Samsung Securities Bundle

Can Samsung Securities Maintain Its Momentum?

Samsung Securities, a cornerstone of South Korea's financial services sector, is constantly navigating a dynamic market. This analysis delves into the Samsung Securities SWOT Analysis, exploring its journey from inception to its current standing. We'll examine its core offerings, which span securities brokerage, investment banking, and wealth management, catering to a diverse clientele.

This exploration of Samsung Securities' Growth Strategy and Future Prospects will provide a comprehensive market analysis, evaluating its financial performance and strategic direction. We will dissect its expansion plans, innovation in digital transformation, and responses to evolving industry trends to understand its potential for Samsung Securities revenue growth and long-term success in the competitive landscape. The goal is to offer actionable insights for investors and stakeholders interested in the future outlook of this key player in Investment Banking.

How Is Samsung Securities Expanding Its Reach?

In 2025, the expansion strategy of Samsung Securities focuses on balanced growth across its retail and investment banking (IB) divisions. This approach aims to establish a stable, long-term foundation for the company. The strategy is multifaceted, encompassing enhancements to core business leadership and the introduction of new products and services.

Key initiatives include strengthening core business leadership by enhancing retail dominance and expanding IB capabilities. This involves revamping the integrated client management system, leveraging data analytics, and implementing AI-driven remote services. The company also plans to bolster infrastructure for Ultra-High-Net-Worth Individuals (UHNWI) and expand its key customer base by segment. This strategic focus is critical for achieving sustainable revenue growth and solidifying its position in the competitive financial services market.

The company's strategic initiatives are designed to foster long-term growth and enhance its competitive position in the market. The goal is to achieve sustainable profitability and increase market share through a combination of organic growth and strategic investments.

Samsung Securities is revamping its integrated client management system. This includes leveraging data analytics to better understand customer needs. AI-driven remote services are also being implemented to access new customers and improve service delivery. These enhancements are designed to improve customer experience and drive revenue growth.

The company is expanding its investment banking capabilities to support its growth strategy. This involves increasing its capacity for IPOs and real estate project financing. The goal is to provide a wider range of services to its clients and enhance its competitive position. This expansion is crucial for increasing the company's market share.

Samsung Securities plans to bolster its infrastructure for Ultra-High-Net-Worth Individuals (UHNWI). It will also expand its key customer base by segment. This targeted approach aims to increase the company's market share among high-net-worth clients. This strategy will focus on providing tailored services to meet the specific needs of these clients.

The company intends to systemize investment book capacity to improve efficiency. This includes optimizing its investment processes and enhancing its risk management capabilities. The goal is to improve the overall performance of its investment portfolio. This will help to drive profitability and support long-term growth.

Samsung Securities plans to elevate its IPO business and enhance real estate project financing capabilities. It will also develop a fee-driven revenue model using managed trusts and wrap accounts. Customized Fixed Income, Currencies, and Commodities (FICC) product packages will be offered, expanding the client base to financial institutions and corporates.

- Offering lifecycle-based financial solutions to corporates, such as Workplace Wealth Management (WM).

- Expanding cross-selling opportunities to increase revenue streams.

- Introducing new FX services following approval for general FX transactions.

- Expanding into the institutional-only private funds market.

Samsung Securities SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Samsung Securities Invest in Innovation?

The core of Samsung Securities' growth strategy centers on leveraging technology and innovation to enhance its financial services offerings. This approach is critical for maintaining a competitive edge in the dynamic financial services industry. The company's digital transformation initiatives are designed to improve client engagement and operational efficiency.

Samsung Securities' future prospects are closely tied to its ability to integrate cutting-edge technologies. This includes the use of data analytics, AI-driven services, and the revamping of its client management systems. These technological advancements are aimed at providing more personalized and efficient services to clients.

The broader strategic direction of Samsung, as a conglomerate, significantly influences Samsung Securities. Samsung's substantial investments in research and development, particularly in areas like artificial intelligence and 5G/6G telecommunications, provide a technological foundation for Samsung Securities' future growth.

Samsung Securities is focused on digital transformation to enhance client engagement and operational efficiency. This includes revamping its integrated client management system and implementing AI-driven remote services.

Samsung Electronics made a record-breaking R&D investment of $24.1 billion in 2024, a 23.5% increase over 2023. In the first quarter of 2025, R&D spending increased by 16%, amounting to KRW 9 trillion.

Samsung is integrating AI into all aspects of its ecosystem, including its SmartThings platform, to create a seamless and hyper-personalized experience. This includes personalized AI-powered appliances that learn from users' routines.

Samsung aims to strengthen its position in the high-value-added market through its server-centric portfolio and the ramp-up of enhanced HBM3E 12H products. AI-related demand is expected to remain high in the second half of 2025.

At CES 2025, Samsung unveiled its 'Home AI' vision, enhancing the interactivity and intelligence of connected devices. This includes advanced security features leveraging Knox technology.

Key focus areas include enhancing retail dominance and expanding IB capabilities. The company is utilizing data analytics and AI-driven remote services to achieve its goals.

The company's strategic initiatives are heavily reliant on technological advancements to drive growth and improve its market position. These advancements are crucial for enhancing client services and operational efficiency within the competitive landscape of financial services.

- Digital Transformation: Revamping the integrated client management system and implementing AI-driven remote services.

- Data Analytics: Utilizing data analytics to gain insights and improve service offerings.

- AI Integration: Leveraging AI across various platforms to create personalized and efficient experiences.

- R&D Investments: Significant investments in AI, semiconductors, and 5G/6G telecommunications.

- Semiconductor Advancements: Focusing on server-centric portfolios and enhanced HBM3E 12H products.

Samsung Securities PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Samsung Securities’s Growth Forecast?

On February 13, 2025, the financial results for Samsung Securities' Q4 2024 were released, revealing a significant positive trend. The company experienced a substantial increase in net revenues, marking a period of robust financial performance. This growth underscores the effectiveness of the company's strategies in the competitive financial services market.

The fourth quarter of 2024 showed a substantial increase in revenue, with a 36.7% year-over-year rise, reaching KRW 2,066 billion. This performance highlights the company's ability to capitalize on market opportunities and strengthen its position. The increase in revenue is a key indicator of the company's overall financial health and its strategic initiatives' success.

The impressive revenue growth was primarily driven by a remarkable 97% year-over-year surge in the Trading & Interest income segment. This significant increase demonstrates the company's proficiency in managing its investment portfolio and capitalizing on market dynamics. This segment's performance is a critical factor in the company's overall financial success and contributes significantly to its market share.

The company's stock has delivered solid returns of approximately 15.5%, reflecting investor confidence and strong market performance. This growth is a testament to the company's strategic initiatives and its ability to generate value for its shareholders. This performance is particularly notable within the competitive landscape of the financial services industry.

Samsung Securities paid an annual dividend of KRW 3,500 per share in FY 2024, resulting in an attractive dividend yield of around 8%, one of the highest in South Korea. Analysts project a dividend yield of approximately 8-9% over the next three years. This high dividend yield makes the company an attractive investment for income-seeking investors.

For the full year 2024, Samsung Electronics reported KRW 300.9 trillion in annual revenue and KRW 32.7 trillion in operating profit. While Q4 2024 revenue and operating profit decreased quarter-on-quarter, annual revenue reached the second-highest on record. This performance provides a solid foundation for the broader group's financial health.

Looking to FY 2025, the company's business strategy aims for balanced growth between its retail and IB businesses, establishing a stable long-term foundation. The company plans to enhance its business portfolio and expand revenue streams for sustainable growth. This strategic approach is designed to ensure long-term profitability and market share expansion.

Analysts have revised their outlook for Samsung Electronics, adjusting their earnings forecast for 2025. The estimated operating profit is now forecast at 40.48 trillion won (28 billion USD), a 36.3% cut from the August forecast. Some brokerage firms have significantly downgraded their 2025 earnings forecasts, with NH Investment & Securities slashing its 2025 forecast from 46.03 trillion won to 35.14 trillion won. This adjustment reflects the challenges and intensified competition in the market. For a deeper understanding of the company's history, you can read more in the Brief History of Samsung Securities.

Despite the revised earnings forecasts, Samsung Electronics' stock is trading at a price-to-earnings-to-growth (PEG) ratio of 0.24, indicating potential undervaluation. This suggests that the stock may be undervalued, considering its growth prospects. The company's leadership in semiconductors and expansion in AI support an upside potential of 18-22% for 2024-2025.

- The company's strong performance in trading and interest income.

- The attractive dividend yield, which is among the highest in South Korea.

- The strategic focus on balanced growth and portfolio enhancement.

- The company's potential for expansion, supported by its leadership in key sectors.

Samsung Securities Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Samsung Securities’s Growth?

The future prospects of Samsung Securities, and its growth strategy, are significantly influenced by several potential risks and obstacles. These challenges range from intense market competition to regulatory changes and geopolitical factors. Successfully navigating these risks is crucial for achieving sustainable growth within the financial services sector.

One of the primary threats is the competitive landscape, particularly in the semiconductor industry, which is a major driver for the broader conglomerate. Samsung faces stiff competition from rivals like SK Hynix and Chinese firms, impacting its profitability and market share. These pressures have led to downward revisions in operating profit forecasts for 2025 by various brokerage firms.

Furthermore, regulatory changes and geopolitical uncertainties pose considerable risks. The impact of U.S. regulations on chip exports to China and global trade dynamics are key concerns. These factors necessitate proactive risk management strategies and strategic initiatives to ensure the company's continued success and positive financial performance, as highlighted in recent market analysis.

Samsung faces intense competition in key sectors, particularly semiconductors. The rise of competitors like SK Hynix and Chinese firms puts pressure on market share and profitability. This competitive environment requires continuous innovation and strategic adjustments.

Changes in regulations and geopolitical tensions significantly impact the company. U.S. restrictions on chip exports to China affect Samsung's operations. Global trade uncertainties add to the complexity of its strategic planning.

Global economic conditions and weaker smartphone demand pose challenges. These factors can influence consumer spending and overall market performance. The company must adapt to these fluctuating economic dynamics.

Maintaining technological leadership in semiconductors is crucial. Falling behind in key areas, such as HBM chips for AI, can affect competitive positioning. Continuous investment in R&D is vital to stay ahead.

Market fluctuations and investor confidence are key considerations. The company's share buyback program, worth 10 trillion won ($7.2 billion) in November 2024, aims to stabilize investor confidence. Managing market volatility is an ongoing challenge.

Adapting the business structure to build a foundation for sustainable growth is essential. This includes exploring mergers and acquisitions (M&A) to drive growth and diversification. Strategic initiatives are key to long-term success.

To mitigate these risks, Samsung Securities is implementing several strategic initiatives. These include actively pursuing mergers and acquisitions to drive growth and diversify its portfolio. A significant share buyback program, worth 10 trillion won ($7.2 billion) in November 2024, demonstrates a commitment to stabilizing investor confidence. The company is also focusing on strengthening its technological competitiveness and improving its business structure. For further insights into the company’s structure and stakeholders, you can refer to this article about Owners & Shareholders of Samsung Securities.

Mergers and acquisitions (M&A) are key to driving growth and diversification. The company actively seeks strategic opportunities to expand its business. This approach helps in navigating competitive pressures and regulatory changes.

A share buyback program, worth 10 trillion won ($7.2 billion) in November 2024, aims to boost investor confidence. This move reflects the company's commitment to shareholder value. Managing financial performance is a priority.

Strengthening technological competitiveness is crucial for long-term success. Investments in R&D and innovation are ongoing. This focus helps in maintaining a competitive edge in the market.

Improving the business structure is vital for sustainable growth. This includes streamlining operations and enhancing efficiency. Adapting to changing market conditions is a key objective.

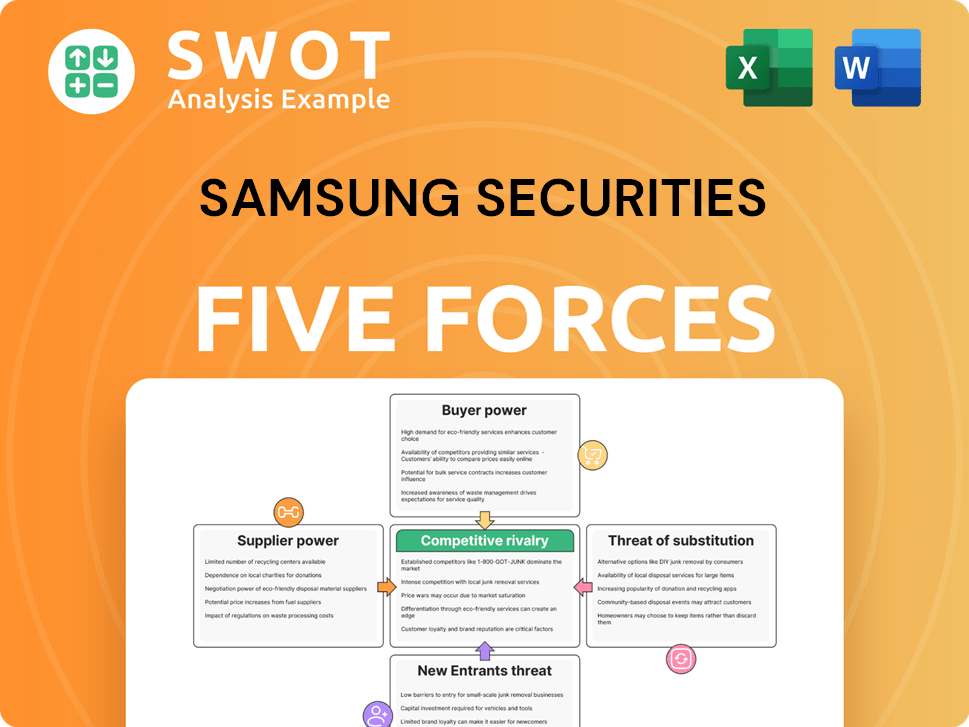

Samsung Securities Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Samsung Securities Company?

- What is Competitive Landscape of Samsung Securities Company?

- How Does Samsung Securities Company Work?

- What is Sales and Marketing Strategy of Samsung Securities Company?

- What is Brief History of Samsung Securities Company?

- Who Owns Samsung Securities Company?

- What is Customer Demographics and Target Market of Samsung Securities Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.