Samsung Securities Bundle

How Does Samsung Securities Thrive in the Financial World?

Established in 1982 and a key part of the Samsung Group, Samsung Securities is a powerhouse in South Korea's financial sector. With a vast network of branches and international offices, it offers a wide array of financial services. But how does this Samsung Securities SWOT Analysis impact its success and what strategies drive its impressive revenue growth?

Samsung Securities, a leading Samsung brokerage, demonstrates its strength through consistent performance, as seen in its Q4 2024 financial results. This success is a testament to its robust Samsung investment platform and strategic engagement in stock trading and other financial services. Understanding the inner workings of Samsung Securities, including its account types, trading fees, and market analysis, is crucial for anyone looking to navigate the financial landscape, from opening an account to exploring international trading opportunities and utilizing its mobile app.

What Are the Key Operations Driving Samsung Securities’s Success?

Samsung Securities delivers value through a wide array of financial services for both individual and institutional clients. Its core operations include securities brokerage, investment banking (IB), wealth management, and asset management, alongside trading and research activities. The company's structure is segmented into five main units: Trading & Interest income, Brokerage, Financial Products, Investment Banking, and Others.

The company's brokerage segment offers services for domestic and international investments. The Investment Banking division provides tailored consulting for financial activities, including initial public offerings (IPOs) and mergers and acquisitions (M&A). Wealth management services focus on optimizing asset management to meet clients' investment goals. The asset management arm, Samsung Asset Management Company Ltd., had an Assets Under Management (AUM) of $248.3 billion as of March 6, 2024.

The value proposition of Samsung Securities lies in its ability to provide comprehensive financial solutions. It is supported by an extensive network of domestic branches and international offices. The company leverages its trading competencies in global markets, offering brokerage services and financial solutions. Digital platforms are also key, delivering diverse products and customer-specific information, emphasizing ease of use for clients. This integrated approach allows Samsung Securities to differentiate itself by providing a holistic and efficient financial experience.

Samsung Securities provides comprehensive brokerage services, facilitating stock trading and other investment activities. The company offers services for both domestic and overseas investments. Overseas business experienced significant growth, with a 92% year-over-year increase in total commissions in Q4 2024.

The Investment Banking division offers customized consulting for various financial activities. These include initial public offerings (IPOs), mergers and acquisitions (M&A), and project finance. The IB division successfully managed high-profile deals in 2024, such as IPOs for INICS, NOBLEND, and CMES AI Robotics, and M&A for Geo-Young, HUGEL, and DIG AIRGAS.

Wealth management services focus on optimizing asset management for clients' investment goals. The asset management arm, Samsung Asset Management Company Ltd., reported an Assets Under Management (AUM) of $248.3 billion as of March 6, 2024. This demonstrates the company's strong position in the financial market.

Digital platforms play a crucial role in delivering diverse products and customer-specific information. These platforms emphasize ease of use for clients, enhancing their overall experience. For more detailed insights into the company's strategic approach, consider reading about the Growth Strategy of Samsung Securities.

Samsung Securities SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Samsung Securities Make Money?

The revenue streams and monetization strategies of Samsung Securities are diverse, reflecting its broad financial services offerings. The company generates income through various segments, including trading, brokerage, financial products, investment banking, and other services. This diversified approach allows Samsung Securities to capture value across different aspects of the financial market.

In Q4 2024, the company experienced significant growth across several key areas. The Trading & Interest income segment saw a substantial increase, while the Brokerage and Investment Banking divisions also performed well. Despite a decline in the Financial Products segment, the overall revenue structure demonstrates a robust and adaptable business model.

Over the years, Samsung Securities has shown consistent growth in both gross revenue and net income. From FY19 to FY24, the company achieved a Compound Annual Growth Rate (CAGR) of 13% in gross revenue, reaching KRW 10,725 billion. Net income grew at an even faster pace, with an 18% CAGR, reaching KRW 899 billion in FY24, leading to an increase in Return on Equity (ROE) to 13% in FY24 from 8% in FY19. This financial performance underscores the effectiveness of its monetization strategies and its ability to generate shareholder value. If you want to learn more about the company's ownership structure, you can read about the Owners & Shareholders of Samsung Securities.

The revenue streams of Samsung Securities are primarily categorized into several key segments, each contributing differently to the company's financial performance. These segments include Trading & Interest income, Brokerage, Financial Products, Investment Banking (IB), and Others. The performance of each segment varies, influencing the overall financial health of the company.

- Trading & Interest Income: This segment was a major growth driver, with a 97% year-over-year increase in Q4 2024, contributing 49% to total segment revenue.

- Brokerage: Total commissions reached KRW 565.5 billion in Q4 2024, driven by a 92% increase in overseas business and a 131.3% rise in trading value. This segment contributed 27% of total segment revenue.

- Investment Banking (IB): The IB division's income grew by 25.1% year-over-year to KRW 314.8 billion in 2024, accounting for 15% of total segment revenue.

- Financial Products: Although this segment experienced a 35.5% decline to KRW 160.8 billion in Q4 2024, it still contributed 8% to the total segment revenue.

- Others: This segment accounted for the remaining 1% of total segment revenue.

Samsung Securities PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Samsung Securities’s Business Model?

Since its inception, the company has evolved significantly. Initially established as Hanil Investment & Finance in 1982, it was integrated into the Samsung Group in 1992 and rebranded as Samsung Securities. This transition provided a solid foundation and access to extensive resources, shaping its trajectory in the financial services sector.

The company's strategic focus on global expansion and service diversification has been a key driver of its growth. This is evident in its international presence and its ability to adapt to market challenges. For example, in Q4 2024, the company reported a 36.7% year-over-year increase in net revenues, primarily from its Trading & Interest income segment, demonstrating effective risk management and nimble operational strategies.

The company's competitive advantages stem from its strong brand affiliation, extensive network, and ability to secure high-profile investment banking deals. Its emphasis on digital channels enhances accessibility and client experience. As of 2025, the company continues to adapt to new trends, such as the increasing demand for high-bandwidth memory (HBM) in the broader ecosystem.

The company's history includes its founding in 1982 as Hanil Investment & Finance. The integration into the Samsung Group in 1992 marked a crucial turning point. This provided access to resources and enhanced its market position, paving the way for future growth in the financial services industry.

A core strategy involves expanding its global footprint and diversifying services. This is evident through its international offices and its response to market changes. The company has demonstrated resilience, exceeding analyst sales estimates for four consecutive quarters, indicating effective risk management.

Its strong brand association with the Samsung Group provides a significant trust factor. The company's extensive network of domestic and international offices allows for broad market penetration and client reach. Furthermore, its ability to secure high-profile investment banking deals showcases its expertise and strong market position.

The company emphasizes digital channels to offer diverse products and customer-specific information. This enhances accessibility and client experience, aligning with modern financial service trends. The company continues to adapt to new trends, such as the increasing demand for high-bandwidth memory (HBM) in the broader ecosystem.

The company leverages its brand recognition and extensive network to offer a range of financial services. Its focus on digital platforms enhances client experience and accessibility. The company's performance in Q4 2024, with a significant increase in net revenues, highlights its strategic prowess and adaptability in the market.

- Strong brand affiliation with the Samsung Group.

- Extensive domestic and international office network.

- Emphasis on digital channels for enhanced client experience.

- Successful investment banking deals and market penetration.

Samsung Securities Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Samsung Securities Positioning Itself for Continued Success?

Samsung Securities holds a prominent position within South Korea's financial investment sector, offering services in brokerage, investment banking, wealth management, and asset management. The company's strong market presence is supported by consistent revenue growth. From FY19 to FY24, it achieved a 13% Compound Annual Growth Rate (CAGR) in net revenues, reaching KRW 10,725 billion. Its net income also saw an impressive 18% CAGR, reaching KRW 899 billion in FY24, highlighting its financial health and market influence.

However, like other financial institutions, Samsung Securities faces several risks. These include potential regulatory changes, particularly with the upcoming 2025 administration, which could affect areas like central clearing requirements and AI governance. Economic downturns and challenges in affiliate companies could also impact investment decisions. Additionally, geopolitical tensions and trade restrictions, such as those on chip exports to China, could indirectly affect the company.

Samsung Securities is a key player in the South Korean financial market. It offers a range of services, including Samsung brokerage and investment banking. The company has shown strong financial performance, with significant revenue and profit growth in recent years.

The company faces risks from regulatory changes and economic conditions. Potential shifts in regulations and economic downturns can impact investment decisions. Geopolitical issues and trade restrictions also pose challenges.

Samsung Securities aims for continued growth through strategic initiatives. The company is focused on leveraging its diverse business portfolio and technological advancements, especially in AI. Analysts project further revenue and income growth.

The company is enhancing its digital channels and AI capabilities. It aims to provide diverse products and customer-specific information. Samsung Securities is committed to navigating market complexities and capitalizing on emerging opportunities.

Samsung Securities is focusing on several key areas to drive future growth, including technological advancements and digital transformation. The company plans to leverage its strengths in AI and digital platforms to enhance customer experiences and expand its market reach.

- Enhancing AI capabilities in smartphones and premium products.

- Developing easy-to-use digital interfaces for diverse product offerings.

- Providing customer-specific information through digital channels.

- Capitalizing on emerging opportunities in the evolving AI landscape.

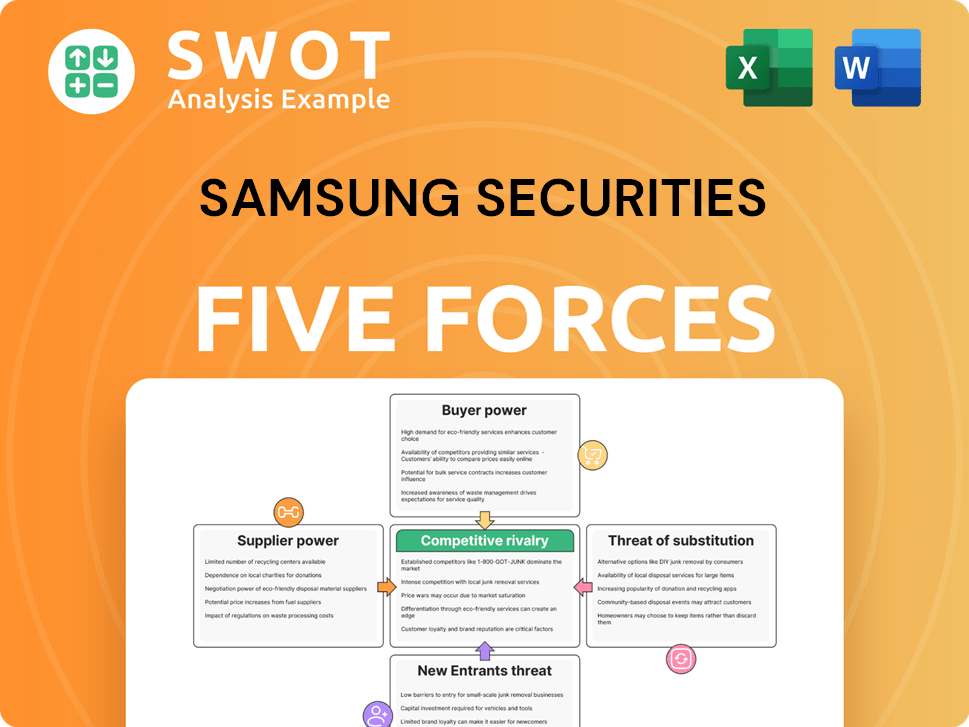

Samsung Securities Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Samsung Securities Company?

- What is Competitive Landscape of Samsung Securities Company?

- What is Growth Strategy and Future Prospects of Samsung Securities Company?

- What is Sales and Marketing Strategy of Samsung Securities Company?

- What is Brief History of Samsung Securities Company?

- Who Owns Samsung Securities Company?

- What is Customer Demographics and Target Market of Samsung Securities Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.