Renco Group Bundle

Can Renco Group Continue Its Ascent in a Changing Market?

The Renco Group, a privately held powerhouse, has quietly shaped industries since 1975, and its recent acquisition of Coach USA signals a bold new chapter. This move, along with its continued presence in metals, auto parts, and defense, prompts a critical examination of its Renco Group SWOT Analysis and future trajectory. What strategic maneuvers are driving Renco Group's expansion, and what does this mean for its long-term success?

This analysis delves into the Renco Group's strategic planning process, evaluating its recent acquisitions and investment portfolio to understand its growth strategy. We'll explore the Renco Group's future prospects, considering market analysis, industry trends, and potential challenges and opportunities. Furthermore, we'll examine the impact of economic factors on the Renco Group's business and its financial performance review to provide a comprehensive view of its competitive landscape and sustainability initiatives.

How Is Renco Group Expanding Its Reach?

The Marketing Strategy of Renco Group includes a strong focus on expansion initiatives, which are key to its growth strategy and future prospects. These initiatives involve strategic acquisitions and diversification across various sectors, including transportation and renewable energy. The company's strategic planning process emphasizes identifying and capitalizing on opportunities for both organic and inorganic growth.

Renco Group's business strategy is designed to enhance its market position and financial performance. The company actively seeks to expand its investment portfolio through projects that align with sustainable development goals. These investments are aimed at creating long-term value and mitigating risks associated with industry-specific challenges.

Renco Group's expansion plans are a crucial part of its long-term growth strategy. The company's recent acquisitions and projects reflect its commitment to adapting to industry trends and addressing challenges and opportunities in the market. These strategic moves are carefully considered to improve stakeholder analysis and ensure sustainable growth.

In November 2024, Renco Group, through its affiliate Bus Company Holdings US, LLC (BCH US), acquired Coach USA. This acquisition includes several bus lines such as Dillon's, Elko, and Megabus, along with intellectual property and retail operations. The move aims to diversify Renco's portfolio into the passenger transportation sector, providing access to new customer bases and supporting investment in technologies and service enhancements.

Renco Group focuses on Engineering, Procurement, and Construction (EPC) projects in high-margin sectors. A significant project is the urban redevelopment of the former railway station in Cortina d'Ampezzo, Italy, valued at approximately €100 million. This project includes residences, commercial spaces, and a hotel, integrating modern and traditional architecture.

Renco Group is investing in renewable energy projects to diversify its revenue streams and promote sustainability. An agreement with the Pollarini Group involves a plant in the Marche region, Italy, for hydrogen and electricity production from renewable sources, with a total investment of approximately €74.7 million. This includes a 4 MW hydrogen production plant and a 36 MW electricity generation plant, expected to be completed within 28 months.

Renco Moz Green Ltd, a 56% owned subsidiary of Renco S.p.A., increased its stake in Central Solar de Mecufi SA from 25% at the end of 2023 to 51% in June 2024. This move gives Renco control over a company building a 20 MW photovoltaic plant in Pemba, Mozambique, demonstrating its commitment to sustainable initiatives.

Renco Group's expansion strategy includes significant investments in transportation, renewable energy, and construction projects. These initiatives are designed to drive future revenue and improve the company's competitive position. These investments are expected to contribute to the company's long-term growth and resilience.

- Acquisition of Coach USA to enter the passenger transportation market.

- Investment in the Cortina d'Ampezzo redevelopment project (€100 million).

- Agreement with Pollarini Group for a hydrogen and electricity plant (€74.7 million).

- Increased stake in Central Solar de Mecufi SA for a 20 MW photovoltaic plant in Mozambique.

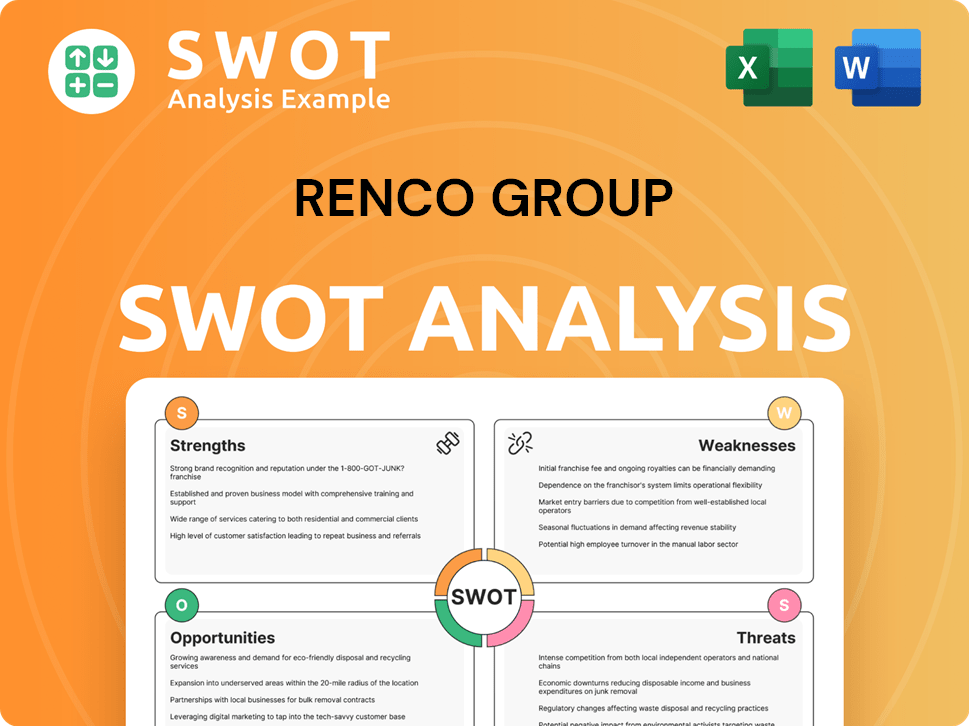

Renco Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Renco Group Invest in Innovation?

The Renco Group's growth strategy is significantly shaped by its commitment to innovation and technology, particularly within the construction and energy sectors. This approach allows the company to address critical global challenges such as housing shortages and the need for sustainable energy solutions. Through strategic investments in cutting-edge technologies, the company aims to enhance its market position and drive long-term value.

This focus on innovation is evident in the development and deployment of advanced construction systems and renewable energy projects. The company's strategic planning process incorporates these technological advancements to improve operational efficiency, reduce environmental impact, and create new opportunities for expansion. This forward-thinking approach is crucial for navigating the competitive landscape and achieving sustained financial performance.

The company's approach to innovation and technology is central to its future prospects, aligning with industry trends and addressing the challenges and opportunities presented by a changing global environment. This strategy is designed to enhance its competitive advantage and ensure long-term growth.

Renco Group's innovation in construction is highlighted by the RENCO MCFR system. This system, recognized with awards in 2023, uses interlocking composite units, improving construction efficiency and resilience.

The RENCO MCFR system is designed to be 23 times stronger than concrete, offering enhanced resistance to extreme weather. The system's approval for up to five-story buildings, with plans to expand to eight stories by 2024, demonstrates its potential to revolutionize construction.

Renco Group is actively involved in sustainability initiatives, including hydrogen and electricity production from renewable sources. The company's investments in renewable energy projects reflect its commitment to sustainable energy management.

In June 2024, Renco Group increased its stake to 51% in Central Solar de Mecufi SA, developing a 20 MW photovoltaic plant in Pemba, Mozambique. This investment is part of the company's strategy to contribute to growth objectives through sustainable energy.

Renco Group emphasizes energy efficiency in its building projects, ensuring LEED BD+C Core and Shell certifications. The company's focus on energy efficiency supports its sustainability goals and contributes to its long-term growth strategy.

The establishment of a Sustainability Committee in 2023 and the development of a Sustainability Plan in 2024 demonstrate Renco Group's commitment to ESG objectives. These initiatives are designed to monitor progress and clearly identify environmental goals and targets.

Renco Group's commitment to innovation and technology is a cornerstone of its Renco Group Business, driving its Renco Group Investments and shaping its Renco Group Performance. The company's focus on advanced construction and sustainable energy solutions positions it for continued success. For more details on the company's target market, see Target Market of Renco Group.

- Development of the RENCO MCFR building system, recognized for innovation and strength.

- Expansion of renewable energy projects, including hydrogen and electricity production.

- Strategic investments in photovoltaic plants to increase sustainable energy capacity.

- Emphasis on energy efficiency and sustainable building practices through LEED certifications.

- Establishment of a Sustainability Committee and development of a Sustainability Plan to monitor ESG objectives.

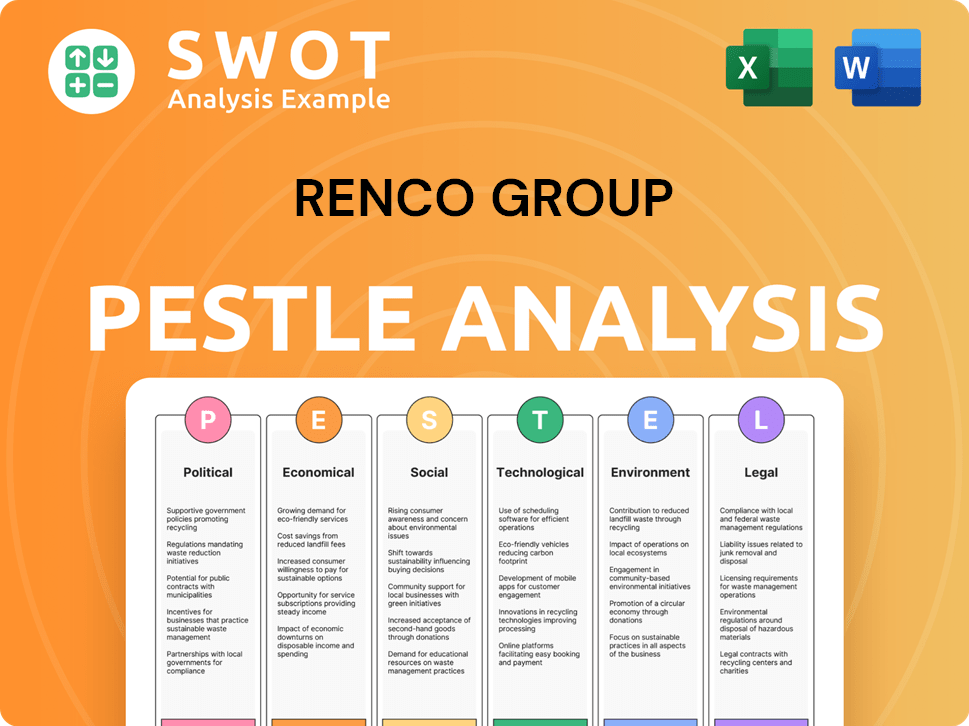

Renco Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Renco Group’s Growth Forecast?

The financial outlook for the Renco Group indicates a strategic focus on recovering and growing its economic results, particularly in the latter half of 2024 and into 2025. This Renco Group Growth Strategy is underpinned by a solid order backlog and strategic investments in key business units.

For the first half of 2024, the Renco Group reported a Value of Production (VoP) of €152.9 million, reflecting a decrease compared to the first half of 2023. This decrease was primarily due to the completion of significant contracts in late 2023 and delayed starts of new projects. Despite these initial challenges, the group anticipates a strong recovery.

Looking at the Renco Group Future Prospects, the company expects to close 2024 with a production level for third parties of approximately €430 million and a margin of approximately €45 million, representing 10.5% on the value of production to third parties. Management estimates a significant VoP growth to approximately €700 million in 2025. This growth is expected to be driven by the Buildings Business Unit and the Energy Business Unit.

The Renco Group Business is focused on achieving significant VoP growth. The company anticipates a production level of approximately €430 million by the end of 2024, with a projected VoP of around €700 million in 2025. These figures highlight the company's strategic direction and its commitment to expansion.

As of November 2024, the order backlog stood at €2.9 billion, providing strong support for the optimistic forecasts. The Buildings Business Unit is expected to contribute over €400 million, while the Energy Business Unit is projected to contribute approximately €165 million to the 2025 VoP.

The gross operating margin (EBITDA) is projected to be around €77 million in 2025, aligning with historical performance. This demonstrates the soundness of the undertaken strategy. The company's financial health is further supported by its ability to maintain profitability.

The company's gross debt remained substantially unchanged at approximately €211 million as of June 30, 2024, with an additional €86 million in non-recourse debt. Interest expenses from gross financial debt amounted to €9.4 million in the first half of 2024. The average annual cost of debt capital was 5.3%.

The financial strategy of the Renco Group Company is also influenced by external factors. For instance, Renco Holdings Group Ltd. (HK:2323) recently announced a delay in publishing its 2024 Annual Results due to audit confirmations and staff shortages, with an expected publication by April 30, 2025. For more insights into the company's background, you can explore the Brief History of Renco Group.

The company's long-term growth strategy is centered around increasing production and margins. The projected VoP growth to €700 million in 2025 demonstrates the company's commitment to expansion. This strategy is supported by the strong order backlog.

The market analysis indicates a positive outlook for the Buildings and Energy Business Units. The significant VoP growth expected in 2025 underscores the company's ability to capitalize on market opportunities. Industry trends are also playing a crucial role.

Renco Group Investments are focused on supporting the growth of its core business units. The company's strategic investments are aimed at enhancing its production capabilities and expanding its market presence. These investments are aligned with its long-term goals.

Stakeholders can expect continued focus on financial stability and growth. The company's ability to maintain a strong order backlog and manage debt effectively is crucial for stakeholder confidence. The company's performance is key.

The company faces challenges related to market fluctuations and project delays. However, the strong order backlog and strategic investments provide significant opportunities for growth. These opportunities are key to achieving the company's financial goals.

Economic factors such as interest rates and market demand influence the company's performance. The company's ability to manage debt and adapt to market changes is crucial. The financial performance review reflects the company's resilience.

Renco Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Renco Group’s Growth?

The Renco Group Company faces various risks that could affect its Renco Group Growth Strategy and future. These challenges span from market competition to regulatory changes and internal operational issues. Understanding these potential obstacles is crucial for assessing the Renco Group Future Prospects.

Market competition, especially in the engineering and construction sector where Renco Group Business operates globally, poses a constant threat. Furthermore, the company must navigate evolving environmental regulations, as past pollution issues have led to lawsuits and penalties. The company acknowledges the need to comply with sustainable practices.

Supply chain disruptions and geopolitical tensions, such as the conflict between Russia and Ukraine, can negatively impact initiatives and profitability. International operations also expose the company to currency fluctuation risks. Additionally, delays in acquisitions and internal operational constraints, as seen with the delayed publication of 2024 results for Renco Holdings Group Ltd., present further challenges.

The engineering and construction industry is highly competitive, requiring continuous enhancements in service offerings and operational efficiency. Renco Group Company must maintain a competitive edge to succeed. This necessitates a robust Renco Group strategic planning process to adapt to market dynamics.

Evolving environmental regulations pose a significant risk, especially given the company's history with pollution concerns. Compliance with sustainable practices is crucial for long-term viability. Renco Group sustainability initiatives are essential to mitigate these risks.

Supply chain vulnerabilities and geopolitical tensions can negatively impact profitability and business operations. These factors can lead to increased costs and delays. Renco Group market analysis must consider these global factors.

International operations, particularly in regions like Kazakhstan and Armenia, expose the company to currency fluctuation risks. These fluctuations can impact financial performance. Careful financial planning is necessary to manage these risks effectively.

Risks are associated with direct investments and acquisitions, including potential delays due to complex authorization procedures. The company must carefully evaluate and integrate acquired assets. Revenue Streams & Business Model of Renco Group provides insight into the company's financial structure.

Internal resource constraints and operational challenges, such as delays in publishing financial results, can impact investor confidence. The stock's bearish cycle and negative outlook suggest potential issues. Effective internal controls are vital.

Renco Group Company is committed to mitigating these risks through careful evaluation of acquisition opportunities, synergetic integration of acquired assets, and internal processes. Management assesses and prepares for risks through diversification. Transparent governance processes and structures are emphasized to ensure sustainability objectives are met. The company's approach includes a comprehensive Renco Group financial performance review.

Renco Group Investments must navigate a challenging landscape. Renco Group SpA reported revenue exceeding EUR 2.84 billion. However, Renco Holdings Group Ltd. experienced a decrease in revenue in 2024. The company's Renco Group expansion plans and Renco Group long-term growth strategy are crucial for future success.

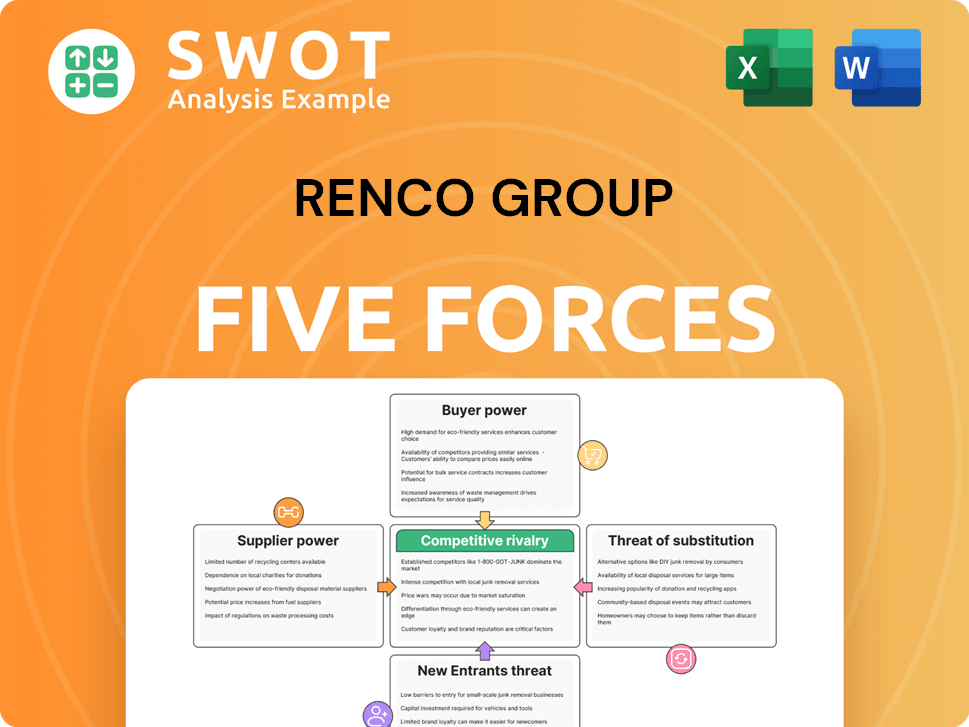

Renco Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Renco Group Company?

- What is Competitive Landscape of Renco Group Company?

- How Does Renco Group Company Work?

- What is Sales and Marketing Strategy of Renco Group Company?

- What is Brief History of Renco Group Company?

- Who Owns Renco Group Company?

- What is Customer Demographics and Target Market of Renco Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.