Samsung Securities Bundle

Who Does Samsung Securities Serve?

In the dynamic world of finance, understanding your customer is key to success. For Samsung Securities SWOT Analysis, knowing the customer demographics and target market is not just beneficial—it's fundamental. This knowledge shapes everything from product development to marketing strategies, ensuring the company stays competitive.

This exploration delves into the specifics of Samsung Securities' customer base, examining their profiles, needs, and behaviors. We'll uncover the intricacies of their target audience analysis, from age ranges and income levels to geographic locations and investment preferences. This deep dive into the financial services customers of Samsung Securities will provide valuable insights for anyone interested in the securities brokerage industry and understanding how a leading firm adapts to a changing market.

Who Are Samsung Securities’s Main Customers?

Understanding the customer base is crucial for any financial institution, and for Samsung Securities, this involves a dual approach. The company caters to both individual consumers (B2C) and institutional clients (B2B), each with distinct needs and expectations. This segmentation allows for tailored services and strategic marketing efforts, ensuring that the company meets the diverse demands of its customer base. Effective customer segmentation is essential for optimizing service delivery and driving revenue growth.

The B2C segment of Samsung Securities includes a wide range of individual investors. These investors vary in age, income, and investment goals. The company has observed a notable increase in retail investors, particularly those in their 20s and 30s, actively participating in the stock market. This demographic is often drawn to accessible mobile trading platforms and the ease of use they provide. High-net-worth individuals, typically older and with higher incomes, seek more sophisticated wealth management services.

For its B2B segment, Samsung Securities serves institutional clients such as corporations, pension funds, and asset management companies. These clients require investment banking services, including corporate finance advisory and asset management. This segment often represents a significant portion of revenue due to the high value of transactions and ongoing advisory relationships. The company has strategically shifted to bolster its institutional client base, driven by the increasing complexity of corporate finance needs and the demand for sophisticated investment solutions. This shift is prompted by market research indicating growth opportunities in specialized financial services and external trends such as corporate restructuring and global investment flows.

The B2C segment includes a broad spectrum of individual investors. These investors range from young professionals to affluent individuals. They are increasingly demanding digital access and personalized advice. The company focuses on providing accessible platforms and diverse investment options.

The B2B segment serves corporations, pension funds, and other financial institutions. These clients require investment banking and asset management services. This segment often represents a significant portion of revenue. The company is strategically focused on expanding its institutional client base.

The age range of Samsung Securities investors varies, with a notable increase in younger investors (20s and 30s) using mobile platforms. High-net-worth individuals, typically older, seek sophisticated wealth management. Income levels also vary, with higher-income individuals seeking more complex financial services. Understanding these demographics helps tailor services.

A key characteristic is the increasing demand for digital access to financial services. Younger investors prioritize ease of use and low fees. High-net-worth individuals seek personalized portfolio management. Samsung Securities adapts to these preferences by offering digital platforms and customized services. This allows the company to meet the diverse needs of its customers.

The primary customer segments for Samsung Securities are individual investors and institutional clients. Understanding the specific needs of each segment is critical for providing tailored financial services. The company focuses on digital access and personalized advice to meet the diverse demands of its customer base. This approach supports customer acquisition and retention strategies.

- Individual Investors: Young professionals, high-net-worth individuals.

- Institutional Clients: Corporations, pension funds, asset management companies.

- Digital Access: Mobile trading platforms, online wealth management tools.

- Personalized Advice: Customized portfolio management, financial planning.

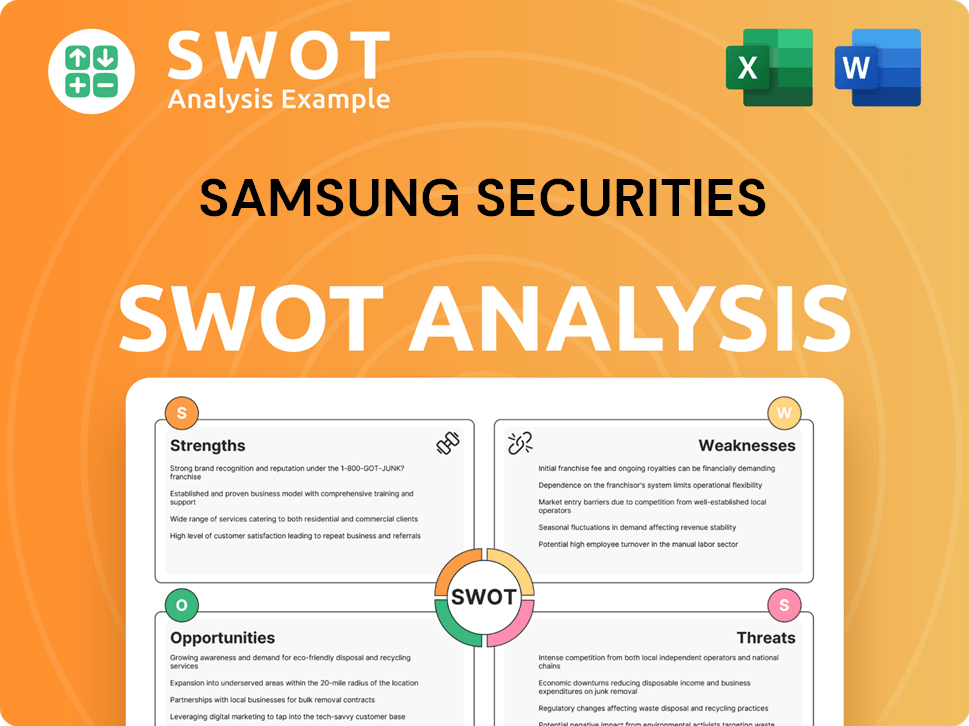

Samsung Securities SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Samsung Securities’s Customers Want?

Understanding the customer needs and preferences is crucial for Samsung Securities' success. Their diverse customer base, ranging from individual investors to institutional clients, drives the company's service offerings. The company must cater to a broad spectrum of needs, motivations, and preferences to maintain and grow its market share.

For individual investors, particularly younger demographics, accessibility, convenience, and educational resources are key drivers. Experienced investors, on the other hand, often seek personalized advice and sophisticated financial planning. Institutional clients prioritize efficiency, expertise, and comprehensive solutions for complex financial challenges.

The company continuously gathers feedback through client relationships and market trends to influence its product development. This customer-centric approach allows them to tailor their marketing and product features by segment, ensuring they meet the specific needs of each client group effectively.

Individual investors, especially younger demographics, value user-friendly mobile trading platforms. They seek real-time data, quick execution, and a wide selection of investment products. Financial literacy and guidance are also essential, with a demand for market insights and educational content.

Experienced or affluent individual investors prioritize personalized advice and sophisticated financial planning. They seek trusted relationships with financial advisors for tailored strategies. Their psychological drivers often include security and long-term financial stability.

Institutional clients require efficiency, expertise, and comprehensive solutions for complex financial challenges. Their decision-making is based on reputation, track record, and research capabilities. They seek partners for in-depth market analysis and strategic advisory services.

Common pain points addressed by Samsung Securities include navigating regulatory complexities and optimizing capital structures. The company also helps clients manage investment portfolios effectively. They tailor their services to address these specific challenges.

The company uses client feedback and market trends to influence product development. This includes enhancing digital platforms with advanced analytics tools for institutional investors. They also develop new structured products to meet specific client demands.

Samsung Securities tailors marketing and product features by segment. Retail investors might see targeted digital campaigns highlighting mobile trading features. Institutional clients receive bespoke proposals and dedicated relationship managers.

Understanding the customer demographics is essential for effective target audience analysis. This allows the company to provide financial services tailored to each segment. Customer acquisition strategies are also influenced by these insights.

- Customer Segmentation: Dividing the market into distinct groups based on needs, behaviors, and demographics.

- Targeted Marketing: Creating specific marketing campaigns for each segment to improve engagement.

- Product Customization: Tailoring investment products and services to meet the unique needs of different customer groups.

- Relationship Management: Building strong relationships with clients through dedicated advisors, especially for high-net-worth individuals and institutional clients.

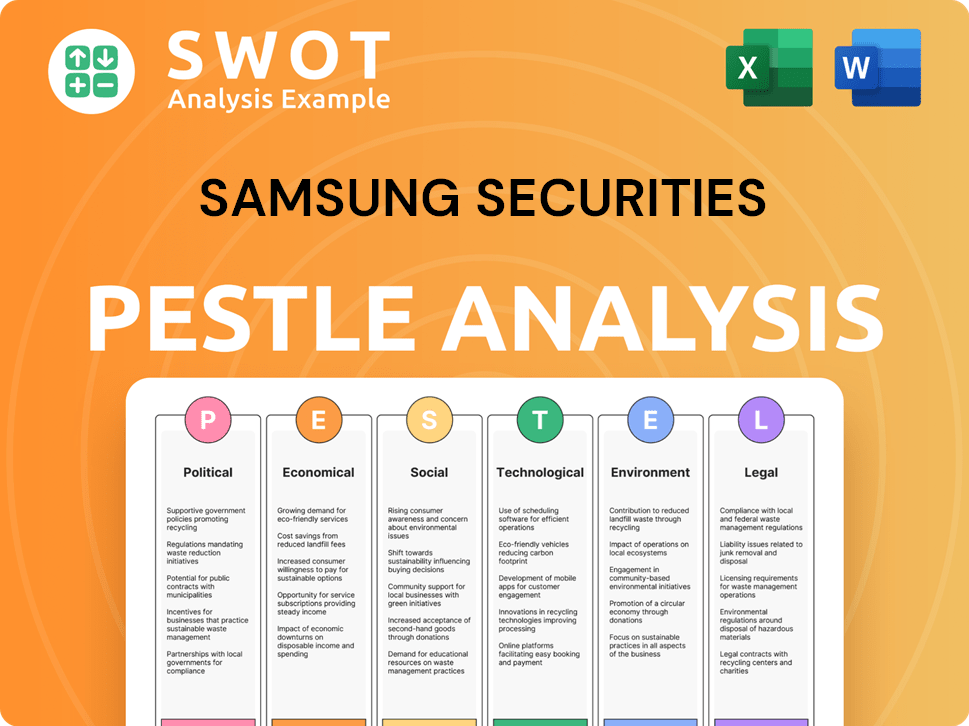

Samsung Securities PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Samsung Securities operate?

The primary geographical market for Samsung Securities is South Korea. The company has a strong presence and brand recognition within the country, operating a comprehensive network of branches, as well as online and mobile platforms. This allows them to serve a wide range of clients across South Korea effectively.

The company's focus on the domestic market is evident in its localized services, which include Korean-language support and investment products tailored to local market conditions. While Samsung Securities does consider international ventures, its main customer base remains firmly rooted in South Korea. The company continuously monitors global market trends for potential opportunities.

Key markets within South Korea include major metropolitan areas like Seoul and Busan, where financial activity is highly concentrated. These urban centers often have a higher concentration of both individual and institutional investors. This concentration of financial activity makes these areas critical for the company's operations and growth strategies.

The company's primary customer base and operations are centered in South Korea. This includes a wide branch network and digital platforms. The Revenue Streams & Business Model of Samsung Securities highlights the importance of this domestic market.

Major cities like Seoul and Busan are particularly important due to their high concentration of investors. These areas are key for customer acquisition and maintaining market share. Strong brand recognition in these urban centers is a significant asset.

While the focus is domestic, the company explores strategic international ventures. These ventures are often limited and aligned with core competencies. Any expansions are carefully considered to align with the company's strengths.

The company provides services in Korean and tailors investment products to the domestic market. This approach ensures compliance with local regulations and meets customer needs. Localization is a key part of their strategy.

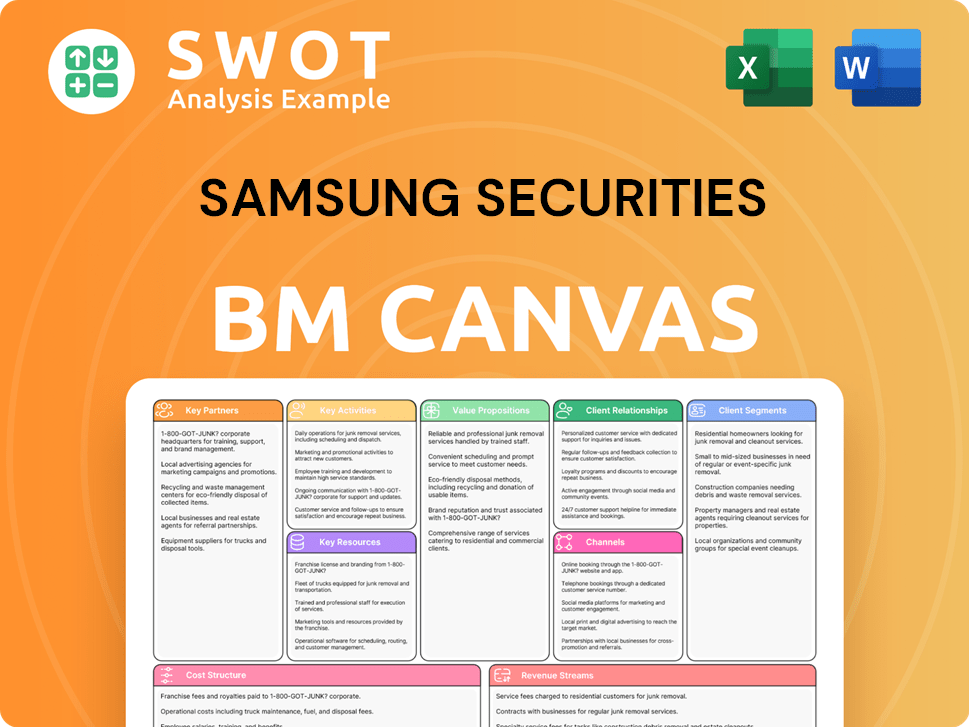

Samsung Securities Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Samsung Securities Win & Keep Customers?

Customer acquisition and retention strategies are crucial for the success of Samsung Securities, a prominent player in the securities brokerage industry. Understanding the customer demographics and adapting strategies to meet the needs of the target market are essential for sustained growth. The company employs a multi-faceted approach, blending digital and traditional methods to attract and retain clients.

Samsung Securities focuses on both acquiring new customers and retaining existing ones through personalized experiences and comprehensive after-sales service. This involves leveraging customer data to tailor communications and investment advice. Furthermore, the company likely utilizes loyalty programs to incentivize continued engagement, especially for wealth management clients.

The company's strategy has likely evolved over time, with an increasing emphasis on digital engagement and personalized services. This shift is a response to changing customer expectations and the competitive landscape in financial services. The ultimate goal is to enhance customer lifetime value and reduce churn by fostering stronger client relationships and providing a seamless, value-added experience.

Samsung Securities leverages digital marketing extensively. This includes online advertising, social media campaigns, and search engine optimization to reach a broad audience. These efforts are particularly aimed at attracting younger investors, who are increasingly active online.

Traditional channels, such as television advertisements and print media, are still utilized. These methods help reinforce the brand image and reach a wider demographic, including older and more established investors. This multi-channel approach ensures broad market penetration.

Sales tactics include direct sales through the branch network and online onboarding processes. The online onboarding caters to self-directed investors, offering convenience and accessibility. This dual approach allows Samsung Securities to serve diverse customer preferences.

For institutional clients, acquisition is often driven by direct outreach and relationship building. The focus is on showcasing expertise in investment banking and asset management. This involves understanding the specific needs of institutional investors and providing tailored solutions.

Samsung Securities uses customer data and CRM systems to segment clients. This enables tailored communications, product recommendations, and investment advice. Personalized experiences are central to retaining clients and increasing customer lifetime value.

Loyalty programs are likely in place, possibly with tiered service levels based on assets under management or trading volume. These incentives encourage continued engagement and reward loyal customers. Such programs help reduce churn.

For wealth management clients, personalized advisory services and regular portfolio reviews are key. Exclusive access to market insights is also provided. These offerings build strong client relationships and foster trust.

For institutional clients, ongoing advisory support, timely transaction execution, and consistent performance are crucial. Maintaining a high level of service and delivering strong results are essential for retaining institutional business. This also involves providing valuable insights.

Samsung Securities has increased its focus on digital engagement and personalized services. This shift aims to meet evolving customer expectations and the competitive pressures in financial services. The goal is to provide a seamless, value-added experience.

The company continuously adapts its strategies to improve customer lifetime value and reduce churn. This involves fostering stronger client relationships and providing a seamless, value-added experience. Understanding the Competitors Landscape of Samsung Securities is also crucial.

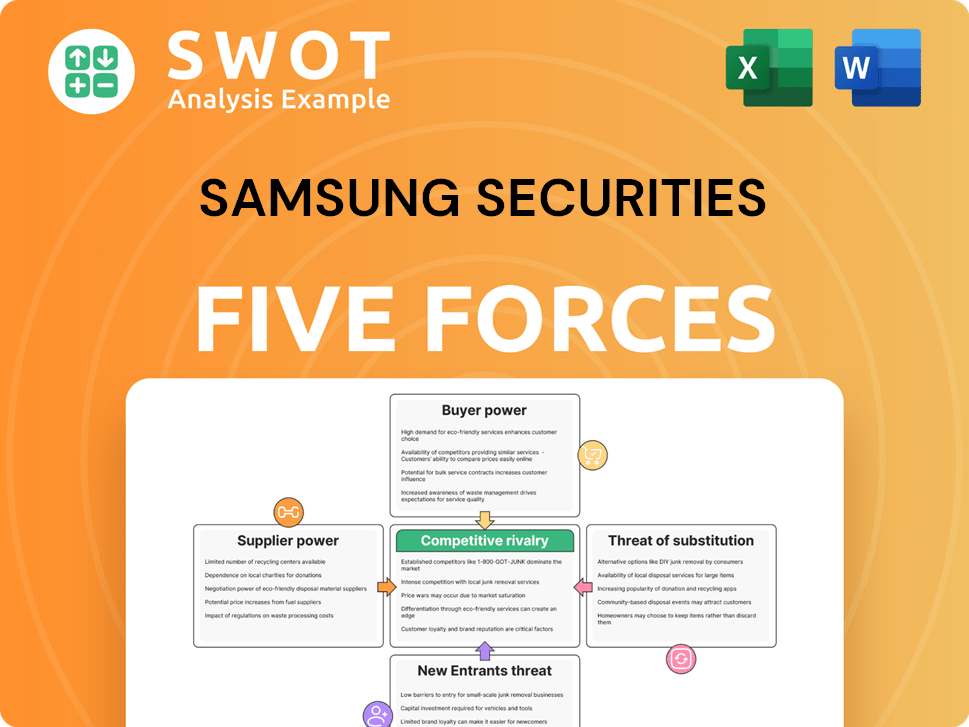

Samsung Securities Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Samsung Securities Company?

- What is Competitive Landscape of Samsung Securities Company?

- What is Growth Strategy and Future Prospects of Samsung Securities Company?

- How Does Samsung Securities Company Work?

- What is Sales and Marketing Strategy of Samsung Securities Company?

- What is Brief History of Samsung Securities Company?

- Who Owns Samsung Securities Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.