Renco Group Bundle

How Does Renco Group Navigate Its Competitive Arena?

The Renco Group, a privately held powerhouse, operates across diverse sectors, making its competitive landscape a complex puzzle. Understanding its market positioning is crucial for investors and strategists alike. This analysis dives deep into the Renco Group SWOT Analysis, key rivals, and the industry trends shaping its future.

This exploration of the Renco Group's competitive landscape provides a comprehensive Renco Group market analysis. We will dissect its business strategy, evaluate its financial performance, and identify its key competitors. This detailed examination will cover Renco Group's industry position, including market share analysis, recent acquisitions, and strategic partnerships, offering insights into its challenges and opportunities, future outlook, and comparison with competitors.

Where Does Renco Group’ Stand in the Current Market?

The Renco Group, as a privately held entity, strategically positions itself within diverse industrial sectors through its subsidiaries. Its core operations primarily revolve around acquiring and managing businesses, with a focus on manufacturing, auto parts, and defense industries. The group's value proposition lies in its ability to improve operational efficiencies and drive growth within its portfolio companies, rather than focusing on rapid market segment shifts.

The company's market position is established through the collective performance of its subsidiaries. While specific market share data for the overall group isn't publicly disclosed, its presence in sectors like lead smelting and magnesium production indicates a significant, albeit not precisely quantified, market presence. Renco's approach involves a long-term investment strategy, focusing on enhancing the value of its holdings over time.

Geographically, Renco's operations span North America and other international markets, serving a wide array of industrial and governmental clients. The company's financial health is assessed through the performance of its subsidiaries, which contribute to the group's overall scale and profitability. The consistent acquisition strategy and operational improvements suggest a robust financial standing, even though specific financial data for the overall group isn't publicly available. For more insights into the company's strategic approach, you can explore the Growth Strategy of Renco Group.

The Renco Group's market analysis involves assessing the potential of its subsidiaries within their respective industries. This includes evaluating industry trends, competitive landscapes, and growth opportunities. The group's focus is on identifying undervalued assets and improving their operational efficiency.

Renco Group's industry position is determined by the performance of its subsidiaries in sectors such as manufacturing, auto parts, and defense. The company's strategy is to acquire and manage businesses, focusing on operational improvements and long-term value creation. This approach helps secure a strong position in niche markets.

Identifying Renco Group's competitors requires examining the specific industries in which its subsidiaries operate. Competitors vary depending on the sector, but may include large industrial conglomerates and specialized manufacturers. The competitive landscape is dynamic, requiring continuous monitoring.

The Renco Group's business strategy centers on acquiring and improving businesses across various sectors. This involves a focus on operational enhancements, strategic investments, and long-term value creation. The company aims to build a diversified portfolio of successful enterprises.

Renco Group's financial performance is primarily reflected in the financial results of its subsidiaries. While the overall group's financial data is not publicly available, the continued acquisitions and operational improvements suggest a solid financial standing. The company's focus on operational efficiency contributes to its financial health.

- The financial performance of subsidiaries is a key indicator of the group's overall success.

- Operational improvements and strategic investments drive financial results.

- Renco Group's financial strategy aims for long-term value creation.

- The company's diversified portfolio supports financial stability.

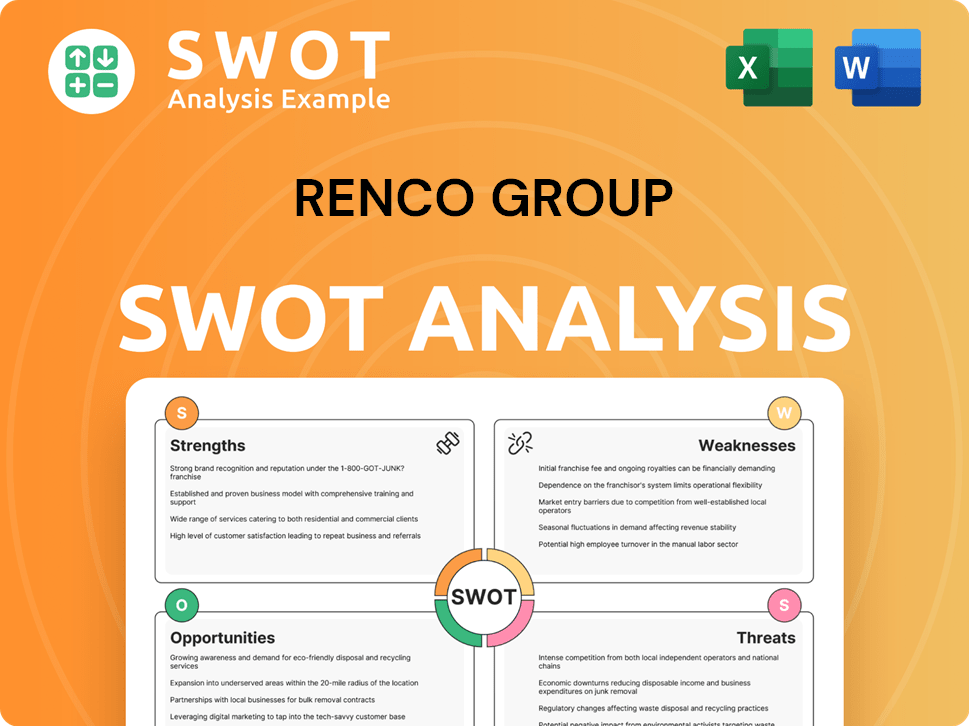

Renco Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Renco Group?

Understanding the Renco Group Competitive Landscape requires a segment-by-segment analysis due to its diversified business portfolio. The company operates in various sectors, each with its own set of competitors and market dynamics. This approach allows for a more precise Renco Group Market Analysis and a clearer view of its Renco Group Industry Position.

The competitive landscape varies significantly depending on the specific industry segment. For instance, in metals manufacturing, the competition differs from that in the automotive or defense sectors. This complexity necessitates a detailed examination of each area to accurately assess Renco Group Competitors and their impact.

In the metals manufacturing sector, particularly in areas like lead or magnesium production, competitors include large-scale global producers. For example, in lead smelting, a subsidiary of Renco Group competes with other major lead producers worldwide. The specific competitors depend on the geographic market and product specifications.

Key competitors include large-scale global producers of raw materials like lead and magnesium.

Competition comes from established global automotive suppliers with extensive R&D and distribution networks.

Major defense contractors compete on technological innovation and contract acquisition.

Indirect competition may arise from new entrants with advanced materials or cost-effective production methods.

Mergers and alliances reshape the competitive landscape, creating larger, more integrated rivals.

Competition varies by geographic market, with different players dominating in different regions.

In the auto parts sector, Renco Group subsidiaries face competition from established global automotive suppliers. These competitors, such as Magna International, Robert Bosch GmbH, and ZF Friedrichshafen AG, offer a wide range of components and systems. They challenge Renco Group through their extensive R&D capabilities, global distribution networks, and long-standing relationships with major automotive OEMs. In the defense sector, depending on the specific products or services offered, competitors could include major defense contractors like Lockheed Martin, Raytheon Technologies, and General Dynamics. These industry giants compete on technological innovation, contract acquisition, and the ability to deliver complex defense systems. Emerging players, particularly in advanced materials or specialized manufacturing processes, could also pose indirect competition by introducing new technologies or more cost-effective production methods. Mergers and alliances among these larger competitors continually reshape the competitive dynamics, creating larger, more integrated rivals. For a more in-depth look at the company's strategies, you can read more about Renco Group's business operations.

Understanding the competitive landscape involves analyzing several key factors that influence Renco Group's market position and strategic decisions.

- Technological Innovation: Competitors' investments in R&D and adoption of new technologies.

- Distribution Networks: The reach and efficiency of competitors' supply chains and distribution systems.

- Customer Relationships: The strength of relationships with major OEMs and other key customers.

- Cost Efficiency: Competitors' ability to produce goods and services at competitive costs.

- Contract Acquisition: Success in securing government contracts and other large-scale projects.

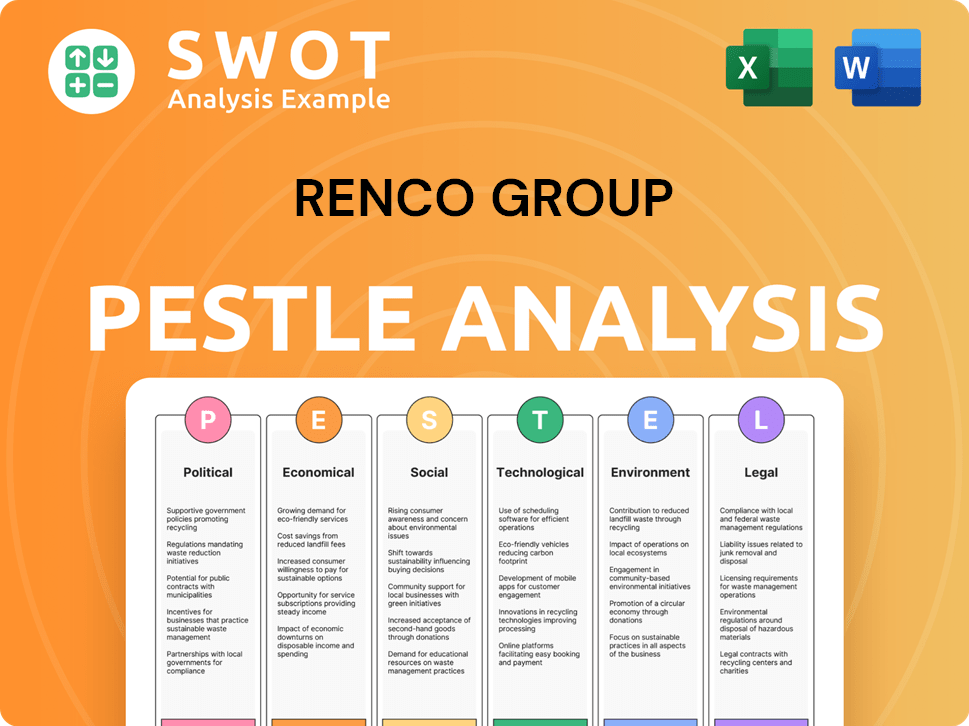

Renco Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Renco Group a Competitive Edge Over Its Rivals?

The Renco Group's competitive advantages are rooted in its strategic positioning as a holding company. Its primary focus is on operational excellence and long-term value creation. This approach allows it to navigate the Renco Group Competitive Landscape effectively. The group's ability to acquire and restructure businesses, often turning around underperforming assets, is a key differentiator.

A significant factor in Renco Group Market Analysis is its expertise in operational improvements and cost efficiencies. The group's strategy includes strategic realignments across diverse industries. While specific technologies are held at the subsidiary level, the group's ability to identify and nurture intellectual property within its portfolio companies is a key strength.

Renco's long-term investment horizon and private ownership structure provide a distinct advantage. This allows for strategic decisions and extensive restructuring efforts without the short-term pressures of public markets. These advantages are sustained by a culture of operational discipline. The group focuses on maximizing the intrinsic value of its acquired businesses.

Renco Group's core strength lies in its ability to acquire and restructure businesses. This involves deep operational improvements and cost efficiencies. The group excels at strategic realignments across various industries, a critical aspect of its Business Strategy.

The group's private ownership allows for a long-term investment horizon. This approach enables strategic decisions and restructuring efforts without short-term market pressures. This strategic patience is a key factor in Renco Group's Financial Performance.

Renco benefits from economies of scale across its holdings. This leads to shared best practices and procurement advantages. Cross-selling opportunities across its diverse industrial base also contribute to its competitive edge.

The established distribution networks and supply chain strengths of its subsidiaries are crucial. These networks contribute to the overall competitive posture of the group. This is a key element in understanding the Renco Group Industry Position.

Renco Group's competitive advantages are multifaceted, including operational expertise, a long-term investment strategy, and economies of scale. These advantages are supported by strong distribution networks and supply chains. For more insights into the ownership structure, consider reading about Owners & Shareholders of Renco Group.

- Acquisition and Restructuring Expertise: Turning around underperforming assets through operational improvements.

- Long-Term Investment Horizon: Making strategic decisions without short-term market pressures.

- Economies of Scale: Leveraging shared best practices and procurement advantages across holdings.

- Strong Distribution Networks: Utilizing established supply chains within individual subsidiaries.

Renco Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Renco Group’s Competitive Landscape?

Understanding the Renco Group's position involves analyzing its diverse industrial holdings amid fluctuating market conditions. The group's competitive landscape is shaped by industry-specific dynamics, including metal manufacturing, auto parts, and defense. A thorough Brief History of Renco Group reveals how it has navigated these sectors. Its future depends on adapting to emerging trends and managing inherent risks.

The Renco Group's market analysis reveals a complex interplay of opportunities and challenges. The metals sector faces environmental regulations and global demand fluctuations. The auto parts industry is experiencing rapid technological shifts, while the defense sector is influenced by geopolitical tensions and government spending. These factors require strategic foresight and operational agility to maintain and enhance the group's competitive advantages.

The metals manufacturing sector is increasingly focused on sustainability, with a growing emphasis on the circular economy. The auto parts industry is undergoing significant transformation due to electrification and autonomous driving. The defense industry is influenced by evolving geopolitical risks and technological advancements.

Increased environmental regulations and intense competition pose significant challenges in metals manufacturing. The auto parts sector faces rapid technological obsolescence and requires substantial R&D investments. Defense spending and priorities are subject to budget constraints and geopolitical shifts.

Leveraging advancements in materials science can lead to lighter, stronger, and more sustainable products. Participating in the supply chain for next-generation automotive technologies presents growth opportunities. Securing contracts for advanced defense systems can provide revenue streams.

Renco Group's business strategy must adapt to these shifts through strategic divestitures, new acquisitions, and operational optimizations. This includes focusing on areas with high growth potential and enhancing resilience. The group's financial performance will depend on its ability to navigate these changes effectively.

Renco Group's future outlook hinges on its ability to adapt to evolving industry dynamics. This involves strategic investments, operational efficiencies, and a proactive approach to risk management. The group's financial reports will reflect its success in navigating these challenges.

- Market Share Analysis: Assessing Renco Group's market share in each sector is crucial for understanding its competitive position.

- SWOT Analysis: A SWOT analysis will highlight the group's strengths, weaknesses, opportunities, and threats.

- Competitive Advantages: Identifying and leveraging competitive advantages is essential for long-term success.

- Geographic Presence: Understanding the group's geographic presence helps in assessing its market reach and potential for expansion.

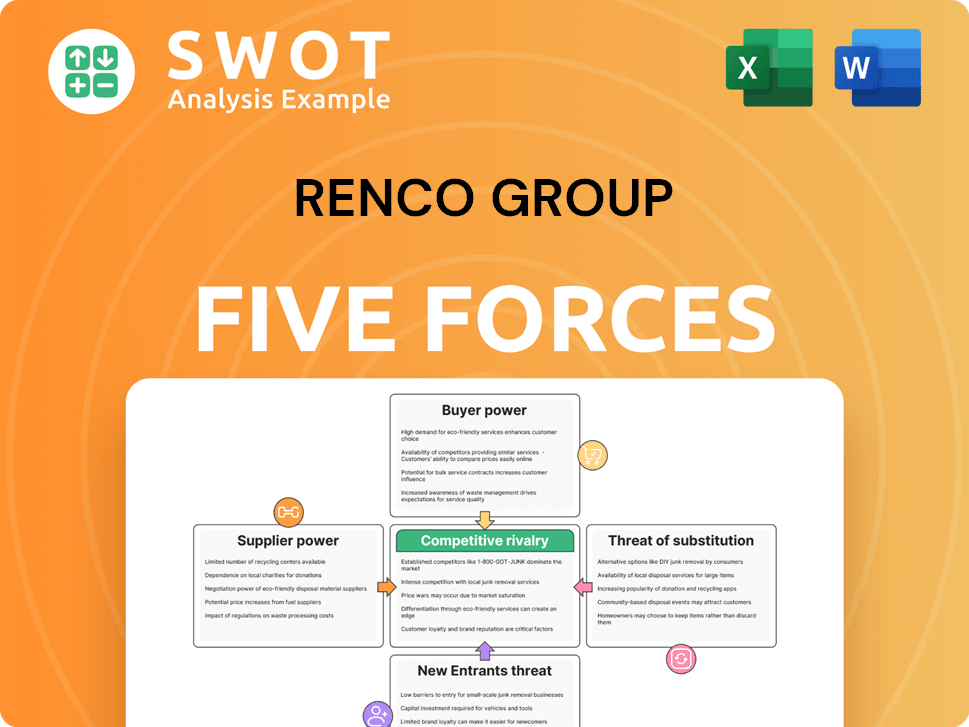

Renco Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Renco Group Company?

- What is Growth Strategy and Future Prospects of Renco Group Company?

- How Does Renco Group Company Work?

- What is Sales and Marketing Strategy of Renco Group Company?

- What is Brief History of Renco Group Company?

- Who Owns Renco Group Company?

- What is Customer Demographics and Target Market of Renco Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.