Robinhood Markets Bundle

How Does Robinhood Navigate Its Competitive Arena?

The Robinhood Markets SWOT Analysis reveals a dynamic financial services industry, significantly altered by commission-free trading. Robinhood, born from a vision to democratize finance, disrupted the traditional brokerage model, attracting a new wave of investors. Its user-friendly platform and zero-commission structure quickly resonated, but how does it stack up against its rivals?

This exploration delves into the competitive landscape of Robinhood Markets, examining its position within the online brokerage space. We'll analyze Robinhood competitors, dissecting their strategies and market shares to understand the challenges and opportunities facing the platform. Understanding the impact of commission-free trading and Robinhood's growth strategy is crucial for investors and strategists alike, offering insights into the future of online brokerage.

Where Does Robinhood Markets’ Stand in the Current Market?

Robinhood Markets operates primarily as an online brokerage, offering commission-free trading of stocks, ETFs, options, and cryptocurrencies. Its core value proposition centers on providing accessible and user-friendly financial services, especially for retail investors. The platform's ease of use and mobile-first approach have been key to attracting a large user base, particularly among younger demographics and novice investors.

The company's competitive advantage lies in its simplified trading experience and zero-commission structure, which disrupted the traditional brokerage model. Beyond trading, Robinhood offers features like fractional shares, cash management tools, and, more recently, retirement accounts. These additions aim to broaden its service offerings and increase user engagement, contributing to its market position within the financial services industry.

As of the first quarter of 2024, Robinhood reported 13.7 million monthly active users (MAU). The company's assets under custody (AUC) reached $129.6 billion as of March 31, 2024, showing substantial growth. Robinhood primarily targets retail investors with commission-free trading of stocks, ETFs, options, and cryptocurrencies.

Robinhood's presence is mainly within the United States, with some international exploration. It focuses on a younger demographic and novice investors, which is a core driver of its business model. The company has expanded its appeal by introducing features like retirement accounts and 24/5 trading.

Revenue for Q1 2024 reached $618 million, a 40% increase year-over-year, driven by transaction-based revenues and net interest revenue. Robinhood reported a net income of $157 million for Q1 2024, indicating improved profitability. The company faces competition from established financial institutions and fintech innovators.

While Robinhood holds a strong position in mobile-first, commission-free trading, its market share is smaller compared to traditional giants. The company's growth strategy involves attracting more sophisticated investors and retaining existing users through expanded services. For more insights, see Revenue Streams & Business Model of Robinhood Markets.

Robinhood Markets SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Robinhood Markets?

The competitive landscape for Robinhood Markets is intense, shaped by both established financial institutions and agile fintech startups. The company operates within the dynamic financial services industry, facing constant pressure to innovate and adapt to changing market conditions. Understanding the key players and their strategies is crucial for evaluating Robinhood's position and future prospects.

Robinhood's success hinges on its ability to differentiate itself in a crowded market. The company's primary focus on commission-free trading has reshaped the industry, forcing competitors to adjust their pricing models. However, this strategy also necessitates exploring diverse revenue streams to ensure profitability and sustainability. The company's ability to navigate regulatory challenges and maintain user trust is also critical in this competitive environment.

The company faces challenges from both direct and indirect competitors. The competitive landscape is also impacted by mergers and acquisitions, such as the Schwab-TD Ameritrade merger, which created an even larger entity with increased market power.

Traditional online brokers pose a significant challenge to Robinhood. These firms, such as Charles Schwab, Fidelity, and E-Trade, have adapted to the commission-free trading model, leveraging their established brand recognition and extensive service offerings.

Charles Schwab is a dominant player with substantial assets under management. It offers a wide array of financial services, including wealth management and advisory services, providing a more comprehensive suite of products than Robinhood.

Fidelity also offers commission-free trading and has a strong reputation. It provides extensive research tools and retirement planning options, appealing to a broader and often more affluent client base than Robinhood.

E-Trade, now part of Morgan Stanley, offers commission-free trading and a robust platform. It caters to active traders and long-term investors, competing directly with Robinhood for a similar user base.

Cryptocurrency exchanges like Coinbase and Binance compete for users interested in digital asset trading. While Robinhood offers crypto trading, these exchanges often provide a wider selection of cryptocurrencies and more advanced trading features.

Robo-advisors like Betterment and Wealthfront offer automated portfolio management. Newer fintech companies and neobrokers also continually emerge, intensifying competitive pressure on Robinhood.

These competitors challenge Robinhood through their established brand trust, broader product offerings, and deeper integration of financial planning services. For instance, while Robinhood pioneered commission-free stock trading, these larger firms quickly followed suit, leveraging their existing infrastructure and customer relationships to retain and attract clients. To understand more about Robinhood's customer base, you can read about the Target Market of Robinhood Markets.

Robinhood faces several key challenges in the competitive landscape. These challenges include brand recognition, product offerings, and regulatory compliance.

- Brand Trust: Established brokers have a long history of trust, a critical factor in financial services.

- Product Breadth: Competitors offer a wider range of services, including wealth management and financial planning.

- Regulatory Compliance: Navigating regulatory hurdles and maintaining compliance is an ongoing challenge.

- Technological Innovation: Staying ahead in technology is crucial, with competitors constantly improving their platforms.

Robinhood Markets PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Robinhood Markets a Competitive Edge Over Its Rivals?

The Robinhood Markets competitive landscape is shaped by its innovative approach to online brokerage and its focus on user experience. The company's journey began with a disruptive move, eliminating trading commissions, which significantly impacted the financial services industry. This strategic decision not only attracted a new generation of investors but also forced established players to adapt, reshaping the dynamics of stock trading platforms.

A key element of Robinhood's success lies in its user-centric mobile platform. This focus on simplicity and accessibility has lowered the barriers to entry for novice investors, contributing to its rapid growth. The company has consistently expanded its offerings, including fractional shares and cryptocurrency trading, to broaden its appeal and maintain a competitive edge in the evolving market. For more information about their growth strategy, check out this article: Growth Strategy of Robinhood Markets.

However, the competitive landscape is dynamic, with rivals constantly innovating. Maintaining a competitive advantage requires continuous adaptation and differentiation. The company's ability to innovate and respond to market changes will be crucial for its long-term success, especially as it navigates regulatory challenges and evolving investor preferences.

The elimination of trading commissions was a groundbreaking move that disrupted the traditional brokerage model. This strategy attracted a large user base, especially among younger investors. This early adoption gave Robinhood a significant first-mover advantage in the online brokerage sector.

The intuitive mobile application is a core strength, simplifying the investing process. This design has made investing more accessible to a wider audience, particularly those new to financial markets. The platform's ease of use has been a key factor in attracting and retaining users.

The introduction of fractional shares allowed investors to buy small portions of expensive stocks. Cryptocurrency trading and retirement accounts with a 1% match further broadened the platform's appeal. These expansions aim to increase customer stickiness and attract more assets.

The company has cultivated a strong brand and a sense of community among its users. This brand equity helps in customer acquisition and retention. This community aspect fosters a sense of accessibility and empowerment in investing.

The company's competitive advantages are rooted in commission-free trading, a user-friendly mobile platform, and product innovation. These elements have allowed it to attract a large user base and disrupt the traditional brokerage model. However, maintaining this edge requires continuous adaptation and differentiation in a competitive market.

- Commission-Free Trading: The elimination of trading fees was a major differentiator, attracting a large user base.

- Mobile-First Approach: The intuitive mobile app simplifies investing, making it accessible to new investors.

- Product Innovation: Features like fractional shares and crypto trading expand the platform's appeal.

- Brand and Community: Strong brand recognition and a sense of community enhance customer loyalty.

Robinhood Markets Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Robinhood Markets’s Competitive Landscape?

The competitive landscape for Robinhood Markets is influenced by industry-wide trends, regulatory changes, and shifting consumer preferences. The company faces challenges from evolving technologies like AI and the emergence of decentralized finance (DeFi) platforms. Success hinges on adapting to these changes while also navigating regulatory scrutiny, particularly regarding payment for order flow (PFOF) and cryptocurrency regulations.

The future outlook for Robinhood involves capitalizing on growth opportunities through international expansion and product innovation. Strategic partnerships and a focus on deepening customer relationships are also key. The company's ability to adapt to these trends and mitigate challenges will determine its competitive position in the financial services industry.

The financial services industry is experiencing rapid technological advancements, particularly in AI and machine learning, which are driving enhanced personalization and risk management. Regulatory scrutiny, especially concerning PFOF and cryptocurrency, continues to evolve, impacting business models. Consumer preferences are shifting towards integrated financial solutions and personalized advice, pushing companies to expand beyond basic trading functionalities.

Anticipated disruptions include the emergence of DeFi platforms and further consolidation within the financial services industry. Intensified competition may lead to pricing pressures. Increased regulatory burdens could impact revenue streams, and cybersecurity risks remain a concern. A decline in retail trading activity, influenced by economic downturns, could also negatively impact transaction-based revenues. Analyzing the Owners & Shareholders of Robinhood Markets can provide further insights.

Expanding into new international markets presents a substantial avenue for user and asset growth. Product innovations, such as offering more sophisticated wealth management tools, advanced analytics, or unique investment products tailored to specific investor needs, could attract a broader customer base. Strategic partnerships with other fintech companies or traditional financial institutions could also enable expansion.

Robinhood's focus on retaining and growing its existing user base through features like retirement accounts and extended trading hours demonstrates its strategy to deepen customer relationships and increase assets under custody. The company's focus on technology and innovation allows it to adapt to changes in the market and to respond to its competitors.

The competitive landscape for Robinhood is dynamic, with several factors influencing its future. The company must continuously innovate and adapt to maintain its market share. The ability to navigate regulatory changes and capitalize on growth opportunities will be critical to its success.

- Technological advancements and integration of AI.

- Navigating regulatory scrutiny, especially regarding PFOF.

- Expansion into new international markets.

- Product innovation and strategic partnerships.

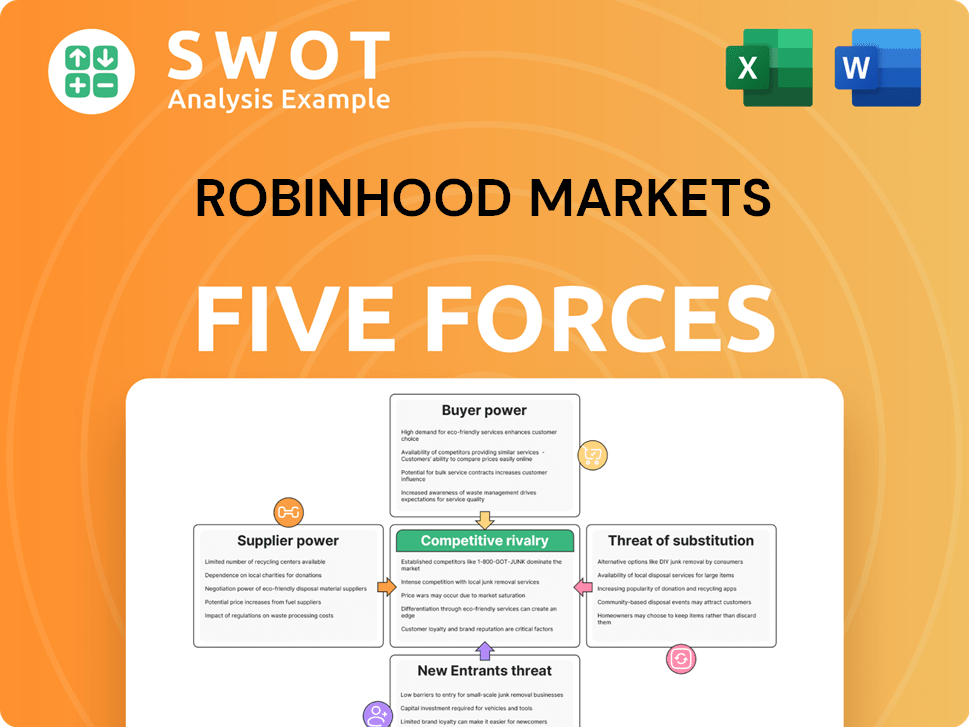

Robinhood Markets Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Robinhood Markets Company?

- What is Growth Strategy and Future Prospects of Robinhood Markets Company?

- How Does Robinhood Markets Company Work?

- What is Sales and Marketing Strategy of Robinhood Markets Company?

- What is Brief History of Robinhood Markets Company?

- Who Owns Robinhood Markets Company?

- What is Customer Demographics and Target Market of Robinhood Markets Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.