Renco Group Bundle

Unveiling the Inner Workings of Renco Group: How Does It Thrive?

Ever wondered how a privately held industrial giant like Renco Group operates and generates wealth? This in-depth exploration peels back the layers of Renco Group, a company with significant influence across sectors like metals manufacturing and auto parts. Discover the secrets behind its strategic acquisitions and operational prowess, shaping its substantial empire.

This analysis will provide critical insights for anyone interested in the private equity landscape. We'll examine the Renco Group SWOT Analysis, its core business model, and its diverse revenue streams, providing a comprehensive understanding of its operational framework. Understanding Renco Group’s investment strategies, including its approach to its Renco Group subsidiaries, is key to grasping its influence in key industries. We'll also touch upon its history, its impact on the economy, and how it navigates legal challenges, offering a complete picture of this complex entity.

What Are the Key Operations Driving Renco Group’s Success?

The core operations of the Renco Group revolve around its function as a holding company. The company acquires and manages a diverse portfolio of businesses, focusing on improving their profitability and market position. This approach allows the Renco Group to create value by identifying and revitalizing underperforming companies, often within established industrial sectors. The Growth Strategy of Renco Group involves strategic oversight and operational expertise.

The Renco Group's value proposition centers on its ability to enhance the performance of its subsidiaries. These subsidiaries operate in various sectors, including metals manufacturing, auto parts production, and defense-related manufacturing. The company's focus on operational improvements, such as optimizing manufacturing processes and streamlining supply chains, enables it to offer more reliable supply, higher-quality products, and potentially more competitive pricing.

The Renco Group's business model is characterized by a decentralized operational structure. Each subsidiary within the Renco Group operates independently, with its own processes and networks. Renco Group provides strategic guidance, capital allocation, and facilitates operational improvements across these diverse entities. This approach allows the company to leverage the existing infrastructure and relationships of its subsidiaries.

Renco Group acts as a holding company, acquiring and managing a diverse portfolio of businesses. Its main goal is to improve the financial performance and market position of its subsidiaries. This involves strategic oversight and operational expertise to enhance profitability.

The operational processes are decentralized, with each subsidiary managing its own operations. Renco Group provides strategic guidance and capital allocation. The subsidiaries focus on manufacturing, supply chain management, and sales.

Renco Group creates value by improving the performance of its subsidiaries. This includes offering reliable supply, high-quality products, and competitive pricing. The company's focus on operational excellence drives market differentiation.

The customer segments served are broad, encompassing other industrial manufacturers, automotive companies, and government defense contractors. The subsidiaries' products and services cater to various needs within these sectors.

Renco Group's operational strategies involve restructuring and improving its acquired businesses. This often includes optimizing manufacturing processes, streamlining supply chains, and investing in technology. The company focuses on revitalizing distressed assets to enhance their profitability and market position.

- Strategic Guidance: Providing oversight and direction to subsidiaries.

- Capital Allocation: Investing in projects that drive growth and efficiency.

- Operational Improvements: Enhancing processes to boost performance.

- Market Differentiation: Achieving a competitive edge through excellence.

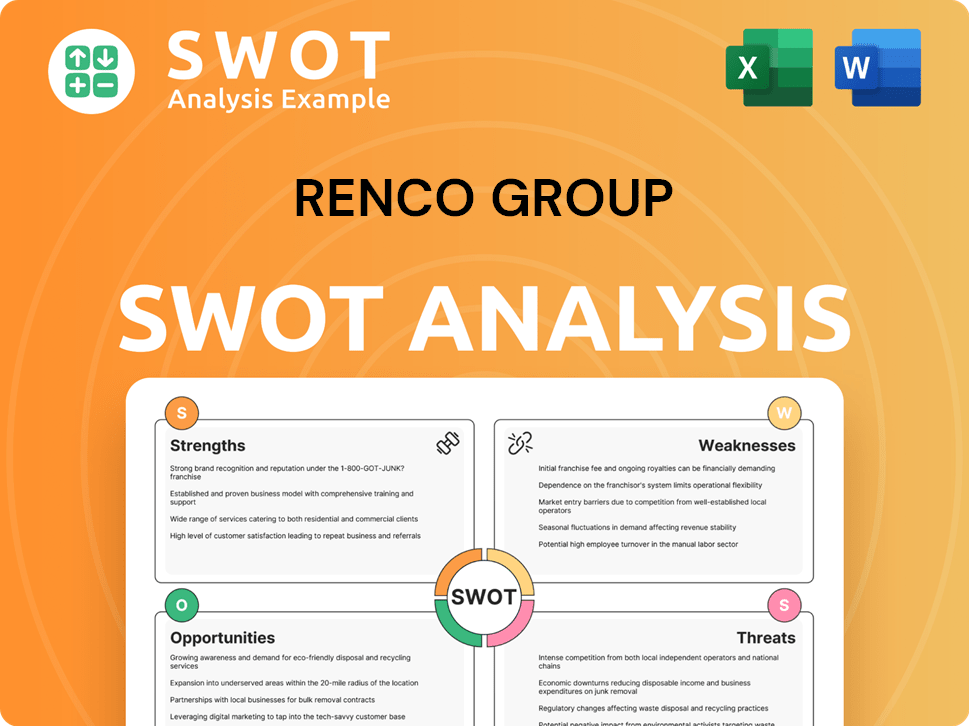

Renco Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Renco Group Make Money?

The Renco Group generates revenue through its diverse portfolio of subsidiaries. As a privately held company, detailed financial breakdowns are not publicly available. However, understanding its revenue streams provides insight into its business model and operations.

The primary sources of revenue for the Renco Group stem from the sales of products and services offered by its subsidiaries. These include product sales from metals manufacturing and auto parts, along with defense-related components. The company’s monetization strategy focuses on the performance and growth of its acquired assets.

Revenue is primarily generated through direct sales to various clients, including industrial clients, automotive manufacturers, and government agencies. The Renco Group's approach emphasizes enhancing the value of its holdings through operational improvements, market expansion, and strategic management.

The majority of the Renco Group's revenue comes from product sales. This includes metals like lead and magnesium, auto parts, and defense-related components.

Clients include industrial clients, automotive manufacturers, and government agencies. These sales are crucial for driving revenue.

The focus is on enhancing the intrinsic value of its holdings. This is achieved through operational efficiencies, market expansion, and strategic management.

Revenue growth is linked to new acquisitions and organic expansion. The addition of new companies in different sectors directly impacts revenue streams.

The Renco Group operates in key industries such as metals manufacturing, automotive, and defense. These sectors provide significant revenue streams.

Investment strategies focus on long-term value creation. This includes improving operational efficiency and expanding market reach.

The Renco Group's revenue model is centered on the performance of its subsidiaries, with product sales being the primary driver. The company's approach to generating revenue is less about innovative pricing and more about the fundamental success of its acquired businesses. For further insights into the Renco Group's business operations and the industries they serve, you can explore the Target Market of Renco Group article.

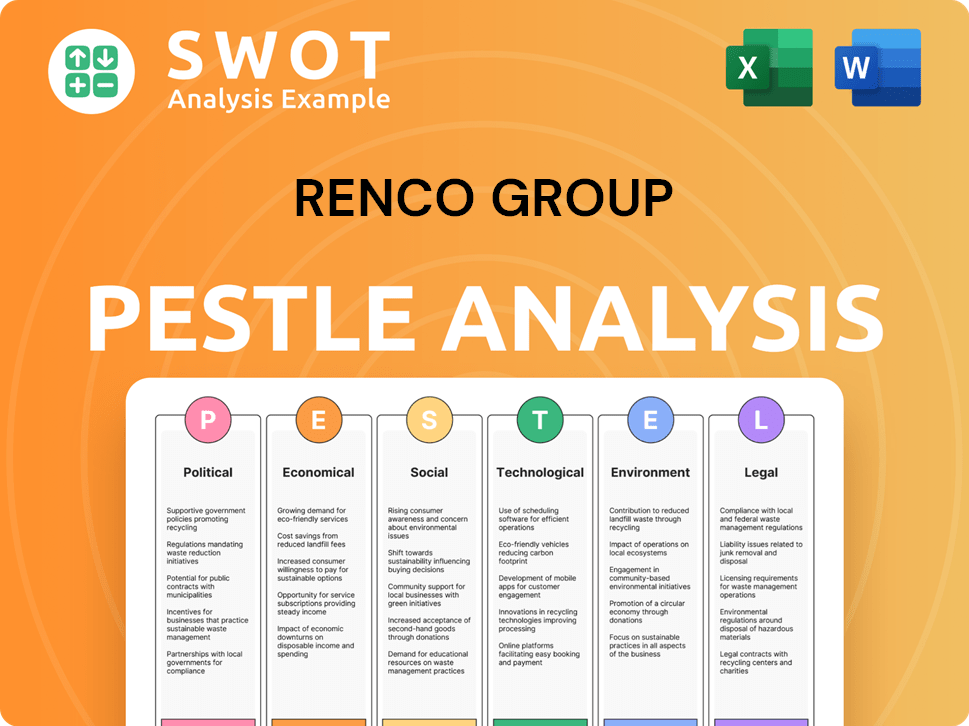

Renco Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Renco Group’s Business Model?

The key milestones of the Renco Group are characterized by strategic acquisitions and operational transformations across its diverse portfolio. These pivotal moments have shaped the company's operational footprint and financial performance. The company's history includes significant acquisitions in industries like lead smelting and magnesium production, alongside involvement in vehicle manufacturing and defense. These moves have been crucial in defining Renco Group's business activities.

Renco Group's strategic moves involve acquiring and restructuring businesses, especially in mature or distressed industrial sectors. This includes identifying undervalued assets and implementing operational improvements. The company has faced operational challenges such as commodity price fluctuations and regulatory hurdles. Its responses typically involve operational efficiencies, debt restructuring, and strategic divestitures or expansions.

Renco Group's competitive edge stems from its expertise in acquiring and restructuring businesses, particularly in mature industrial sectors. This includes a strong financial acumen for identifying undervalued assets and a deep understanding of operational improvements. Its competitive advantage is built on strategic prowess and operational excellence within the B2B industrial landscape. The company continues to adapt to new trends by potentially seeking opportunities in emerging industrial technologies.

Renco Group has made strategic acquisitions in various sectors. These acquisitions have been pivotal in expanding its operational reach and influence. They have included major players in lead smelting, magnesium production, and other industrial areas. For more information, you can read Brief History of Renco Group.

The company faces operational challenges common in industrial sectors. These include commodity price fluctuations, regulatory hurdles, and economic downturns. Renco Group responds by implementing operational efficiencies and restructuring its holdings. These challenges require strategic adaptability for sustained performance.

Renco Group's competitive advantages are rooted in its acquisition and restructuring expertise. The company excels at identifying undervalued assets and implementing operational improvements. This strategic focus enables Renco Group to maintain a strong position in the industrial market. The company's success is built on strategic acumen and operational excellence.

Renco Group adapts to new trends by seeking opportunities in emerging industrial technologies. The company also focuses on optimizing existing operations. This proactive approach ensures Renco Group remains competitive in a globalized market. The company's adaptability is key to its long-term success.

Renco Group concentrates on acquiring and restructuring businesses in mature industrial sectors. The company's investment strategies involve identifying undervalued assets and improving operational efficiency. This strategic focus allows Renco Group to generate value and maintain a competitive edge.

- Acquisition of undervalued assets.

- Implementation of operational improvements.

- Focus on mature industrial sectors.

- Adaptation to emerging technologies.

Renco Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Renco Group Positioning Itself for Continued Success?

The Renco Group operates differently than companies that focus on a single market. Its position is unique as a holding company. Its market share and customer loyalty come from its various companies in sectors such as metals, auto parts, and defense. The global reach of Renco Group is determined by the international operations of its holdings, which can be across multiple continents depending on the industry and the specific company. For more insights into the business approach, you can refer to the Marketing Strategy of Renco Group.

Key risks for Renco Group include cyclical downturns in the industrial and automotive sectors, commodity price volatility, and environmental regulations. New competitors and technological advancements in specific industries could also impact its subsidiaries. As a private entity, Renco Group is less transparent, which can be a risk for stakeholders seeking detailed financial or operational insights. Strategic initiatives involve operational optimization, potential acquisitions, and maintaining profitability amidst economic fluctuations.

Renco Group's industry position is shaped by its diverse portfolio. Its subsidiaries operate in metals manufacturing, auto parts, and defense. These subsidiaries likely hold significant positions within their respective industries.

Risks include economic downturns, commodity price volatility, and environmental regulations. Competition and technological changes can also pose challenges. As a private entity, it faces transparency challenges.

The future depends on identifying value, restructuring businesses, and adapting to market changes. The goal is to sustain and expand profitability across varied industrial enterprises. The company is expected to focus on operational efficiency and strategic acquisitions.

The Renco Group business model depends on the performance of its subsidiaries. Renco Group subsidiaries operate in various sectors. The company's operations are affected by global economic trends and industry-specific dynamics.

The company’s success depends on its ability to manage risks and adapt to market changes. It is important to consider the impact of commodity price volatility on its metals businesses. Strategic initiatives, including acquisitions and operational improvements, are crucial for long-term success.

- Focus on operational optimization within its existing portfolio.

- Potential acquisitions in target industrial sectors.

- Maintaining profitability amidst economic fluctuations.

- Adapting to evolving market conditions and regulatory landscapes.

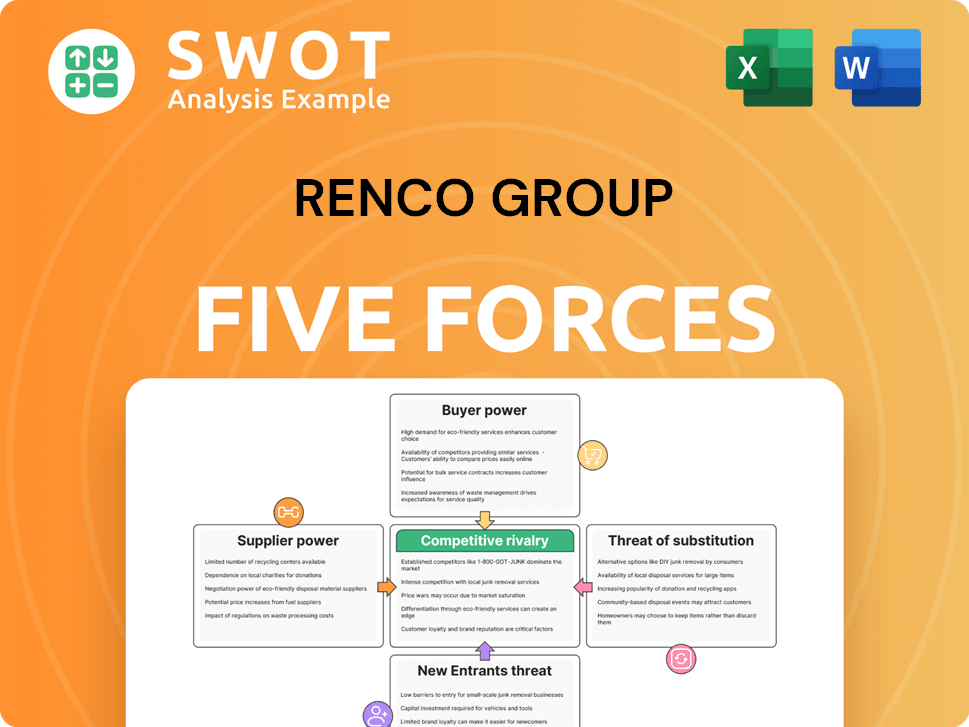

Renco Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Renco Group Company?

- What is Competitive Landscape of Renco Group Company?

- What is Growth Strategy and Future Prospects of Renco Group Company?

- What is Sales and Marketing Strategy of Renco Group Company?

- What is Brief History of Renco Group Company?

- Who Owns Renco Group Company?

- What is Customer Demographics and Target Market of Renco Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.