Robinhood Markets Bundle

How Does Robinhood Make Money?

Robinhood Markets, Inc. disrupted the financial world with its commission-free trading platform, opening doors to millions of new investors. This Robinhood Markets SWOT Analysis reveals the strategies behind its success. This innovative approach transformed the online brokerage landscape, making investing more accessible than ever before.

From its user-friendly stock trading app to its cryptocurrency trading options, understanding How Robinhood Works is essential for anyone navigating today's financial markets. Whether you're a beginner looking for a Robinhood account setup tutorial or an experienced investor exploring Robinhood investment strategies, this analysis provides valuable insights. Discover the key elements of this investing platform and how it's reshaping the future of finance.

What Are the Key Operations Driving Robinhood Markets’s Success?

Robinhood Markets, a prominent player in the online brokerage industry, operates primarily through its user-friendly, mobile-first platform. It offers commission-free trading for a variety of financial instruments, including stocks, ETFs, options, and cryptocurrencies. This approach caters to a wide range of investors, from those just starting out to experienced traders.

The company's core operations are heavily reliant on advanced technology and a streamlined digital platform. This includes sophisticated order routing systems, real-time market data integration, and a robust back-end infrastructure. Continuous technological development is a key focus, with efforts aimed at enhancing user experience, expanding product offerings, and improving security. This focus helps make Robinhood's target market accessible.

Customer service is primarily digital, utilizing in-app support and online resources to address user queries and issues. Robinhood's operational effectiveness also depends on partnerships with market makers for order execution, clearing firms for trade settlement, and various financial institutions for banking and custody services. This network enables the commission-free model, leveraging Payment for Order Flow (PFOF).

Robinhood offers commission-free trading of stocks, ETFs, options, and cryptocurrencies. It provides access to a diverse range of financial instruments, catering to different investment preferences. This broad selection is a key factor in attracting a wide user base.

The company relies on advanced technology for order routing, real-time market data, and account management. Its digital platform is designed for efficiency and ease of use. This streamlined approach is crucial for its operational success.

Robinhood primarily uses digital customer service through in-app support and online resources. This approach allows for scalable support for its large user base. The digital-first model is integral to its operational efficiency.

Robinhood partners with market makers for order execution and clearing firms for trade settlement. It utilizes Payment for Order Flow (PFOF) to offer commission-free trading. This model is central to its value proposition.

Robinhood's value proposition centers on simplifying investing and removing barriers to entry. Its user-friendly interface makes financial transactions accessible to a wider audience. This approach has attracted a large user base, particularly among younger demographics and first-time investors.

- Reduced Trading Costs: Commission-free trading lowers the barrier to entry for new investors.

- Immediate Market Access: Instant access to markets allows users to trade quickly.

- Educational Resources: The platform provides resources to help users make informed decisions.

- User-Friendly Interface: The intuitive design makes investing accessible to a broad audience.

Robinhood Markets SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Robinhood Markets Make Money?

Understanding the revenue streams and monetization strategies of Robinhood Markets is key to grasping its business model. The company has successfully diversified its income sources beyond the traditional commission-based model, making it a significant player in the online brokerage space. This approach has allowed it to offer commission-free trading while still generating substantial revenue.

The company's financial performance in early 2024 highlights the effectiveness of its strategies. In the first quarter of 2024, Robinhood reported total net revenues of $618 million, marking a 40% year-over-year increase. This growth reflects the success of its multifaceted approach to generating revenue, which includes interest income, transaction-based revenues, and subscription services.

A closer look at the revenue streams reveals the key components of Robinhood's financial model. Transaction-based revenues, interest income, and subscription services all contribute to the company's financial health. These diverse sources of income enable Robinhood to maintain its competitive edge in the market.

Robinhood's revenue model is built on several key pillars, each contributing significantly to its overall financial performance. These streams work together to support the company's operations and growth.

- Transaction-Based Revenues: This includes Payment for Order Flow (PFOF) from options, equities, and cryptocurrencies. In Q1 2024, transaction-based revenues were $329 million, up 22% year-over-year. Options PFOF was $153 million, equities PFOF was $51 million, and crypto transaction revenue was $126 million.

- Interest Income: Interest earned on customer cash and securities lending is a major revenue source. Net interest revenue for Q1 2024 was $244 million, a 49% increase year-over-year, driven by higher interest rates and increased interest-earning assets.

- Subscription and Other Revenues: Robinhood Gold subscriptions and other services contribute to this revenue stream. Subscriptions and other revenues totaled $45 million in Q1 2024, an increase of 36% from the prior year.

- Payment for Order Flow (PFOF): A key component of its business model, PFOF allows Robinhood to offer commission-free trades. While subject to regulatory scrutiny, it remains a significant revenue generator.

Robinhood Markets PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Robinhood Markets’s Business Model?

The journey of Robinhood Markets has been marked by significant milestones and strategic decisions. The introduction of commission-free stock trading in 2013 was a game-changer, disrupting the brokerage industry. This move forced competitors to adjust their pricing models. Expansion into cryptocurrency trading was another key step, capitalizing on the growing interest in digital assets.

The company's initial public offering (IPO) in July 2021 was a major event, enabling it to raise capital and further invest in its platform and services. Operational challenges have included navigating regulatory scrutiny, particularly concerning its Payment for Order Flow (PFOF) model and handling volatile market events. In response, Robinhood has continuously worked to enhance its compliance frameworks and improve communication with its users.

Robinhood's competitive advantages include its strong brand recognition, especially among younger investors, and its technological leadership in creating a user-friendly and accessible trading platform. Its early mover advantage in commission-free trading allowed it to capture a significant market share. The company also benefits from network effects, where more users attract more services, and more services attract more users. Robinhood continues to adapt to new trends by expanding its product offerings, such as introducing retirement accounts and expanding its crypto offerings.

The launch of commission-free stock trading in 2013 was a pivotal moment. Expansion into cryptocurrency trading was another significant step. The IPO in July 2021 allowed for capital raising and platform investment.

Focus on diversifying revenue streams, including net interest revenue and subscriptions. Continuous enhancement of compliance frameworks and user communication. Expansion of product offerings, such as retirement accounts and crypto trading.

Strong brand recognition, particularly among younger investors. Technological leadership in creating a user-friendly trading platform. Early mover advantage in commission-free trading, capturing significant market share. Benefit from network effects, attracting more users and services.

In Q1 2024, Robinhood saw a 69% increase in cryptocurrency notional trading volume year-over-year. The company continues to invest in educational content and tools to empower its growing user base. Robinhood's revenue in Q1 2024 was $618 million, a 40% increase compared to Q1 2023.

Robinhood has faced regulatory scrutiny and market downturns, impacting trading volumes. The company has focused on enhancing compliance and diversifying revenue streams. It has also expanded its product offerings, such as retirement accounts and crypto trading.

- Navigating regulatory scrutiny related to PFOF and market events.

- Adapting to market downturns and their impact on trading volumes.

- Enhancing compliance frameworks and improving user communication.

- Diversifying revenue streams through net interest and subscriptions.

Robinhood Markets Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Robinhood Markets Positioning Itself for Continued Success?

The financial services industry, particularly the retail brokerage sector, has seen a significant transformation due to companies like Robinhood Markets. This online brokerage platform has carved out a substantial niche, especially among younger investors, by offering commission-free trading and a user-friendly interface. However, the company faces intense competition from established financial institutions and emerging fintech firms.

Several factors influence the future of Robinhood. These include regulatory scrutiny, technological advancements, and evolving consumer preferences. The company must navigate these challenges while continuing to innovate and expand its offerings to maintain its market position and drive revenue growth. The competitive landscape is dynamic, and the ability to adapt and respond to market changes will be critical for its long-term success.

Robinhood holds a strong position in the online brokerage market, particularly among new investors. Its commission-free trading model and easy-to-use platform have attracted a large user base. The company competes with established players like Charles Schwab and Fidelity, as well as other fintech companies. The company is also exploring international expansion, although its global reach is still developing.

Key risks for Robinhood include regulatory scrutiny, especially regarding Payment for Order Flow (PFOF). Competition from other commission-free brokers and the rapid evolution of DeFi and blockchain technologies also pose threats. Changing consumer preferences, such as a shift away from speculative trading, could impact trading volumes. These factors could affect the company's revenue model and market position.

Robinhood is focused on expanding its product offerings, such as retirement accounts, and enhancing its options and crypto trading platforms. The company aims to improve profitability and operational efficiency. Its future hinges on navigating regulatory challenges, innovating its product suite, and competing effectively for new and existing investors. The company's ability to adapt to market changes will be essential.

Robinhood is expanding its product offerings, including retirement accounts, to attract more long-term assets and diversify its revenue base. The company is investing in enhancing its options and crypto trading platforms. In Q1 2024, there was significant growth in crypto notional trading volume. Leadership is focused on improving profitability and operational efficiency.

In Q1 2024, Robinhood achieved its first GAAP profitable quarter, with net income of $157 million, demonstrating improved financial performance. The company's ability to navigate regulatory challenges and effectively compete in the market will be crucial for its long-term success. The competitive landscape is constantly evolving, with new entrants and established players vying for market share. Understanding the Competitors Landscape of Robinhood Markets is essential for assessing its future prospects.

- Customer Growth: Robinhood continues to attract new users, particularly among younger investors.

- Revenue Streams: The company's revenue is derived from various sources, including transaction-based revenues and interest earned on customer cash.

- Regulatory Environment: Ongoing regulatory scrutiny, particularly regarding Payment for Order Flow (PFOF), could impact the company's revenue model.

- Technological Advancements: The rapid evolution of DeFi and blockchain technologies presents both opportunities and challenges.

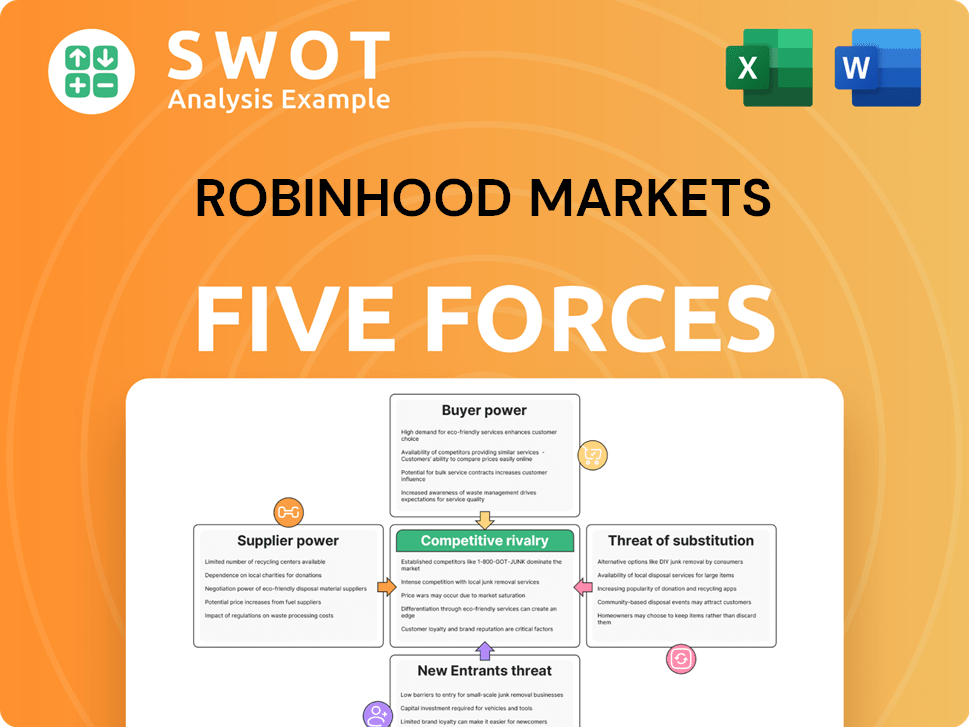

Robinhood Markets Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Robinhood Markets Company?

- What is Competitive Landscape of Robinhood Markets Company?

- What is Growth Strategy and Future Prospects of Robinhood Markets Company?

- What is Sales and Marketing Strategy of Robinhood Markets Company?

- What is Brief History of Robinhood Markets Company?

- Who Owns Robinhood Markets Company?

- What is Customer Demographics and Target Market of Robinhood Markets Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.