Revolve Bundle

Can Revolve Maintain Its Fashion-Forward Momentum?

In the ever-evolving world of fashion e-commerce, Revolve has captured a significant share, particularly among Millennial and Gen Z consumers. Founded in 2003, the company has leveraged technology and data to create a unique online retail experience. This approach, offering a curated selection of clothing and accessories, has allowed Revolve to stand out in a competitive market.

This Revolve SWOT Analysis delves into the core of Revolve's business model, examining its past successes and future potential. We explore how Revolve's growth strategy, fueled by innovative marketing and data analytics, has positioned it within the luxury fashion market. Understanding Revolve's future prospects requires a deep dive into its competitive advantages and plans for international expansion, offering insights for investors and industry observers alike.

How Is Revolve Expanding Its Reach?

The growth strategy of the company centers on expanding its reach and diversifying its offerings within the global fashion market. This involves a multi-faceted approach, including international expansion, product diversification, strategic partnerships, and continuous investment in its operational infrastructure. A thorough Revolve company analysis reveals a dynamic approach to capturing market share and adapting to evolving consumer preferences.

Key to its strategy is leveraging its established e-commerce platform and influencer network to penetrate new geographical markets. The company continually assesses opportunities in regions with growing online retail penetration and a strong interest in Western fashion trends. This approach is supported by data analytics, enabling rapid identification of emerging trends and efficient product onboarding, which is critical for the company's success in the competitive online retail trends landscape.

The company's expansion initiatives are designed to capitalize on the evolving dynamics of the luxury fashion market and the broader fashion e-commerce sector. By focusing on these areas, the company aims to solidify its position as a leading player in the industry and drive sustainable growth. For more insights into the company's ownership structure, you can explore the details in Owners & Shareholders of Revolve.

The company actively pursues international expansion, focusing on regions with high growth potential in online retail. This strategy involves leveraging its existing e-commerce platform and influencer network to build brand awareness and drive sales in new markets. The company's approach is data-driven, allowing it to adapt quickly to local market preferences and trends.

The company consistently introduces new brands and expands its in-house label portfolio to meet evolving consumer tastes. This includes venturing into adjacent lifestyle categories, such as beauty and activewear, to create a more comprehensive lifestyle destination. This diversification strategy helps capture additional spending from its target audience and strengthens its market position.

The company actively explores strategic partnerships and collaborations with designers, celebrities, and other brands. These collaborations result in exclusive collections and generate significant marketing buzz. Such partnerships serve as powerful marketing tools, attracting new customers and reinforcing brand loyalty. The company's collaborations often feature limited-edition products, driving demand.

The company continues to invest in its logistics and fulfillment infrastructure to support its expansion. This investment ensures efficient delivery and customer satisfaction across its growing operational footprint. The company's commitment to operational excellence is crucial for maintaining its competitive edge in the fast-paced online retail market.

The company's growth strategy is propelled by several key drivers, including international expansion, product diversification, strategic partnerships, and technological innovation. These drivers are interconnected, creating a synergistic effect that enhances the company's market position and drives revenue growth. The company's ability to adapt to changing consumer preferences and market trends is critical to its long-term success.

- International Expansion: Penetrating new geographical markets with tailored marketing and product offerings.

- Product Diversification: Expanding into new categories like beauty and activewear to broaden appeal.

- Strategic Partnerships: Collaborating with designers and influencers to create exclusive collections.

- Technological Innovation: Utilizing data analytics to optimize product offerings and customer experiences.

Revolve SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Revolve Invest in Innovation?

The sustained growth of the company is significantly shaped by its innovation and technology strategy, which leverages data analytics and digital platforms to optimize its business operations. The company's focus on enhancing its proprietary e-commerce platform through in-house development is a key aspect of this strategy. This includes advanced recommendation engines that utilize customer data to suggest relevant products, improving the shopping journey and driving sales, which is a critical component of the company's mission.

A cornerstone of the company's technological approach is its effective use of data analytics to inform merchandising decisions, inventory management, and marketing campaigns. By analyzing vast amounts of customer data, the company can identify emerging trends, predict demand for specific products, and optimize pricing strategies. This data-driven approach minimizes inventory risk and ensures that the company offers products that resonate with its target demographic.

The company heavily utilizes cutting-edge technologies in its marketing efforts, particularly through its extensive influencer network. The company employs sophisticated algorithms to identify and collaborate with social media influencers who align with its brand aesthetic and target audience, effectively transforming them into powerful marketing channels. This strategy has been instrumental in building brand awareness and driving sales among Millennial and Gen Z consumers. The company's commitment to digital transformation extends to its operational efficiencies, exploring automation in warehousing and logistics to streamline processes and reduce costs.

The company uses data analytics to inform merchandising decisions, ensuring they offer products that align with customer preferences. By analyzing customer data, including browsing behavior and purchase history, the company can predict demand and optimize inventory. This data-driven approach helps minimize inventory risk and maximize sales.

The company heavily leverages influencer marketing to build brand awareness and drive sales. Sophisticated algorithms are used to identify and collaborate with social media influencers. This strategy effectively transforms influencers into powerful marketing channels, particularly targeting Millennial and Gen Z consumers.

The company invests in in-house development to enhance its proprietary e-commerce platform. This includes improving user experience, personalization, and conversion rates. Advanced recommendation engines are used to suggest relevant products, enhancing the shopping journey and driving sales.

The company focuses on operational efficiencies by exploring automation in warehousing and logistics. This streamlining of processes helps reduce costs and improve overall operational performance. The company is always looking for ways to optimize its supply chain management.

A key focus is on enhancing the user experience through personalization. This involves using customer data to tailor product recommendations and create a more engaging shopping journey. Improved user experience directly contributes to higher conversion rates and increased sales.

The company integrates cutting-edge technologies across various aspects of its business. This includes data analytics for informed decision-making, advanced algorithms for influencer marketing, and automation in warehousing and logistics. This integrated approach supports the company's overall growth strategy.

The company's technological strategies are centered around data analytics, influencer marketing, and e-commerce platform enhancements. These strategies are crucial for its Revolve growth strategy and future prospects. The company's Revolve company analysis reveals a strong emphasis on leveraging technology to drive growth in the fashion e-commerce and luxury fashion market sectors.

- Data Analytics: Analyzing customer data to inform merchandising, inventory management, and marketing.

- Influencer Marketing: Utilizing algorithms to identify and collaborate with social media influencers.

- E-commerce Platform: Continuously improving the platform for better user experience and higher conversion rates.

- Operational Efficiency: Exploring automation in warehousing and logistics.

- Personalization: Tailoring product recommendations to enhance the shopping experience.

Revolve PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Revolve’s Growth Forecast?

The financial outlook for Revolve is shaped by its strong position in the online fashion retail market. The company has demonstrated a consistent ability to generate substantial revenue and maintain profitability, which supports its growth strategy. This is further enhanced by its strategic investments in technology and expansion, which are designed to foster long-term growth and market share gains. For a deeper understanding of its operations, consider exploring Revenue Streams & Business Model of Revolve.

In its Q4 2023 earnings report, Revolve Group reported net sales of $257.6 million. For the full year 2023, net sales reached $1.065 billion, showcasing significant revenue generation. The company's financial strategy focuses on sustainable growth, operational efficiency, and continuous innovation within the e-commerce fashion sector, which is crucial for its future prospects.

Revolve's ability to effectively manage inventory and maintain healthy gross margins underscores its data-driven merchandising and pricing strategies. This operational efficiency enables the company to invest in initiatives that support its long-term growth and market share gains. Analyst forecasts generally reflect a positive outlook, anticipating continued growth driven by effective marketing strategies and appeal to its core demographic.

Revolve's revenue has shown consistent growth, with net sales of $1.065 billion for the full year 2023. This growth is a key indicator of the company's success in the fashion e-commerce market. The company's ability to generate substantial revenue supports its overall growth strategy and future prospects.

The company reported a net income of $7.5 million for Q4 2023 and $15.5 million for the full year 2023. These figures demonstrate Revolve's ability to maintain profitability. The company's financial performance review indicates a strong financial foundation for future expansion.

Investment levels are primarily directed towards enhancing its technology platform, expanding its brand portfolio, and supporting international expansion efforts. The company's capital allocation strategy prioritizes initiatives that promise long-term growth and market share gains. This strategy aligns with online retail trends.

Revolve's strong market position in online fashion retail supports its financial ambitions. The company's effective marketing strategies and appeal to its core demographic drive continued growth. This strong market position is key for Revolve's future prospects.

Revolve's financial performance review highlights several key aspects of its operations and strategic direction. The company's ability to maintain healthy gross margins is a testament to its data-driven merchandising and pricing strategies.

- Net Sales: $1.065 billion (Full Year 2023)

- Net Income: $15.5 million (Full Year 2023)

- Strategic Investments: Technology, brand portfolio, international expansion

- Focus: Sustainable growth through operational efficiency

Revolve Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Revolve’s Growth?

The success of any e-commerce business, including that of Revolve, hinges on its ability to navigate potential risks and obstacles. The fashion e-commerce sector is dynamic, with intense competition and evolving consumer preferences. Understanding these challenges is crucial for assessing the Revolve growth strategy and its future prospects.

Several factors could impede Revolve's expansion plans. These include market competition, regulatory changes, supply chain vulnerabilities, and technological disruptions. These factors can affect profitability and operational efficiency, thus impacting the company's ability to maintain its market position and achieve its growth targets. The luxury fashion market is also subject to economic fluctuations, which can influence consumer spending habits.

Internal resource constraints and the need to attract and retain top talent are also critical. These internal challenges can limit innovation and expansion. A proactive approach to risk management and strategic planning is essential for Revolve to mitigate these risks and capitalize on opportunities.

The online retail trends landscape is crowded with established retailers and new direct-to-consumer brands. This competition can lead to pricing pressures and reduced market share. Differentiating from competitors is crucial for Revolve to maintain its position.

Regulatory changes, particularly in data privacy and international trade, can increase compliance costs. New regulations could restrict data utilization for marketing and complicate cross-border transactions. These changes can impact profitability.

Disruptions in manufacturing, shipping delays, and increased raw material costs can hinder inventory levels. These issues can lead to lost sales and reputational damage. The impact of influencer marketing on Revolve can also be affected.

The fast-paced digital world requires continuous adaptation to new platforms and AI advancements. Significant investment in new technologies is necessary. Changes in consumer behavior could necessitate a pivot in Revolve's digital strategy.

Attracting and retaining top talent in technology, marketing, and merchandising is critical. These constraints could limit the company's capacity for innovation and expansion. A strong team is essential for Revolve's success.

Economic downturns can impact consumer spending in the luxury fashion market. Changes in disposable income can affect sales. Revolve's financial performance review can be influenced by these broader economic trends.

Revolve mitigates risks by diversifying its brand portfolio to reduce reliance on any single trend. The company invests in robust cybersecurity measures to protect customer data. Agile supply chain management practices are also maintained. Brief History of Revolve provides further context on the company's evolution.

Continuous monitoring of market trends and competitive landscapes is essential. This allows Revolve to adapt its strategies proactively. Understanding consumer preferences and industry changes is crucial for staying ahead. Revolve's competitive advantages include its ability to adapt.

Revolve must continually innovate and adapt to changing consumer behaviors and technological advancements. This includes leveraging new platforms and AI technologies. Revolve's technology and innovation are key to its future.

Revolve's financial performance review is critical for understanding its ability to withstand challenges. Factors like revenue growth, profit margins, and operational efficiency are key. Revolve's market share analysis 2024 will be influenced by its risk management.

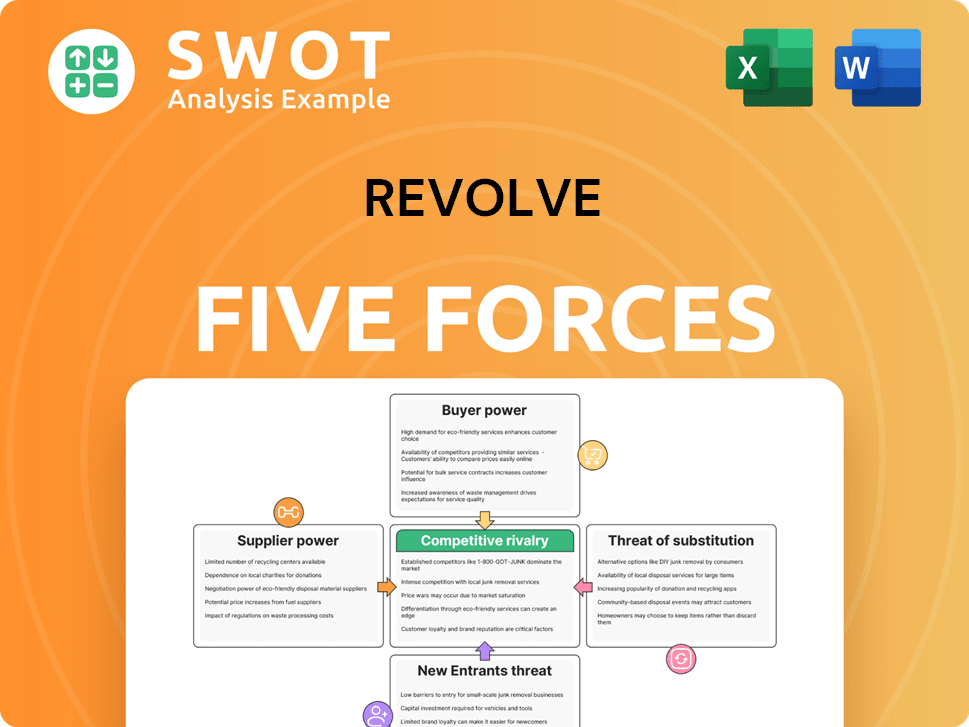

Revolve Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Revolve Company?

- What is Competitive Landscape of Revolve Company?

- How Does Revolve Company Work?

- What is Sales and Marketing Strategy of Revolve Company?

- What is Brief History of Revolve Company?

- Who Owns Revolve Company?

- What is Customer Demographics and Target Market of Revolve Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.