Sage Bundle

How Did Sage Company Revolutionize Business Software?

In 1981, a groundbreaking venture began in Newcastle upon Tyne, England, with the founding of Sage. This marked the genesis of what would become a global powerhouse in business software. From its roots in accounting solutions for small businesses, Sage has transformed the way companies manage their finances and operations.

Sage's Sage SWOT Analysis reveals a history of strategic adaptation and innovation. The company's journey, guided by Sage founder David Goldman, Paul Muller, and Graham Wylie, showcases the evolution of business management solutions. Understanding the Sage Group timeline is key to appreciating its impact on the UK tech industry and its enduring influence on accounting software practices.

What is the Sage Founding Story?

The story of the Sage Company history began on April 27, 1981, in Newcastle upon Tyne, England. Founded by David Goldman, Paul Muller, and Graham Wylie, the company emerged from a need to streamline business processes.

The genesis of Sage software origins can be traced back to Goldman's printing company, Campbell Graphics. He needed to automate print estimating and accounting. This led to the creation of the first version of Sage Accounts, which would later become Sage Line 50.

Impressed by the software's potential, Goldman, along with Wylie and Muller, saw a broader market opportunity. Their initial focus was on selling accounting software to printing companies, expanding later through a reseller network. The idea for Sage was reportedly conceived in a pub in Newcastle. The company started with Goldman's business acumen and Muller and Wylie's software development skills, addressing the prevalent problem of manual accounting for small businesses.

Here are some key milestones in the early years of Sage's development:

- 1981: Sage is founded in Newcastle upon Tyne.

- Early 1980s: Development of Sage Line 50 and the first version of Sage Accounts.

- Initial Business Model: Selling accounting software to printing companies and expanding through a reseller network.

- Founding Team: David Goldman, Paul Muller, and Graham Wylie.

The early years of Sage software development were marked by a focus on addressing the needs of small businesses. The founders recognized the potential of personal computers to revolutionize accounting practices. This led to the creation of user-friendly software solutions. The company's growth was fueled by its ability to provide accessible and efficient business management solutions. For additional insights, you can explore the Competitors Landscape of Sage.

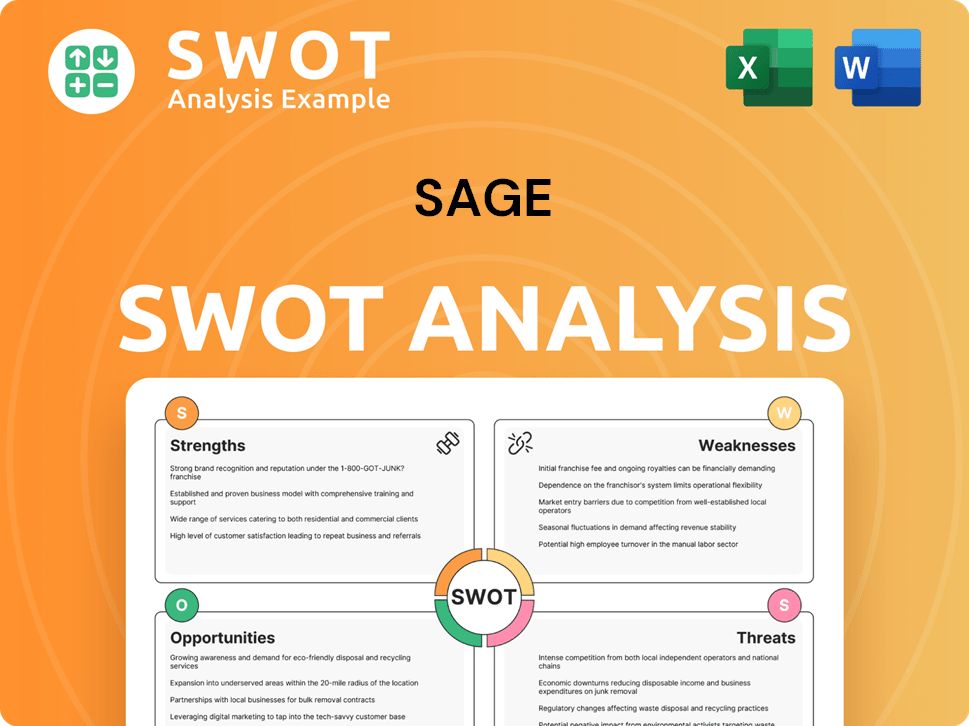

Sage SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Sage?

The early growth and expansion of the company, now known as Sage, were significantly fueled by the increasing adoption of desktop PCs. The company's initial success in the 1980s demonstrated the market's demand for accessible accounting software. This period was marked by strategic acquisitions and international expansions that solidified its position in the market. The company's journey from startup to a global company highlights its adaptability and vision.

In 1984, the company launched 'Sage software' for the Amstrad PCW word processor, which used the CP/M operating system. This marked the beginning of the company's journey in the accounting software market. The sales of this early product quickly grew, showcasing the potential of the business management solutions.

The company's expansion gained momentum with its listing on the London Stock Exchange in 1989, with a valuation of £20 million. This initial public offering was a pivotal moment, providing capital for further growth and acquisitions. This strategic move set the stage for significant expansion.

The company entered the US market in 1991 by acquiring Dac Software, Inc. This acquisition of an American accounting software developer was a strategic move to tap into new markets. This expansion was key to the company's growth and global presence.

Further international expansion followed, with entry into the French market in 1992 and the Portuguese and Swiss markets by 1999. In 1998, the company established its Professional Accountants Division. By 1999, the company became a constituent of the FTSE 100 Index, a position it still holds. You can find more information about the Owners & Shareholders of Sage.

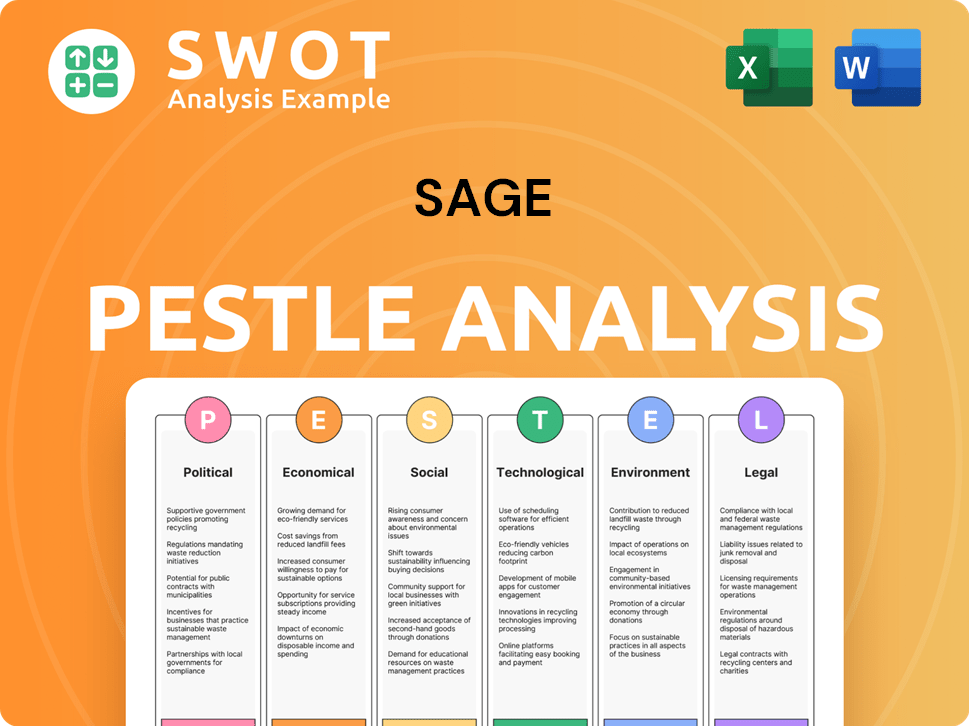

Sage PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Sage history?

The Sage Company history is marked by significant milestones, including early recognition and strategic expansions. In the early 2000s, Sage was celebrated in the UK business press. The company has consistently adapted and innovated to maintain its market position.

| Year | Milestone |

|---|---|

| 2001 | Sage entered the CRM/contact management market through the acquisition of Interact Commerce Inc. |

| 2016 | Introduction of Pegg, Sage's first AI chatbot. |

| 2017 | Launch of Sage Business Cloud and the acquisition of Intacct for $850 million. |

| 2024 | Launch of Sage Copilot, a generative AI-powered assistant. |

Sage has consistently introduced innovative solutions to meet evolving market demands. The company's commitment to technology is evident in its AI-driven tools and cloud-based platforms.

Sage integrated AI, such as the chatbot Pegg in 2016. This early adoption of AI reflects Sage's commitment to leveraging advanced technologies for its users.

The launch of Sage Business Cloud in 2017 provided cloud software solutions. This move was crucial for adapting to the growing demand for cloud-based services.

The acquisition of Intacct in 2017 for $850 million was a strategic move. This acquisition helped Sage expand its cloud-native SaaS offerings.

In February 2024, Sage launched Sage Copilot, its first generative AI-powered assistant. This assistant is designed to automate tasks and provide business insights.

Sage expanded its product portfolio by entering the CRM/contact management market. This expansion allowed Sage to offer more comprehensive business management solutions.

Sage has consistently focused on customer needs. This customer-centric approach has been key to its long-term success and market position.

Sage has faced challenges, particularly from the rise of cloud-native SaaS providers. The company addressed these issues by investing in product development and adapting its business model.

The emergence of cloud-native SaaS providers disrupted the traditional on-premises software market. This shift required Sage to adapt quickly to maintain its competitive edge.

Increased competition from cloud-based solutions put pressure on Sage's market share. Sage responded by reinvesting in product development, sales, and marketing.

The transition to cloud-based services presented a significant challenge for Sage. Sage has worked on cloud-based solutions to meet evolving customer demands.

High switching costs provided an economic moat for Sage, helping it maintain its market position. This factor has been crucial in retaining existing customers.

Sage has been recognized for its workplace culture, leadership, and diversity efforts. This recognition reflects a commitment to employee satisfaction and well-being.

Sage has used strategic acquisitions to adapt to market changes and expand its offerings. These acquisitions have been key to its long-term growth strategy.

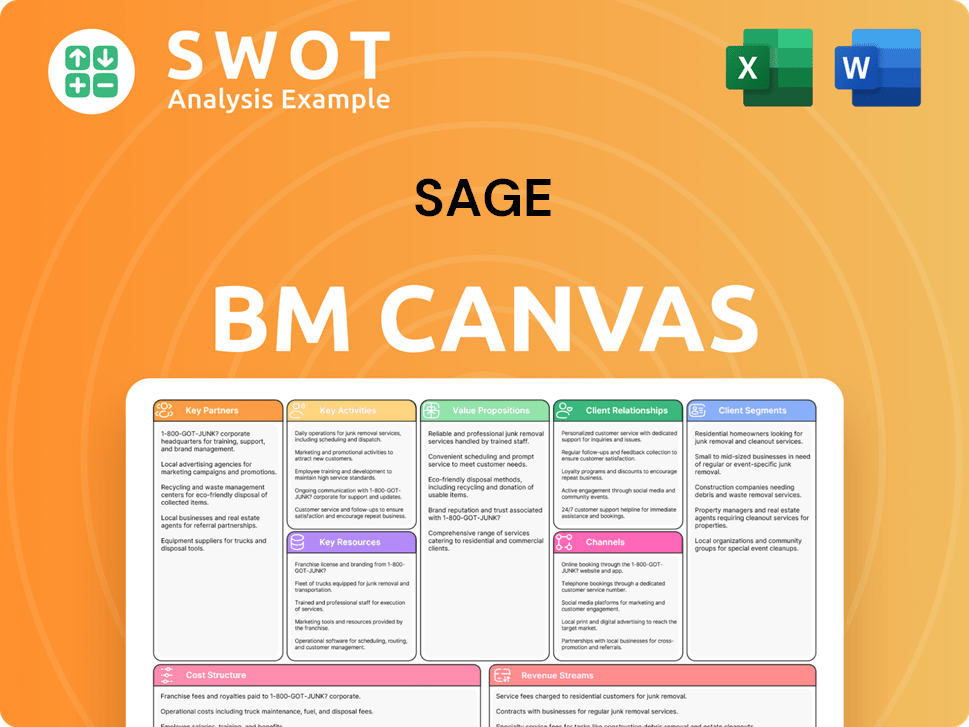

Sage Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Sage?

The Sage Company history is marked by significant milestones, reflecting its growth and adaptation in the software industry. From its origins in Newcastle upon Tyne to its global presence, Sage has consistently evolved to meet the changing needs of businesses. The journey of Sage Group plc, from a small startup to a global company, showcases its resilience and strategic vision in the competitive market of business management solutions.

| Year | Key Event |

|---|---|

| 1981 | Sage was founded in Newcastle upon Tyne. |

| 1984 | Sage launched its software for the Amstrad PCW word processor, leading to substantial sales growth. |

| 1989 | The company was listed on the London Stock Exchange. |

| 1991 | Sage entered the US market through the acquisition of Dac Software, Inc. |

| 1992 | Sage expanded into the French market. |

| 1999 | It entered the FTSE 100 Index. |

| 2000 | Sage reached 2 million customers worldwide. |

| 2001 | The company entered the CRM market by acquiring Interact Commerce Inc. |

| 2007 | Sage surpassed 5 million customers worldwide. |

| 2009 | Sage surpassed 6 million customers worldwide. |

| 2012 | The company entered the Brazilian market. |

| 2014 | Stephen Kelly became Group CEO. |

| 2015 | Sage transformed business payments with Salary and Supplier Payments. |

| 2016 | The company introduced Pegg, its first AI offering. |

| 2017 | Sage acquired Intacct for $850 million and launched Sage Business Cloud. |

| 2018 | Steve Hare was appointed Group Chief Executive Officer. |

| 2024 | Sage launched Sage Copilot, a generative AI-powered assistant. |

| 2024 | The company acquired ForceManager in November 2024. |

Sage is strategically focused on becoming a leading SaaS company. This transition involves moving towards cloud-connected and cloud-native products, such as Sage Accounting and Sage Intacct, which is expected to drive midterm growth.

The company continues to invest in strategic acquisitions, completing 25 acquisitions with an average amount of $196 million as of April 2025. Recent acquisitions include ForceManager in November 2024 and Infineo in September 2024. Sage is also prioritizing investments in AI, with the launch of Sage Copilot in early 2024.

Sage has a strong financial performance, with recurring revenue making up 97% of its total revenue as of March 2024. Underlying recurring revenue increased by 11% to £1,112 million, supporting its strategic initiatives and demonstrating a solid financial foundation.

Sage remains committed to simplifying business processes for SMBs, connecting them digitally, and providing insights to help them thrive. The company's disciplined capital allocation policy focuses on accelerating strategic execution through organic and inorganic investment while delivering shareholder returns.

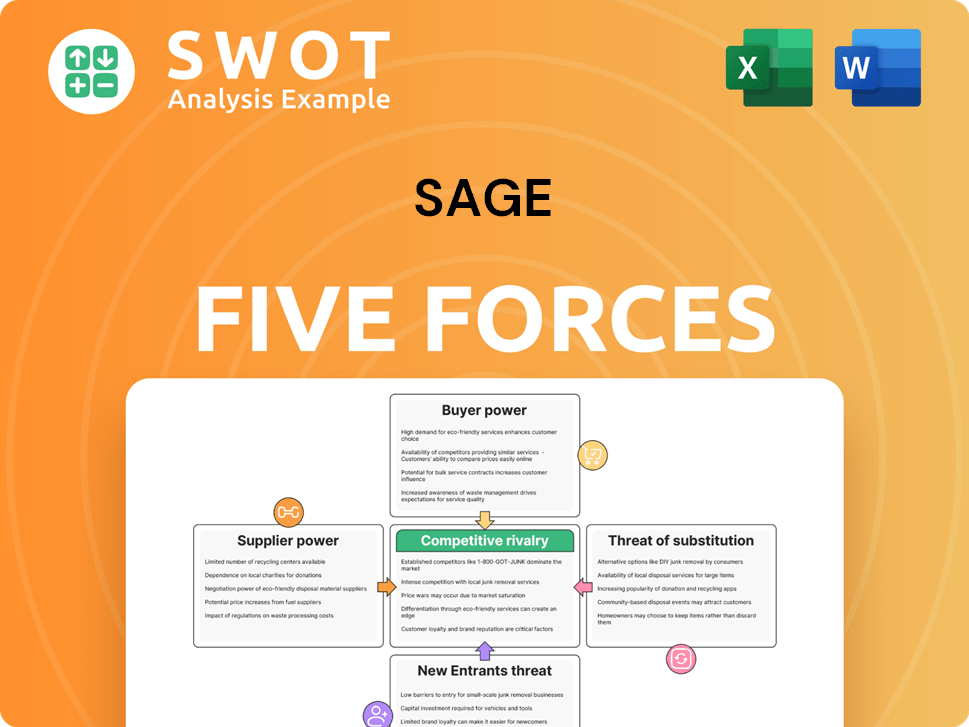

Sage Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Sage Company?

- What is Growth Strategy and Future Prospects of Sage Company?

- How Does Sage Company Work?

- What is Sales and Marketing Strategy of Sage Company?

- What is Brief History of Sage Company?

- Who Owns Sage Company?

- What is Customer Demographics and Target Market of Sage Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.