Samsung Securities Bundle

How Does Samsung Securities Thrive in a Dynamic Market?

Explore the intricate sales and marketing strategies of Samsung Securities, a financial powerhouse navigating the complexities of the South Korean market. Discover how this leading investment company leverages cutting-edge digital transformation and client-centric approaches to stay ahead. Uncover the secrets behind their success in a competitive landscape, from innovative Samsung Securities SWOT Analysis to strategic market positioning.

This deep dive into Samsung Securities' sales strategy and marketing strategy reveals how they attract investors and maintain a strong brand presence. We'll examine their digital marketing plan, including social media marketing and content marketing approaches, to understand their customer acquisition strategy. Analyzing their sales performance review and investment product promotion strategies offers valuable insights for anyone interested in financial services marketing and securities industry trends.

How Does Samsung Securities Reach Its Customers?

The sales strategy of Samsung Securities Company centers on a multi-channel approach, blending traditional methods with a strong digital presence to cater to a diverse clientele. Historically, physical branches and direct sales teams were key, offering personalized services for securities brokerage, wealth management, and investment banking. However, the company has significantly increased its digital capabilities to meet evolving market demands.

The evolution of these channels underscores a strategic shift towards digital adoption and omnichannel integration. Samsung Securities is enhancing its client management system, leveraging data analytics and AI-driven remote services to improve retail dominance and expand investment banking capabilities. This includes online platforms like the company website and mobile applications for retail brokerage and digital asset management. The focus on a fee-driven revenue model, utilizing managed trusts and wrap accounts, also points to streamlined digital processes.

In 2024, South Korean brokerage firms, including Samsung Securities, launched promotions offering zero commission fees on foreign stock trades to attract retail investors. This indicates a strategic pivot towards online trading platforms for retail investors. The expansion of its client base to financial institutions and corporates with FX service needs, and the introduction of new FX services, likely involves direct sales teams supported by advanced digital trading platforms. The company's intention to provide lifecycle-based financial solutions to corporates, such as Workplace Wealth Management (WM), and expand cross-selling opportunities, suggests a combination of direct sales and digital tools for corporate clients.

These channels have traditionally been essential for providing personalized services, particularly for high-net-worth individuals (HNWIs) and complex institutional dealings. Direct interaction allows for tailored advice and relationship building, crucial for wealth management and investment banking. Despite the rise of digital platforms, physical branches and direct sales teams remain a cornerstone of Samsung Securities' sales strategy.

Samsung Securities has significantly invested in digital platforms, including its website and mobile applications, to cater to retail brokerage and digital asset management. The company is leveraging data analytics and AI-driven remote services to enhance its online presence. This digital focus is reflected in the zero-commission promotions on foreign stock trades, driving digital adoption among retail investors.

The company expands its client base to financial institutions and corporates with FX service needs, likely involving direct sales teams supported by advanced digital trading platforms. Samsung Securities aims to provide lifecycle-based financial solutions to corporates, such as Workplace Wealth Management (WM), suggesting a blend of direct sales and digital tools for corporate clients. This segment benefits from both personalized service and advanced digital trading capabilities.

Samsung Securities is enhancing its integrated client management system. This system leverages data analytics and AI-driven remote services. This approach improves retail dominance and expands investment banking capabilities. This integration ensures a seamless experience across all channels.

The sales strategy of Samsung Securities focuses on a multi-channel approach, integrating physical branches, direct sales teams, and digital platforms. This strategy aims to cater to a diverse clientele, from retail investors to institutional clients. The company's digital transformation is a key aspect of its growth strategy, as highlighted in the Growth Strategy of Samsung Securities.

- Digital Platforms: Online trading platforms, mobile apps, and website functionalities are crucial for retail investors.

- Direct Sales Teams: Essential for high-net-worth individuals, institutional clients, and corporate services, offering personalized advice.

- Integrated Client Management: Leveraging data analytics and AI to enhance client experience and streamline services.

- Fee-Driven Revenue: Focus on managed trusts and wrap accounts, supported by streamlined digital processes.

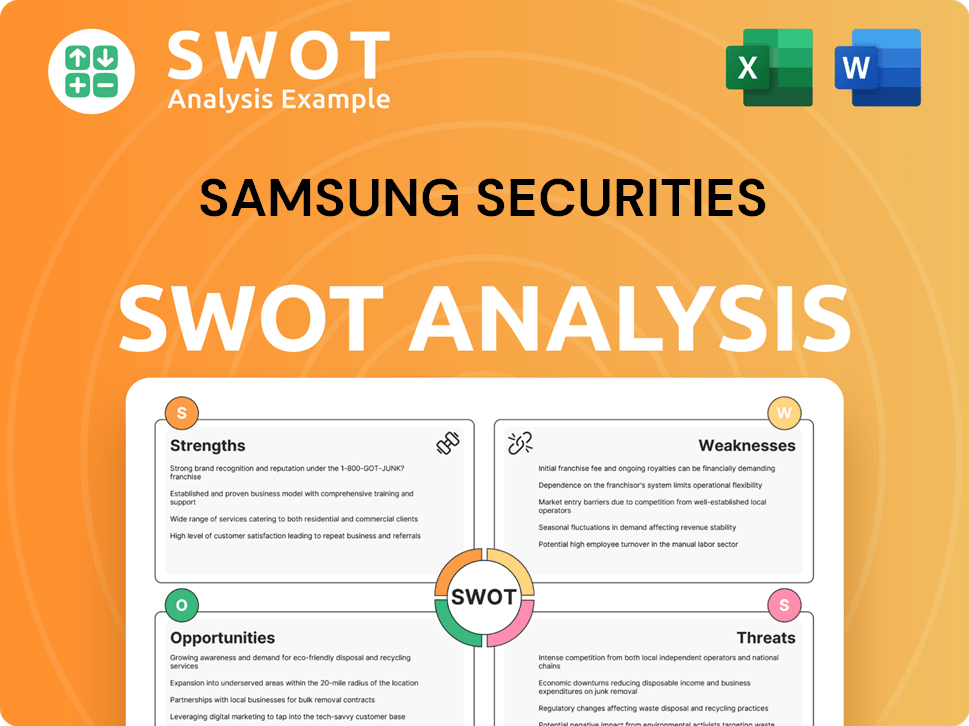

Samsung Securities SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Samsung Securities Use?

The marketing strategy of Samsung Securities, like other major players in the financial services industry, is multifaceted, blending digital and traditional tactics to reach a broad audience. The company focuses on building brand awareness, generating leads, and driving sales in a competitive market. This approach is crucial for attracting and retaining clients in the investment and wealth management sectors.

Digital marketing plays a central role, with an emphasis on content marketing, paid advertising, email campaigns, and a strong social media presence. Data-driven insights inform targeted advertising, ensuring that marketing efforts resonate with specific audience segments. Simultaneously, traditional media channels are still utilized to maintain a broad reach and cater to different demographics.

In its 2025 business strategy, Samsung Securities plans to revamp its integrated client management system, data analytics, and AI-driven remote services, showcasing a commitment to personalized customer segmentation and tailored financial solutions. This shift highlights the importance of adapting to the evolving needs of investors.

Digital marketing is a cornerstone of the strategy, encompassing content marketing, paid advertising, and email campaigns. Social media is also a key component, with platforms like X (formerly Twitter), Instagram, and Facebook used to engage with customers. This approach is essential for Samsung Securities to stay competitive.

Data analytics are crucial for hyper-targeted advertising, ensuring that ads resonate with specific audience segments. The company uses data to personalize customer segmentation and tailor financial solutions. This approach allows Samsung Securities to offer more relevant and effective services.

Traditional media such as TV, radio, and print are still used for broader brand awareness. Events like investor seminars and financial forums are key for lead generation and direct client engagement. This blend of digital and traditional methods helps Samsung Securities reach a wider audience.

The company is focused on enhancing customer experience through innovations in remote services and cross-selling opportunities. This includes revamping its integrated client management system and leveraging AI-driven remote services. By prioritizing customer needs, Samsung Securities aims to build stronger relationships.

Marketing efforts are highly targeted based on client needs and investment goals, especially in areas like wealth management and investment banking. They focus on developing a fee-driven revenue model using managed trusts and wrap accounts. This allows Samsung Securities to offer customized financial solutions.

The marketing mix is constantly evolving, integrating traditional channels with digital touchpoints to create a seamless customer journey. Innovation in remote services and cross-selling opportunities is a key focus. This ensures that Samsung Securities remains at the forefront of the industry.

The Samsung Securities marketing strategy is designed to attract and retain clients, with a strong emphasis on digital channels and data-driven insights. This approach is crucial for success in the competitive securities industry. The company's focus on innovation and customer experience is central to its growth strategy.

- Digital Marketing: Content marketing, paid advertising, and social media engagement are key components.

- Data Analytics: Used to personalize customer segmentation and tailor financial solutions.

- Traditional Media: TV, radio, and print are still used for broader brand awareness.

- Events: Investor seminars and financial forums are used for lead generation.

- Customer Experience: Focus on innovation in remote services and cross-selling opportunities.

- Targeted Approach: Marketing efforts are highly targeted based on client needs and investment goals.

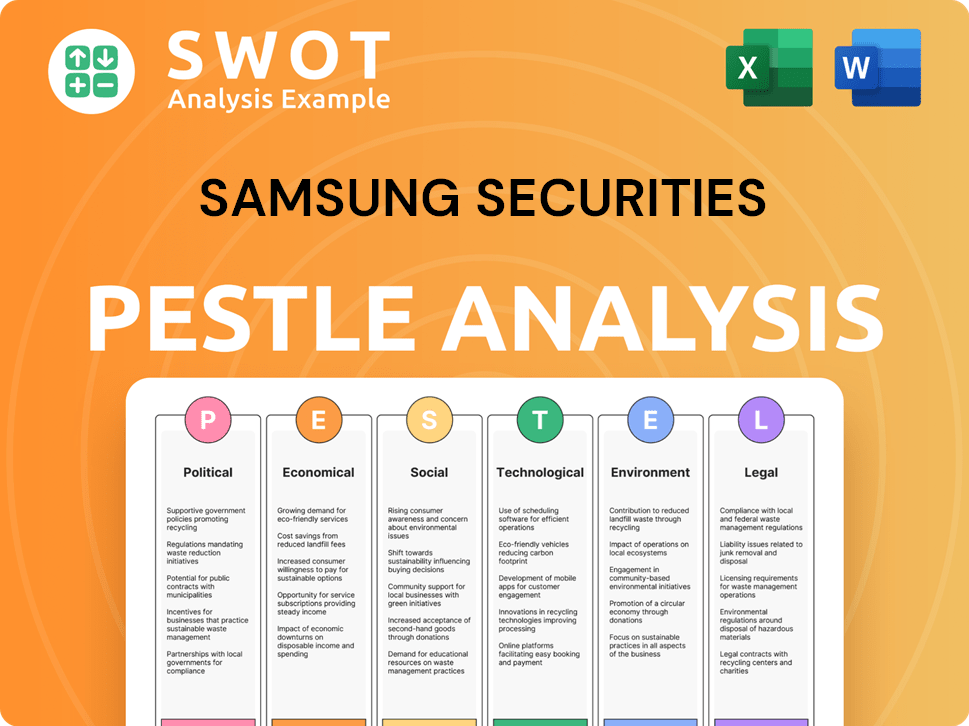

Samsung Securities PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Samsung Securities Positioned in the Market?

The brand positioning of Samsung Securities centers on reliability, comprehensive financial solutions, and a forward-looking approach, leveraging technology and client-centricity. Its core message emphasizes being an optimal partner for asset growth, offering services tailored to investment goals. This strategy is crucial in the competitive financial services marketing landscape.

Samsung Securities distinguishes itself through its association with the broader Samsung Group, recognized globally for innovation and technological leadership. This affiliation inherently provides a perception of stability, advanced technology, and trust. This is a key element in its investment company sales approach, helping to build brand awareness.

The visual identity and tone of voice likely reflect professionalism and trustworthiness, consistent with the broader brand. The company appeals to its target audience by offering a wide array of financial products and services, catering to both individual and institutional clients. For more information on their target audience, you can read about the Target Market of Samsung Securities.

Samsung Securities tailors its services to meet diverse client needs, whether through luxury, value, or specialized expertise. This includes strengthening infrastructure for Ultra-High-Net-Worth Individuals (UHNWI) and expanding its key customer base. This is a key element of their Samsung Securities sales strategy.

The company's commitment to ESG (Environmental, Social, and Governance) principles contributes to a perception of responsible management and societal contribution. This focus helps differentiate it in a market where ethical considerations are increasingly valued by investors. This is a key element of Samsung Securities marketing strategy.

Samsung Securities leverages technological advancements to enhance its service offerings. This includes digital asset management and other tech-driven solutions. This approach is crucial for staying competitive in securities industry trends.

Brand consistency across all channels and touchpoints is crucial for reinforcing its image. This includes digital platforms and advisory services. Maintaining a consistent brand message is critical for effective financial services marketing.

Samsung Securities' competitive advantage lies in its association with the Samsung Group, its focus on client needs, and its commitment to ESG principles. These factors contribute to its brand recognition and customer acquisition strategy.

- Strong Brand Association: Leveraging the reputation of the Samsung Group for trust and innovation.

- Client-Centric Approach: Tailoring services to meet the diverse needs of individual and institutional clients.

- ESG Integration: Highlighting responsible management and societal contribution.

- Technological Leadership: Utilizing advanced technology to enhance service offerings.

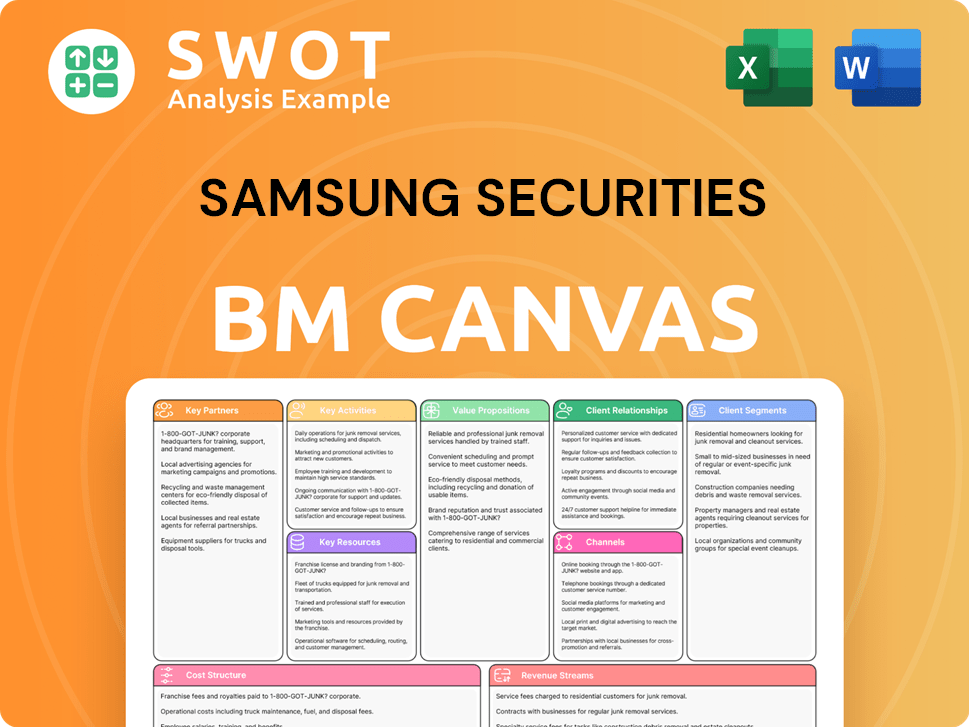

Samsung Securities Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Samsung Securities’s Most Notable Campaigns?

The sales and marketing strategies of Samsung Securities are multifaceted, focusing on digital transformation, retail investor engagement, and wealth management. These initiatives aim to strengthen market position and drive financial performance. The company leverages digital platforms and targeted campaigns to attract and retain clients within the competitive financial services marketing landscape.

Samsung Securities' approach involves a blend of technological advancements, strategic partnerships, and customer-centric services. These efforts are designed to enhance its competitive advantage and cater to the evolving needs of its diverse clientele. The company's focus on innovation and customer satisfaction is evident in its strategic investments and marketing campaigns.

The company's ongoing strategies and campaigns are designed to increase its customer base and diversify its revenue streams. This includes attracting both domestic and international investors through various promotional activities. The company's performance in the market reflects the effectiveness of its sales and marketing initiatives.

A key 'campaign' is the digital transformation and enhancement of the integrated client management system, data analytics, and AI-driven remote services. The aim is to strengthen core business leadership and enhance retail dominance. This strategy supports its Competitors Landscape of Samsung Securities by improving customer service and operational efficiency.

The company launched promotions offering zero commission fees on foreign stock trades, capitalizing on the rising interest of retail investors in overseas markets. This campaign aimed to increase commission fees from increased trading of overseas stocks. The focus is on investment product promotion to attract a wider customer base.

Continuous efforts in wealth management and asset management, especially bolstering infrastructure for Ultra-High-Net-Worth Individuals (UHNWI) and expanding its key customer base, can be viewed as an ongoing, targeted sales and marketing campaign. These initiatives aim to grow assets under management and diversify revenue streams. This strategy is crucial for long-term growth.

Samsung Securities has exceeded analyst sales estimates for four straight quarters as of April 2025, with gross revenue reaching KRW 10,725 billion in FY24 and net income growing to KRW 899 billion. Anticipated net revenues for FY25 are projected to reach KRW 2,530 billion, with net income at KRW 962 billion by FY27. These figures highlight the success of its sales performance review and growth strategy.

The primary objectives include strengthening core business leadership, enhancing retail dominance, and expanding investment banking capabilities. These objectives are supported by digital transformation and targeted marketing efforts. The company focuses on attracting investors through various channels.

- Digital transformation to improve client services and operational efficiency.

- Promotion of overseas stock trading to capitalize on retail investor interest.

- Expansion of wealth management services to grow assets under management.

- Focus on customer acquisition strategy and brand awareness strategy.

- Continuous improvement in sales team structure and investor relations.

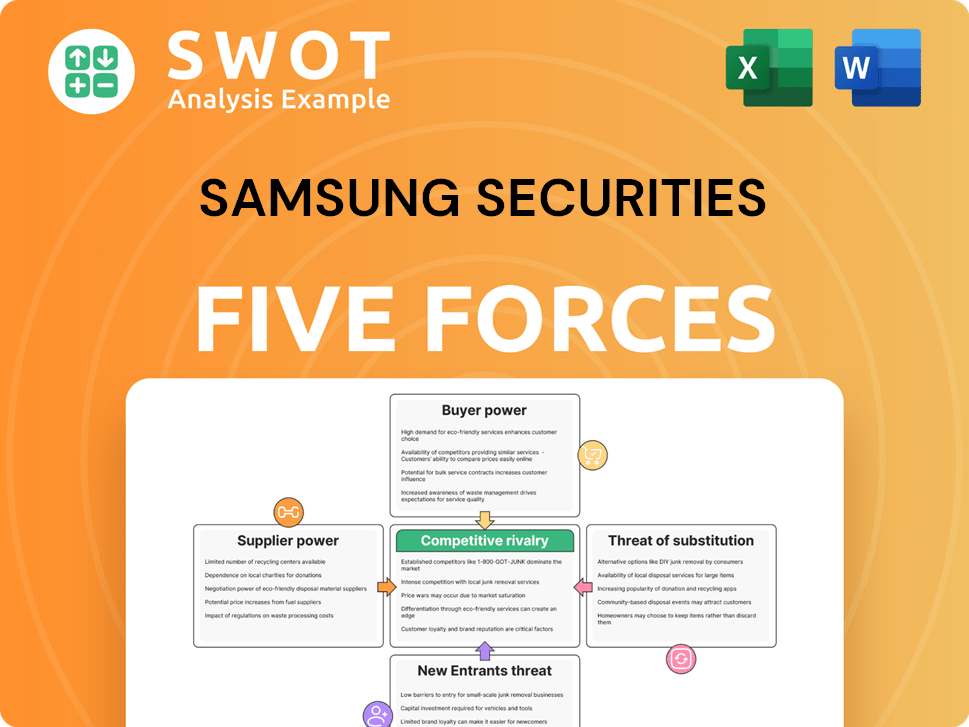

Samsung Securities Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Samsung Securities Company?

- What is Competitive Landscape of Samsung Securities Company?

- What is Growth Strategy and Future Prospects of Samsung Securities Company?

- How Does Samsung Securities Company Work?

- What is Brief History of Samsung Securities Company?

- Who Owns Samsung Securities Company?

- What is Customer Demographics and Target Market of Samsung Securities Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.