Revolve Bundle

Unpacking Revolve: How Does This Fashion Powerhouse Operate?

Revolve Group, Inc. (NYSE: RVLV) has become a dominant force in online fashion, particularly for Millennials and Gen Z. Its impressive first-quarter 2025 net sales of $297 million, a 10% year-over-year increase, highlight its growing influence. But how does the Revolve SWOT Analysis really work, and what makes this

Revolve's strength lies in its data-driven approach, leveraging a massive social media presence and a network of influencers to stay ahead of trends. Understanding the

What Are the Key Operations Driving Revolve’s Success?

The Revolve company focuses on creating value by offering a curated selection of fashion items, primarily targeting Millennials and Gen Z. Its core offerings include clothing, shoes, accessories, and beauty products from roughly 500-600 unique fashion brands. The company emphasizes premium and luxury labels, alongside its own in-house brands, to cater to its target demographic.

As of 2024, the majority of the Revolve Group's target demographic consists of Millennials and Gen Z consumers, representing 76% of its consumer base. This demographic, with an average age range of 18-34 years old, holds significant spending power, estimated at $1.4 trillion. This focus allows the Revolve brand to tailor its offerings and marketing efforts effectively.

Operational processes at Revolve clothing are heavily reliant on technology and data analytics. The company uses real-time data to predict trends and manage inventory. This approach helps in reducing overstocking and markdowns. The company introduces approximately 1,900 new styles weekly, managing a cycle of 110,000 styles across its Revolve and FWRD marketplaces during 2024. Its supply chain is characterized by quickly turning, shallow orders to mitigate fashion risk.

The value proposition of the Revolve website is enhanced by its strong network of social media influencers. These influencers drive brand visibility and sales. This strategy is a key component of the Revolve brand's marketing efforts.

The company also maintains exclusive partnerships with certain brands. For example, the partnership with Alice + Olivia generated approximately $35.2 million in revenue in 2023. This strategy supports the company's revenue streams.

Compared to competitors, Revolve fashion stands out due to its data-driven merchandising, influencer marketing, and focus on the affordable luxury category. This combination allows the company to maintain a competitive edge in the online retail market. To understand more about the company's structure, read about Owners & Shareholders of Revolve.

- Data-driven merchandising helps predict trends and manage inventory.

- Influencer marketing increases brand visibility and sales.

- Focus on affordable luxury attracts a specific customer base.

- Exclusive partnerships drive revenue and brand recognition.

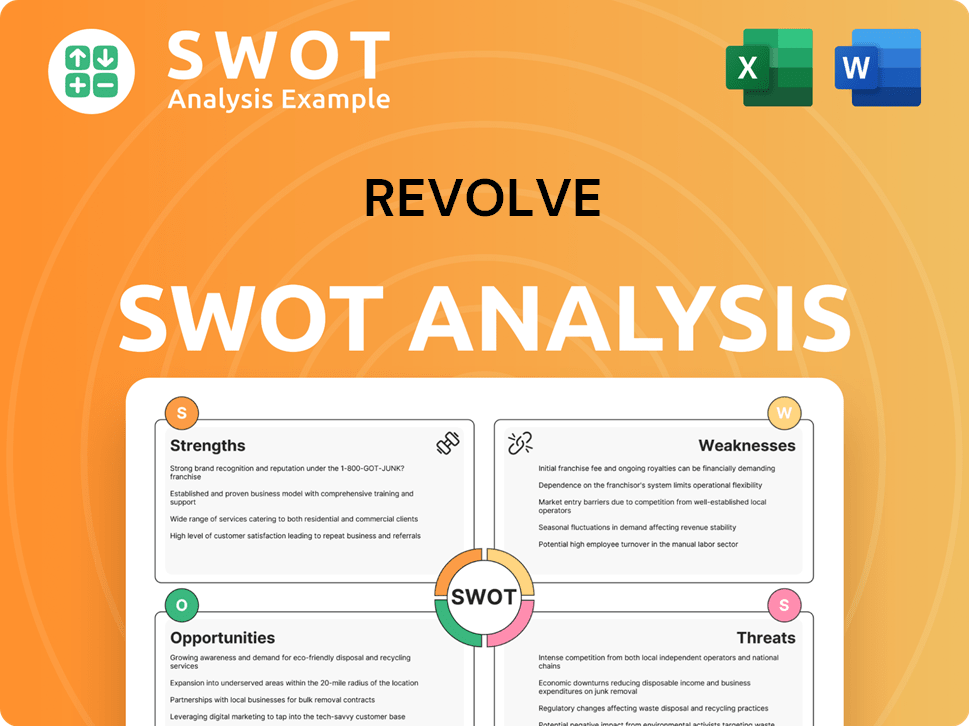

Revolve SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Revolve Make Money?

The primary revenue stream for the Revolve company stems from selling clothing, shoes, accessories, and beauty products. This is achieved through its two main segments: REVOLVE and FWRD. The company employs a premium pricing model, which helps to maintain higher profit margins.

For the full fiscal year 2024, the company reported net revenue of $1.087 billion, marking a 7.9% increase compared to 2023. The gross profit for 2024 was $587.9 million, with a gross margin of 54.1%. This demonstrates the company's strong financial performance and its ability to generate substantial revenue.

In the first quarter of 2025, the company's net sales reached $297 million, reflecting a 10% year-over-year increase. The REVOLVE segment's net sales increased by 11% year-over-year, reaching $252.0 million in Q4 2024, while the FWRD segment's net sales increased by 3% year-over-year in Q1 2025, and 11% in Q4 2024, to $41.8 million. The company also generates revenue from its in-house brands, which constituted 18% of REVOLVE Segment net sales for the full year 2024.

The company focuses on expanding its revenue base beyond the U.S. market. This includes leveraging platforms like Tmall Global, RED, and Douyin in China, as well as Nykaa Fashion in India. This strategy allows the Revolve brand to reach a wider customer base and increase sales.

- The company's strategic use of influencer marketing is a key part of its strategy.

- Revolve fashion utilizes a premium pricing model.

- The company's global expansion efforts include platforms like Tmall Global, RED, Douyin, and Nykaa Fashion.

- Domestic net sales increased by 9% and international net sales increased by 12% year-over-year in Q1 2025.

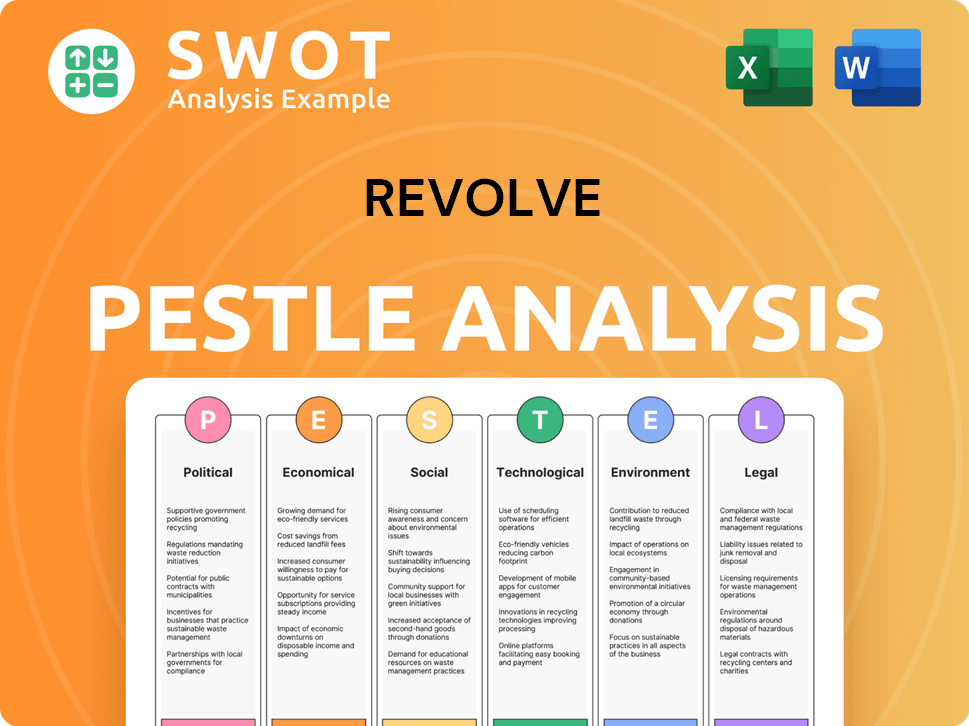

Revolve PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Revolve’s Business Model?

The success of the Revolve company is marked by significant milestones and strategic decisions that have shaped its growth and market position. A key focus has been the expansion of its owned brands and the integration of AI technology to boost efficiency and drive growth. Furthermore, the company is investing in physical retail, with a permanent store planned for 2025 in Los Angeles.

Revolve clothing has demonstrated resilience in the face of economic challenges. It reported a net income of $11.8 million in Q4 2024, marking a 237% year-over-year increase, with adjusted EBITDA reaching $18.3 million, a 114% increase. These figures highlight the company’s ability to adapt and thrive in a dynamic market.

Revolve fashion leverages its brand recognition, data-driven merchandising, and effective influencer marketing. The company's proprietary technology and efficient inventory management also contribute to its competitive edge. This approach allows Revolve to quickly respond to changing customer preferences and fashion trends.

Revolve has expanded its owned brands and integrated AI technology. The company is also expanding into physical retail with a permanent store opening in 2025.

Strategic moves include the use of AI, expanding product categories, and elevating service levels in international markets. The company focuses on data-driven merchandising and influencer marketing.

Revolve benefits from strong brand recognition and a data-driven approach. The company's efficient inventory management and ability to respond to fashion trends quickly are also key advantages.

In Q4 2024, Revolve reported a net income of $11.8 million, a 237% year-over-year increase, and adjusted EBITDA of $18.3 million, a 114% increase, demonstrating strong financial health.

Revolve's success is rooted in its ability to adapt and innovate. The company's focus on AI and personalization, coupled with its strong brand presence, allows it to cater to a broad customer base. To understand more about the target audience, you can read more about the Target Market of Revolve.

- Data-driven merchandising helps in inventory management.

- Effective influencer marketing.

- Investment in AI and personalization.

- Expansion of product categories and international markets.

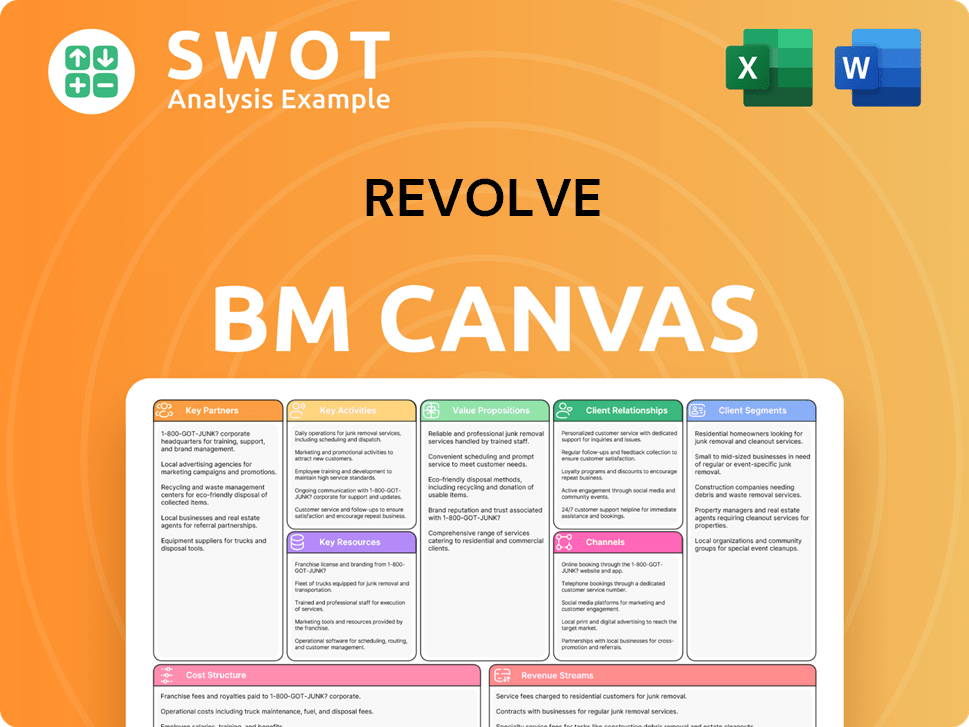

Revolve Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Revolve Positioning Itself for Continued Success?

The Revolve company holds a strong position in the online fashion retail sector, focusing on the affordable luxury market and targeting Millennials and Gen Z consumers. As of March 31, 2025, the company had 2.7 million active customers, a 6% year-over-year increase, demonstrating solid customer loyalty. This growth indicates a significant addressable market for expansion within the fashion industry.

The competitive landscape for Revolve clothing includes many online fashion retailers, operating within a total addressable market projected at $264.5 billion in 2024. The online fashion retail market is experiencing a growth rate of 12.3% annually, presenting both opportunities and challenges for Revolve. This dynamic environment requires continuous adaptation and strategic initiatives to maintain its market position.

Revolve is well-positioned in the affordable luxury online fashion market, appealing to Millennial and Gen Z consumers. The company's focus on influencer marketing and trend-driven styles helps it stand out. The company's strong brand recognition and customer loyalty contribute to its competitive advantage.

Economic downturns and changing consumer preferences pose significant risks to Revolve's revenue. Macroeconomic conditions and increased competition within the online fashion sector also present challenges. The company is exposed to market risks, including interest rate changes and foreign currency fluctuations.

Revolve plans to expand its profitability through strategic initiatives like owned brands and AI technology. The company aims to explore physical retail, with a permanent store opening in 2025. International expansion is a key focus, with the international market viewed as significantly larger than the U.S.

The company is expanding its owned brands and investing in AI technology to enhance customer experience. Revolve is also exploring physical retail expansion and focusing on international markets. These initiatives aim to drive growth and increase market share.

Several factors could impact Revolve's operations and financial performance, including economic downturns and shifts in consumer behavior. Regulatory changes, new competitors, and technological disruption also pose challenges. Market risks like interest rate changes and foreign currency fluctuations, along with tariffs, could influence gross margins.

- Economic downturns affecting consumer spending.

- Changes in consumer preferences and fashion trends.

- Increased competition from other online retailers.

- Potential impacts from tariffs and currency fluctuations.

Revolve Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Revolve Company?

- What is Competitive Landscape of Revolve Company?

- What is Growth Strategy and Future Prospects of Revolve Company?

- What is Sales and Marketing Strategy of Revolve Company?

- What is Brief History of Revolve Company?

- Who Owns Revolve Company?

- What is Customer Demographics and Target Market of Revolve Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.