Samsung Securities Bundle

How did Samsung Securities become a financial powerhouse?

Ever wondered about the origins of a financial giant? Samsung Securities, a leading South Korean brokerage and investment banking firm, boasts a rich history. From its inception in 1982 as Hanil Investment & Finance, the company has evolved significantly. This exploration will unveil the Samsung Securities SWOT Analysis, its early days, and its transformation into a key player in the global financial arena.

Understanding the brief history of Samsung Securities company provides crucial context for its current success. Its journey reflects the dynamic growth of South Korea's financial services sector. This deep dive into Samsung Securities history will examine its key milestones, including its evolution within the broader Samsung company ecosystem. The company's financial performance, particularly its recent gains, underscores its continued relevance in the investment banking landscape.

What is the Samsung Securities Founding Story?

The story of Samsung Securities begins in Seoul, South Korea. It was founded on October 19, 1982, initially known as Hanil Investment & Finance. The company's early days were focused on providing investment and financial services, laying the groundwork for its future in the financial sector.

A significant turning point came in 1992. The company became part of the Samsung Group, a major South Korean conglomerate. This integration led to a rebranding as Samsung Securities, giving it the backing and resources of the Samsung brand. This move was crucial for its growth.

While specific details about the founders aren't widely available, the company's establishment was part of the wider development of South Korea's financial markets. The acquisition by Samsung Group provided a strong financial foundation and strategic direction. To learn more about their marketing approach, you can explore the Marketing Strategy of Samsung Securities.

Here are some key facts about Samsung Securities' founding:

- Founding Date: October 19, 1982

- Original Name: Hanil Investment & Finance

- Location: Seoul, South Korea

- 1992: Incorporated into the Samsung Group and rebranded as Samsung Securities

Samsung Securities SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Samsung Securities?

Following its rebranding as Samsung Securities, the company experienced substantial growth and expansion. This period was marked by strategic moves in the financial services sector, including early ventures into mutual funds and international markets. These initiatives, along with mergers and expansions of service offerings, solidified its position in the investment banking industry.

In 1998, Samsung Securities became the first company in South Korea to sell mutual funds, a significant milestone. Prior to this, in 1996, it attempted a joint venture with J.P. Morgan & Co. for mutual fund sales, though this did not materialize by 1997. These early moves positioned Samsung Securities as a key player in the burgeoning investment market.

A crucial step in its growth was the merger with Samsung Investment Trust in 2000, which strengthened its market presence. This strategic consolidation helped broaden its service offerings and enhance its competitive edge within the financial services landscape. These actions were part of a broader strategy to expand its influence.

Samsung Securities began its international expansion by establishing offices in London (1996), New York (1998), and Hong Kong (2001). These overseas ventures were designed to tap into global markets and offer a wider range of investment opportunities. This expansion was a key component of its strategy.

In 2005, Samsung Securities launched Samsung Wrap Accounts, expanding its service offerings beyond traditional brokerage. The company demonstrated consistent financial growth, achieving a compound annual growth rate (CAGR) of 13% in gross revenue from FY2019 to FY2024, reaching KRW 10,725 billion. Net income also saw robust growth, rising at an 18% year-over-year CAGR to KRW 899 billion in FY2024, with its return on equity (ROE) increasing significantly to 13% in FY2024 from 8% in FY2019. To understand the competitive landscape of Samsung Securities, consider the Competitors Landscape of Samsung Securities.

As of March 2024, Samsung Securities employed over 2,400 individuals, including more than 550 advisors. The company operates through 28 domestic branches and five overseas offices. This extensive network supports its wide range of investment banking and financial services.

Samsung Securities PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Samsung Securities history?

The Growth Strategy of Samsung Securities has been marked by significant milestones, innovations, and challenges within the financial services industry. The company's journey reflects its commitment to adapting and growing in the dynamic South Korean market and beyond. The early years of Samsung Securities saw it establish itself as a key player in investment banking.

| Year | Milestone |

|---|---|

| 1998 | Became the first company in Korea to sell mutual funds. |

| 2005 | Launched Samsung Wrap Accounts. |

| 2007 | Won in nine finance categories in the Asiamoney Brokers Poll. |

| 2010 | First Korean financial company to underwrite inflation-linked bonds. |

| 2014 | Declared a Customer Protection Charter. |

| 2015 | Introduced the online asset management platform 'SmartAdvisor.' |

| 2016 | Launched 'New mPOP,' an all-in-one asset management Mobile Trading System (MTS). |

Samsung Securities has consistently focused on innovation to enhance its financial services offerings. The introduction of 'SmartAdvisor' and 'New mPOP' demonstrates the company's commitment to leveraging technology for asset management and customer convenience.

In 1998, Samsung Securities became the first in Korea to sell mutual funds, expanding investment options for clients. This pioneering move set a precedent for the financial services industry in South Korea.

Launched in 2005, Samsung Wrap Accounts provided customized investment solutions. These accounts offered tailored services to meet diverse client needs, enhancing the company's service portfolio.

The 'SmartAdvisor' platform, introduced in January 2015, brought online asset management to the forefront. This innovation improved accessibility and convenience for clients managing their investments.

In September 2016, Samsung Securities launched 'New mPOP,' an all-in-one asset management Mobile Trading System (MTS). This platform offered comprehensive trading and management tools on mobile devices, enhancing user experience.

Samsung Securities has formed strategic partnerships to expand its global reach and capabilities. Collaborations with firms like Rothschild & Co, Neuberger Berman, KGI Securities, and Societe Generale have broadened its service offerings.

The Customer Protection Charter, declared in January 2014, underscored Samsung Securities' commitment to safeguarding client interests. This initiative enhanced trust and transparency in its operations.

Despite its achievements, Samsung Securities, like other companies within the Samsung Group, has faced challenges. The financial performance of Samsung Securities is closely tied to the broader market conditions and economic trends.

The broader Samsung Group experienced market volatility, with its market capitalization shrinking by over $110 billion in 2024. This decline reflects the impact of share price fluctuations across its affiliates.

To address evolving market conditions, Samsung Securities plans to expand into new business areas. These include introducing new FX services and expanding into the institutional-only private funds market.

Samsung Securities aims to enhance market competitiveness by growing corporate lending and real estate investments as a General Partner (GP). This strategy is designed to diversify revenue streams and improve financial performance.

The financial services sector in South Korea is highly competitive, requiring continuous innovation and adaptation. Samsung Securities faces pressure from both domestic and international competitors.

Changes in financial regulations can pose challenges for Samsung Securities. Compliance with new rules and standards requires ongoing investments and adjustments to business practices.

Like all financial institutions, Samsung Securities is vulnerable to market downturns. Economic recessions or financial crises can significantly impact its profitability and asset values.

Samsung Securities Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Samsung Securities?

The history of Samsung Securities reflects its evolution within the South Korean financial services landscape. From its founding as Hanil Investment & Finance to its current status, the company has consistently adapted to market changes and expanded its offerings. Here's a look at some key milestones.

| Year | Key Event |

|---|---|

| October 19, 1982 | Founded as Hanil Investment & Finance, marking the beginning of its journey in the financial sector. |

| 1988 | Publicly listed on the Korea Exchange, increasing its visibility and access to capital. |

| 1991 | Changed its name to Kookje Securities. |

| 1992 | Incorporated into the Samsung Group and rebranded as Samsung Securities, integrating it within a major conglomerate. |

| 1996 | Attempted a joint venture with J.P. Morgan & Co. to sell mutual funds in Korea; opened a London office. |

| 1998 | Became the first company in Korea to sell mutual funds; opened a New York office, expanding its global presence. |

| 2000 | Merged with Samsung Investment Trust, consolidating its investment services. |

| 2001 | Opened a Hong Kong office, furthering its reach in Asia. |

| 2005 | Launched Samsung Wrap Accounts, introducing new investment products. |

| 2007 | Won in 9 categories of finance in the Asiamoney Brokers Poll (First in Korea), highlighting its industry leadership. |

| 2008 | Signed a partnership with Rothschild & Co. |

| 2010 | First Korean financial company to underwrite inflation-linked bonds; joined the DJSI World Index (First in Korean financial industry), demonstrating its commitment to sustainable practices. |

| 2014 | Declared the Customer Protection Charter; partnership with Neuberger Berman, emphasizing client-centric services. |

| January 2015 | Launched 'SmartAdvisor,' an online asset management platform, adapting to digital trends. |

| September 2016 | Launched 'New mPOP,' an all-in-one asset management MTS, enhancing its mobile offerings. |

| 2018 | Set up a team specializing in analyzing investments related to North Korea, reflecting its responsiveness to geopolitical dynamics. |

| February 13, 2025 | Reported Q4 2024 results, exceeding analyst sales estimates for the fourth straight quarter with net revenues reaching KRW 2,066 billion. |

| March 2025 | Announced a rights offering to raise an estimated KRW 2 trillion ($1.38 billion) for future competitiveness and mid- to long-term growth, with funds to be used for a joint venture with General Motors, expansion of Hungary production facilities, and establishment of all-solid-state battery lines. |

The 2025 business strategy emphasizes balanced growth between retail and Investment Banking (IB) to create a stable long-term foundation. This approach seeks to diversify revenue streams and enhance overall financial performance.

Key initiatives include strengthening core business leadership by enhancing retail dominance and expanding IB capabilities. This involves revamping the integrated client management system, data analytics, and AI-driven remote services.

The company plans to expand new business areas by introducing new FX services and expanding into the institutional-only private funds market. This strategic move aims to capitalize on emerging opportunities within the financial sector.

Analysts anticipate net revenues to reach KRW 2,530 billion and net income to reach KRW 962 billion by FY2027. Additionally, the company is projected to offer an attractive dividend yield of approximately 8-9% over the next three years.

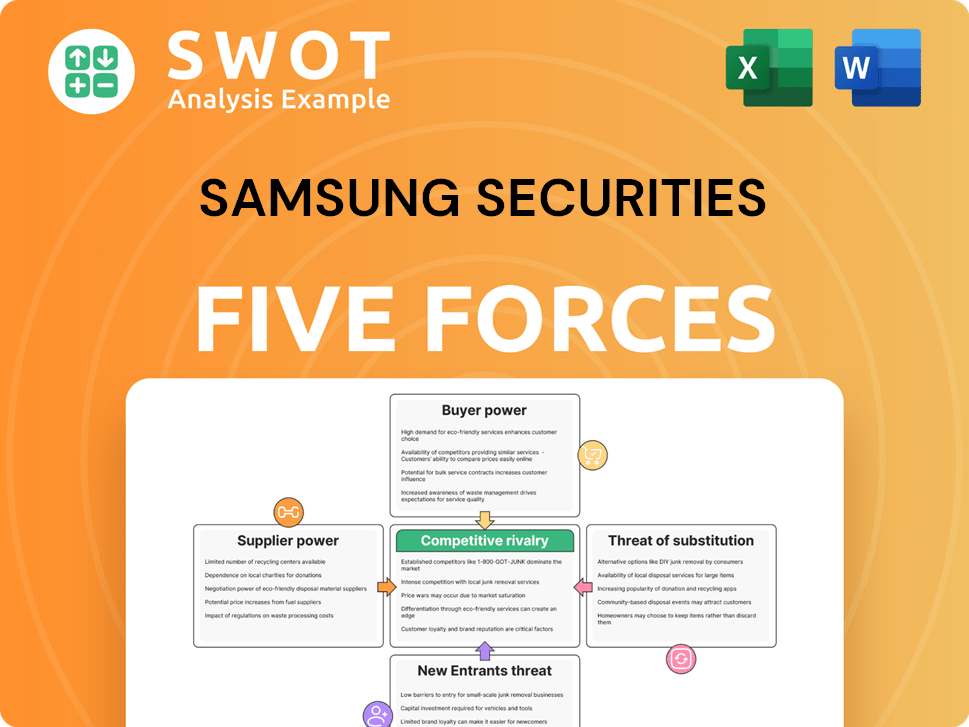

Samsung Securities Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Samsung Securities Company?

- What is Growth Strategy and Future Prospects of Samsung Securities Company?

- How Does Samsung Securities Company Work?

- What is Sales and Marketing Strategy of Samsung Securities Company?

- What is Brief History of Samsung Securities Company?

- Who Owns Samsung Securities Company?

- What is Customer Demographics and Target Market of Samsung Securities Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.