Revolve Bundle

Who Really Owns Revolve?

Understanding a company's ownership structure is paramount for investors and strategists alike. Revolve Group, Inc., a prominent player in the online fashion retail space, offers a compelling case study in how ownership evolves, especially after an Initial Public Offering (IPO). This analysis peels back the layers to reveal the key players shaping Revolve's destiny, from its founders to institutional investors and the public market.

Delving into Revolve SWOT Analysis reveals crucial insights into the Revolve brand's strengths, weaknesses, opportunities, and threats, all of which are influenced by its ownership dynamics. Examining the Revolve company's ownership structure provides a critical lens through which to assess its strategic direction and long-term potential. Uncover the details of who owns Revolve, including the Revolve parent company and its major shareholders, to better understand this dynamic fashion retailer and its future trajectory. Knowing who is the CEO of Revolve and who founded Revolve clothing is also key.

Who Founded Revolve?

The story of the Revolve Group begins with its founders, Michael Mente and Mike Karanikolas, who launched the company in 2003. Their initial investment of $50,000 laid the groundwork for what would become a significant player in the fashion industry. Understanding the origins of the Revolve brand is crucial for anyone interested in its ownership structure and evolution.

Michael Mente and Mike Karanikolas have been at the helm since the beginning, serving as co-chief executive officers and board members. This enduring leadership highlights their deep involvement and influence over the company's direction. The co-founders' continued roles underscore their substantial early ownership and control.

Before founding the company, both Mente and Karanikolas gained experience at NextStrat. Mente worked as an analyst, and Karanikolas as a software engineer. While the specifics of their initial equity split aren't publicly detailed, their ongoing leadership and influence suggest a significant stake in the company.

Michael Mente and Mike Karanikolas are the founders of the Revolve company.

They started with an initial capital investment of $50,000.

Both founders have served as co-CEOs and board members since the company's inception.

Prior to founding the company, Mente worked as an analyst and Karanikolas as a software engineer.

In its early stages, Revolve Group, LLC had an Equity Incentive Plan allowing employees to purchase Class A Units.

The exercise prices for these units ranged from $0.26 to $1.01.

The Revolve company's early structure included an Equity Incentive Plan in 2013, which allowed employees, consultants, and directors to purchase Class A Units. The exercise prices for these units varied, reflecting the company's growth phase. Understanding the ownership structure is key to understanding the Revolve brand's evolution and its current position in the fashion market. For more insights into the company's target audience, consider exploring the Target Market of Revolve.

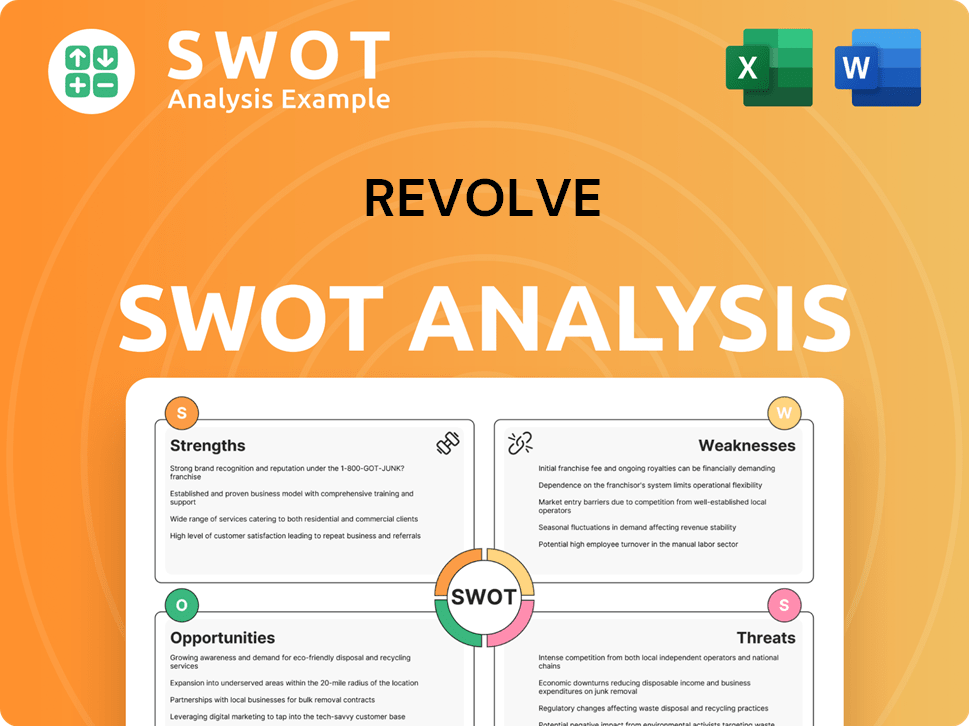

Revolve SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Revolve’s Ownership Changed Over Time?

The ownership structure of the Revolve Group, Inc. has evolved significantly since its inception. Initially operating as a limited liability company, Revolve transitioned into a Delaware corporation before its initial public offering (IPO). This transformation paved the way for the company to enter the public market, allowing for broader investment and increased visibility. The IPO, which took place on June 7, 2019, marked a pivotal moment, as the company began trading on the New York Stock Exchange (NYSE) under the ticker symbol 'RVLV'.

The IPO involved the offering of shares of Class A common stock, with an initial price of $18.00 per share. This event not only introduced new investors but also established a market valuation for the company. The dual-class share structure, where Class B shares held a higher voting power, was also a key element in the ownership structure, allowing the founders to retain significant control over the company despite the public offering. For more insights into the company's strategic approach, you can explore the Growth Strategy of Revolve.

| Ownership Category | Approximate Ownership (May 2025) | Key Details |

|---|---|---|

| Institutional Investors | 62.27% to 76.85% | Hold a significant majority of shares. Major shareholders include Fmr Llc, BlackRock, Inc., and Vanguard Group Inc. |

| Company Insiders | 0.61% to 19.18% | Includes executives and board members. |

| Retail/Individual Investors | 5.75% to 16.79% | Represents the remaining public shareholders. |

As of March 31, 2025, major institutional investors included Fmr Llc with 6,044,804 shares, BlackRock, Inc. with 4,856,919 shares, Kayne Anderson Rudnick Investment Management Llc with 4,669,682 shares, and Vanguard Group Inc with 3,930,620 shares. Jennifer Baxter Moser is a large individual shareholder, owning 13.41 million shares, representing 18.81% of the company as of June 2025. This distribution highlights the influence of institutional investors and the concentrated control maintained by company insiders and founders.

The ownership of the Revolve company is primarily held by institutional investors, indicating strong market confidence.

- Institutional investors hold the largest portion of shares.

- Company insiders retain a significant stake, ensuring strategic control.

- The dual-class share structure concentrates voting power with the founders.

- Public offerings have expanded the shareholder base while maintaining founder influence.

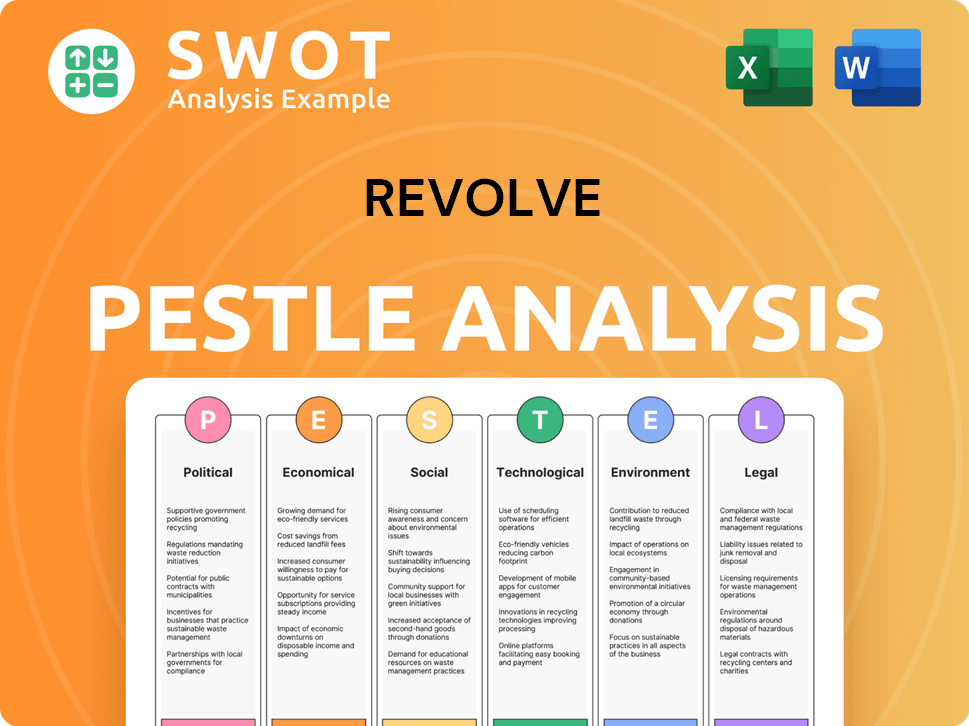

Revolve PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Revolve’s Board?

The current board of directors of the Revolve Group, Inc. includes co-founders Michael Mente and Mike Karanikolas, who also serve as co-chief executive officers. Melanie Cox serves as a lead independent director, also serving on the audit committee and as the chairperson of the compensation committee. The board's structure includes a mix of executive and non-executive directors. As of April 25, 2025, the board believes that having co-chief executive officer Mike Karanikolas also serve as chairperson of the board, with Melanie Cox as lead independent director, is an appropriate leadership structure for the Revolve brand.

The composition of the board reflects the company's leadership and governance approach. The presence of both executive and independent directors aims to balance operational expertise with independent oversight. The lead independent director plays a crucial role in ensuring the board's effectiveness and independence, particularly in areas such as executive compensation and audit functions. This structure is designed to support the company's strategic objectives and maintain accountability to shareholders. Understanding the board's composition is key to assessing the governance of the Revolve company.

| Director | Position | Key Role |

|---|---|---|

| Michael Mente | Co-Chief Executive Officer, Director | Co-founder, strategic direction |

| Mike Karanikolas | Co-Chief Executive Officer, Chairperson of the Board | Co-founder, operational leadership |

| Melanie Cox | Lead Independent Director | Oversight, governance |

Revolve ownership structure includes a dual-class share system, which significantly impacts voting power. Each share of Class A common stock has one vote, while each share of Class B common stock has ten votes. Holders of both classes generally vote together on most matters, including director elections. This structure concentrates significant voting control with executive officers, directors, and their affiliates. Following the IPO, Class B common stock held by MMMK Development, Inc., an entity controlled by the co-chief executive officers, represented approximately 67% of the voting power. This makes the company a 'controlled company' under NYSE rules. There is no cumulative voting in director elections, so a majority of the combined voting power can elect all directors. To learn more about the Revolve fashion market, consider exploring the Competitors Landscape of Revolve.

The dual-class share structure gives significant voting power to the founders.

- Class B shares hold ten times the voting power of Class A shares.

- This structure allows the founders to maintain control even with a minority of the outstanding shares.

- The company operates as a 'controlled company' under NYSE rules.

- This impacts shareholder influence on major decisions.

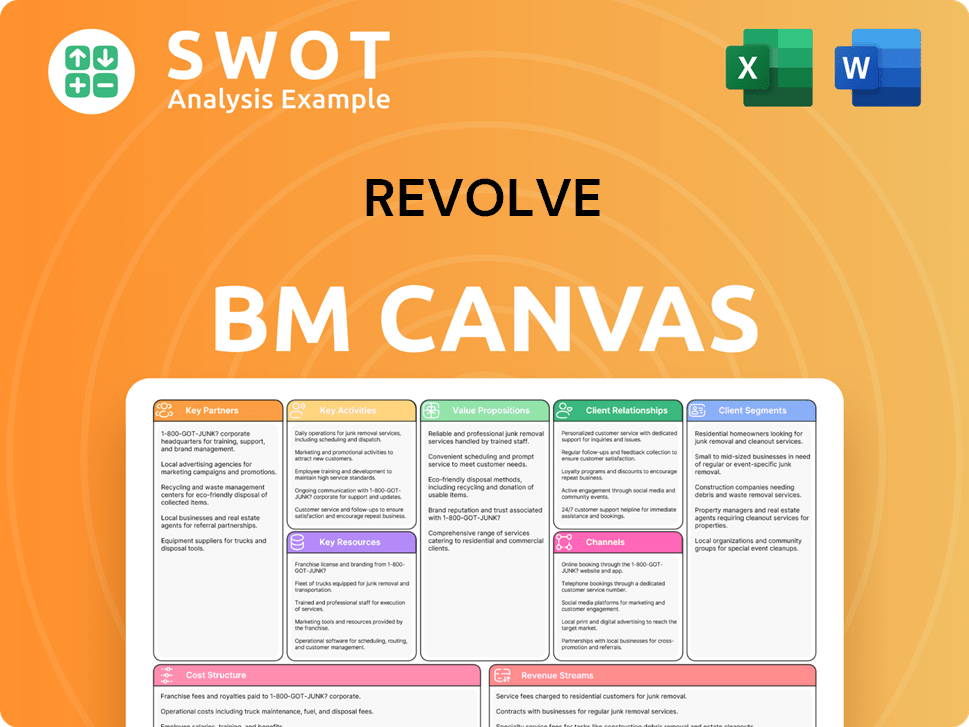

Revolve Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Revolve’s Ownership Landscape?

In the past few years, the ownership structure of the Revolve company has seen some shifts. As of May 2025, insider holdings remained relatively stable at 1.62%. Institutional investors held a significant portion at 62.27%, and mutual funds increased their stake from 52.04% to 52.09%. Recent insider trading activity indicates that company insiders have primarily been selling shares.

Institutional ownership has experienced notable changes. BlackRock, Inc. increased its stake, while William Blair Investment Management, LLC and Citadel Advisors LLC reduced their holdings significantly. Other institutions also decreased their positions. Conversely, Balyasny Asset Management L.P. and Driehaus Capital Management LLC increased their holdings. These movements suggest a mixed sentiment among institutional investors regarding the Revolve brand.

| Ownership Category | May 2025 | Change |

|---|---|---|

| Insider Holdings | 1.62% | Unchanged |

| Institutional Investors | 62.27% | Various changes |

| Mutual Funds | 52.09% | Increased |

The company's financial performance in 2024 included net revenue of $1.087 billion and net income of $42.9 million. However, analysts have adjusted their earnings forecasts for 2025, citing various economic factors. The management has also warned about potential gross margin shrinkage due to increased supply chain costs.

In June 2024, the company acquired a majority stake in the luxury fashion brand Alexandre Vauthier. This move aims to expand the company's presence in the premium fashion market. In May 2025, the company also acquired the IP-related assets of Australian designer label Dion Lee.

In November 2024, Steve Dalton transitioned from CEO to Executive Chairman. Myke Clark was appointed as the new CEO and director of Revolve Renewable Power Corp., a separate entity. It is important to note the distinction between Revolve Group, Inc. (fashion retailer) and Revolve Renewable Power Corp. (renewable energy company).

Revolve Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Revolve Company?

- What is Competitive Landscape of Revolve Company?

- What is Growth Strategy and Future Prospects of Revolve Company?

- How Does Revolve Company Work?

- What is Sales and Marketing Strategy of Revolve Company?

- What is Brief History of Revolve Company?

- What is Customer Demographics and Target Market of Revolve Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.