Robinhood Markets Bundle

How Did Robinhood Markets Revolutionize Investing?

Robinhood Markets, a name synonymous with commission-free trading, dramatically altered the financial landscape. Launched in 2013, this Robinhood Markets SWOT Analysis reveals the strategic underpinnings of its success. But how did this stock trading app become a major player in the world of financial technology?

The Robinhood company, born from a desire to democratize finance, quickly gained traction. Understanding the Robinhood history is crucial to grasping its impact on retail investors and the evolution of online brokerage platforms. From its founding to its current status, the company's journey offers valuable insights into the future of investing.

What is the Robinhood Markets Founding Story?

The story of Robinhood Markets began on April 18, 2013. It was founded by Vladimir Tenev and Baiju Bhatt, who aimed to revolutionize the stock trading experience. Their vision was to make financial markets accessible to everyone, a mission that would change the landscape of online brokerage.

Tenev and Bhatt, having worked on Wall Street, recognized the disparity in trading fees. They saw how large institutions enjoyed low-cost trading while individual investors faced significant commissions. This observation fueled their desire to create a more equitable system, leading to the birth of Robinhood.

The founders set out to 'democratize finance for all' by eliminating trading commissions. Their innovative business model focused on alternative revenue streams. The first product was a mobile app offering commission-free trading of stocks and ETFs.

Robinhood Markets was founded on April 18, 2013, by Vladimir Tenev and Baiju Bhatt.

- The founders aimed to eliminate trading commissions, making stock trading accessible to everyone.

- They observed the high fees charged to individual investors compared to institutional clients.

- The name 'Robinhood' was chosen to reflect their mission of taking from the brokerage firms and giving to the investors.

- Initial funding came from bootstrapping and seed rounds from venture capital firms and angel investors.

The name 'Robinhood' was carefully chosen to reflect the company's core mission. It symbolized the act of taking from the 'rich' (brokerage firms charging high fees) and giving to the 'poor' (everyday investors through commission-free trading). The initial funding came from various sources, including bootstrapping and seed rounds from notable venture capital firms and angel investors.

The founders' expertise in building sophisticated trading systems provided a strong technological base. This enabled them to disrupt the existing brokerage landscape. By offering commission-free trading, Robinhood quickly attracted a large user base, changing the way people invest in the stock market.

As of 2024, Robinhood has over 23 million users. In Q1 2024, the company reported $618 million in revenue, a 40% increase year-over-year. This growth highlights the lasting impact of Robinhood's founding vision and its continued evolution in the financial technology sector.

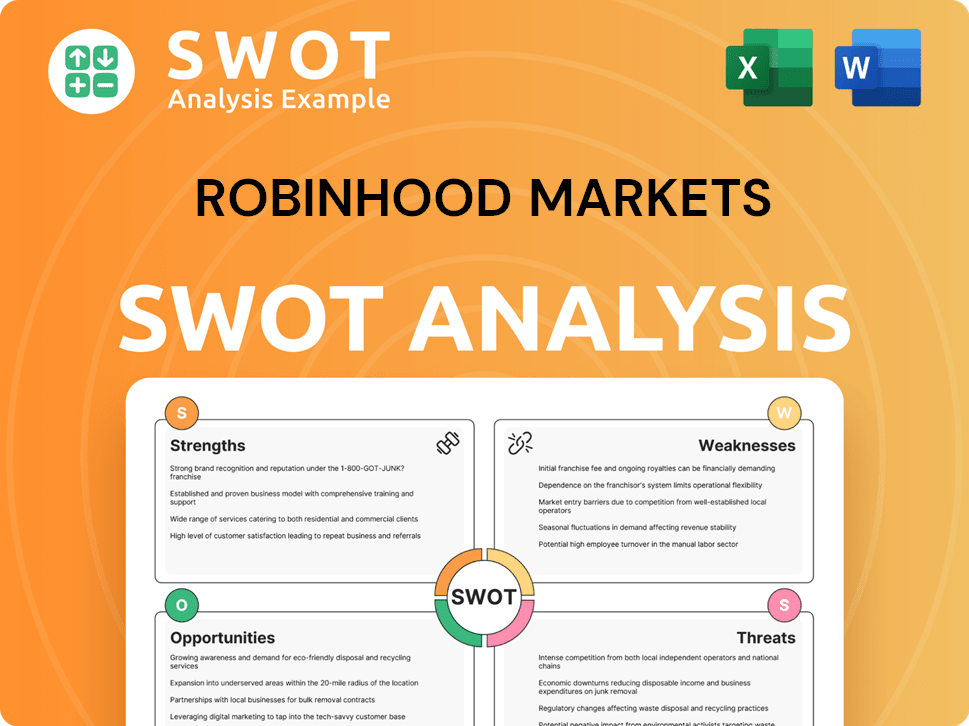

Robinhood Markets SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Robinhood Markets?

The early growth of Robinhood Markets was marked by a rapid expansion of its user base. This growth was largely fueled by its commission-free trading model and mobile-first approach. The company quickly gained traction, particularly among younger investors, after its public launch in December 2014. This period saw the company evolve from a startup to a significant player in the financial technology sector.

The initial user acquisition strategy heavily relied on a waitlist model. This generated significant buzz and a sense of exclusivity. By 2015, just a year after launch, the

In 2016,

Significant capital raises fueled this early growth. In April 2017, the company raised a Series C round of $110 million. This funding valued the company at $1.3 billion, officially making it a unicorn startup. This influx of capital allowed

The market reception during this period was overwhelmingly positive. Robinhood tapped into a previously underserved demographic of retail investors. By late 2019, competitors were forced to eliminate trading commissions. This shift fundamentally reshaped the competitive landscape. This validated Robinhood's disruptive vision and cemented its position in the fintech sector.

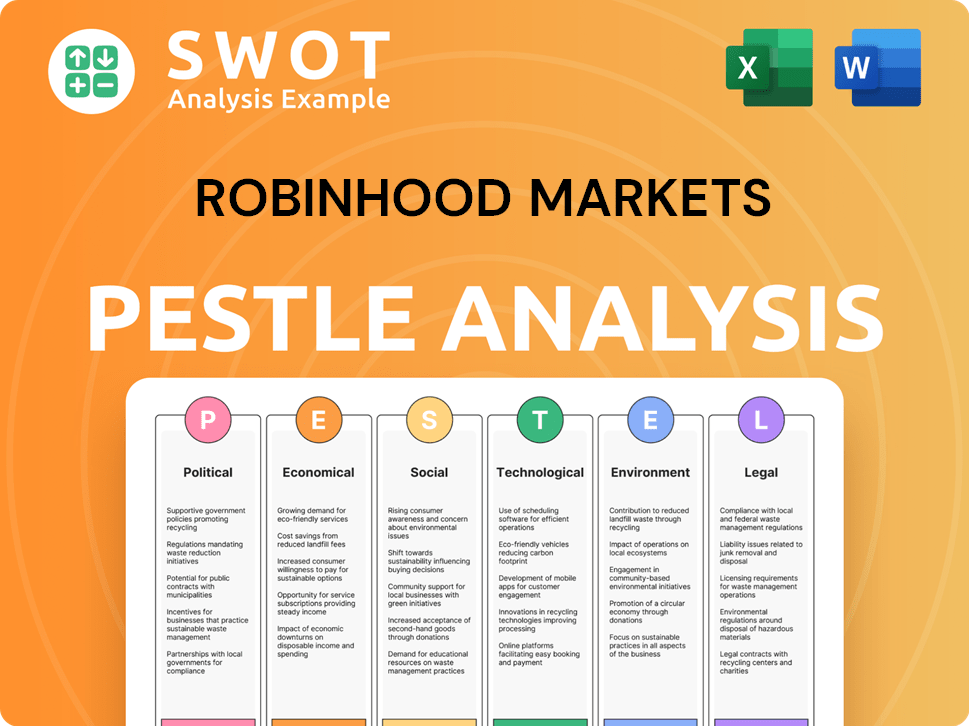

Robinhood Markets PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Robinhood Markets history?

The journey of Robinhood Markets, a prominent player in the financial technology sector, has been marked by significant milestones. From its inception, the Robinhood company has experienced rapid growth and transformation, shaping its position in the online brokerage landscape.

| Year | Milestone |

|---|---|

| 2013 | Launched its stock trading app, introducing commission-free trading, a groundbreaking move in the brokerage industry. |

| 2018 | Expanded its offerings by launching commission-free cryptocurrency trading through Robinhood Crypto, including Bitcoin and Ethereum. |

| July 29, 2021 | Achieved a significant milestone with its initial public offering (IPO) on Nasdaq under the ticker HOOD. |

Robinhood Markets has been at the forefront of innovation in the financial industry, particularly with its commission-free trading model, which revolutionized how people access the stock market. This strategy significantly lowered the barriers to entry for retail investors, making investing more accessible and affordable for a broader audience. This approach has influenced the entire industry, leading to widespread adoption of commission-free trading by competitors.

Robinhood's introduction of commission-free trading was a game-changer, eliminating fees for stock trades. This innovation democratized investing, making it more accessible to a wider range of investors. This move forced other online brokerage firms to follow suit, changing the industry landscape.

Robinhood expanded its services to include cryptocurrency trading, offering access to digital assets like Bitcoin and Ethereum. This move showcased the company's commitment to staying current with evolving financial markets. It allowed users to diversify their portfolios with digital currencies.

Robinhood is known for its intuitive and easy-to-use interface, which simplifies the investment process for beginners. The app's design focuses on simplicity, making it easier for new investors to navigate the stock market. This design choice has contributed to its popularity among younger investors.

Robinhood offers fractional shares, allowing users to invest in parts of a share, making high-priced stocks more accessible. This feature enables investors with smaller budgets to diversify their portfolios. It allows users to invest in companies like Amazon and Google, even with limited capital.

Robinhood Gold is a subscription service that offers enhanced features, such as margin investing, larger instant deposits, and access to professional research. This service provides additional tools and resources for more experienced investors. It allows users to leverage their investments and access premium features.

Robinhood has increased its educational resources to help users learn about investing and financial markets. This includes articles, videos, and other educational materials. This initiative aims to promote responsible investing and help users make informed decisions.

Despite its successes, Robinhood Markets has faced several challenges, including regulatory scrutiny and operational issues. The company's handling of the 'Gamestonk' trading frenzy in early 2021 led to significant criticism and legal actions, highlighting the need for improved infrastructure and risk management. The company has been working to address these issues and enhance its compliance measures.

During the 'Gamestonk' trading frenzy, Robinhood restricted trading in certain stocks, leading to user backlash and regulatory investigations. This event highlighted the company's operational vulnerabilities and raised questions about market manipulation. The restrictions sparked widespread criticism and led to numerous lawsuits.

Robinhood has faced significant regulatory scrutiny and fines, including a $70 million fine from FINRA in June 2021 for systemic failures. These penalties reflect the need for enhanced compliance and operational improvements. The company has been working to strengthen its compliance and risk management practices.

Robinhood's reliance on Payment for Order Flow (PFOF) has drawn criticism, raising concerns about potential conflicts of interest. PFOF involves brokers receiving payments from market makers for routing trades. Regulators and consumer advocates have questioned the practice's impact on best execution.

Robinhood has faced challenges related to customer support and the scalability of its infrastructure, especially during peak trading times. The company has been working to improve its customer service and strengthen its technological infrastructure. These improvements aim to provide a better user experience.

Robinhood has had to navigate periods of high market volatility, which can impact its operations and user experience. During volatile times, the company has to ensure its systems can handle increased trading volumes. This requires robust infrastructure and effective risk management strategies.

Robinhood faces intense competition from other online brokerage firms, which have also adopted commission-free trading. This competition puts pressure on Robinhood to innovate and maintain its market share. The company must differentiate itself through features, services, and user experience.

For more detailed information on the ownership structure and key stakeholders, you can refer to Owners & Shareholders of Robinhood Markets. Robinhood's journey reflects the dynamic nature of the financial technology industry, with ongoing efforts to adapt and innovate in response to market changes and regulatory demands.

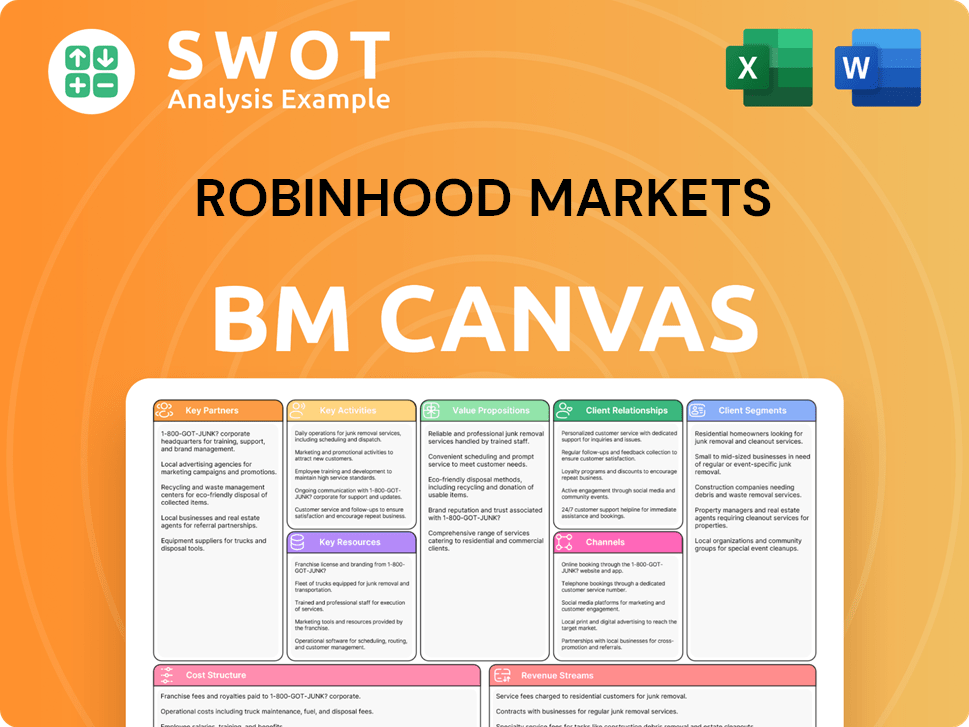

Robinhood Markets Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Robinhood Markets?

The story of Robinhood Markets, a prominent player in the financial technology sector, is marked by rapid growth and significant shifts in the online brokerage landscape. From its inception, Robinhood's mission has been to democratize finance, and its journey reflects both its successes and the challenges it has faced in a dynamic market. This Robinhood history is a fascinating case study of a company's rise and evolution.

| Year | Key Event |

|---|---|

| April 2013 | Robinhood Markets was founded by Vladimir Tenev and Baiju Bhatt, setting the stage for a new approach to stock trading. |

| December 2014 | The stock trading app officially launched, offering commission-free trading, a groundbreaking move that disrupted the industry. |

| 2015 | The company reached 1 million users, a testament to its growing popularity and the appeal of its commission-free model. |

| 2016 | Options trading was introduced, expanding the range of investment products available to Robinhood users. |

| April 2017 | Robinhood raised a $110 million Series C round, valuing the company at $1.3 billion, indicating strong investor confidence. |

| 2018 | Robinhood Crypto was launched, further diversifying its offerings with commission-free cryptocurrency trading. |

| Late 2019 | Major brokerages began eliminating commissions, a direct response to Robinhood's disruptive influence on the market. |

| January 2021 | The 'Gamestonk' trading event brought significant controversy and regulatory scrutiny, highlighting the risks of high-volume trading. |

| June 2021 | FINRA imposed a $70 million fine on Robinhood for various failures, reflecting the need for robust regulatory compliance. |

| July 29, 2021 | Robinhood went public on Nasdaq under the ticker HOOD, marking a significant milestone in its journey. |

| Q1 2024 | Robinhood reported a net income of $157 million, a substantial improvement driven by higher interest rates and increased trading activity. |

| Q1 2024 | Total net revenues increased by 40% year-over-year to $618 million, showing strong financial performance. |

| Q1 2024 | Assets Under Custody (AUC) increased by 65% year-over-year to $129.6 billion, reflecting growing user trust and investment. |

| Q1 2024 | Gold subscribers grew 42% year-over-year to 1.7 million, indicating the success of its premium subscription service. |

Robinhood is focused on expanding its services beyond trading. The company aims to attract and retain long-term investors by emphasizing retirement products and expanding its offerings.

International expansion, particularly in Europe, is a key strategic initiative. Robinhood launched commission-free crypto trading in the EU in late 2023, and continues to grow its global footprint.

The company is exploring new product developments in areas like passive investing and financial advisory services. This diversification aims to meet the evolving needs of its user base.

Analysts predict continued growth in net interest revenue due to higher interest rates. Transaction-based revenues could potentially increase with an improved crypto market.

Robinhood Markets Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Robinhood Markets Company?

- What is Growth Strategy and Future Prospects of Robinhood Markets Company?

- How Does Robinhood Markets Company Work?

- What is Sales and Marketing Strategy of Robinhood Markets Company?

- What is Brief History of Robinhood Markets Company?

- Who Owns Robinhood Markets Company?

- What is Customer Demographics and Target Market of Robinhood Markets Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.