Sage Bundle

How Does Sage Company Thrive in the Business World?

Sage, a global force in cloud business management solutions, is a key partner for businesses worldwide, simplifying finance, operations, and people management. With a rich history spanning over four decades, Sage has transformed from a UK startup to a FTSE 100 giant, serving millions. Its impact is particularly strong in the SMB sector, where its Sage SWOT Analysis solutions are widely adopted, empowering businesses to streamline processes and drive growth.

This exploration of Sage Company will delve into its core operations, value proposition, and diverse revenue streams. Whether you're interested in Sage accounting, curious about Sage ERP system benefits, or seeking insight into Sage software for small businesses, this analysis provides a comprehensive view. We'll examine the key strategic moves and milestones that have shaped its journey, including its approach to Sage company customer support and Sage 50 pricing and features, analyzing its industry position and future outlook. Understanding how Sage Intacct works and the broader Sage business cloud features is vital for anyone looking to make informed decisions in the business software landscape.

What Are the Key Operations Driving Sage’s Success?

The core operations of the Sage Company revolve around providing integrated cloud-based solutions designed to streamline complex business processes. This approach is primarily targeted at small and medium-sized businesses (SMBs), though its offerings also extend to larger enterprises. Sage software aims to simplify critical operational needs, enabling businesses to manage finances, optimize workforce management, and ensure regulatory compliance.

The value proposition of Sage business solutions lies in its ability to offer comprehensive software suites. These include accounting and financial management software, human resources and payroll solutions, and payment processing services. These solutions are designed to improve efficiency, enhance decision-making through real-time data, and reduce administrative burdens.

The operational processes supporting Sage products are built on technology development, customer support, and a strong partner ecosystem. Significant investments in research and development are made to enhance cloud platforms, integrate technologies like AI, and ensure software scalability and security. The global sales and distribution networks utilize direct sales teams, a vast reseller network, and strategic alliances to reach customers across various geographies and industries. Customer service is delivered through multiple channels, including online support, dedicated account managers, and community forums.

Sage provides a range of software solutions including accounting and financial management (e.g., Sage Intacct, Sage 50cloud), human resources and payroll (e.g., Sage People, Sage Payroll), and payment processing services. These solutions are designed to meet the diverse needs of businesses.

The primary focus is on small and medium-sized businesses (SMBs), with solutions tailored to their specific needs. This focus allows Sage to offer user-friendly software that bridges the gap between enterprise-level and basic accounting tools.

Sage leverages a vast network of resellers and strategic alliances to reach customers globally. This extensive partner network ensures broad market coverage and provides localized support and expertise.

Customer support is delivered through multiple channels, including online support, dedicated account managers, and community forums. This multi-channel approach ensures businesses can maximize the value from their Sage products.

The unique understanding of the SMB market allows Sage to tailor solutions that are both powerful and user-friendly. This focus, combined with its extensive partner network, translates into significant customer benefits, such as improved efficiency and enhanced decision-making.

- Improved efficiency and reduced administrative burden.

- Enhanced decision-making through real-time data insights.

- Focus on core business activities and growth.

- Extensive partner network for localized support.

For more detailed information on the company's performance and strategy, you can refer to the insights provided in Owners & Shareholders of Sage. The company's commitment to innovation and customer support continues to drive its market position, with a focus on cloud-based solutions designed to meet the evolving needs of businesses worldwide. As of the latest reports, Sage has shown consistent growth in its cloud business, reflecting the increasing demand for its digital solutions. The company's strategic investments in AI and other emerging technologies are aimed at further enhancing its product offerings and maintaining a competitive edge in the market.

Sage SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Sage Make Money?

The Sage Company primarily generates revenue through recurring subscriptions to its cloud-based software and related services. This subscription-first model provides a stable and predictable revenue base, which is a key factor in the company's financial performance. In the fiscal year ending September 30, 2024, Sage reported total revenue of £2.36 billion, with recurring revenue reaching £2.25 billion, representing around 95% of total revenue.

This shift to a cloud-centric business model has been successful, as evidenced by the growth in recurring revenue. The company's focus on subscriptions has allowed it to build strong, ongoing relationships with its customers. This transition is part of a broader industry trend towards Software-as-a-Service (SaaS), enhancing both revenue predictability and customer loyalty for Sage business solutions.

The company's monetization strategies include tiered pricing models, cross-selling, and bundling services. These approaches aim to increase customer lifetime value and provide flexibility based on business needs. For more insights, explore the Growth Strategy of Sage.

The main revenue streams for Sage are software subscriptions, services revenue, and payments revenue. These diverse income sources contribute to the company's financial stability and growth. The company offers various Sage products to cater to different business needs.

- Software Subscriptions: This is the largest segment, including fees for access to cloud accounting, HR, payroll, and business management platforms like Sage Intacct and Sage 50cloud. Revenue is often based on the number of users, modules utilized, or transaction volumes.

- Services Revenue: This includes professional services such as implementation, consulting, training, and ongoing technical support. These services are crucial for customer onboarding and retention.

- Payments Revenue: This stream grows as Sage integrates payment processing capabilities into its platforms, generating revenue from transaction fees and related payment services.

Sage PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Sage’s Business Model?

The journey of the Sage Company has been marked by significant milestones and strategic moves that have shaped its operational and financial trajectory. A pivotal shift has been its aggressive transition to cloud-native solutions, exemplified by the continued growth of products like Sage Intacct and Sage Business Cloud. This strategic pivot has allowed Sage to remain competitive in a rapidly evolving software landscape and cater to the increasing demand for flexible, accessible, and scalable business management tools. For example, in the first half of fiscal year 2024, Sage Intacct's recurring revenue grew by 19%, demonstrating strong adoption of its cloud financial management platform.

The company has also expanded its capabilities through strategic acquisitions, such as its continued investment in enhancing its payments capabilities and integrating AI into its offerings. These moves address evolving market demands and strengthen its ecosystem. Sage has faced operational challenges common to large software providers, including the need for continuous innovation to keep pace with technological advancements and competitive pressures. However, its response has been to double down on cloud investment and focus on customer success, leading to high recurring revenue and customer retention.

Sage's competitive advantages are multifaceted. Its strong brand recognition, particularly within the SMB sector, provides a significant moat. The sheer scale of its customer base globally creates network effects and economies of scale in product development and support. Furthermore, its deep integration with local regulatory frameworks and compliance requirements in various countries offers a distinct advantage, especially for businesses operating internationally. Sage continues to adapt to new trends by embedding artificial intelligence and automation into its products, aiming to further streamline workflows for its customers. This proactive approach to technology adoption and its established market presence enable Sage to sustain its business model against new entrants and established competitors alike.

Key milestones for Sage include its aggressive shift to cloud-native solutions, such as Sage Intacct. This has allowed the company to remain competitive. The company has also expanded its capabilities through strategic acquisitions and AI integration.

Strategic moves include the transition to cloud-native solutions like Sage Business Cloud and investments in AI and payments. These moves address evolving market demands and strengthen its ecosystem. Focus on customer success has led to high recurring revenue and customer retention.

Sage's competitive advantages include strong brand recognition, particularly within the SMB sector. The company benefits from its global customer base, creating network effects. Deep integration with local regulatory frameworks is another key advantage.

The company is adapting to new trends by embedding artificial intelligence and automation into its products. This proactive approach to technology adoption and its established market presence enable Sage to sustain its business model. For more detailed information, you can explore the Target Market of Sage.

In fiscal year 2024, Sage demonstrated robust financial performance, driven by its strategic focus on cloud solutions and customer success. The company's recurring revenue model continues to be a key driver of its financial health, with significant growth in its cloud-based products. This performance is supported by a strong market position, particularly within the small and medium-sized business (SMB) sector, where Sage has a well-established brand and customer base.

- Strong Recurring Revenue: Recurring revenue growth is a key indicator of Sage's financial health, reflecting the success of its subscription-based model.

- Cloud Adoption: The adoption of cloud-based solutions, such as Sage Intacct and Sage Business Cloud, has been a major driver of growth.

- Customer Retention: High customer retention rates demonstrate customer satisfaction and the value of Sage's products and services.

- Strategic Acquisitions: Acquisitions have played a role in expanding Sage's product offerings and market reach.

Sage Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Sage Positioning Itself for Continued Success?

The software company holds a strong position in the global business software market, particularly in accounting, HR, and payroll for small and medium-sized businesses. It competes with major enterprise resource planning (ERP) vendors like SAP and Oracle, as well as cloud-native accounting software providers such as QuickBooks (Intuit) and Xero. The company is consistently recognized as a leading provider, often ranking among the top three in its core markets. Its extensive customer base and high recurring revenue demonstrate significant customer loyalty and a broad global reach.

Despite its robust position, the company faces several key risks. Regulatory changes, particularly concerning payroll, taxation, and data privacy, can impact its compliance requirements and product development efforts. The competitive landscape is intensely dynamic, with both established players and agile startups constantly innovating, necessitating continuous investment in research and development to maintain a technological edge. Economic downturns could lead to reduced IT spending by businesses, potentially impacting new customer acquisition and existing customer retention. Furthermore, the increasing sophistication of cyber threats poses an ongoing risk to data security and customer trust.

The company is a leading provider of business management solutions, particularly for small and medium-sized businesses (SMBs). It competes with a range of software providers, including both established players and cloud-native startups. The company's global reach and recurring revenue model contribute to its strong market position. The Competitors Landscape of Sage reveals the competitive dynamics.

The company faces risks from regulatory changes, especially those related to payroll, taxation, and data privacy. The competitive landscape is dynamic, requiring continuous innovation. Economic downturns and cybersecurity threats also pose significant challenges. Maintaining customer trust and adapting to technological advancements are critical.

The company is focused on expanding its cloud solutions, payments capabilities, and leveraging AI and machine learning. Its future outlook centers on its transition to a cloud-first company. The company aims to deliver greater value to customers through integrated, intelligent solutions, focusing on recurring revenue.

The company is investing in cloud solutions, expanding its payments capabilities, and integrating AI and machine learning. Leadership emphasizes driving cloud adoption, strengthening relationships with accountants, and expanding into new geographies. The company aims to sustain growth by focusing on recurring revenue and expanding its ecosystem.

The company's strategic initiatives include a focus on cloud solutions and leveraging AI. This is in response to the growing demand for cloud-based services and the need to enhance product functionality. The company is also working to strengthen its relationships with accountants and expand its global footprint.

- Focus on cloud adoption to meet market demand.

- Expansion of payment capabilities to enhance service offerings.

- Integration of AI and machine learning to improve user experience.

- Strengthening relationships with accountants to drive sales.

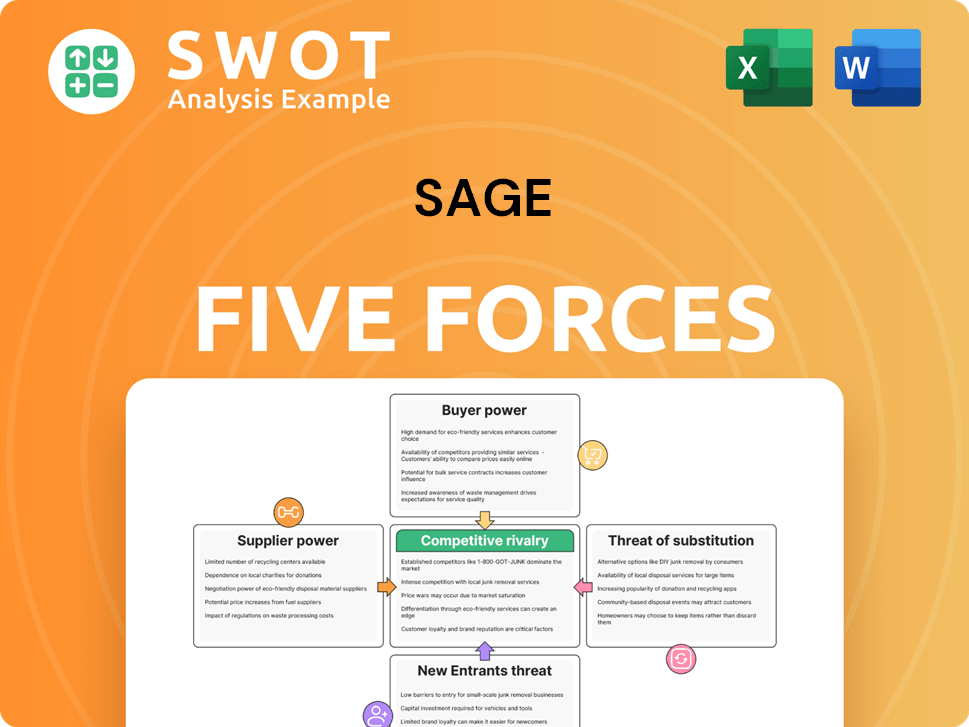

Sage Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Sage Company?

- What is Competitive Landscape of Sage Company?

- What is Growth Strategy and Future Prospects of Sage Company?

- What is Sales and Marketing Strategy of Sage Company?

- What is Brief History of Sage Company?

- Who Owns Sage Company?

- What is Customer Demographics and Target Market of Sage Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.