Revolve Bundle

How Did Revolve Revolutionize Fashion Retail?

Revolve, a leading online fashion retailer, has fundamentally reshaped the Revolve SWOT Analysis industry. Founded in Los Angeles in 2003, the Revolve brand quickly identified the potential of data analytics and social media to connect with Millennial and Gen Z consumers. This data-driven approach fueled its transformation from a startup to a global powerhouse.

From its early days, the Revolve company has consistently demonstrated an understanding of consumer needs, which has been pivotal to its success in the competitive online shopping landscape. This article explores the brief history of Revolve, examining its strategic growth, key milestones, and its impact on the clothing industry. Understanding Revolve's business model and marketing campaigns provides invaluable insights for anyone interested in the evolution of fashion retail.

What is the Revolve Founding Story?

The story of the Revolve company began in 2003 in Los Angeles, California. It was the brainchild of Michael Mente and Mike Karanikolas. Their combined backgrounds in data science and business, rather than fashion, shaped their unique approach to the fashion retail industry.

The founders met at a software startup in Los Angeles. They launched the business with an initial investment of $50,000. This early capital was crucial in setting the foundation for what would become a significant player in online fashion.

Mente and Karanikolas identified a gap in the market: the limited online availability of desirable brands. They saw an opportunity to capitalize on the growing trend of online shopping, especially among younger consumers. Their original business model focused on creating an e-commerce platform that offered a wide selection of fashionable brands.

The initial focus was on selling men's and women's apparel, shoes, and accessories from local boutiques and designers. A key element of their strategy was the use of analytical search tools.

- These tools helped them understand consumer demand.

- They used data to identify gaps in the market.

- This data-driven approach was a key differentiator.

- It allowed them to make informed decisions about inventory and marketing.

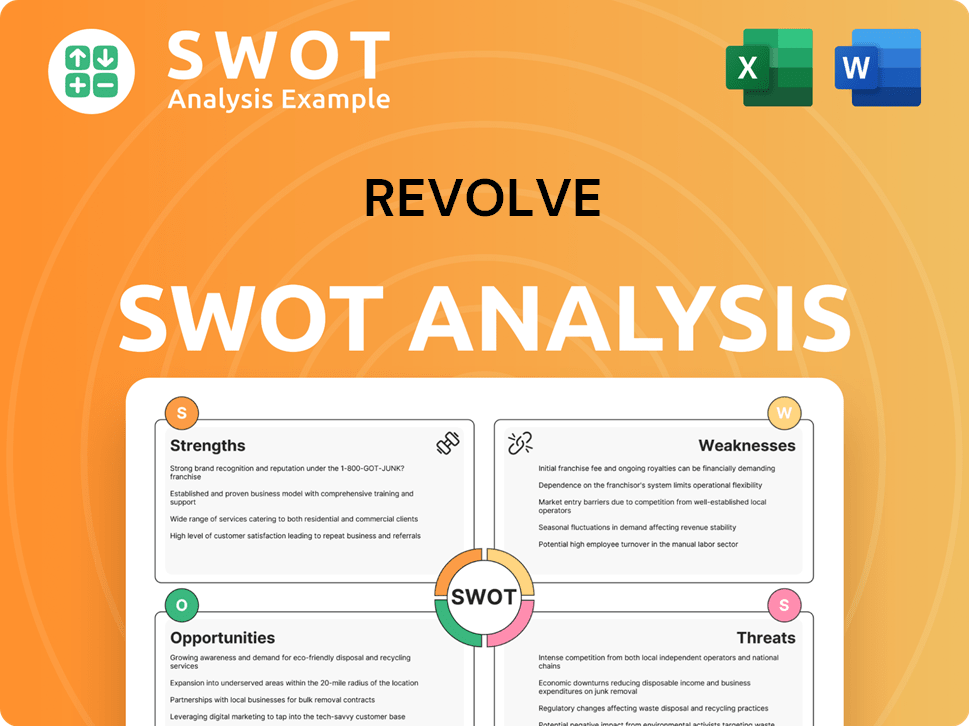

Revolve SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Revolve?

The early growth of the Revolve company was marked by a strategic focus on broadening its brand offerings and establishing a strong e-commerce platform. This period saw the expansion of its online presence and the development of a keen understanding of its target market. The company's ability to adapt to changing consumer preferences and leverage technology played a crucial role in its early success. The Revolve brand quickly became a notable player in the fashion retail sector.

By 2007, just four years after its founding, the Revolve company's e-commerce site featured over 1,000 brands, showcasing its rapid expansion in the online shopping space. This early growth was fueled by a strategy of curating a wide variety of products to attract a broad customer base. This growth was a key part of the Revolve history.

A pivotal shift occurred after the 2008 recession, when the company recognized the need to focus on Millennial women. This strategic pivot, driven by the founders' insights into consumer behavior and data analysis, helped refine the Revolve brand's identity. This focus on a specific demographic was a key element of the company's Revolve's growth strategy.

In 2012, Revolve company acquired Forward by Elyse Walker, adding a luxury fashion component to its business. This acquisition, along with the development of in-house brands, diversified its offerings within the clothing industry. The company's approach to acquisitions was a key part of its Revolve company timeline.

The expansion into the beauty category began with a curated assortment in 2018, growing to over 350 brands by November 2024. Marketing efforts increasingly leveraged social media and influencer relationships, which became a cornerstone of its growth strategy. This approach allowed Revolve to connect with its target demographic, as highlighted in Mission, Vision & Core Values of Revolve, and generate substantial brand visibility.

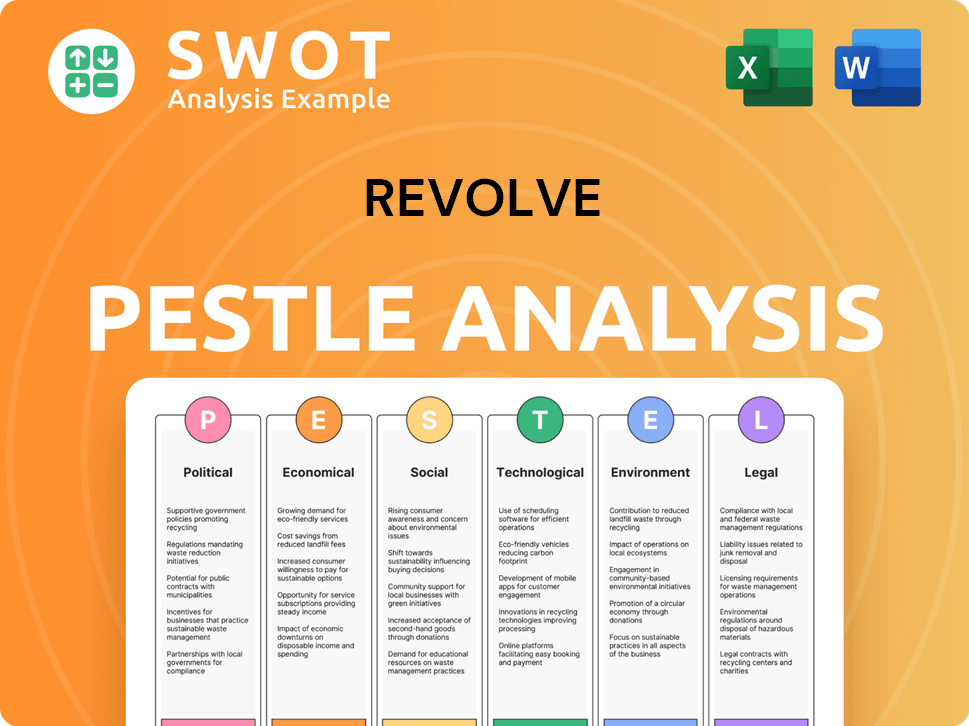

Revolve PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Revolve history?

The Revolve company has achieved significant milestones, demonstrating its evolution and impact on the fashion retail landscape. Key achievements include a successful Initial Public Offering (IPO) and strategic expansions.

| Year | Milestone |

|---|---|

| 2019 | Initial Public Offering (IPO) in June, valued at $1.8 billion. |

| 2024 | Owned brands comprised 18% of the business. |

| 2025 | Planned opening of a permanent store in Los Angeles. |

Innovation has been a cornerstone of the Revolve brand's strategy, particularly in leveraging technology to enhance its operations and customer experience. The company has consistently integrated data analytics and AI to predict trends and manage inventory.

Utilizing AI for site search, personalization, and inventory management to drive revenue benefits. This helps in offering a more tailored shopping experience.

Launched Revolve Beauty in late 2016, which has grown significantly, carrying over 350 brands as of November 2024. This expansion allowed for diversification.

Expanding its own brands, which constituted 18% of the business in 2024, down from 36% in 2019. This strategy helps to control product offerings and margins.

Using data analytics to predict fashion trends and consumer behavior. This helps the company stay ahead of the curve in the fast-paced clothing industry.

Planning a permanent retail store in Los Angeles, set to open in 2025. This expansion includes both Revolve and FWRD brands.

Improving inventory management through AI and data analysis. This ensures optimal stock levels and reduces the risk of overstocking or stockouts.

The Revolve company has faced challenges, including macroeconomic factors and competitive pressures within the online shopping sector. The company has adapted its strategies to address these issues.

Facing macroeconomic headwinds and shifts in consumer sentiment, leading to adjustments in product mix and marketing strategies. The company has observed a shift towards lower-priced products.

Managing tariff impacts, with approximately 22% of inventory imported and 16% from China, along with fluctuating tariff rates, currently at 30%. This impacts the cost of goods sold.

Focusing on improving operational efficiency and reducing return rates, which saw a 300 basis point improvement in March. This improves profitability and customer satisfaction.

Navigating the competitive online shopping landscape, which requires continuous innovation and adaptation. This involves staying relevant and appealing to the target audience.

Adapting to shifts in consumer preferences and spending habits. This involves understanding the target audience and adjusting the product offerings and marketing accordingly.

Improving operational efficiency to manage costs and maintain profitability. This includes optimizing supply chain and logistics.

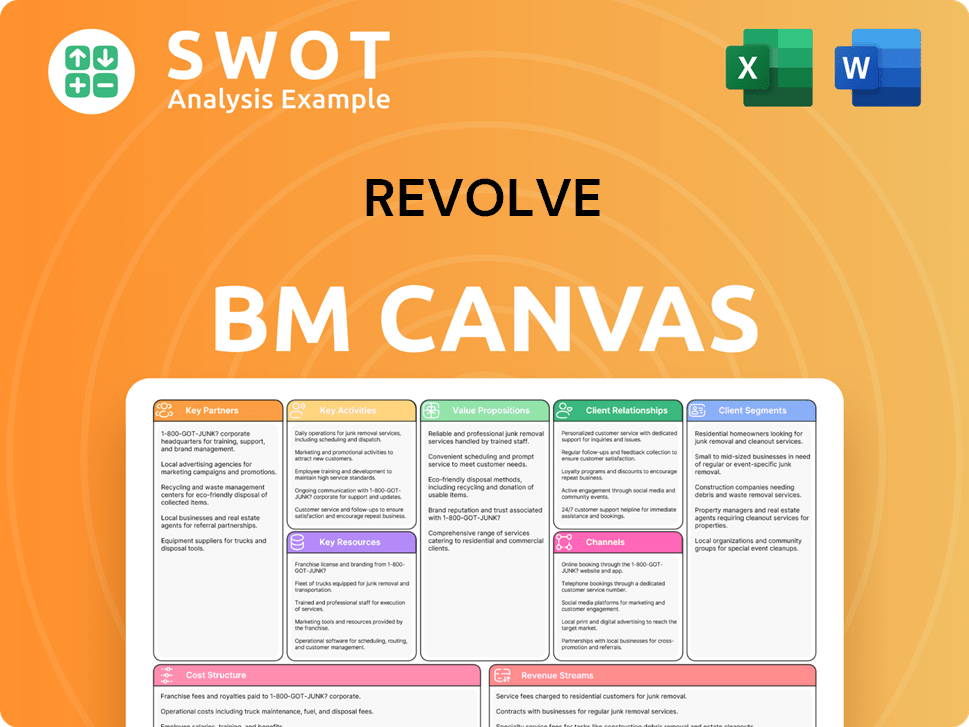

Revolve Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Revolve?

The Revolve company, founded in 2003, has a rich history marked by strategic pivots and innovative approaches to online fashion retail. From its inception with initial capital of $50,000 to its 2019 IPO, the company has consistently adapted to market trends and consumer preferences. Early acquisitions and the expansion of its brand portfolio, including the launch of REVOLVE Beauty and the REVOLVE Social Club, highlight its commitment to diversification and customer engagement. The appointment of Kendall Jenner as Creative Director for FWRD in 2021 further solidified its position in the luxury fashion market.

| Year | Key Event |

|---|---|

| 2003 | Michael Mente and Mike Karanikolas founded Revolve in Los Angeles, California. |

| 2007 | The company launched its e-commerce platform with over 1,000 brands. |

| 2008 | Revolve refocused its strategy to target Millennial women. |

| 2012 | Forward by Elyse Walker was acquired, adding a luxury fashion component. |

| 2013 | Lovers and Friends was acquired. |

| 2015 | Alliance Apparel was acquired. |

| 2016 | REVOLVE Beauty and the REVOLVE Social Club were launched in Los Angeles. |

| 2019 | Revolve Group went public with an IPO on the NYSE under the ticker RVLV. |

| 2020 | Revolve focused on expanding its international presence. |

| 2021 | Kendall Jenner was appointed Creative Director for FWRD. |

| 2024 | Reported $1.1 billion in net sales for the full year. |

| Q4 2024 | Net sales increased 14% year-over-year to $293.7 million, with net income surging 237% to $11.8 million. |

| Q1 2025 | Net sales increased 10% year-over-year to $296.7 million, and net income grew 5% to $11.4 million. |

Revolve is prioritizing international growth, with stronger performance in international markets observed in April 2025. This expansion includes targeted marketing campaigns and localized content to cater to diverse customer bases. The company's focus on global markets is a key element of its long-term growth strategy within the fashion retail sector.

The company plans to launch new owned brands from late 2025 into early 2026. Investments in AI technology are also underway to enhance product discovery and improve operational efficiency. These efforts are expected to boost customer engagement and profitability, furthering Revolve's evolution in the clothing industry.

Revolve is exploring physical retail with a permanent store at The Grove in Los Angeles as a test case. The company maintains a strong financial position, with $300.8 million in cash and cash equivalents as of March 31, 2025, and remains debt-free. This financial stability supports its strategic initiatives and future growth plans.

The company faces potential headwinds, including tariffs, inflation, and consumer spending volatility. Analysts project a 6% revenue growth for fiscal year 2025, with possible downward revisions due to consumer demand concerns. Revolve's leadership is focused on efficiency gains and strategic investments to redefine fashion retail.

Revolve Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Revolve Company?

- What is Growth Strategy and Future Prospects of Revolve Company?

- How Does Revolve Company Work?

- What is Sales and Marketing Strategy of Revolve Company?

- What is Brief History of Revolve Company?

- Who Owns Revolve Company?

- What is Customer Demographics and Target Market of Revolve Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.