year ended December 31, 2024. This highlights that the governance and financial performance of the public entity are separate from the private Renco Group controlled by Ira Rennert. For more insights into the company's strategic direction, you can read about the Growth Strategy of Renco Group.

Ira Rennert, through family trusts, maintains significant control over Renco Group. The company operates as a private, family-owned holding company. Decision-making power is concentrated within the family leadership.

- Ira Rennert is the current Chairman and CEO.

- Ari Rennert serves as President.

- Renco Holdings Group Limited is a separate public entity.

- Renco Group's structure limits public scrutiny.

Renco Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Renco Group’s Ownership Landscape?

In the past few years, The Renco Group has continued to expand its portfolio. A significant development was the acquisition of Coach USA in November 2024, following its bankruptcy. This move highlights the group's interest in distressed assets. Previously, in June 2021, Renco Group acquired Renfro Brands, a company specializing in socks and legwear. These actions reflect the group's strategy of acquiring businesses and its focus on long-term investments.

As a privately held entity, the ownership of The Renco Group is concentrated. Ira Rennert and his family control the group through trusts. Ira Rennert's estimated net worth was approximately $3.8 billion as of November 2024. This structure allows The Renco Group to maintain its focus on long-term investment strategies without the pressures faced by publicly traded companies.

| Key Aspect | Details | Recent Developments |

|---|---|---|

| Ownership Structure | Private, family-owned | Concentrated ownership with Ira Rennert and family through trusts. |

| Recent Acquisitions | Strategic acquisitions | Coach USA (November 2024), Renfro Brands (June 2021). |

| Financial Status | Private; not subject to public market pressures | Ira Rennert's net worth estimated at $3.8 billion as of November 2024. |

The Renco Group's ownership structure allows it to operate independently from the influences of public markets. This independence supports its long-term investment approach. For further insights into the group's background, a Brief History of Renco Group provides additional context.

Ira Rennert and his family, through trusts, own The Renco Group. The company remains privately held, maintaining a concentrated ownership model. This structure allows for long-term strategic investments without external shareholder influence.

Recent acquisitions include Coach USA in November 2024 and Renfro Brands in June 2021. These acquisitions showcase the group's strategy of acquiring businesses and its interest in distressed assets. These acquisitions reflect a commitment to expanding its portfolio.

As a private entity, The Renco Group is not subject to public market pressures. Ira Rennert's net worth was estimated at $3.8 billion as of November 2024. This financial stability supports the group's long-term investment approach and strategic acquisitions.

There are no public statements indicating plans for succession or a public listing for The Renco Group. This reinforces its commitment to a private, family-owned model. The group is expected to continue its strategy of acquiring and managing businesses.

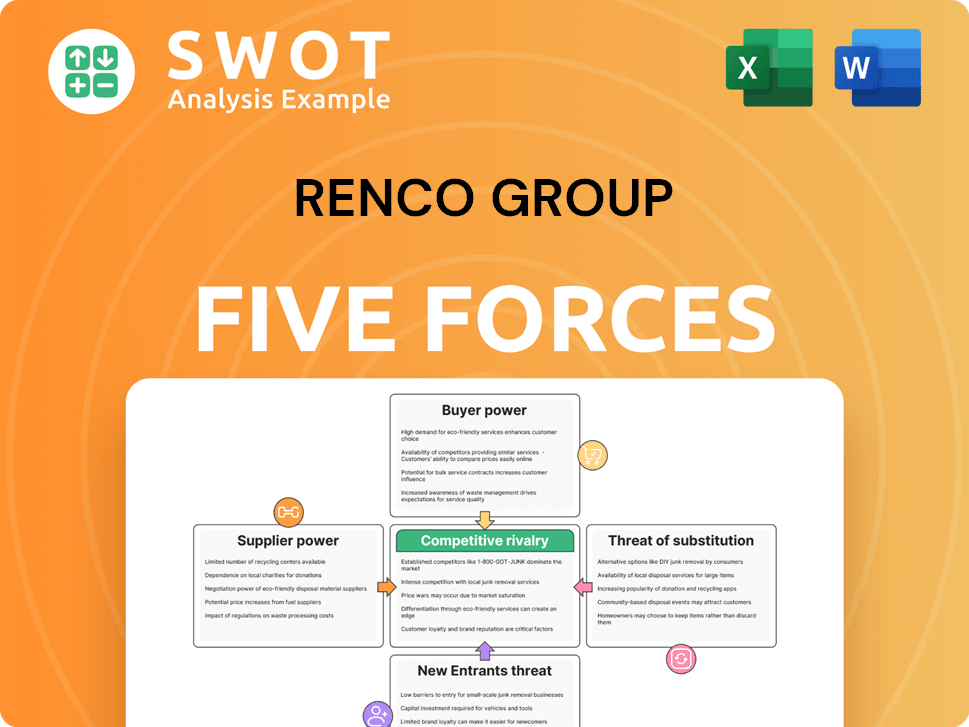

Renco Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Renco Group Company?

- What is Competitive Landscape of Renco Group Company?

- What is Growth Strategy and Future Prospects of Renco Group Company?

- How Does Renco Group Company Work?

- What is Sales and Marketing Strategy of Renco Group Company?

- What is Brief History of Renco Group Company?

- What is Customer Demographics and Target Market of Renco Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.