Sage Bundle

Can Sage Company Sustain Its Growth Trajectory?

Founded in 1981, Sage has evolved from a small business accounting solution to a global leader in enterprise software. This comprehensive analysis delves into the Sage SWOT Analysis, exploring the company's strategic initiatives and future prospects. We'll examine how Sage plans to navigate the ever-evolving tech landscape and maintain its competitive edge.

This exploration of Sage's growth strategy will cover its shift to cloud-based solutions and its innovative use of AI, including Sage Copilot. We'll dissect the company's expansion plans, financial outlook, and potential risks to provide a complete picture of Sage's future. This deep dive into Sage's business prospects will equip you with the insights needed to understand its position in the market and its long-term growth opportunities, including its impact on the future of Sage accounting software and Sage financial solutions.

How Is Sage Expanding Its Reach?

The expansion initiatives of the company are primarily focused on deepening its presence in existing markets, entering new geographical and product categories, and strategically utilizing mergers and acquisitions. A key aspect of their strategy involves scaling Sage Intacct, their flagship cloud-native financial management software for midsize businesses, particularly in North America and the UKIA region (UK, Ireland, Africa, and APAC), and establishing it in Europe where cloud adoption is lower. This is a core part of the overall Marketing Strategy of Sage.

The company is also actively launching new product suites, such as Sage for Small Business in the UK and Canada, and expanding Sage for Accountants in the UK, Canada, and France. These launches are designed to capture new market segments and increase overall market share. The emphasis on cloud solutions reflects the broader trend toward digital transformation in the business world, enhancing accessibility and efficiency for users.

To diversify revenue streams and stay ahead of industry changes, the company has been pursuing strategic acquisitions. These acquisitions are aimed at expanding its product offerings and market reach, particularly in areas like CRM, supply chain management, and educational resources. The company's strategic moves are supported by joint sales force expansions and digital marketing campaigns, particularly for products aimed at expanding market growth and driving significant topline revenue growth in 2025.

Sage Intacct has shown strong growth, with a 24% increase in the US and approximately 60% in other markets. This growth highlights the increasing demand for cloud-based financial solutions among midsize businesses.

In November 2024, the company acquired ForceManager, a mobile CRM and field sales management software platform. This acquisition strengthens the company's offerings in customer relationship management, aiming to improve sales processes and customer interactions.

The company acquired Infineo in September 2024. This acquisition is part of the company's strategy to enhance its product portfolio and expand its market reach through strategic investments.

In November 2024, the company acquired Cambridge Business Publishers, a U.S.-based provider of college textbooks and technology for accounting and finance courses. This acquisition expands its footprint in higher education.

Further acquisitions in 2024 included GOOD DOCS LLC and Mary Ann Leibert, Inc., which added documentaries and peer-reviewed journals to the company's offerings, respectively. The acquisition of Anvyl in 2024, rebranded as Sage Supply Chain Intelligence, demonstrates the company's move beyond financial services to offer real-time visibility and workflow management across the supply chain, managing over $4 billion in gross merchandise.

- These acquisitions are designed to diversify revenue streams.

- The company is focused on expanding its product offerings.

- The strategy includes entering new geographical markets.

- The company aims to enhance customer value through strategic investments.

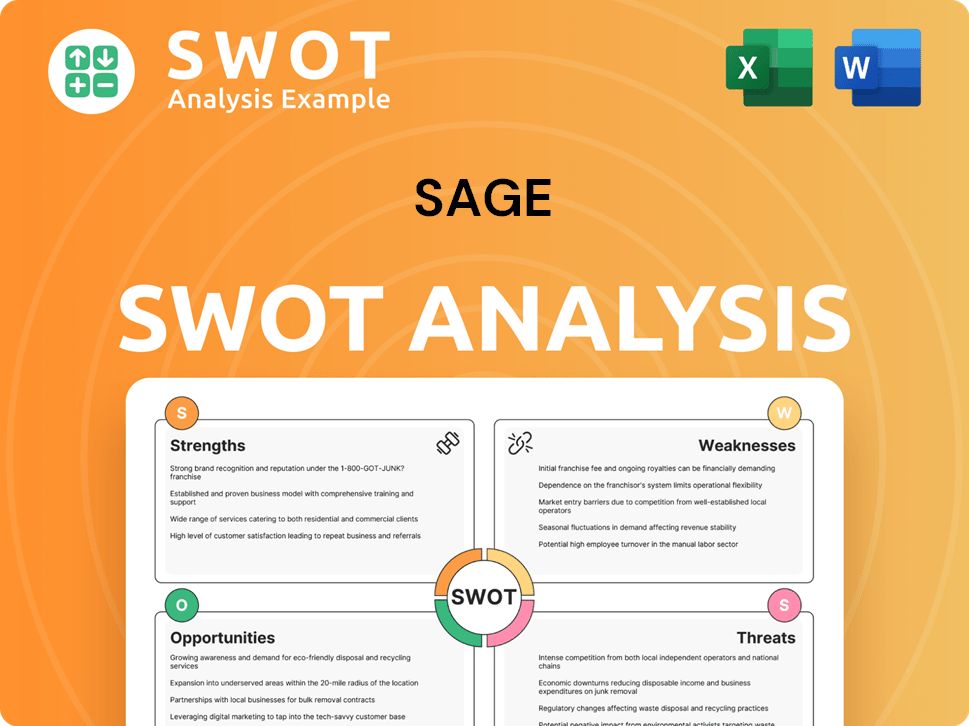

Sage SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Sage Invest in Innovation?

The company is heavily investing in technology and innovation, focusing on digital transformation and integrating cutting-edge technologies to drive sustained growth. A central element of their strategy is the Sage Network, a platform of cloud products and services designed to digitally transform customer workflows and connect their products, customers, and data flows. This platform enables digital capabilities such as bank reconciliations, tax submissions, and invoicing.

This commitment to innovation is evident in the development and deployment of advanced technologies like AI and machine learning. These advancements are designed to streamline operations, provide valuable insights, and enhance decision-making processes for their customers. The company's focus on technology is a key component of its overall strategy for long-term growth and market leadership.

The company's strategic investments in technology and innovation are crucial for its future prospects. By leveraging these advancements, the company aims to enhance its product offerings, improve customer experiences, and maintain a competitive edge in the market. This approach is expected to drive growth and solidify its position as a leader in financial solutions.

The Sage Network is a core component of the company's digital transformation strategy. It provides a platform of cloud products and services designed to streamline workflows. The network connects products, customers, and data flows, enabling digital capabilities such as bank reconciliations and tax submissions.

Sage Copilot is a generative AI-powered assistant. It is currently available to over 8,000 customers of Sage Accounting, Sage for Accountants, and Sage Active. The company plans broader deployment across its portfolio, including Sage Intacct, in 2025. Copilot streamlines routine tasks and enhances decision-making.

The company has partnered with Amazon Web Services (AWS) to develop a domain-specific large language model focused on accounting and compliance. They have also rolled out Microsoft Copilot internally to enhance employee productivity. The company's investments in AI and automation are key growth catalysts.

Sage Earth, powered by machine learning and AI, demonstrates the company's commitment to leveraging advanced technologies. This initiative supports the company's goal of providing innovative solutions. The use of AI is expected to improve efficiency and provide valuable insights.

The company's digital transformation strategy addresses challenges like organizational silos and legacy applications. They are building relationships between business and IT departments. The company is creating a roadmap for both quick wins and long-term platform investments.

Investments in AI and automation are seen as key growth catalysts for the financial services industry in 2025. These technologies enable businesses to boost productivity and efficiency. This is a critical part of the company's strategy.

The company's innovation strategy focuses on digital transformation, AI integration, and strategic partnerships. These initiatives are designed to enhance product offerings and improve customer experiences, driving the company's growth.

- Sage Network: A cloud platform for digital transformation.

- Sage Copilot: An AI-powered assistant for enhanced decision-making.

- Strategic Partnerships: Collaborations with AWS and Microsoft.

- Sage Earth: Utilizing machine learning and AI for advanced solutions.

- Addressing Challenges: Building relationships between business and IT.

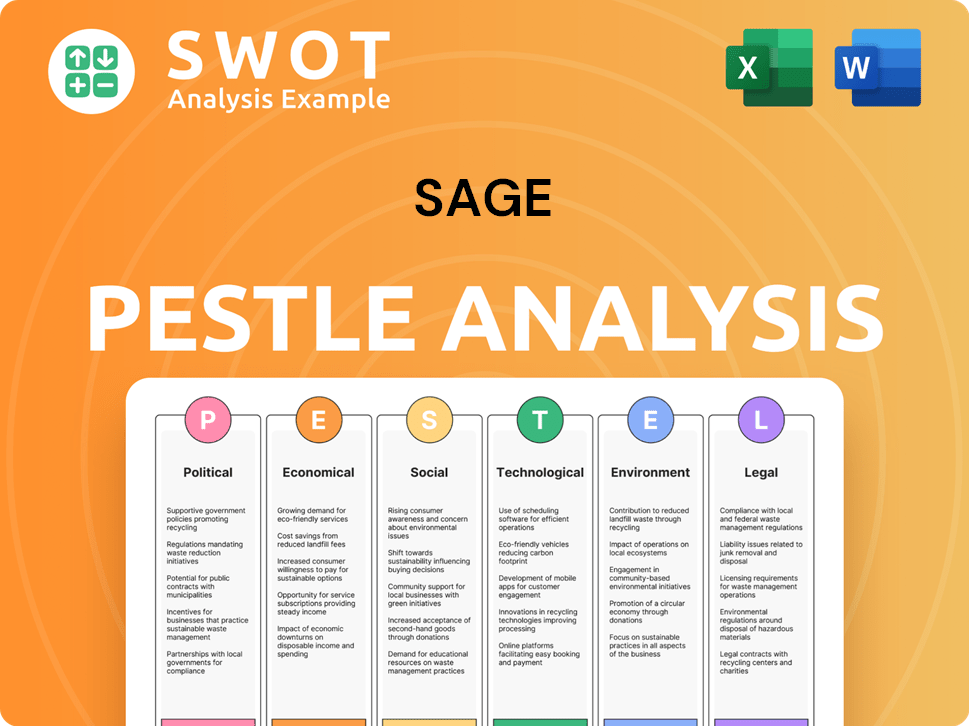

Sage PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Sage’s Growth Forecast?

The financial outlook for the company is robust, with expectations of continued strong performance and growth. The company anticipates an organic total revenue growth of 9% or above for the financial year 2025. This positive trajectory is supported by strategic initiatives and operational efficiencies.

Operating margins are projected to increase in FY25 and beyond, driven by operational efficiencies as the Group scales. This indicates a focus on profitability and effective cost management. The company's performance in the first quarter of FY25 reflects this positive trend.

In the first quarter of FY25, the company's total revenue grew by 9.2% to £612 million. This growth was fueled by strong performances across key regions. North American revenue rose by 11% to £279 million, European revenue increased by 8.3% to £176 million, and UKIA revenue improved by 7.3% to £157 million.

Sage Business Cloud revenue was up 12% year-on-year to £502 million, demonstrating the success of its cloud offerings. Cloud-native revenue, a key area of focus, increased by 20% to £208 million, highlighting the company's shift to cloud-based solutions.

As of March 31, 2025, the underlying annualised recurring revenue (ARR) increased by 11% to £2,454 million. This growth in ARR is a key indicator of the company's financial health and future revenue potential. The strong renewal rate by value of 101% further supports this positive outlook.

The company reported an underlying operating profit increase of 16% to £288 million for the first half of FY25. This resulted in an underlying operating margin of 23.2%, showcasing improved profitability. This is a positive sign for the company's financial health.

Sage's strong cash generation is evident with free cash flow of £524 million in FY24 and an underlying cash conversion of 123%. The company announced a share buyback program of up to £400 million to be executed in FY25. This reflects its robust financial position and confidence in future prospects.

The company's transition to a SaaS business model underpins its financial narrative, which is expected to drive higher-priced subscription contracts. The continued growth from its flagship products, such as Sage Intacct, is a key element of its competitive landscape analysis. This strategic shift, coupled with strong financial performance, positions the company well for sustained growth in the future.

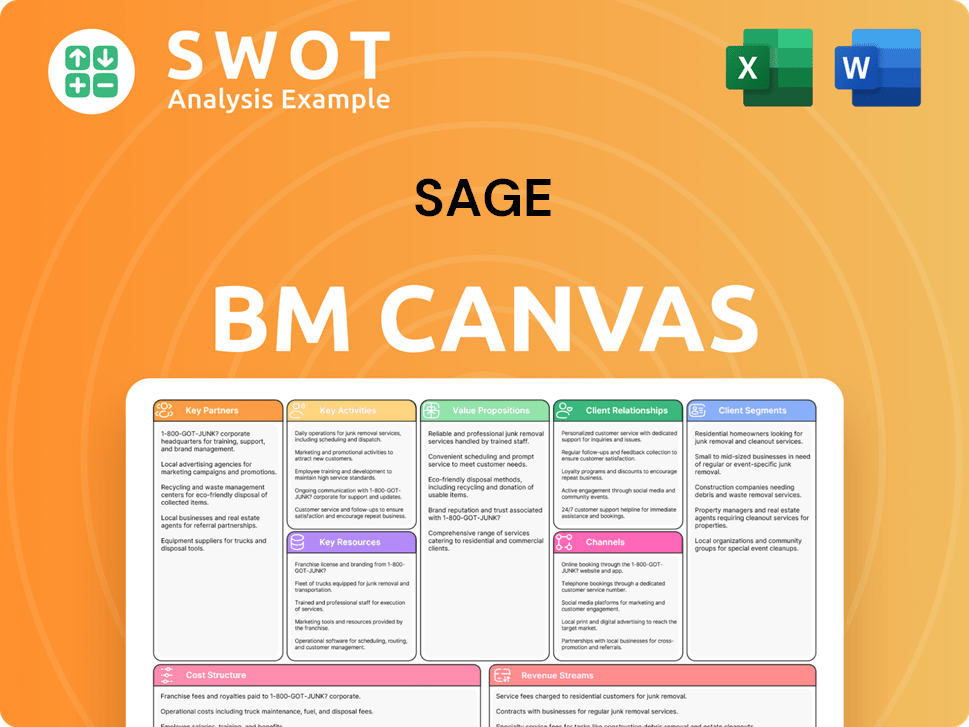

Sage Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Sage’s Growth?

The path for the Sage company is not without its hurdles. Navigating the competitive landscape and adapting to technological shifts are crucial for its long-term success. Understanding these potential risks is essential for anyone evaluating the Sage growth strategy and its Sage company future.

Several factors could impede Sage's business prospects. These include market competition, macroeconomic uncertainties, and the need to continuously innovate in the fast-paced tech industry. The company must proactively manage these challenges to maintain its position and achieve its goals.

Operational and strategic risks are integral to Sage's expansion plans. These risks include market competition, macroeconomic fluctuations, and the rapid evolution of technology. Regulatory changes, particularly those concerning data privacy, also pose ongoing challenges for a global software provider like Sage.

The software market is intensely competitive, with digital-first fintechs constantly raising customer expectations. These competitors often leverage innovative technologies and business models, pressuring established firms like Sage to continually adapt and innovate to stay relevant. This impacts Sage's competitive landscape analysis.

Economic downturns and fluctuations can influence businesses' spending priorities. This can affect Sage's ability to achieve revenue growth. Such conditions also impact businesses' cost reduction strategies, which can indirectly affect Sage's financial performance.

Changes in data privacy regulations and compliance requirements present ongoing challenges. Software providers operating globally must navigate these evolving rules. Compliance costs and the need to adapt products to meet these standards can be significant.

The software industry is subject to rapid technological advancements, especially in AI and other cutting-edge areas. Sage must continuously invest in research and development to avoid becoming obsolete. This requires significant financial commitment and strategic foresight.

Attracting and retaining skilled talent is crucial in the competitive tech landscape. Internal resource constraints, such as the availability of skilled professionals, can hinder growth. This competition for talent can increase operational costs and limit expansion capabilities.

Supply chain issues, although addressed through solutions like Sage Supply Chain Intelligence, pose a broader economic risk. These vulnerabilities can affect Sage's customers and, indirectly, Sage's business. These disruptions can lead to increased costs and operational inefficiencies.

Sage employs a multi-faceted approach to address these risks. This includes diversifying its product portfolio and expanding its geographical reach to reduce reliance on any single market or solution. A customer-centric approach, featuring simpler, integrated offerings with tiered pricing, is used to improve customer retention and drive growth. The company's focus on cost management and operating efficiencies supports ongoing investment while maintaining strong operating profit margins. Sustained investment in R&D and strategic partnerships also helps to mitigate technological disruption and maintain a competitive edge. For further insight into Sage's core values, consider reading about the Mission, Vision & Core Values of Sage.

In its most recent financial reports, Sage has shown resilience. For instance, in the first half of fiscal year 2024, organic revenue growth was reported at 10%. The company's focus on recurring revenue streams, which accounted for 93% of total revenue, provides stability. Furthermore, the operating profit margin has expanded, indicating effective cost management and operational efficiency. These figures reflect Sage's ability to navigate challenges and maintain financial health.

Sage Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Sage Company?

- What is Competitive Landscape of Sage Company?

- How Does Sage Company Work?

- What is Sales and Marketing Strategy of Sage Company?

- What is Brief History of Sage Company?

- Who Owns Sage Company?

- What is Customer Demographics and Target Market of Sage Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.